The Changing Face of Clean Label

INGREDIENTS

Much like the famous pronouncement on obscenity, consumers know what clean label is when they see it.

The growing preference for food and beverage ingredients perceived as somehow “clean” is a global phenomenon, says Dave Lundahl, founder and CEO of the behavioral research firm InsightsNow, which has been tracking this consumer segment extensively for the past four years. “These are consumers with heightened concerns about ingredients—they will not buy products that have certain ingredients in them,” he says. “They will go right to the back of the package and look to see what’s in a product.”

Euromonitor International projected global sales of clean label food products would hit $180 billion in 2020, while worldwide sales of clean label ingredients like natural colors and flavors, starch and sweeteners, fruit and vegetable ingredients, flours, and others will jump from $38.8 billion in 2021 to $64.1 billion in 2026 at a compound annual growth rate of 6.8%, predicts Market Data Forecast.

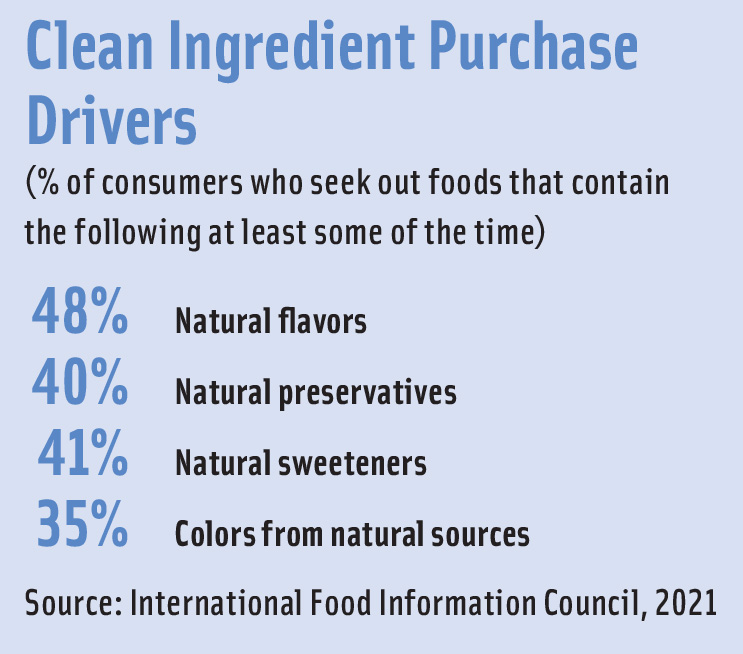

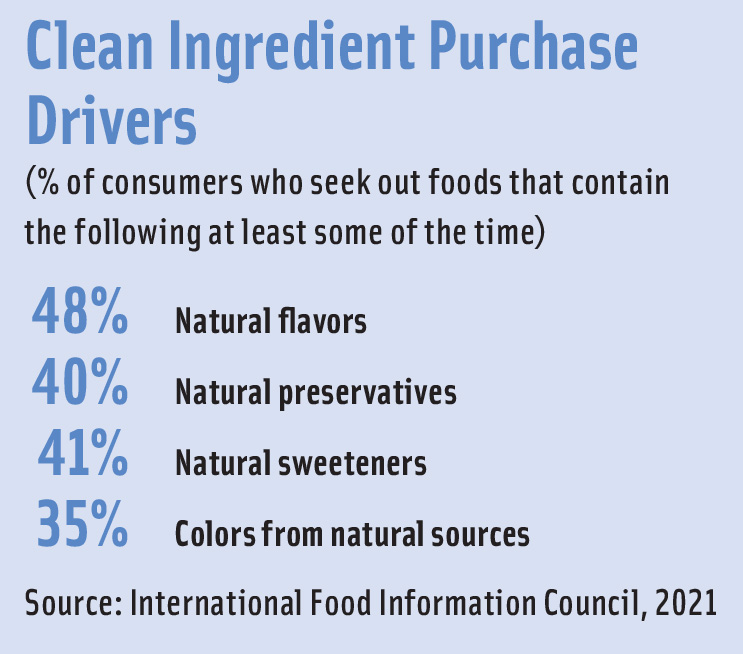

In the United States, 63% of adults say the ingredients in a food or beverage have at least a moderate influence on what they buy, and 64% say they try to choose foods made with clean ingredients, according to the International Food Information Council’s (IFIC) June 2021 survey From “Chemical-sounding” to “Clean”: Consumer Perspectives on Food Ingredients. Twenty percent of U.S. consumers also say they regularly buy foods and beverages because they are advertised on the label as having clean ingredients, reports IFIC’s 2021 Food and Health Survey.

“Health is a top motivator for people who seek out clean ingredients. Of those who try to choose foods and beverages with clean ingredients, 25% do so to seek the health benefits from these foods and beverages,” says Megan Meyer, director of science communications at IFIC, citing IFIC’s June survey on clean food ingredients.

What’s in a Name

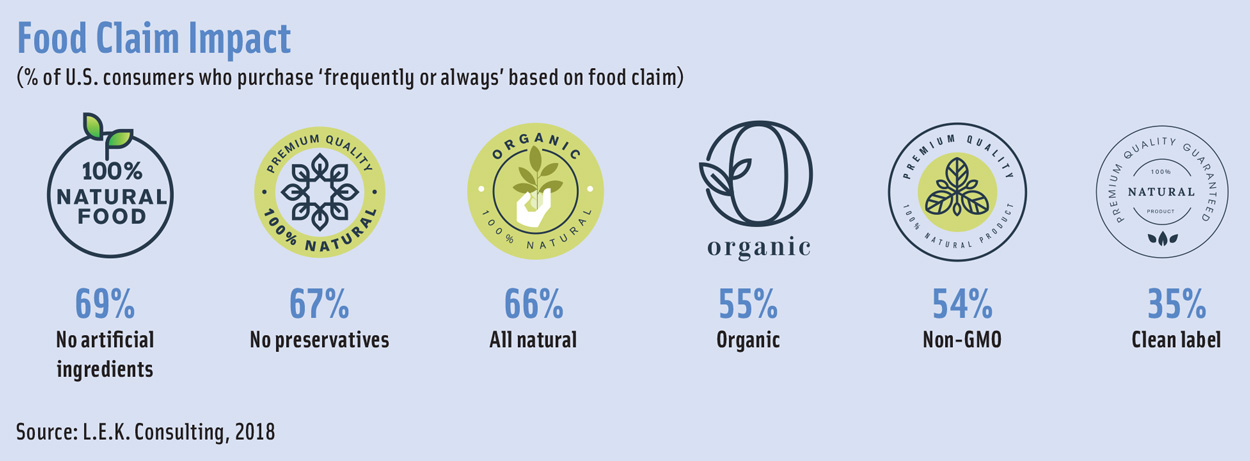

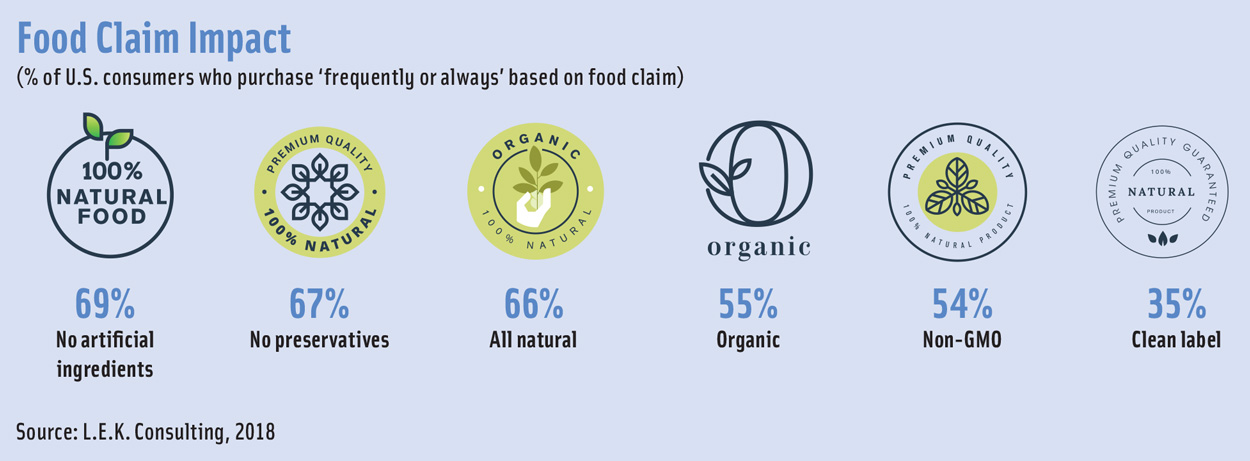

At the most basic level, many consumers are looking for foods and beverages with short lists of “natural” ingredients, whether they use or even know the term “clean label.” Sixty-nine percent of consumers say simple, recognizable ingredients influence their purchasing decisions, and 66% say they are looking for labels with the shortest ingredients list, according to ADM Outside Voice research.

“Globally, more than half of consumers say they are actively seeking or purchasing more products with natural claims, according to insights from Ingredion’s proprietary ATLAS clean label research,” says Pat O’Brien, regional platform leader, clean and simple ingredients, U.S./Canada at Ingredion.

But the specific attributes that consumers say they want to see in clean products can cover a wide range. Respondents to IFIC’s June 2021 survey define them as “not artificial or synthetic” (22%), “organic” (16%), “fresh” (15%), “something they know is nutritious” (14%), and “natural” (14%). Among global consumers, clean eating means “free of additives and preservatives” (51%), “only natural ingredients” (46%), “organic” (33%), “sustainably sourced” (33%), “unprocessed” (31%), “ethically responsible” (27%), and “sticking to my diet principles” (17%), according to Innova Market Insights’ Innova Health & Nutrition Survey 2020.

The COVID-19 pandemic’s ongoing impact on consumer behavior is also helping to expand the definition of clean label. A 2020 New Hope Network NEXT Data and Insights survey found that consumers said they were placing more importance on both personal health (77%) and environmental or planetary health (67%) during the COVID-19 pandemic than they did in 2019.

“With 37% of U.S. consumers starting or increasing cooking during the pandemic [according to March 2021 research from The Hartman Group], many people have new opportunities to ‘eat clean,’” says Brad Schwan, vice president, category marketing at ADM. “With more people engaged in cooking at home over the past year, we anticipate that scrutiny of product labels will continue to intensify, expanding to how ingredients are sourced.”

In fact, 2020 data from Innova Market Insights, a global market research firm, suggests there has been a jump in those who greatly identify with issues related to transparency and responsible production since the COVID-19 pandemic hit. Thirty-two percent now say they identify “a lot” with both “naturalness and transparency” and with “responsibly made,” up from 21% and 24% before the pandemic, respectively.

“Early on, clean label focused on simplicity, with an eye toward recognizable ingredients and short, easy-to-understand ingredient lists,” says Courtney LeDrew, senior marketing manager at Cargill. “Today, however, the clean label trend has morphed to encompass much more, reflecting a shift by some consumers toward a lifestyle that supports healthier eating for both people and the planet. In a post-lockdown world, I think we’ll see consumers double down on this broader definition.”

Looking for Transparency

The concept of clean eating may still be most closely associated with natural ingredients, but it is gradually evolving into “clear” labeling with more transparency about how food is made and the impact it has on the world, according to Lu Ann Williams, global insights director at Innova Market Insights.

“In periods of uncertainty, we look for safety,” says Williams. “But transparency means more than just safety. It means different things to different consumers.”

Shoppers say a brand or manufacturer is transparent if it provides a complete list of ingredients (62%), the description of ingredients is in plain English (53%), it provides certifications, such as USDA organic (48%), and it provides in-depth nutritional information (47%), according to Transparency Trends: Omnichannel Grocery Shopping from the Consumer Perspective, a 2020 research report from FMI – The Food Industry Association and Label Insight.

“Today’s conscious consumer views sustainability as a key component of clean label products, and many people want healthy foods to be more sustainable,” says ADM’s Schwan. “The pandemic has elevated consumer concerns for food safety and quality, sharpening their desire for transparency and responsible sourcing in the supply chain.”

This consumer demand for greater transparency and traceability is also pushing clean label concepts throughout the entire supply chain, adds Cargill’s LeDrew.

Clean Ingredients on the Rise

As formulators work to match ingredient selections to the latest clean label demands from consumers, they will need to strike a balance, says Courtney Schwartz, marketing director at Kemin.

“When manufacturers look to switch to more label-friendly ingredients, this can impact the shelf life, cost, and/or sensory attributes of the product. When evaluating reformulation of a product to meet the demand for clean label, manufacturers may have to choose between these attributes,” says Schwartz. “When it comes to the consumer, they too have to make a similar decision. They may find a label-friendly product that meets their shelf-life expectations, but they may have to pay an increased price for the item or be willing to store the product in the refrigerator or freezer.”

Natural flavor is the fastest-growing clean label ingredients market segment, according to Mordor Intelligence, and 39% of U.S. consumers now say the sustainability of flavor ingredients is important to them, according to Innova Market Insights’ Innova Flavor Survey 2021. Some of the key ingredients dominating the clean label food market include hydrocolloids such as gellan, acacia, and guar gums, natural mold inhibitors such as sorbic acid, stevia, food enzymes, and fruit and vegetable pieces and powders, according to How the Clean-Label Mega-Trend Is Changing the Food Ingredients Landscape, a 2019 report from global strategy firm L.E.K. Consulting.

“A lot of progress is being made on the bakery front with natural mold inhibitors and other advancements in technology,” says Rob Wilson, managing director and partner in the Chicago office of L.E.K. Consulting.

While freshness remains a top priority for consumers, the continued reliance on processed foods will drive demand for better-for-you options with clean labels, says Karen Formanski, health and nutrition analyst at market research firm Mintel. “Moving forward, it will be important for brands to be transparent about less-familiar ingredients: why they are considered natural, how they are sourced, the reasons they are used,” she says.