Restaurants Reset for a Rough Ride

Returning menu superstars, reimagined classics, and internationally inspired cuisine are upgrading foodservice menus.

Article Content

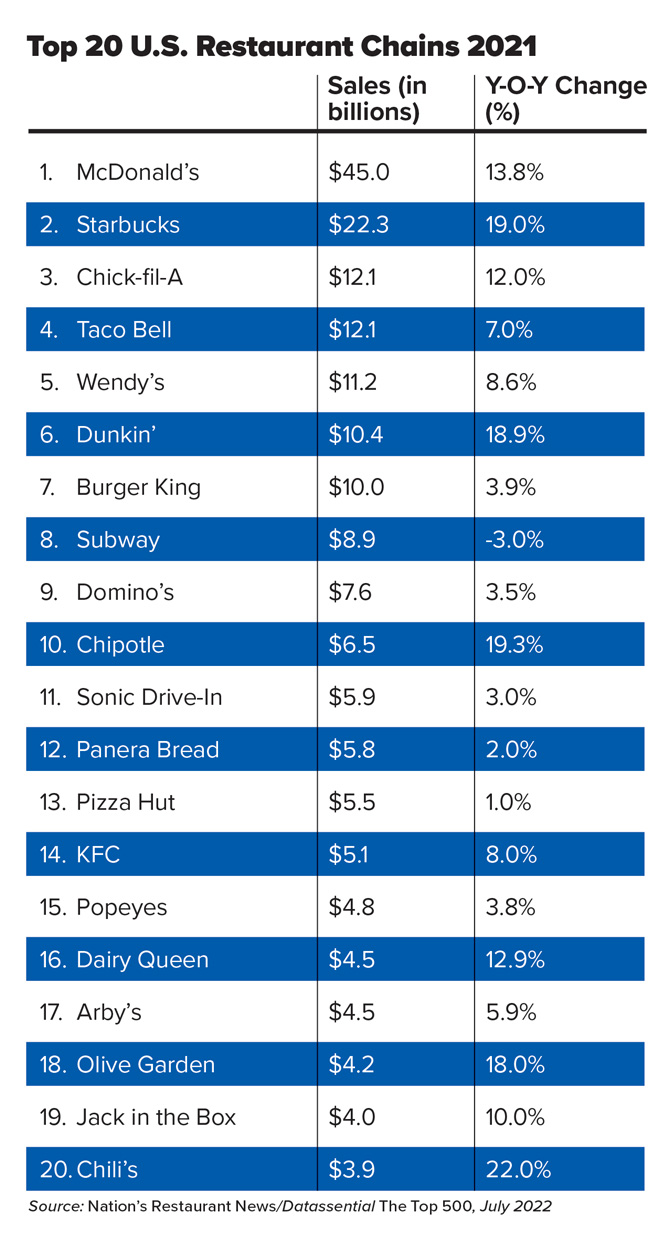

Armed with lessons learned during the pandemic downturn, restaurants appear to be much better prepared to navigate the tough times ahead. Despite labor, inflation, and supply chain issues, five of the top 10 restaurants posted double-digit growth last year, and one-fifth of the top 500 chains boosted their average unit volume, although their store counts shrunk or remained the same, according to The Top 500 2022 report from Nation’s Restaurant News and Datassential.

How are they doing it? Maximizing off-premises opportunities such as drive-thru and delivery, leveraging digital ordering, customer contacts, and kitchen efficiencies, and beefing up menu innovation are the keys to success.

Soaring Sales

With sales up 14%, McDonald’s remains the top U.S. restaurant chain by a wide margin. Chick-fil-A, which is open only six days per week, inched ahead of Taco Bell to take third place. Dunkin’ soared past Burger King and Subway to rank sixth, while Chipotle ousted Sonic Drive-In from its top 10 slot.

Chili’s, Denny’s, Outback Steakhouse, Red Robin, Cinnabon, and Noodles & Company were among the chains that grew sales by more than 20% even as their store counts fell, per The Top 500. Taco Bell, Jersey Mike’s Subs, Domino’s, and Chipotle added the most brick-and-mortar locations last year.

With diners returning to eating out, and many full-service restaurants (FSRs) enjoying increased revenue from their newly developed off-premises capabilities, fine dining revenues increased 30.9% in 2021, according to The Top 500, followed by casual dining (7.7%), fast casual (7.4%), and quickservice restaurants (6.4%).

Chili’s, Applebee’s, and The Cheesecake Factory posted the largest sales gains in the FSR American dining sector last year, per The Top 500. Olive Garden and Carrabba’s Italian Grill led in FSR Italian/pizza, while Denny’s and Cracker Barrel were tops in midscale dining. For global/regional FSRs, P.F. Chang’s (Asian and Chinese) and Fogo de Chao (Brazilian) notched the biggest sales increases. Texas Roadhouse, Outback Steakhouse, and Red Lobster rode the wave for highest FSR seafood/steak sales.

By menu category, the largest sales increase last year came from FSR seafood/steak. Rounding out the top sales gains were limited-service restaurant (LSR) sandwich (not including burgers), LSR salad/health, LSR dessert/snack, and chicken restaurants, according to The Top 500.

Business as Un-Usual

Despite the strong postpandemic bounceback, however, skyrocketing operating expenses and consumer cutbacks are taking their toll. In August, 85% of operators surveyed by the National Restaurant Association (NRA) said their restaurant is less profitable now than it was before the pandemic. As of mid-September, restaurant sales had declined for the past few months after adjusting for menu-price inflation (7.1% year to date), reports NRA. In addition, Datassential records a 40% drop in operator margins compared with prepandemic, down from 21% to 13% by midyear 2022.

Physical and online restaurant traffic fell by 2% in the second quarter compared with a year ago and is now 6% lower than in 2019, based on CREST information collected from NPD’s online consumer panel. Dinner visits, which account for 34% of restaurant traffic, decreased 2% in the second quarter versus a year ago, followed by a 3% drop at lunchtime (30% of traffic) and a 6% decline for the P.M. snacks daypart (16% of traffic). Early morning visits (20% of traffic) remained flat.

The Off-Premises Promise

Focusing on off-premises has been a key advantage for many of the fastest-growing fullservice chain restaurants. Off-premises now accounts for 25% of Applebee’s sales, while app/website/off-premises sales pull in 43% of revenue at Shake Shack.

Datassential reports that one-quarter of restaurants are transitioning to off-premises ordering, with another 18% considering doing so. Chipotle, for example, is adding new walk-up windows and drive-thru Chipotlanes for digital orders only. Panera Bread opened Panera To Go in Chicago without seating, and 81% of Panera’s sales in 2021 came from off-premises channels. Torchy’s Tacos is testing pickup cubbies that staff can move orders to directly from the kitchen.

In-store pickup/takeout and drive-thru are the most frequently used methods of sourcing off-premises meals, followed by delivery and curbside pickup, per Momentive’s 2022 report Momentive Study: How Gen Z and Millennials Are Reshaping the Restaurant Industry. Datassential suggests that drive-thru has the highest appeal for ordering at QSR, fast casual eateries, and convenience stores, followed by dine-in and, to a lesser extent, delivery. In fact, drive-thru contributes 75% of QSR sales, according to The Top 500. Auntie Anne’s sales, for example, grew 64.6% in 2021 after the chain added drive-thrus and cobranded with its sister company Jamba.

Breakfast pastry, breakfast sandwiches, and nonalcoholic beverages hold the highest average appeal in the drive-thru format for 70% of adults, while burgers, sandwiches, Mexican items, pizza, and donuts are tops for 60%, per Datassential.

In the first half of 2022, carryout continued to dominate orders (58%) in LSRs versus dine-in (27%) and delivery (15%), according to Technomic’s 2022 Delivery & Takeout Consumer Trend Report. On average, consumers order carryout/delivery four to five times per month. The one in five who are super heavy users (10-plus times per month) are most likely to be ages 35–44 with income of $150,000-plus. Dinner and then lunch are the most popular dayparts for diners opting for takeout/delivery, according to DoorDash’s 2022 Restaurant Online Ordering Trends report.

One-third of diners often try a new menu item when ordering takeout or delivery, and 60% do so occasionally, per DoorDash. To help diners move beyond the familiar, Krispy Kreme rolled out a donut/churro hybrid, the ChurrDough, while Sonic Drive-In’s new Churro Shake can be a dessert, a snack, or a meal. Roy Rogers’ French Toast Sticks with dip are perfect for all-day snacking, Chick-fil-A is testing Chorizo Cheddar Egg Bites, and at IHOP, diners can opt for new Cinna-Minions donut holes as a side with eggs and breakfast meats.

Third-party delivery makes up about 20% of all restaurant revenue, per Datassential, although high fees increasingly are becoming a concern. American, Mexican, Japanese, Italian, and Chinese are the cuisines most often delivered by DoorDash this year. The most-ordered items overall include french fries, burritos/Mexican bowls, chicken nuggets, sandwiches, hash browns, and cheeseburgers.

While plant-based burger sales started from a small base, these items posted the largest increase in delivery orders at Grubhub last year, according to the company’s website. Shredded pork tacos, Detroit-style pizza, margaritas, pork dumplings, chicken burritos, poke nacho, and lettuce wraps also saw strong growth.

Menu Innovation

Not surprisingly, four in 10 restaurant operators plan to focus their culinary innovation on value menu items/promotions in the coming year, according to Datassential’s “One Table 2022” webinar.

Savvy marketers are reintroducing menu superstars like Taco Bell’s Mexican Pizza, Long John Silver’s Lobster Bites, and Red Lobster’s Ultimate Endless Shrimp To Go. KFC has rolled out a 2-Piece Drum & Thigh Combo Meal for $6, while Domino’s cut prices 20% on all digital orders during a fall promotion. And Sonic Drive-In pours half-price drinks/slushes during its daily Happy Hour.

The opportunity to eat dishes that can’t easily be made at home and the chance to try something new have long driven foodservice decisions, suggests Datassential. Just over half (55%) of operators plan to focus their culinary innovation on their core menu items this year. One-quarter of QSR, fast casual, and fine dining operators also are concentrating on innovating higher-margin premium menu items and limited time offers, along with one in five casual dining and midscale eateries.

Diners looking to sample something new are most likely to branch out with dessert, followed by appetizers/sides, bowls, smoothies, and sandwiches, according to Datassential’s 2022 webinar “The Innovation Episode.” Tapping into this adventuresome spirit are new dessert offerings like BJ’s Peanut Butter S’mores Pizookie made with Ghirardelli chocolate, Classic Basque Cheesecake at The Cheesecake Factory, and Johnny Rockets’ Funnel Cake Fries. Timid diners have nothing to fear from White Castle’s new Ghost Slider featuring ghost pepper cheese.

Regional Twists

Upgraded American and regional crossovers will continue to garner attention, according to T. Hasegawa’s 2022 Flavor Flash Regional and International report, as more than half of baby boomers, 40% of millennials/Generation X, and one-third of Generation Z say they’re trying to stick to cuisines/items they know they will like. Black Bear Diner, whose sales jumped 55.4% in 2021, is featuring its Chicken Fried Steak in its new Fettuccine Alfredo. TGI Fridays has reimagined fajitas with global flavors—think Tandoori Chicken Skewers FRIjitas with jasmine rice—and On The Border staked its claim with a new Mexican Surf & Turf.

On the all-American dining scene, six in 10 have tried and liked foods from the Mid-Atlantic states (Philly cheesesteaks), the Midwest (cheese curds), and New England (lobster roll), according to T. Hasegawa’s regional and international report, while barbecue consumers would most like to try Kansas City, Memphis, and North Carolina style dishes.

Operators can breathe new life into familiar Italian, Mexican, and Chinese dishes too. Mexican menus are broadening their appeal with El Pollo Loco’s Mexican Shredded Beef Birria Taco, Chipotle’s Chicken Al Pastor, and Taco Bueno’s Brisket Tacos. Velvet Taco touts “tacos without borders” including Chicken Parmesan, Fried Paneer, and Korean Fried Rice versions.

Adding a taste of American flavors to these cuisines also gets diners interested, opening up opportunities for dishes like Del Taco’s new Epic Tortas in Chicken BLT and Piada Italian Street Food’s hand-rolled Piada wraps in Mediterranean and Avocado varieties. Bocadillo sandwiches, served on long baguettes, and sopapilla fried pastry are other fast-emerging forms.

Beyond the top three international cuisines, Japanese is now the fourth-most consumed ethnic cuisine in the United States, eaten by 34% of consumers, per T. Hasegawa’s regional and international report. Japanese is followed by Greek (25%), Thai (24%), Latin (23%), Middle Eastern (18%), Indian (18%), Korean (15%), Vietnamese (12%), Filipino (8%), and African (7%). Korean barbecue grew 42% on menus during the past four years, reports Datassential, along with Chinese bao bread (44%) and Thai drunken noodles (35%). Spanish bomba rice, Japanese sushi rice, South American arepas, Indian roti, and Japanese milk breads are also posting strong gains.

One-third of young adults say fusion menu items, such as The Cheesecake Factory’s Ahi Poke Nachos and Avocado Eggrolls, offer a good way to try new international flavors, according to T. Hasegawa’s regional and international report. Introducing new ethnic lookalikes using familiar descriptive names, like Indian chicken curry pizza, is a winning strategy, as is preparing an old favorite in a new way. Sonic Drive-In’s Fried Cookie Dough Bites and Buffalo Wild Wings’ Bird Dawg, a hot dog bun stuffed with chicken tenders and toppings, both fit the bill.

Adventures in Eating

Customization takes the worry out of trying something new for the 46% of consumers who are concerned they won’t like an unfamiliar product, per T. Hasegawa’s regional and international report. Jamba’s boba drinks, for example, allow drinkers to customize their “sip” with tapioca or strawberry boba balls.

Novelty continues to excite too. Papa Johns’ football-shaped pizza is a must for game day, and its Papa Bowls offer favorite pizza toppings sans crust. McDonald’s unwrapped its new Cactus Plant Flea Market Box, essentially a Happy Meal with either a Big Mac or a 10-piece Chicken McNuggets, fries, and a beverage along with a figurine targeted specifically to adults.

Plant-based options continue to be important to some diners, although growth appears to be slowing on menus compared with a year ago, according to Datassential. Panda Express has added plant-based Beyond The Original Orange Chicken, while Taco Bell is testing plant-based Beyond Carne Asada Steak, which can be substituted for protein in any menu item. McDonald’s, however, has quietly ended its 600-unit U.S. test of the McPlant burger.

Profitable Solutions

When it comes to labor issues, operators most often cite a shortage of prep, line, and short order cooks, followed by assistant/sous chefs, reports Datassential, creating an explosive opportunity for more speed-scratch foodservice products. One-third of kitchen managers want more frozen and more fully prepared items, and one-quarter would like more ready-to-drink beverages and fully prepared scratch ingredients. New products that are ready to meet these needs include Simplot’s Latin prepared ingredients line—“More Latin. Less Labor.”—and Bridgford’s Mexican Sopapilla Dough Sheets, which are also perfect for French beignets and Italian zeppole.

For the first time, chefs surveyed by NRA called out nonfood items as their second and third hot culinary trends for 2022: packaging that enables to-go menu items to remain intact during travel, and packaging that retains temperature. Seafood, salads, soups, and some desserts and drinks are the top pain points for delivery, per Technomic’s delivery and takeout report.

Half (53%) of all consumers—and eight in 10 millennial/Gen Z consumers—say they’d be likely to purchase a do-it-yourself meal kit from their favorite restaurant, according to NRA. Hopdoddy’s new Doddy DIY Burger Kit makes cheeseburgers and truffle fries for five, while Papa Murphy’s Take ‘N’ Bake Pizza caters to a crowd with gluten-free, dairy-free, and keto-friendly crustless options.

NRA reports that four in 10 operators believe the practice of selling fresh food or signature packaged foods at restaurants will continue to grow. Black Angus Steakhouse, for example, has found great success with its new on-premises “meat market” featuring signature fresh, ready-to-grill prepared steaks and seafood, grilling sides, sauces, and rubs.

Cobranding restaurants with leading retail food brands both in the aisles and on the menu continues to pay off in both markets. Consumers are doubling down on products like Carvel Ice Cream’s new Reese’s & Kit Kat Duo Sundae Dasher and Tim Hortons’ Tims Boost Energy Infusion Beverages, created in partnership with Red Bull.

With one-third of consumers planning on entertaining more at home this year, according to IRI’s webinar “What's Next for CPG Demand, Supply and Inflation,” there’s opportunity in to-go build-your-own guest/party platters, game day meals, and family night munchies. Look for new crowd pleasers such as Pizza Hut’s Big Dinner Box with pizza, breadsticks, and pasta or wings, along with Chili’s Party Platter Triple Dipper, which lets diners choose three appetizers, including sliders.

Key Takeaways

- Despite labor, inflation, and supply chain issues, restaurants are continuing to rebound with sales gains in full-service, casual dining, fast-casual, and quick-service sectors.

- More restaurants are growing revenues by expanding off-premises options like in-store pickup/takeout, drive-thru, delivery, and curbside pickup.

- Innovation in menu development is tapping into consumer demands for upgraded American and regional crossover products, international and fusion dishes, customization, DIY meal kits, plant-based meats, and novelty items.

.jpg?mw=500&hash=D1E2E8B94FED0CCA2F5CEA8243FD787B)