Bread Winners Around the World

Global consumers are united in their desire for healthier, more environmentally friendly bread products.

Article Content

Bread products are on the rise worldwide despite some hefty ingredient price increases spurred by ongoing global supply chain events. The global market for breads, including artisan and packaged products, is projected to increase by $118 billion at a compound annual growth rate (CAGR) of nearly 7.3% from 2022–2027, according to market research firm Technavio.

New bread and bread product launches grew at a 1.5% CAGR from 2018–2022, according to Innova Market Insights, with the fastest growth in Asia (11.7% CAGR). Western Europe and Asia together accounted for 54% of global bread rollouts from 2018–2022, while Latin America and North America combined made up 30%. Global introductions of rolls, meanwhile, are dominated by the United States (16%) and the United Kingdom (15%), Innova reports.

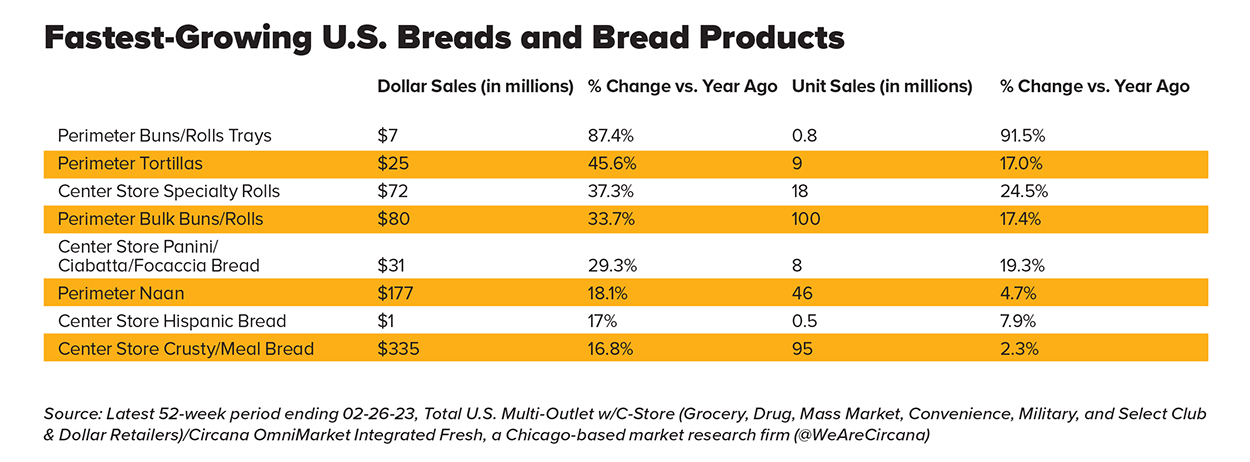

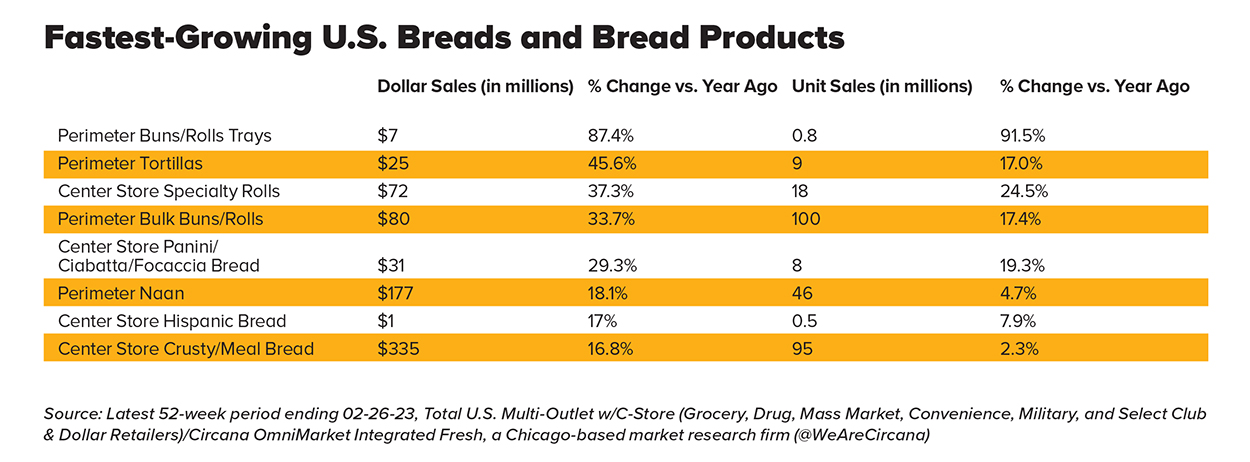

Bread products continue to heat up the bakery category in U.S. grocery stores. In 2022, center store bread was the best-selling bakery product category in the United States, according to Statista, and center store breads and rolls hit nearly $18 billion in the 52 weeks ending Feb. 26, 2023, a jump of 11.3% over the same period a year earlier, reports market research firm Circana OmniMarket Integrated Fresh.

Rising ingredient costs, however, are impacting bread products worldwide and are likely to continue doing so. That’s especially true in Europe, where the average price of bread was 18% higher in August 2022 compared with August 2021 because European countries imported raw materials from regions involved in the Ukraine war, according to research firm Mordor Intelligence. In the United States, the avian influenza outbreak also sent egg prices soaring in 2022.

Healthy Appeal

The global COVID-19 pandemic has focused the world’s attention on health, spurring increased demand for clean label bread products with functional and nutritional attributes. “Health continues to influence innovation with better-for-you and plant-based breads growing in profile,” writes Amrin Walji, senior innovation analyst at Mintel, in the research firm’s 2022 report A Year of Innovation in Bread and Bread Products.

“New [bread] product development is also likely to feature benefits such as high-fiber, gluten- and grain-free, organic, reduced-sugar or sugar-free, lactose-free, and digestive or immunity support,” says Lu Ann Williams, global insights director at Innova Market Insights.

TrulyGood offers South Africa consumers its fiber-rich Ancient Grain and Vegetable Wraps made from fresh vegetables, plant fiber, and mature cheddar cheese with only 87 calories and 2 grams of carbs in each wrap. In the United Kingdom, Warburtons Plant Power sliced bread is billed as a blend of 12 pulses, grains, and seeds that is low in sugar and high in protein and fiber. Sara Lee Bread in January announced the rollout of Sara Lee White Bread Made with Veggies, packed with the equivalent of one cup of vegetables per 18-ounce loaf.

Label claims with the most clout for new bread products range from no additives or preservatives, which is frequently used on new bread products in North America (35%) and Australasia (52%) regions, to no trans fat (16%) and low cholesterol (10%) claims that are most prevalent in Latin American launches, reports Innova. Lactose-free claims skew primarily to Western Europe (13%), while Australasia (16%) and North America (14%) see the highest proportion of gluten-free claims for new bread products.

“According to Ardent Mills proprietary research, 53% of U.S. consumers are opting (by choice, not dietary necessity) to eat gluten-free foods at least sometimes,” says Lindsey Morgan, senior director of product marketing at Ardent Mills. “We don’t see this trend slowing down anytime soon.”

In March, The Cloud Bread Co. introduced its gluten-free Cloudies bread alternative (made from eggs, cream cheese, baking soda, and baking powder) at Natural Products Expo West in the United States, touting it as low calorie, keto friendly, and also free of grain, sugar, carbs, and added preservatives. Canyon Bakehouse launched its new gluten-free Brioche-Style Sweet Rolls nationwide last year, while Mission Foods unwrapped new Zero Net Carbs Tortillas in Original and Sundried Tomato Basil flavors last fall.

In China, a growing interest in high-fiber foods has sparked innovation in whole grain bread formulations and a marked increase in launches of bread and bread products with whole grain claims, according to Mintel. Nearly 80% of consumers in China have tried fiber-rich food for gut health improvement, Mintel reports, and 44% of packaged bakery buyers in China are willing to pay a higher price for whole wheat bakery foods.

Sustainable Claims

With two-thirds (67%) of global consumers saying that environmental health and how their choices impact the planet is important to them, according to the NielsenIQ report An Inside Look into the 2021 Global Consumer Health and Wellness Revolution, it’s no surprise that shoppers are scrutinizing their staple bread products for sustainability claims. “Expect more environmentally friendly [bread product] packaging and claims of sustainability benefits, including use of climate neutral and 100% renewable energy,” says Williams.

In North America, there was a sharp increase in launches of bread and bread products with environmentally friendly packaging claims in the first half of 2022, according to Mintel, following a continuing rise in these claims during the past few years. From mid-2021 to mid-2022, 69% of new bread product launches in North America made environmentally friendly ethical claims, compared with 44% from mid-2018 to mid-2019.

Sea & Flour Baking Co. is planning a U.S. introduction this fall for its new line of carbon-negative baked goods including bread, buns, and rolls created with a blend of processed seaweeds, promoting the products as helping to address climate change and expand regenerative coastal agriculture and the “blue economy.” The Essential Baking Co. is highlighting its ESSENTIAL FRESH SEAL packaging for the company’s Take & Bake artisan bread products as a way to reduce food waste: The packaging keeps the product fresh for months without the use of preservatives.

Breadbasket Standouts

Consumers around the world are increasingly interested in expanding their bread choices beyond the basic everyday loaf, says Williams. “Flatbread, pita, and naan launches have increased by 6.7% globally over the last five years, with West Europe seeing 41% of the launch activity tracked,” she says.

“In Australia, there has been an exponential year-on-year increase in wraps and flatbread, as people seek out versatile bread formats,” writes Mintel’s Walji. Simson’s Pantry, for example, has expanded its line of Better for You wraps in the Australian market with three Low Carb KETO products, including a Super Seeds variety.

Artisanal, authentic, and rustic bread products also are growing in popularity, offering fresh-baked/homemade taste and texture, says Williams. Center store panini, ciabatta, and focaccia bread products are among the sales leaders in the U.S. market, ringing up $31 million for a 29.3% gain for the 52 weeks ending Feb. 26, 2023, according to market research firm Circana OmniMarket Integrated Fresh. Crusty/meal bread products are slicing into the market too, with $335 million in sales for a 16.8% increase in the same period.

In addition, Innova reports that sourdough breads are emerging globally at 12.1% CAGR from 2018–2022, led by Germany and the United Kingdom as the countries with the most sourdough bread product launches.

Asia Pacific: Frozen Is Hot

Asia Pacific consumers are less likely to use fresh bread frequently than consumers in other regions, according to Innova Market Insights, but the area is posting the fastest overall bread sales and new product development growth.

Although shelf-stable bread products overwhelmingly dominate the Asia Pacific market, frozen products are on the rise. More than 50% of frozen bread and bread product introductions appeared in China, South Korea, and Taiwan in the first half of 2022, writes Amrin Walji, senior innovation analyst at Mintel, in the research firm’s 2022 report A Year of Innovation in Bread and Bread Products.

“Frozen bread products are increasingly gaining traction in Asia as consumers seek to bake ‘fresh’ bread at home,” according to Walji. “Frozen bread is well-positioned to tap into the increasing demand for long-life staples.”

In fact, 24% of Chinese category buyers look at the length of shelf life when choosing packaged bread, reports Mintel.

Plant-Based Breads See Growth Spurt

As plant-based foods continue to make inroads into traditional supermarket categories, bread products are benefiting from their natural affinity for ingredients that come from the ground. “Most breads are inherently plant-based, but we see growing demand for what we call ‘plant-forward’ ingredients in bread,” says Lindsey Morgan, senior director of product marketing at Ardent Mills. “These ingredients include alternative grains such as chickpea, quinoa, and sorghum flours, which make excellent additions to breads.”

Globally, plant-based claims for new bread products are highest in North America, reports Innova Market Insights. Nearly a quarter (22%) of U.S. adults ages 35–44 say a plant-based diet has become more important to them due to COVID-19, writes Amrin Walji, senior innovation analyst at Mintel, in the research firm’s 2022 report A Year of Innovation in Bread and Bread Products, and U.S. vegan and plant-based claims for bread introductions have seen a sharp increase. From mid-2021 to mid-2022, 15% of U.S. bread and bread product launches used vegan/no animal ingredients claims, and 5% made plant-based claims, compared with 9% and 2%, respectively, for mid-2019 to mid-2020.

“Plant-based claims are likely to become more mainstream as manufacturers target consumers who desire the perceived health and environmental benefits,” says Lu Ann Williams of Innova.

Key Takeaways

- Bread and bread products continue to see increased sales worldwide and rule over center store bakery in the United States.

- Bread products that can make health and sustainability claims are growing in popularity globally.

- Consumers around the world are interested in expanding beyond staple loaves to products like flatbreads, wraps, artisanal breads, plant-based breads, and more.