Marketing Low-Glycemic Foods

Low-GI products are appearing on store shelves around the world, but will they go the way of the low-carb phenomenon?

With obesity rates and concern about childhood nutrition, heart disease, stroke, and myriad other ailments on the rise, it is no surprise that consumers seem to be looking for that latest diet craze or fad that will give them the quick hit that they seek.

However, it seems that consumers may be beginning to understand that there is no real quick fix. Instead, that weight loss can and perhaps should be a more slow and gradual change, accompanied by lifestyle changes, such as smoking cessation, healthy food choices, and exercise. The consumer press these days is full of what consumers can do to shape up, slim down, and create lasting change. And the impact of the U.S. Dept. of Agriculture’s Food Guide Pyramid is just beginning to be felt in a number of very small ways in the United States.

However, it seems that consumers may be beginning to understand that there is no real quick fix. Instead, that weight loss can and perhaps should be a more slow and gradual change, accompanied by lifestyle changes, such as smoking cessation, healthy food choices, and exercise. The consumer press these days is full of what consumers can do to shape up, slim down, and create lasting change. And the impact of the U.S. Dept. of Agriculture’s Food Guide Pyramid is just beginning to be felt in a number of very small ways in the United States.

As has been well documented, overweight and obesity have led to health issues such as an increase in type 2 diabetes. An estimated 30% of U.S. adults age 20 years and older—more than 60 million people—are obese, defined as having a body mass index (BMI) of 30 or higher. An estimated 65% of U.S. adults age 20 and older are either overweight or obese, defined as having a BMI of 25 or higher.

What does that mean for the next diet craze or the next way of healthy eating? One way of thinking about food that has been gaining ground is looking at the glycemic index of the foods and beverages that are consumed. While the concept does have its problems, and most certainly has its detractors, it could contribute to long-term eating changes.

The University of Sydney (Australia)—a repository for extensive glycemic index information and part of the GI Symbol Program in Australia which registers products to bear an official glycemic index symbol— offers a clear definition of glycemic index (www.glycemicindex.com):

"The glycemic index (GI) is a ranking of carbohydrates on a scale from 0 to 100 according to the extent to which they raise blood sugar levels after eating. Foods with a high GI are those which are rapidly digested and absorbed and result in marked fluctuations in blood sugar levels. Low-GI foods, by virtue of their slow digestion and absorption, produce gradual rises in blood sugar and insulin levels, and have proven benefits for health. Low-GI diets have been shown to improve both glucose and lipid levels in people with diabetes (type 1 and type 2). They have benefits for weight control because they help control appetite and delay hunger. Low-GI diets also reduce insulin levels and insulin resistance.

"Recent studies from Harvard School of Public Health indicate that the risks of diseases such as type 2 diabetes and coronary heart disease are strongly related to the GI of the overall diet. In 1999, the World Health Organization (WHO) and Food and Agriculture Organization (FAO) recommended that people in industrialized countries base their diets on low-GI foods in order to prevent the most common diseases of affluence, such as coronary heart disease, diabetes, and obesity."

There seems to be some evidence that a low-GI diet works. According to researchers from Boston Children’s Hospital, following a low-GI diet appears to be more beneficial than a traditional low-fat diet in reducing cardiovascular disease risk factors in obese youth (Ebbeling et al., 2005).

--- PAGE BREAK ---

Products Enter the Market

We saw the first consumer food and beverage products that discussed or mentioned glycemic index in Asia Pacific in the mid- to late-1990s. After that time, the concept spread first to Australia in food and beverages.

One of the first food products recorded on Mintel’s Global New Products Database (GNPD, www.gnpd.com) that specifically mentions a GI positioning was from the Australian company Defiance Quality Foods, with its line of muffin mixes. The line was called, not surprisingly, Energy, and contained extensive information on the label regarding the glycemic (or glycaemic) index. It was introduced in early 1999.

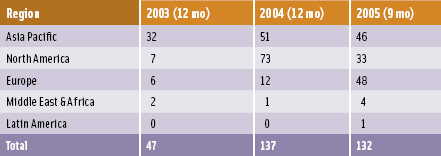

Although we did see the first products in other parts of Asia Pacific, it is in Australia that we have seen some of the most significant introductions. The accompanying table shows the incidence of food and beverage introductions bearing low-GI claims, by world region.

Although we did see the first products in other parts of Asia Pacific, it is in Australia that we have seen some of the most significant introductions. The accompanying table shows the incidence of food and beverage introductions bearing low-GI claims, by world region.

Asia Pacific shows the greatest number of product introductions, followed relatively closely by North America (which is driven almost exclusively by introductions in the U.S.). Europe has had a slower build, but relatively explosive growth in 2005.

In Asia Pacific, most of the products are in Australia, with some appearing in New Zealand as well. Starting in 2002, Australian companies began labeling products with the GI Symbol and the GI level (low, medium, or high) on the front of the package.

In North America, new product introductions jumped from almost nothing in 2003 to a ten-fold increase in 2004. One of the reasons for this significant jump is related to the other food formulation trends appearing in the U.S. at the same time. Dietary supplements in the U.S. have had GI claims since the late 1990s.

Europe’s new product introduction numbers are relatively low for a specific reason: most of the introductions that bear low-GI claims have appeared in the United Kingdom. Significant impact by private-label brands has caused the figures to jump in 2005.

The Australian Experience

Down under, new products bearing low-GI claims have grown steadily since 2002. Besides categories in which carbohydrates figure prominently (baked goods, confectionery), low-GI claims have also appeared on yogurt, energy drinks, and even water.

Here are a few recent key products of note from Australia:

Sanitarium extended its Up & Go line of nutritional drinks to include a variety called Energize. The company says that the dairy-based product enhances performance due to its protein content, and is also high in fiber, calcium, iron, and other vitamins and minerals. It makes a key GI claim that is repeated over and over among products: it has a low GI for slow release of energy. The product also is low-fat. It is quite typical for what we see on the market in Australia—products that bear a variety of better-for-you attributes, one of which is low GI.

--- PAGE BREAK ---

Sara Lee introduced a line of muffins just for kids. The company says that each 60-g muffin is lower in fat, sugar, and sodium than other choices and higher in fiber. The label says that the low-GI formulation aids sustained energy release.

Increasingly in Australia, products bear the GI symbol. While not all companies use the symbol, other ways of branding low GI appear on products. National Foods, for example, offers its Yoplait Nonfat Yogurt in a cup that clearly indicates that the product is low GI.

In New Zealand, low-GI products also appear, although in smaller numbers than in Australia. For example, Annies Marlborough offers FibreFruit fruit bars that contain a high percentage of fruit plus psyllium, flaxseed, soy fiber, and inulin. As a result, the package clearly promotes the benefits of slow energy release and digestive health (since the inulin also functions as a prebiotic).

The European Experience

In the European market, most of the significant low-glycemic products appear in the UK rather than in other countries. While the introductions were off to a relatively slow start, beginning in 2002, introductions have grown quite a bit, showing strong figures through the first three months of 2005.

Some of this growth has been spurred by the activity of a single company. Marks & Spencer has been an active supporter of GI labeling, and shows the GI level on a growing number of its products. The retail company’s broad line of better-for-you products is sold under the Count On Us brand. A selection of those products now bears very clear GI labeling on front of the package.

Elsewhere in Europe, low-GI products do exist, although they may be positioned a bit differently.

For example, Biocentury sells a line named Gluceminus in Spain and Portugal. The line is relatively diverse, in that it includes cereal bars, cookies, and confectionery products. All have a low GI and are clearly labeled as such. Unlike many of the other low-GI products on the market, this one is formulated and targeted specifically for diabetics.

The U.S. Approach

As mentioned above, we have seen "low glycemic" or "low GI" appear on products in the U.S. since the late 1990s. However, most products before 2003 were dietary or nutritional supplements rather than foods and beverages. For the most part, the products were focused specifically on athletes and bodybuilders and sold in natural food stores. As the low-carb diet swept the nation, and as consumers began to understand more about the positives and negatives of carbohydrates, the market seemed more open to the idea of "low glycemic" in foods and beverages.

Several companies have taken a unique approach to the issues of low carb, low sugar, and low glycemic, as they are all related. Russell Stover and Hershey Foods both have introduced products that fit each of these three nutritional profiles. Russell Stover has been perhaps the most progressive, with its DiabetX line of sweet treats that includes detailed information on glycemic index and glycemic load, and carries an endorsement from a major Australian diabetic research association. Hershey has taken a somewhat softer approach with its Sugar Free products by not focusing specifically on the diabetic market.

--- PAGE BREAK ---

As would be expected in the U.S. market, we see a wide variety of energy bars, nutrition bars, snack bars, and meal replacement bars that make low-GI claims. In fact, according to Mintel Premier Reports, one of the top-three-selling diet bars in 2004 was Abbot Lab’s ZonePerfect, which is a balanced nutrition brand with an emphasis on the GI.

Most of the companies that offer bars with low-GI labeling come from smaller companies. Solo GI Nutrition, for example, offers several varieties of its Solo snack bars, which are billed as weight management bars that provide sustained energy. Like most other low-GI products, the product also promotes its fiber content.

Where Next?

So where is low-GI going? Many would say that the concept has some significant hurdles for wide acceptance in the U.S. The concept can be difficult to understand, and it sometimes feels as if an advanced degree in nutrition is required to master the concept. This also ties into consumers’ seeming fear of all things scientific, which GI ratings can appear to be.

New product introductions as tracked by GNPD show some interesting changes over time related to low-carb, low-sugar, and low-glycemic. Introductions of low-carb products (almost exclusively in the U.S.) reached a high very quickly, then descended just as fast. Similar product activity also has been seen by low-sugar products, which can be partly attributed to the fact that low-sugar claims often appear in conjunction with low-carb claims. Low-glycemic introductions, on the other hand, have shown much smaller, but somewhat steady growth.

There may be opportunity for manufacturers to take a page from lessons learned in the past on fat reduction. When the Nutrition Labeling and Education Act went into effect in the early 1990s, much promotion was done about the need for consumers to eat 30% or fewer of their calories from fat. Labeling helped them to determine what levels of fat were contained in the products they were choosing. That shorthand ("30% of calories from fat"), while not precise, allowed consumers to better learn about the role of fat in the diet and how to create a diet more balanced in fat and calories.

The same may be possible with GI. Although GI figures vary widely from product to product and from category to category, there may be some benefit in promoting "a low number is a good number." Additionally, manufacturers of finished products should also keep an eye on popular diet plans to see what is being discussed. NutriSystem, for example, has its latest complete diet plan "based on the glycemic index system."

Perhaps even limited adoption of GI labeling on products will help continue to educate consumers of the role of fat, calories, carbohydrates, and other nutrients in the body and the connections among all of those components in creating a healthy positive food lifestyle.

by Lynn Dornblaser is Director, Custom Solutions Group, Mintel International, 351 W. Hubbard St., 8th floor, Chicago, IL 60610 ([email protected]).

References

Ebbeling, C.B., Leidig, M.M., Sinclair, K.B., Seger-Shippee, L.G., Feldman, H.A., and Ludwig, D.S. 2005. Effects of an ad libitum low-glycemic load diet on cardiovascular disease risk factors in obese young adults. Am. J. Clin. Nutr. 81: 976-982.