Converting Demographics Into Dollars

Demographic changes are creating unprecedented demand for instant preparation, little indulgences, budget gourmet items, and convenient take-to-work foods.

Itb�19;s hard to believe that so much has changed right before our eyes. According to the U.S. Census Bureau, one-third of the United States population are now age 55 and older (55+). Two-thirds of Americans live in single or two-person units. And with incomes under $35,000, more than one-third of U.S. households are struggling just to get by. All these segments present enormous food and beverage opportunities, yet the food and restaurant industries have been slow to respond.

Ongoing demographic shifts will spawn even-more-lucrative markets. Growing ethnic diversity will increase demand for authentic ethnic and specialty foods. A rise in the number of dual-income households, to whom time is evermore important than money, will drive the need for convenience and speed to an all-time high. With affluent households increasing and 45% of workers saying they're "overworked very often," indulgent little luxury foods and beverages will have even greater appeal (Wigton, 2006).

Ongoing demographic shifts will spawn even-more-lucrative markets. Growing ethnic diversity will increase demand for authentic ethnic and specialty foods. A rise in the number of dual-income households, to whom time is evermore important than money, will drive the need for convenience and speed to an all-time high. With affluent households increasing and 45% of workers saying they're "overworked very often," indulgent little luxury foods and beverages will have even greater appeal (Wigton, 2006).

As 31 million older Boomers turn age 65 in the next ten years, they'll set a new pace for "better-for-you" and functional foods. And, sadly, as more health issues afflict younger Americans, changing wellness demographics will create new opportunities, too. This article will discuss these demographic shifts and provide insights into eight significant demographic-directed opportunities for the food, beverage, and foodservice industries.

Suddenly Senior

Suddenly Senior

By 2010, 75 million Americans will be age 55+; 85 million by 2015 (Census, 2005; Figure 1). Already one of the largest, wealthiest, and most misunderstood generations in food industry history, they're going to have a dramatic impact on where, when, and what America eats (Sloan, 2007a). By 2015, 107 million will be age 50+, and they'll be a gold mine for new food opportunities.

Older adults are the most likely to prepare home-cooked meals, 90% of those age 61+ and 84% of those 43-60 made a home-cooked meal three or more times a week, compared to 70% of those 29-42 and 59% of those 18-28; up 4, up 8, down 5, and up 4%, respectively, over 2006 (FMI, 2007).

Easy to prepare is very important in selecting dinner foods for 33% of those 52-60 and 25% of those 65+ (MSI, 2005). One-third (31%) of older Boomers (age 52-60) use packaged foods at least once a week, 29% frozen, 23% prepared, 14% ready-to-cook, and 22% fast-food take-out; compared to 33, 25, 21, 12, and 16%, respectively, for those 62+ (FMI, 2005).

Unlike generations before them, those 55+ will drive explosive growth in the restaurant business as high-spending Empty Nesters - now 30% of all U.S. households - return to restaurants after their kids have gone. Those 55-64, followed by those 45-54, are the highest per-capita restaurant spenders (NRA, 2007).

Diners 50+ now account for 27% of casual-dining chain restaurant traffic and 36% of independent casual restaurant trafficb�14;higher than for any other age group (NPD, 2007a). In 2006, diners 50+ were 25% of fast-casual dining traffic, compared to 26% for those 35-49, 20% for those 25-34, and 14% for those 18-24 (NPD, 2007b).

One-third (31%) of single and 36% of married seniors 65b�13;75 and 27% of single and 32% of married adults age 75+ buy a meal at a restaurant at least once during a typical day (Blazer, 2007). According to Technomic (2007a), 16% of those age 55+ are heavy users of full-service-restaurant take-out.

--- PAGE BREAK ---

Balanced nutrition is also a very important dinner food selection factor for 60% of those 65+ and 54% of those 52-64; including a vegetable for 60% and 52%, respectively (MSI, 2005). Raised on the "Basic 4" concept of healthy eating, older consumers are aiming for a "balanced plate - protein, starch, vegetable, and, often, bread - and they're sending sales of side dishes soaring.

Despite the "meat and potatoes" image, pasta was the main dish most eaten for dinner in the past week by 65% of those 65+, followed by steak/beef (49%) and chicken/turkey (49%) (MSI, 2005).

Those 55-64 are 33% and those 65+ are 50% more likely to eat skillet/fried fish than any other age group; 32% and 54%, respectively, for shellfish (Balzer, 2007). McCormick's new Seafood Steamers Seasoning & Steaming Bags are perfect for these convenience-minded adults.

Older adults are the heaviest consumers of pork, lamb, veal, turkey, and duck, yet these items are rarely included in prepared meals. Those 55+ are also well-above-average consumers of pork tenderloin/roasts, ham, and ribs and 22% more likely to eat turkey than other groups (Snyder, 2007; Rodgers, 2007; NTF, 2007; U.S. Duck Council, 2005). Those 65+ are the least likely to eat chicken away from home; 26% of those 65+ and 28% of those 55b�13;64 are the most likely to say theyb�19;re tired of eating chicken (NCC, 2006; Mintel, 2006a). Maple Leaf Farmsb�19; new fully cooked Simply Duck entrees should have very high appeal.

Those 55+ are also the top salad, entrC)e salad, fruit, and vegetable consumers (PBHF, 2006). Those 65+ top the list of in-home potato eaters; those 60+ are the most frequent bean consumers (U.S. Potato Board, 2007; Rose, 2007).

Older adults are three times more likely to list meatloaf and casseroles as their favorite comfort foods; those 18b�13;24 name macaroni and cheese. Bob Evansb�19; new microwavable Green Bean Casserole makes an old favorite easy to prepare.

Healthier recipes are a must; half of those 55+ eat fewer comfort foods than five years ago (ICR, 2005). Theyb�19;re also partial to half and half in their coffee and are above-average users of dairy creamers, cottage cheese, milk shakes, and buttermilk (Moore, 2007).

Those 65+ are the heaviest consumers of soups, stews, and pot pies (ICR, 2005). And theyb�19;ll love Murrayb�19;s Chickenb�19;s all-natural Chicken Express Pre-Baked Chicken Pot Pies which microwave in two minutes.

And those 65+ top the list of dessert eaters, too. They are 42% more likely to eat ice cream; 89% frozen yogurt (Moore, 2007). The demand for pies, cakes, baking nuts, and dessert toppings will grow as 55+ consumers age, as will coffee and sugar substitutes (IRI, 2006a). Coppenrathb�19;s & Wieseb�19;s new Baileyb�19;s CrC(me Puffs, made with Baileyb�19;s Irish CrC(me, will be a big hit with the over-50 set.

Although older diners are the most likely to eat b�1C;3-squareb�1D; meals a day, theyb�19;re the least likely to snack, except on healthy snacks. Fresh fruit, nuts, dried fruit, trail mix, raw veggies, crackers, popcorn, and cheese top their list of b�1C;healthyb�1D; snacks (Mintel, 2006b). Theyb�19;re the most frequent eaters of breakfast but least likely to eat it at a restaurant (Mintel, 2007a). Theyb�19;re also the most likely to order eggs/omelet, meat, toast, and hash browns.

--- PAGE BREAK ---

Bold but not spicy, high-umami flavors such as meats, fish, aged cheese, and aromatic spices/herbs have been found to have high appeal to seniors (NIH, 2007). Those 55+ are the least likely to like foods cooked with lots of spices and are least interested in gourmet and foreign foods (SMRB, 2006). With older eaters less adventuresome, upgrading flavors of favorite/familiar foods is best.

Older adults have the highest preferences for boldly flavored cheese such as blue cheese and prefer Swiss, Muenster, and Parmesan; theyb�19;re the leading purchasers of natural cheese (Moore, 2007). Those 55+ are also the most frequent buyers of specialty cheeses and gourmet oils/vinegars; those 55b�13;64 gourmet olives, pickles, and relishes (Tanner, 2006).

Barbecue is eaten by 91% of those 50+ (MSI, 2005). Of those 50b�13;64, 59% have tried Cajun, 51% mesquite, 52% Tex Mex, 43% Creole, 41% curry, 39% Szechwan, 30% sushi, 25% Vietnamese, and 23% Caribbean Jerk seasonings (MSI, 2005).

While web�19;ve long thought of those 55+ as not very fond of ethnic cuisines, Technomic reports that 94% find Italian very/somewhat appealing, 91% Chinese, 80% Mexican, 66% German and Greek, 65% French and Japanese, 63% Caribbean, 56% Irish, 47% Korean, 44% Cuban, 40% Indian, and 29% African (Miller, 2007).

Perhaps the most important generational food difference is that those 50+ grew up on foods prepared with classic European cooking techniques. With a culinary pace set by Julia Child and Irma Rombauerb�19;s Joy of Cooking, traditional Northern European and classic French dishes still hold the high appeal for older Americans. German cuisine appears to be an overlooked opportunity for those 65+ (MSI, 2005).

Grab-and-Go Gourmets

At the other end of the age spectrum, the children of the Baby Boomersb�14;the 72 million Echo Boomers or Generation Y, now age 12b�13;29b�14;are creating explosive new food and beverage markets as they enter the work force and their child-bearing years. By 2015, 31 million Americans will be 18b�13;24 and 41 million 25b�13;34 (Figure 1).

And theyb�19;re as different from their parents as they can be (Sloan, 2005). Gen Yers are the heaviest users of restaurants; those 18b�13;24 eat out 6.5 times/week and those 25b�13;34 5.9 times/week, compared to 3.0 times/week for those age 65+ (NRA, 2007). Gen Yers are seven times more likely to eat at fast-food places than those 65+, who prefer full-service restaurants (FMI, 2007).

Economic pressures, however, have caused some Gen Yers to cut back on restaurant spending. In 2007, 13% of those 15b�13;26 ate out at least four times/week, compared to 24% in 2006 (FMI, 2007). While these young adults are least likely to cook, theyb�19;re faithful followers of The Food Channel and will drive the trend to gourmet home meal assembly kits (Sloan, 2007b).

Despite their lack of cooking skills, those 18b�13;24 are 33% more likely to eat gourmet whenever they can and 34% more likely to prefer food presented as an art form. Gen Yers also have the highest preference for foods cooked with lots of spices and rank just behind those 25b�13;34 in enjoying foreign foods (SMRB, 2006).

While Technomic reports that Italian, Chinese, and Mexican are still the favorite cuisines of those 34 and youngerb�14;appealing to 82, 88, and 87%, respectivelyb�14;66% of these young adults find French extremely/somewhat appealing, 62% Japanese, 62% Caribbean, 61% Greek, 57% Cuban, 54% Irish, 54% German, 50% Indian, 46% Korean, 42% Moroccan, 37% African, and 34% Nicaraguan (Miller, 2007). Kahiki Foodsb�19; Naturals line of minimally processed, single-serve entrees and Gourmet Expressb�19;s Gourmet Dining skillet meals, including Garlic Chicken and Beef Stir Fry, should have high appeal.

Those 18b�13;24 are the most frequent purchasers of specialty foods and are the highest per-capita specialty food spenders (Tanner, 2006). Theyb�19;re most likely to buy items that require few cooking skills and/or offer b�1C;little luxuries.b�1D; Young adults have the highest incidence of purchasing specialty breadsb�14;bought by 63% of those 18b�13;24b�14;followed by chocolate, cookies, barbecue sauce, meats, pasta/sauce, condiments/mustards, crackers/crisps/bread sticks, prepared ready-to-eat gourmet foods, salty snacks, jams/jellies/preserves, and non-chocolate candy. Those 25b�13;34 are the heaviest purchasers of specialty salad dressings.

--- PAGE BREAK ---

Gen Yers most enjoy trying new foods (SMRB, 2006). Theyb�19;re the most likely to order appetizers and samplersb�14;twice as likely as those 55+ (Technomic, 2006a). Of those under age 34, 29% order appetizers every time and 42% sometimes when dining out. More than half (57%) of those under 34 find ranch dressing very appealing, 36% BBQ, and 27% b�1C;hotb�1D; sauce; those 55+ have the highest preference for sweet b�19;nb�19; sour, blue cheese, and sweet and spicy (Technomic, 2006a).

Those 18b�13;24 are also 89% more likely than other age groups to want to try new drinks; those 25b�13;34, 44% (SMRB, 2006). One-third of those 21b�13;29 use energy beverages, compared to 4% of those 55+. Gen Yers are also more likely to indulge in regular (non-diet) soft drinks, thirst-quenching/ activity beverages such as Gatorade, and specialty coffee beverages like espresso and cappuccino. Adults 55+ are the highest users of diet beverages and vegetable juices; consumption of coffee and hot tea (bag) increases with age.

Flavored alcoholic beverages, beer, rum, tequila, and vodka also appeal to Gen Y consumers more than other age groups. Domestic wines, brandy and Armagnac are more heavily consumed by those 55+ than by younger adults (SMRB, 2006).

Young adults 18b�13;34 are the most frequent chicken consumers, having eaten 5.9 meals/snacks with chicken in the past two weeks, compared to 5.1 for those 35b�13;64 and 4.1 for those 65+ (NCC, 2006). They are the least likely to eat pasta for dinner (Mintel, 2007b).

Surprisingly, those 18b�13;24b�14;followed by those 25b�13;34b�14;were the least likely to purchase burgers at a restaurant in the past month or to say that burgers were their favorite lunch sandwich, although burgers were their favorite item for dinner (Technomic, 2007b).

Those under 30 also eat fewer sandwiches than older adults (IDDBA, 2006). Chicken (fried/breaded), turkey, veggie, chicken/grilled, BLT, cold cut combo, grilled cheese, and roast beef were the most-ordered sandwiches by those 18b�13;24; a Reuben, fish, barbecued pork, or tuna salad sandwich by those 65+; and a tuna, Reuben, steak, or chicken salad sandwich for those 50b�13;64 (IDDBA, 2006). Younger adults have the highest preference for Caesar salad; they prefer chicken as a salad topping and least prefer shrimp (Technomic, 2007c).

Those 18b�13;25 are also the least likely to cite Mozzarella as their favorite pizza cheese topping or plain tomato as their favorite sauce. They are the most likely to prefer a thin crust, but fresh toppings are not as important as they are to older adults (Technomic, 2006b). LaRocco Pizza Co.b�19;s new ethnic pizzas, including Greek Sesame and Shiitake Mushroom, should be a big hit with Gen Yers. And with Gen Yers being big fans of organic foods, Kashib�19;s new All Natural Mediterranean and Roasted Garlic Chicken pizzas will also be right on target.

Only one-third of those 18b�13;24 eat breakfast every day, compared to 72% of those 65+ (FMI, 2007). Younger breakfast eaters order more pancakes, waffles, and French toast, as well as juice, tea, hot chocolate, and soda. They have the highest interest in leftovers, delivery, bagels, pastries, sandwiches/wraps, and ethnic cuisines for breakfast. Those 25b�13;34 are most interested in baked goods (Mintel, 2007a). Bob Evansb�19; decadent new Stacked and Stuffed Hotcakes are right on target for Gen Y.

Last, while hand-held, on-the-go, and b�1C;no utensilsb�1D; have been hallmarks of this grab-and-go generation, those 18b�13;24 are the most likely to visit limited-service restaurants with friends or co-workers and dine in instead of using the drive-thrub�14;30% dine in with friends or co-workers for fast-food breakfasts (Mintel, 2007a).

--- PAGE BREAK ---

Young Families

As Gen Yers enter parenting ageb�14;coupled with tremendous growth in the Hispanic communityb�14;the number of families, particularly with children under age 6, will explode. From 2005 to 2015, the number of children under age 5 will grow by 10%, those 6b�13;11 will grow by 4.1%, and those 12b�13;17 will fall 3% (Census, 2005). In 2007, 25 million kids are under age 5, 21 million are 6b�13;11, and 25 million are 12b�13;17.

The U.S. food and beverage market for kids age 3b�13;11b�14;not including candyb�14;is expected to grow from $15.5 billion in 2006 to $26.8 billion in 2011 (Packaged Facts, 2007a). Not surprisingly, foods and beverages for before, during, and after pregnancy and infant and toddler foods are already skyrocketing (Sloan, 2007b). In fact, in 2006 there were more babies born in the U.S. than at the height of the postb�13;World War II baby boom. Beech-Nut Nutrition Corp. has introduced Good Morning and Good Evening, the first line of baby food specially formulated to provide babies with the nutrients that they need when they need them. Good Evening contains high-quality protein to help keep babies calm and relaxed during the evening, plus the probiotic inulin to help babiesb�19; digestive health. Beech-Nut is the first major jarred baby food and cereals to include prebiotics.

Although generally cash concerned, young families have above-average expenditures on convenience foods and are above-average purchasers of aseptic juice, refrigerated lunch packs, dry fruit snacks, toaster pastries, frozen breakfast food, Mexican foods, dry packaged dinners, and frozen appetizers/snack rolls (IRI, 2006b). Skipping breakfast is no longer an excuse in busy households, with Kangaroo Brandsb�19; All Natural Cheese Omelet Pitas.

At the same time, young family households are among the lowest spenders on self-indulgent categories such as alcoholic drinks and snack nuts.

With 28% of parents admitting they have an overweight child; 50% of children, tweens, and teens expected to be overweight by 2010; and concern over high blood pressure, high cholesterol, and diabetes in kids rising, "better-for-you" kids' foods will be big business (FMI, 2007; Sloan 2006). IRI (2006b) reports that sales of such foods were three times the sales of regular kids' foods in 2006. NestlC) Nesquik Powder now has 25% less sugar than other brands.

In addition, mothers of young children are becoming strong purchasers of organic food. Nearly two-thirds (63%) of shoppers with children prefer to buy organic foods for their families (FMI, 2006). Lower middle-income households, those with income between $35,000 and $49,999, are more likely to buy organic for a baby. Moreover, 42% of moms are very concerned about antibiotics and hormones in their kidsb�19; foods. Free-Bird offers a line of frozen, fully cooked, antibiotic- and hormone-free chicken products.

Young & Not-so-Healthy

There's no doubt that the demographics of those who are changing their eating habits and taking action for health are skewing younger. In fact, those over 65 are the most likely to say they're satisfied with their eating habits (FMI, 2007).

Those 40-58 were the least satisfied with their eating habits, weight, and health and the most likely to be making changes in their diets for health (Technomic, 2007d). Those seeking healthier fare at restaurants are skewing younger, too. In May 2007, 25% of patrons seeking healthier menu items in restaurants were age 35-49, 13% were 18-24, 17% were 25-34, 18% were 50-64, and 11% were 65+ (Glazer, 2007).

--- PAGE BREAK ---

However, older adults are the most likely to have specific health conditions that have dietary implications and most likely to be on a special diet. Of those 65+, 38% are on a low-fat diet, 34% low-salt, 28% low-sugar, and 26% high-fiber; of those 55-64, the respective figures were 31%, 24%, 23%, and 19% (IRI, 2006a). Just over half of those 65+ have high cholesterol, compared to 44% of those 55-64. One in five (20%) of those 65+ are diabetic; 17% of those 55b�13;64. Those 52-60 have the highest percentage of self-reported overweight 71%, compared to 56% of those 65+ and 59% of those 52-61. Green Giant's Seasoned Vegetables provide only 40 calories/serving and are low in fat.

Two-thirds of those 55-64 and 55% of those 65+ have increased their use of whole grains in the past two years, and 51% of those 55-64 and 40% of those 65+ have increased their dietary fiber (HealthFocus, 2007). Of those age 65, 45% have decreased their use of salt, 46% sugar, and 36% beverages with sugar; of those 55-64, the numbers are 43%, 50%, and 42%, respectively.

According to HealthFocus (2007), the top five ingredients that adults 55+ consider extremely/very important to seek when choosing foods are whole grain, high fiber, protein, calcium, and antioxidants, and the five to avoid are trans fat, saturated fat, cholesterol, sugar, and sodium; six in ten older adults are avoiding trans fats. Zatarain's New Orleans Style rice mixes now have 25% less sodium, for those seeking to limit their sodium intake.

Desktop Dining

With 150 million Americans on the job every dayb�14;and less time available to pick up lunch or prepare it at homeb�14;itb�19;s no wonder savvy consumer product marketers have begun targeting workers, long the purview of the restaurant business.

And a big market it could be. In 2006, 59% of full-time workers bought a lunch from a foodservice location at least once during the past week, 31% a breakfast item, 42% a snack or beverage, and 44% dinner on their way home from work (NRA, 2007). One-quarter (26%) of quick-service restaurant (QSR) customers come from work during the day and 22% from 10:00 p.m. to 5:00 a.m. (NPD, 2007c). Not surprisingly, some full-service and QSR restaurants are starting office/plant delivery programs to hold their ground.

With 40% of American workers eating at their desks and 70% saying they work straight though lunch or spend 5b�13;10 minutes on a quick bite, it is not surprising that a new generation of microwavable, frozen/refrigerated brown-bag meals are emerging (IRC, 2007). Six in ten would prefer a hot meal for lunch, and with microwave ovens available in most workplaces that's a cinch (IRC, 2007). Oscar Mayer's Deli Creations Hot Sandwich Melts can be microwaved hot in 60 seconds, and Fast Fixinb�19;s individually wrapped On the Go CheeseBurgers in one minute.

With female Gen Xers and Boomers the most likely to bring lunch from home, healthful options such as Ready Pac's single-serve Bistro Salads will find a welcome market. And thereb�19;s plenty of room for growth. One-fifth of those who eat lunch four or more days a week bring lunch from home; 11% eat at home (FMI, 2007).

Single-Minded Solutions

American households are becoming smaller. In 2007, the average household is estimated to have 2.55 persons; the average family 3.07. More than 65% of Americans live in one- or two-person households (Census, 2005).

--- PAGE BREAK ---

Empty Nesters - married couples with no children at home - will continue to gain share as the largest household unit, accounting for 31.5% of all U. S. households by 2010, followed by those living alone (26.8%). Two-parent households with children will fall to 20.1%; 6.1% of households will be headed by a single mom with children and 1.6% by a father with children (Census, 2005).

With more than 95 million Americans over age 15 unmarried, 30 million living alone, and 12 million single parents - not to mention Empty Nesters - the demand for flexible portion packaging and servings for one or two will continue to grow. Four out of ten singles are under age 35, 57% under 45 (Packaged Facts, 2007b).

While singles eat out more often and cook less, 70% still ate dinner at home at least five nights a week in 2006 (FMI, 2006). One-quarter (24%) often eat frozen dinners, 24% store-made pre-cooked meals (Packaged Facts, 2007b). While 52% say that easy-to-prepare foods are their favorite, 49% also say they really enjoy cooking, 50% say they like trying new recipes, and 35% say they like to try new drinks (SMRB, 2006). One in five (20%) have eaten at fast-food restaurants 14 or more times in the past month. Singles are also the most likely to use food delivery services. Singles account for 40% of carryout from casual restaurants (Sandelman, 2007). Singles are also 35% more likely to be vegetarians (Packaged Facts, 2007b).

Love and Quiches Desserts? Gourmet Grab & Go® collection is designed for single-serve portability and includes Four Cheese Quiche and Broccoli & Cheddar Quiche. Swissrose International's Mini Fondue Cups are single-serve, shelf-stable products that come in chocolate and cheese versions.

Extreme Value

Unfortunately, many American households are struggling to make ends meet, creating unprecedented opportunities for "budget" or "extreme value" (very discounted) foods and beverages (IRI, 2006b). Just witness the incredible success of "value" and "dollar" menus in QSRs last year.

Households with annual income levels of $50,000 or less account for 53% of the U.S. population, and households under $35,000 account for 38% (Census, 2005). When adjusted for inflation, income among non-elderly households fell by 2.7% from 2000 to 2005 (IRI, 2006b). At the same time, the number of budget-strapped minority and single-parent households continues to rise.

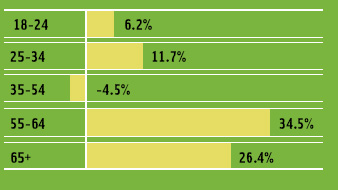

Over the longer term, the economic crunch will most affect the younger generations. Nearly all additional wealth created in the U.S. since 1989 has gone to those 55+. While wealth has doubled for those 55+, households headed by those in their 20s, 30s, and 40s have barely kept up with inflation (Couchon, 2007).

Not surprisingly, with attractive contemporary labels and product concepts, including organics and premium, sales of private-label products have soared, reaching $48 billion in 2006 and projected to top $56 billion by 2011 (Packaged Facts, 2007c). While dairy and grain foods still top the sales list, convenience items like pizza have enjoyed the strongest growth.

Lower-income households are well above average for purchases of canned meats and shelf-stable dinners (IRI, 2006b). But where are the budget-minded "gourmet" frozen meals for cash-strapped Gen Yers, reasonably-priced baby foods, and low-cost, healthy, kids' meals for price-minded moms? Michelina's Budget Gourmet, Lean Gourmet, Authentico, and Signature® lines are model examples of marketing to budget-minded shoppers.

--- PAGE BREAK ---

Opportunidades

No discussion of demographics would be complete without a mention of the phenomenal growth in the U.S. Hispanic population, projected to increase by 29% by 2015 vs 9% for the total population (Census, 2005). IRI (2006b) estimates that U.S. Hispanic buying power - now $652 billion today - is growing at 9% per year.

Among the total U.S. population, the 0-6 and 6-11 age groups will grow by 10% and 4%, respectively, by 2015. Among Hispanics, though, the 0-6 population will grow by 22% and the 6-11 population by a staggering 23%. By 2015, one-third of U.S. Hispanics will be under the age of 18 (IRI, 2006b).

Marketing to Hispanics is no easy task, as country of origin and degree of acculturation play a major role in Hispanic eating and buying preferences. IRI (2006b) reports that Hispanics index above average for purchases of Mexican foods, aseptic juices, sports drinks, rice, tea/coffee/ready-to-drink, bottled water, spices/seasonings, refrigerated fresh eggs, luncheon meats, shortening and oil, seafood, and other foods. With a high percentage of young families, products for babies and young children also have above-average purchase. Busy Hispanic households will love Juanita's Foods prepared authentic menudo products, packaged in easy-open cans.

Plan to React

It's ironic: the more diverse our population becomes, the more the key drivers for food and beverage successes remain the same. Nearly everyone seems to be in hurry, and convenience reigns. New product ideas must consider portability, preparation ease/time, and household size. Health-concerned demographics have broadened, making health and wellness key factors in product formulation for all ages as health clinics move into stores. Indulgence and reward remain important, too. Marketers must put plans in place to react to new diet trends and issues.

by A. Elizabeth Sloan, Ph.D., a Professional Member of IFT and Food Technology Contributing Editor, is President, Sloan Trends & Solutions, Inc., P.O. Box 46119, Escondido, CA 92046 ([email protected]).

References

Balzer, H. 2007. Data from NPD/Crest. Personal communication, NPD Group, Port Washington, N.Y. www.npdfoodworld.com.

Census. 2005. Current population reports. U.S. Census Bureau, Washington, D.C. www.census.gov.

Couchon. D. 2007. Generation gap? About $200,000. USA Today. May 21. www.usatoday.com.

FMI. 2005. Shopping for health. Oct. Food Mktg. Inst., Washington, D.C. www.fmi.org.

FMI. 2006. Shopping for health 2006. May.

FMI. 2007. U.S. Grocery shopper trends 2007. May.

Glazer, F. 2007. NPD: Patrons seeking healthful fare find more satisfaction. Nation’s Restaurant News 41(19): 28.

HealthFocus. 2007. HealthFocus U.S. Trends Study. HealthFocus Intl., St. Petersburg, Fla. www.healthfocus.com.

ICR. 2005. Country Crock Side Dishes comfort food survey. International Communications Research, Media, Pa. www.icrsurvey.com.

IDDBA. 2006. The sandwich study. Intl. Dairy, Deli, Bakery Assn., Madison, Wis. www.iddba.org.

IRC. 2007. Lunch survey, March. Impulse Res. Corp., Los Angeles, Calif. www.impulse-research.com.

IRI. 2006a. 55+: The new “must win” market. Times & Trends, June. Information Resources, Inc., Chicago. www.infores.com.

IRI. 2006b. Emerging consumer segments. Times & Trends, Dec.

Miller, H. 2007. Personal communication, Technomic, Inc., Chicago. See also Am. Express Market Brief, June. Technomic, Inc.

Mintel. 2006a. Poultry—U.S. July. Mintel Intl., Chicago. www.mintel.com.

Mintel. 2006b. Healthy snacks U.S. March.

Mintel. 2007a. Dining out review: Limited service breakfast—U.S. Feb.

Mintel. 2007b. Pasta and pasta-based meals—U.S. May.

Moore, C. 2007. Data from NPD’s National Eating Trends. Personal communication, Dairy Mgmt., Inc., Rosemont, Ill. www.innovatewithdairy.com.

MSI. 2005. Gallup 2005 study of home meal replacement. Multi-Sponsor Surveys, Inc., Princeton, NJ. www.multisponsor.com.

NCC. 2006. National Chicken Council consumer survey. June. Natl. Chicken Council, Washington, D.C. www.nationalchickencouncil.com.

NIH. 2007. NIHSeniorHealth. gov, the web site for older adults. www.nihseniorhealth.gov.

NPD. 2007a. Casual chain dining by age. Nation’s Restaurant News 41(17): 18.

NPD. 2007b. Consumer scorecard: People over 35 drive growth in fast casual dining. Nation’s Restaurant News 41(17): 3.

NPD. 2007c. Consumer scorecard: QSR customers likely coming from home or office. Nation’s Restaurant News 41(16): 3.

NRA. 2007. National Restaurant Association 2007 forecast. Natl. Restaurant Assn., Washington, D.C. www.restaurant.org.

NTF. 2007. National boomer and senior turkey survey. May. Natl. Turkey Federation, Washington, D. C. www.eatturkey.com.

Packaged Facts. 2007a. Kids food and beverage in the U.S. Packaged Facts, New York. www.packagedfacts.com.

Packaged Facts. 2007b. Singles in the U.S.: The nuclear family. May.

Packaged Facts. 2007c. Private label food and beverages in the U.S. January.

PBHF. 2006. Closing the opportunity gap. Produce for Better Health Foundation, Wilmington, Del. www.pbhfoundation.org.

Rodgers, P. 2007. Personal Communication. Am. Sheep Industry Assn., Centennial, Colo. www.sheepusa.org.

Rose, D. 2007. Personal communication, Bush Brothers, Knoxville, Tenn.

Sloan, A.E. 2005. Demographic directions: Mixing up the market. Food Technol. 59(7): 34-36, 39-40, 43-45.

Sloan, A.E. 2007a. 55+: Food, flavors, nutrition & health. June. Sloan Trends Inc., Escondido, Calif. www.sloantrend.com.

Sloan, A.E. 2007b. Top 10 food trends. Food Technol. 61(4): 22-24, 27, 29-32, 35-39.

SMRB. 2006. Fall 2006 Experian Simmons national consumer study. Simmons Mkt. Res. Bureau, New York. www.smrb.com.

Snyder, C. 2007. National Pork Board. Des Moines, Iowa. www.pork.org.

Tanner, R. 2006. Today’s specialty food consumer. Specialty Food 39(9):34-48.

Technomic. 2006a. Appetizer category report, appeal varies dramatically. Am. Express Market Brief, September, pp. 3-5. Technomic, Inc., Chicago. www.technomic.com.

Technomic. 2006b. 2006 pizza category report.

Technomic. 2007a. FSR takeout sees growth. Am. Express Market Brief, June. pp.1-3.

Technomic. 2007b. The evolving sandwich category report.

Technomic. 2007c. The salad category report.

Technomic. 2007d. Generational marketing: Dancing to different tunes. Am. Express Market Brief, April, pp.3-5.

U.S. Duck Council. 2005. National consumer duck survey. www.impresswithduck.com.

U.S. Potato Board. 2007. USPB consumer, market, industry research. Denver, Colo. www.uspotatoes.com.

Wigton, T. 2006. The state of the American workforce & workplace. Families & Work Inst. www.familiesandwork.org.