Private Label Is Getting Complicated

Shifts in sales patterns for value, mainstream, and premium private brands are changing the market dynamic. Where’s the momentum in 2021?

Article Content

It’s impossible to get a clear picture of private brand trends without recognizing the multi-tiered nature of the segment as well as the fact that sales trends have shifted across tiers and are likely to continue to do so. Overall—except for a dip in 2016—U.S. private label food and beverage products have enjoyed steady growth for the past several years as retailers have differentiated themselves with unique high-caliber, yet relatively affordable, store brand items that match or exceed the quality of comparable national brands. In its January 2020 report Private Label Food and Drink Trends—U.S., Mintel projected pre-pandemic that private brand food and beverage sales would grow by more than 12% over five years, increasing from an estimated $82.6 billion in 2019 to $92.8 billion in 2024.

Prior to the COVID-19 pandemic, retailer-owned value (lowest-priced) and mainstream (national-brand-equivalent [NBE]) tiers faced challenges in the grocery channel, however, as retailers focused on more premium items (FMI 2020). Per IRI data, private label food products in the value tier declined in retail dollar sales by 5% in 2019 and 2% in 2018. Meanwhile, the mainstream tier experienced flat (0%) growth in 2019, preceded by a 1% decline in 2018, FMI reports.

Then in March 2020, SARS-CoV-2 abruptly reversed this slide in performance. The deleterious financial impact of the coronavirus on many consumers—coupled with shortages of some national brand products—led to a surge in sales of value and NBE store brand food products in the grocery channel during the first couple of months of the pandemic. As the FMI report notes, in the eight-week period from March 8, 2020, to April 26, 2020, private brand food and beverage dollar sales in the value and mainstream tiers soared, respectively, 28% and 29% higher than year-ago sales. However, by May 31, gains in the value segment had tapered off, likely due to competition from dollar stores, according to FMI.

As the pandemic winds down and the economy strengthens, the market for premium private brand food and beverage items, including products with health and wellness and free-from attributes, will continue to grow, experts predict. “Higher-income shoppers—those with incomes of $100,000 or more—are more likely than others to purchase private brands going forward,” notes FMI (2020), which has done extensive demographic analysis. What’s more, “millennials are the age cohort most expecting to purchase private brands in the future compared to before,” and Gen Z consumers have discovered the high quality of store brand foods and beverages, FMI reports (2020).

“Absolutely, retailers will still focus on premium food and beverage introductions,” emphasizes private brand industry consultant Linda Severin. Besides being food adventurers who like to try unique items and care about the quality of ingredients, millennial and Gen Z consumers tend to be passionate about issues such as environmental sustainability and the humane treatment of animals and have demonstrated willingness to pay more for products that reflect their values. They also use social media to share amazing finds with others, whether a delicious vegan ice cream or fair trade coffee from Tanzania.

Catering to consumers’ ongoing penchant for indulgent snacking, Target this spring debuted Favorite Day, a food brand focused on dessert and bakery products, including premium ice cream and candy, that will ultimately include more than 700 SKUs.

On the Upswing

By the end of 2020, private label and name-brand food and beverage products had experienced comparable sales growth across multiple retail channels in the United States. In full-year 2020, private brand edible CPGs grew 14% in retail dollar sales over 2019, while national brand edible CPGs grew 15%, notes Mary Ellen Lynch, principal–center store for IRI.

After ranking the top 20 private brand edible categories on absolute dollar growth from the previous year, Lynch noticed a distinct pattern. “What I observed is that the categories that are a base or core ingredient in recipes came to the top,” she says. These growth categories included natural cheese, frozen seafood, milk (tied to kids being at home), refrigerated meat, eggs (for making breakfast at home), bottled water, and spices and seasonings, among others.

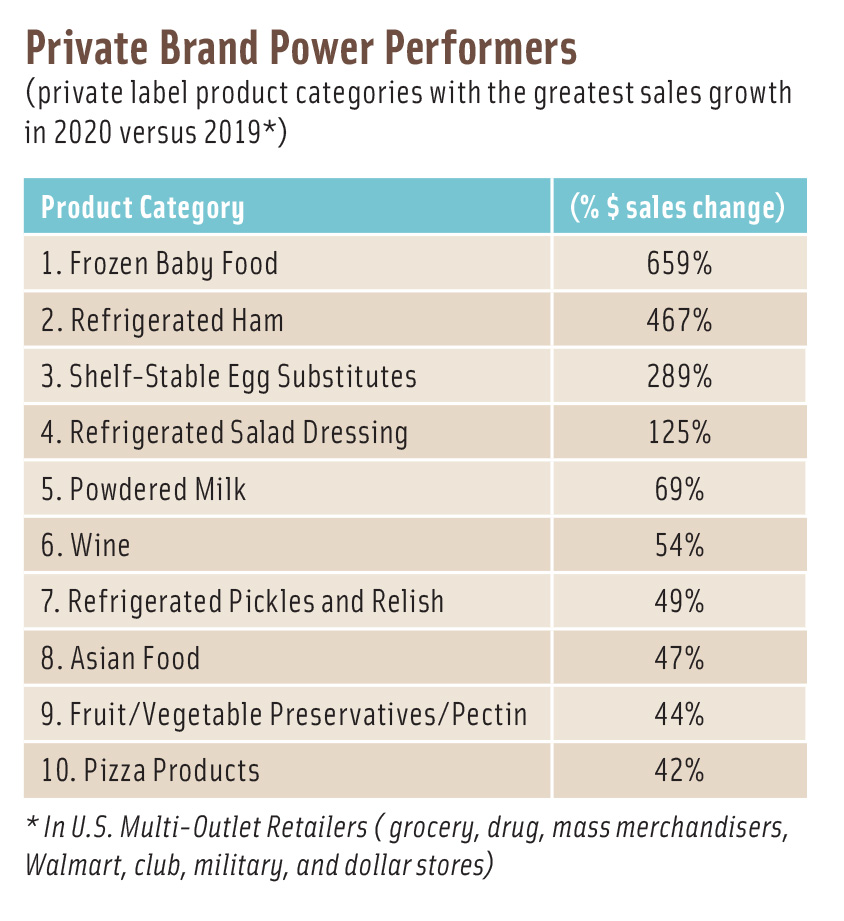

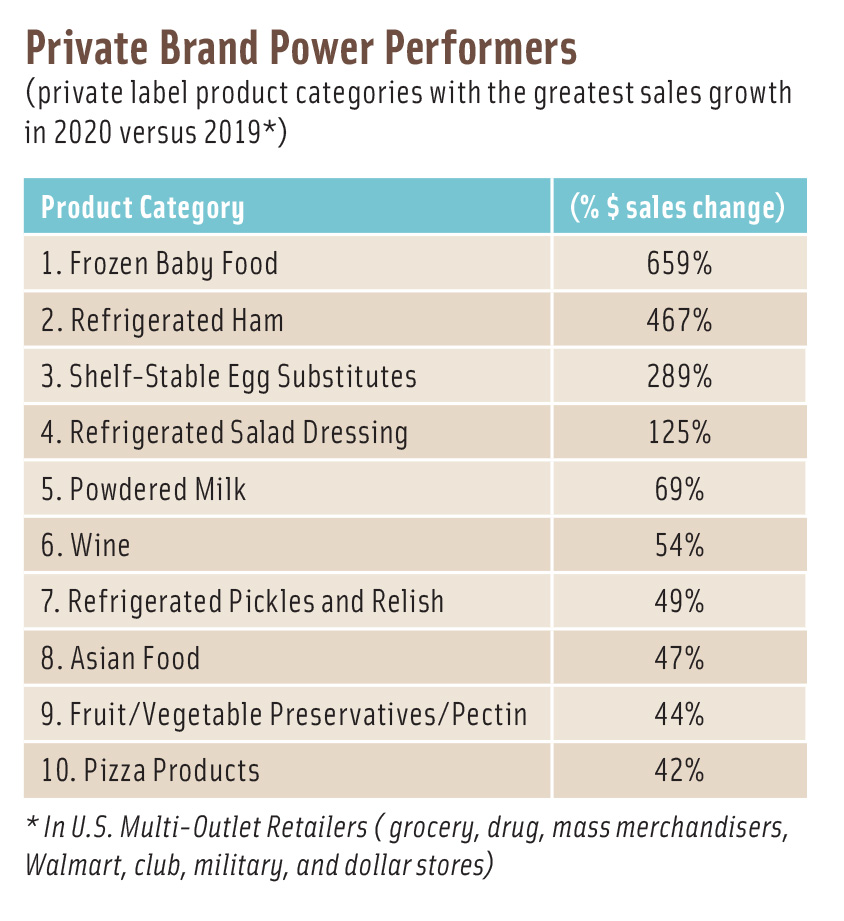

In contrast, when Lynch ranked the categories on percentage growth from the previous year, a new pattern emerged for store brand edible CPGs. “Many of the categories that came to the top are enhancements to the core,” she explains. These strong gainers included egg substitutes, refrigerated dressing, powdered milk, and wine. (See the table for other Top 10 private brand gainers.)

Internationally, the picture is similar, with food staples dominating private brand growth. According to Lu Ann Williams, co-founder of Innova Market Insights, the top three categories for global private label product launches in 2020 were fruit and vegetables; meat, fish, and eggs; and ready meals and side dishes.

It’s also important to look at changes in purchasing behavior over the course of the prolonged pandemic. Initially, U.S. consumers gravitated toward comfort food and ordered a lot of pizza, fried chicken, and burgers for takeout or home delivery. Although Americans are still enjoying these familiar favorites, as COVID-19 dragged on and store shelves became better stocked, people have turned to meal preparation to save money, enjoy a fun activity with their family, and eat more healthfully. But not everyone is a skilled chef, so convenience has been paramount.

What other private brand trends have emerged over the course of the past year that will continue to shape this market segment? Here’s a look at what the experts are seeing.

• Meal Kit Solutions. The “resurgence of the meal kit,” a natural niche for supermarket store brands, caught the attention of Kara Nielsen, director, Food & Drink, for global trend forecasting company WGSN. “It made sense, but I’m a little surprised,” says the longtime food industry trends analyst, noting that she had closely tracked the rise and fall of what was once thought to be a dying fad.

Kroger, which acquired Home Chef in 2018, is a prominent player in the meal kit space, transforming the previously independent company into a robust private brand that now includes other meal solutions. Earlier this year, Kroger rolled out its new Home Chef Heat & Eat Soup line to its stores across the country. Made from fresh ingredients, the refrigerated soup line includes seven flavors: Broccoli Cheddar, Creamy Tomato, Chicken Noodle, Loaded Potato, Chicken Wild Rice, Beef Chili with Beans, and Thai Style Chicken Coconut Curry.

• Private Label Goes Global. While most of the Home Chef soup flavors are classic American, the latter reflects a trend that was gaining ground before the pandemic: growing interest in global cuisine and seasonings, especially Asian, Latin American, African, and Middle Eastern. Initially driven by millennials, who are known to be food adventurers, the rising demand for internationally influenced foods and beverages has spread to other demographic groups. “Ethnic flavors going mainstream” is a trend that is having a significant impact on private brand food and beverage products, says Severin.

For example, Severin points out that Trader Joe’s, a chain where more than 80% of products are private label, has a line of fresh vacuum-packaged marinated meats with SKUs such as Shawarma Beef Sirloin and Harissa Flavored Chicken Thighs. “Years ago, shawarma and harissa would have been very niche, but they are definitely in the mainstream now,” she notes.

Another good example of this trend, according to Severin, is a line of globally influenced simmer sauces in Target’s Good & Gather private brand. The SKUs in this line include Pad Thai (made with authentically brewed soy sauce and tart tamarind), Panang Curry (made with real coconut milk and creamy peanut butter), Tikka Masala (made with yogurt and toasted spices), and Butter Chicken (made with cream, butter, and toasted tandoori masala).

“Now consumers can go to their local Target, buy these sauces that are very easy to use, and make these dishes quickly and easily,” Severin observes. “Because restaurants have been closed, grocery retailers have been the ones to bring ethnic experiences to consumers.”

Indeed, when it comes to sauces and other flavor-enhancing products, store brands have long been at the cutting edge. “Some categories such as condiments and sauces, where consumers are more open to experimentation, lend themselves to more innovation,” Lynch explains. Because grocery retailers closely monitor their customers’ purchasing data, they can pilot-test SKUs more easily and measure their success, whereas it is more of a financial risk for a national brand to introduce a new line or bold new items.

“One of the great things about private brands is that they’re not afraid to try new flavors,” says Severin. “And if something doesn’t work, they’ll move on. Retailers have very quick access to the data on what’s working and what’s not.”

Walmart’s Sam’s Choice brand, for one, has been particularly innovative with its line of mustards in such flavors as Garlic Aioli, Cuban Style, Chipotle, and Dill. Like most shelf-stable store brand items, the SKUs can be purchased online from the retailer’s website, where customers are encouraged to rate and comment on the products. Many retailers also engage with customers via social media to find out what they like or don’t like about a chain’s signature brands. Customer feedback can lead to new product innovation.

• Building on the Familiar. “Private brands often take something that is familiar, but they bring in a new twist,” Severin observes. For instance, Kroger’s Simple Truth brand has launched a line of flavored pistachios in three flavors: Pink Himalayan Salt and Pepper, Chipotle Barbecue, and Habanero Lime. “If you think about it, flavored almonds have been around for years, and you sometimes see flavored cashews,” says Severin. “But pistachios predominantly have been just shelled or unshelled. What Kroger has done is take pistachios, which many shoppers love and are certainly on trend as a high-protein food, and they’ve brought in just a little twist that makes the product more craveable.”

Another product that exemplifies this strength of store brands, according to Severin, is Trader Joe’s Calabrian Chili Tomato Dumpling Soup, which was introduced earlier this year. “The tomato soup is that traditional comfort food, dumplings are very familiar, and then all kinds of chilis have been popular for the past five years,” she explains. “Trader Joe’s brings those familiar themes together in an interesting way to make something that sounds very appealing.”

Consumers are seeking novelty after being shut in for so long, agree food industry experts. This is no less true in the snack food, confectionery, and frozen dessert categories—long areas of flavor innovation for store brands. “Consumers definitely sought out the familiar and nostalgic flavors that provide comfort during the onset of the pandemic, but boredom is starting to set in,” notes Dawn Sykora, vice president of marketing for Mount Franklin Foods, a manufacturer of private label candy and nut snacks.

The confectionery business is growing, with people indulging themselves and their children with treats more frequently to break the monotony of staying at home, as well as splurging even more than usual during candy-centric holidays. “The nonchocolate chewy candy category is really thriving,” says Sykora. “Sours are still on trend, but consumers are also enjoying some of the less traditional flavors like pomegranate, ginger, and tamarind.”

In addition, Mount Franklin is offering a new product to retailers that combines a soft, sweet candy base with a bit of spicy flavor. This “sweet heat” candy “appeals to consumers looking for flavor experimentation,” Sykora says.

• Limited-Time Launches. The ability of private brands to innovate quickly also makes them adept at producing limited-time-only and seasonal products. For example, Raley’s, a supermarket chain based in Sacramento, Calif., debuted Raley’s brand Hot Cocoa Bombs during the winter holidays. “These fun bombs were made of chocolate and filled with marshmallows and created instant, delightful hot cocoa when dropped into warm milk or water,” says Jessica Blakely, director of merchandising, pricing, and private brands for Raley’s. “The Hot Cocoa Bombs sold through so quickly that we made the decision to add them to our seasonal rotation every year. Shoppers are looking for unique and exciting flavors in the products they purchase, now more than ever.”

In January, San Antonio, Texas-based H-E-B introduced its limited-edition Creamy Creations Spurs Sherbet in three flavors—strawberry, orange, and blue raspberry—to celebrate the return of “fiesta” colors to the uniform of the San Antonio Spurs basketball team.

Putting a Premium on Health

It’s important to remember that many types of shoppers buy private brand products, emphasizes IRI’s Lynch. “There are consumers who are being squeezed by unemployment or other COVID-related pressures. These consumers must maximize the value of their grocery dollars,” she says, “and they’ll often pick a store brand option rather than giving up buying the product completely.”

But a key consumer segment remains those with means. “During the pandemic, there are consumers who actually have more in their budgets to spend on groceries because they are not spending it on commuting, wardrobe, or other work-related expenses,” Lynch explains. “So, when they shop, they want to keep life interesting. They’ll buy premium; they’ll buy indulgent. But they’re also savvy consumers.”

In a blog touting its 2020 Food Sourcing in America report, The Hartman Group notes that compared with before the pandemic, “one-fifth (22%) of shoppers said they now rely more on private label products, and half of these (52%) say they expect to continue purchasing store brands even as major concerns about COVID-19 subside.” The study also determined that “while consumers may see store brands as a way to save on quality products, it is not exclusively those with the lowest income levels who have leaned on private label: Consumers in a range of socioeconomic tiers show similar propensities to purchase store brands during the pandemic.”

Thus, it’s not surprising that premium private brands—including organic, clean label, and vegan lines—remain robust and are increasingly seen as providing better value for the money than comparable national brands.

Aldi, a retailer that sells mostly its own brands at remarkably low prices, has ramped up its selection of organic and health-oriented items in recent years. For example, Aldi VitaLife kombucha in two flavors—Ginger Awakening and Berry Nirvana—has been a popular beverage line since its launch in 2019. Rich in probiotics that promote gut health, kombucha is surging in demand as part of the functional food movement that has resonated with a broad swath of consumers during the pandemic.

Besides VitaLife, Aldi has several other wellness brands, including liveGfree (gluten-free), Fit & Active (better-for-you on a budget), and Simply Nature (organic and non-GMO).

At Raley’s, the top-tier clean label brand is Raley’s Purely Made, which expanded last year and is continuing to grow. “Raley’s Purely Made products are organic when possible, mindful of added sugar and salt, and free from the over 100 ingredients on our banned ingredient list, including artificial colors, preservatives, and flavors,” Blakely says, noting that the brand’s new products did better than expected last year. “We launched several new product lines in 2020 that pleasantly surprised us with their strong momentum immediately after hitting stores. One was a line of Purely Made Organic Cold Pressed Juices featuring flavors like honeydew melon, blackberry, apricot, and pear. The juices sold so quickly that it was incredibly difficult to keep the shelves stocked.”

In 2021, Raley’s Purely Made has debuted a line of single-origin bottled teas, as well as a line of plant-based snacks, including veggie straws and veggie chips, and a line of dairy-free frozen desserts. In addition, “this spring, we will be launching a line of plant-based burger patties just in time for the summer grilling season,” Blakely points out.

New Market Opportunities

Nielsen of WGSN has observed continued growth in the use of plant-based products—such as oat milk and cashew milk—as ingredients in more complex vegan offerings. This presents a tremendous opportunity for store brands, she says. Think of the possibilities surrounding a cheesy pizza that features a queso made of cashew milk, Nielsen suggests, noting that vegan chocolate made with oat milk has already started to emerge.

Further out, Nielsen anticipates that laboratory-created proteins will make their mark on private brands. For example, Perfect Day, a startup that manufactures animal-free casein protein via fermentation, is partnering with several companies to produce delicious, creamy vegan ice cream, cheese, and yogurt.

Although plant-based products generate a lot of buzz today, private brands have historically been innovating in the meat and poultry category as well. Perdue-owned Coleman Natural Foods, which has served many private label customers since its founding in 1875, specializes in antibiotic-free, hormone-free sausage, bacon, and other meat products. During the pandemic, “shoppers have become more cognizant of how they spend their money,” says Mel Coleman, Jr., co-founder of Coleman Natural and vice president of Perdue Premium Meat Company. “If consumers spend the extra dollar, they want to spend it for a reason, and we believe that reason is confidence in the quality and value of the item they are purchasing. More consumers are looking for meat products raised in the United States on farms that care about the humane treatment of their animals.”

Besides animal welfare, some retailers tout other humanitarian causes through their store brands. Lidl’s Way to Go! milk chocolate and dark chocolate bars, for example, are Fairtrade certified. “Way To Go! is the first and only private label chocolate bar in the United States that contributes directly to a living income for cocoa farmers,” states Lidl on its website. Likewise, the growing social justice movement in the United States could be an opportunity for private brands that are genuinely committed to helping marginalized cultural groups.

REFERENCES

FMI. 2020. The Power of Private Brands 2020: New Thinking for the Pandemic Era and Beyond. FMI–The Food Industry Association, Alexandria, Va. fmi.org.

Hartman. 2021. “The Rise of Private Label During COVID-19.” The Hartman Group, Jan 12. https://www.hartman-group.com/newsletters/1895897632/the-rise-of-private-label-during-covid-19.

Mintel. 2020. Private Label Food and Drink Trends—U.S. Mintel Intl., Chicago. mintel.com.