A New World Order for CPG Companies

Appliance-friendly cooking, experimentation with unfamiliar cuisines, and a search for multi-benefit functional foods are among the new consumer behaviors creating opportunities for product developers around the globe.

Article Content

The ebb and flow of the COVID-19 pandemic will continue to impact the way consumers worldwide work, learn, eat, and play for the foreseeable future, creating challenges for food manufacturers as well as new opportunities for product innovation and growth.

Around the world, consumers are thinking differently about their lives, and that affects their preferences and purchasing patterns. Globally, coronavirus remains consumers’ greatest concern, followed by unemployment, per Ipsos. Only one-third of consumers expect to return to something close to their pre-pandemic lifestyle in the next year. A third of Japanese consumers and one-quarter of those in France and Australia believe COVID-19 will never be contained.

Although those living in China and Saudi Arabia say their country’s economy has recovered from the pandemic, the majority of consumers in 27 countries surveyed by Ipsos expect recovery will take at least two years.

After climbing steadily since March 2021, in August Ipsos’s Global Consumer Confidence Index plateaued at a level similar to March 2020 and below January 2020, when COVID began to spread across the globe.

Climate change has dropped to the ninth global concern overall, with 15% of global consumers citing it among their top three worries. Those in Germany, Australia, and Canada are most concerned, per Ipsos.

With concern over the pandemic deepening due to the rise of strain variants and potentially less-effective vaccines, focusing on home-centric, convenience, and value-driven food trends, as well as healthier and more culinarily exciting fare—all while keeping an eye on the planet—will pay off for food marketers.

The New ‘Not-So-Normal’

Cooking ingredients, followed by staple foods, were the fastest-growing major packaged food categories globally in 2020, Euromonitor reports. Staple foods and dairy products/alternatives were the largest sectors.

Global sales of fortified/functional beverages reached $102 billion in 2020; sales of fortified/functional foods reached $173 billion, per Euromonitor. Kerry data show that 42% of consumers bought more functional foods/drinks since the pandemic began. And Innova Market Insights reports that new functional food/drink launches have increased 59% since 2016.

In July, one-quarter of workers surveyed by Ipsos were still working at home more than before the pandemic; 39% were working at home at least sometimes. One-quarter expect to return to their pre-COVID work routine within six months, 24% expect to do so in six to 12 months, 15% anticipate doing so more than a year from now, and 18% think they will never resume their pre-COVID schedules.

CPG manufacturers appear to be responding to the fact that at least some employees have returned to the office. New global product launches in common eat-at-home categories such as soup, pizza, and shelf-stable meals fell 12% for the year ended April 2021; private label options in the same categories were down 14%, per Mintel.

Meanwhile, consumers’ transition to shopping more online continues. Global grocery e-commerce sales are projected by Euromonitor to grow from about $250 billion in 2020 to $420 billion in 2025. Restaurant delivery will increase from $370 billion to $580 billion.

According to BroadbandSearch, nearly two-thirds (63%) of global consumers use the internet; 50% of all traffic is on mobile phones.

Although McDonald’s, Starbucks, and KFC remained the world’s largest restaurant chains in 2020, Domino’s, up 12.5%, and Wendy’s, up 3.6%, were the only top 10 chains to enjoy positive sales growth, per Technomic. Domino’s leadership in delivery/digital ordering and Wendy’s new breakfast menu are credited with their success.

Millennials and Gen Zers now account for nearly half (46%) of the global population. Japan, Italy, Finland, Portugal, and Greece have the highest percentage of adults aged 65-plus, according to World Bank data. China (166 million), India (85 million), and the United States (53 million) have the largest senior populations.

With 1.9 billion children globally under age 18 and 130 million babies born annually, infant and kid-specific foods and drinks will be in high demand in the years ahead. Infant formula sales are projected to reach $93 billion by 2025, per MarketsandMarkets.

Persons living alone are the fastest-growing global household unit; more than half (57%) of the world’s population dwell in urban areas, per the Organisation for Economic Co-operation and Development.

Lastly, the pandemic accelerated pet adoption and focused attention on pet health. In 2020, global sales of pet food and treats reached $96 billion, according to Packaged Facts.

Culinary Passports

Interest in more exotic global cuisines and flavors has never been higher. Over the next two years, more than one-third of U.S. consumers plan to eat more new menu items that they have never tried before, according to Datassential.

Italian food, led by pizza and pasta, is the world’s most tried and liked cuisine, followed by Chinese, Japanese, Thai, and French, according to YouGov’s global survey.

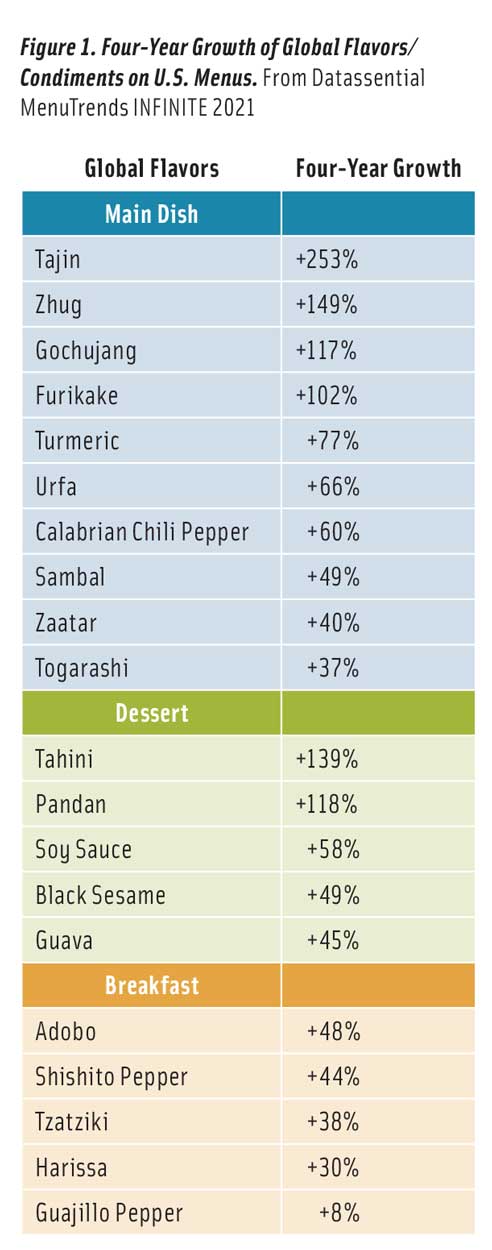

Americans think Japanese and Mediterranean cuisines are healthiest, followed by Thai, Korean, Chinese, Indian, and Caribbean, according to Datassential. The term halal has grown 265% on U.S. menus over the past four years, per Datassential’s MenuTrend; tajin was among the fastest-growing global flavors (Figure 1).

Laksa, yaki, tonkotsu ramen, guisada, birria, and butter chicken are global bowl meals posting high double-digit four-year growth on U.S. menus with continued strong growth potential; bhatura, roti, and bao are the breads to watch, according to Datassential.

Takoyaki, elote, chilli paneer, and Japanese chicken karaage are among the global appetizers/street foods getting restaurateurs’ attention. Parrillada, lamb shawarma, and Manchurian gobi are fast-emerging menu preparations.

Watch for global variations on pasta, rice, tater tots, cheese, or sushi, such as gnudi, jeera rice, jeera aloo, Oaxacan cheese, or tamago nigiri. Pho, falafel, churros, and basmati rice are trending on U.S. kids’ menus, Datassential reports.

Basque-inspired desserts, churros, beignets, and global favorites like ube, gajar ka halwa, ras malai, dulce de leche, and mochi are sweetening up U.S. after-dinner menus.

Bubbies has launched plant-based mochi ice cream. Ramar Foods offers Magnolia Boba ice cream. New Raymundo’s Small Batch Caramel Flans come in a six-pack.

Risotto, kabobs, gyros, labneh, tempura, tostadas, and divorciados are increasingly popular on U.S. breakfast menus.

Consumers can go global on pizza night with Argentinian fugazzeta pizza, Alsace-Lorraine’s tarte flambee, Polish zapiekanka, Sicilian pizzolo, or okonomiyaki from Japan.

The Cooking Craze

More cooking for pleasure and spending more time at home will be among the lasting legacies of the COVID-19 pandemic, according to Mintel’s The Future of Meals, Pizza and Soup report.

Eight in 10 Chinese consumers (82%) are interested in learning about foreign cuisines; 57% say that cooking or baking at home can make their daily diet healthier, per a Mintel report.

With newly upgraded cooking skills, many global consumers are looking for convenient meals and meal kits that require more involvement. The United Kingdom’s School of Wok offers meal kits for made-from-scratch bao buns and gyoza. In Brazil, Sto Alimento Gluten-Free Chicken Frying Pan Pizza Kits are designed to prepare in a skillet.

Cooking ingredients are flagging their regional connections. Iliada Extra Virgin Olive Oil is made from Koroneiki olive varieties grown in Kalamata, Greece. Caravaglio Sicilian Capers are packed in local wine vinegar.

Nearly one-third of global consumers bought more frozen foods since the pandemic; in some Asian markets, as many as six in 10 did so, per YouGov. Dairy-based ice cream/frozen yogurt, fish/seafood, and snacks/appetizers were the most active new product categories, Innova Market Insights reports. Global frozen food sales are projected to reach $312.3 billion by 2025, with a CAGR of 5.0%, per MarketsandMarkets.

One-quarter of global consumers bought more chilled/prepared ready meals, according to YouGov data. Co-branded restaurant and celebrity chef meals are in high demand. In China, 29% of consumers say the taste of ready meals from restaurant brands is “guaranteed,” Mintel reports.

Appliance cooking is a fast-emerging global trend. In China, 57% of family households own a crockpot, and 61% have an Instant Pot/pressure cooker. Nearly every household has a rice cooker, per Mintel. In South Korea, Mychefs’ Whole Eel Rice Pot Kit is ready in 20 minutes in a pressure cooker.

Weekday in-home breakfast and lunch occasions will be an innovation battleground as consumers continue to work and school from home. In Canada, Co-op Gold Croissant Loaf comes as sliced sandwich bread. Bimbo offers Japanese Style Steam Baked doughnuts and cakes. Maxwell House Canada introduced a 100% recyclable Zero Waste coffee pod.

Casual at-home entertaining and adult Zoom dinner parties represent other opportunities for product developers. Brazilian catering company Box Gastronomy offers a happy hour kit that comes complete with beer and six appetizers.

Sales in the global snack industry reached $1.2 trillion in 2020, according to Mondeleˉz. Nearly half (46%) of global consumers say they are snacking more than before the pandemic.

Watch for more contrasting flavor combinations (e.g., spicy/hot) as well as ethnic, plant-based/botanical, and meal-mimicking (think Pringles Honey Glazed Ham chips) options. Australia’s DJ&A Shitake Mushroom Crisps come in smoked chili and garlic flavors.

Also expect to see more blended plant-based snacks. New Zealand’s probiotic Piranha Snaps are mix of potato, rice, and pumpkin with a Smokehouse BBQ flavor.

In the United Kingdom, Cadbury Caramilk Golden Caramel chocolate bar and Cadbury Fizzing chocolate bars are innovative sweet snack options. Kind offers Be Kind Almonds with Sesame Seaweed flavor for the Chinese marketplace.

A Silver Lining

Six in 10 consumers in India, Mexico, Brazil, and China surveyed by the Hartman Group say their diet is much healthier or somewhat healthier than a year ago.

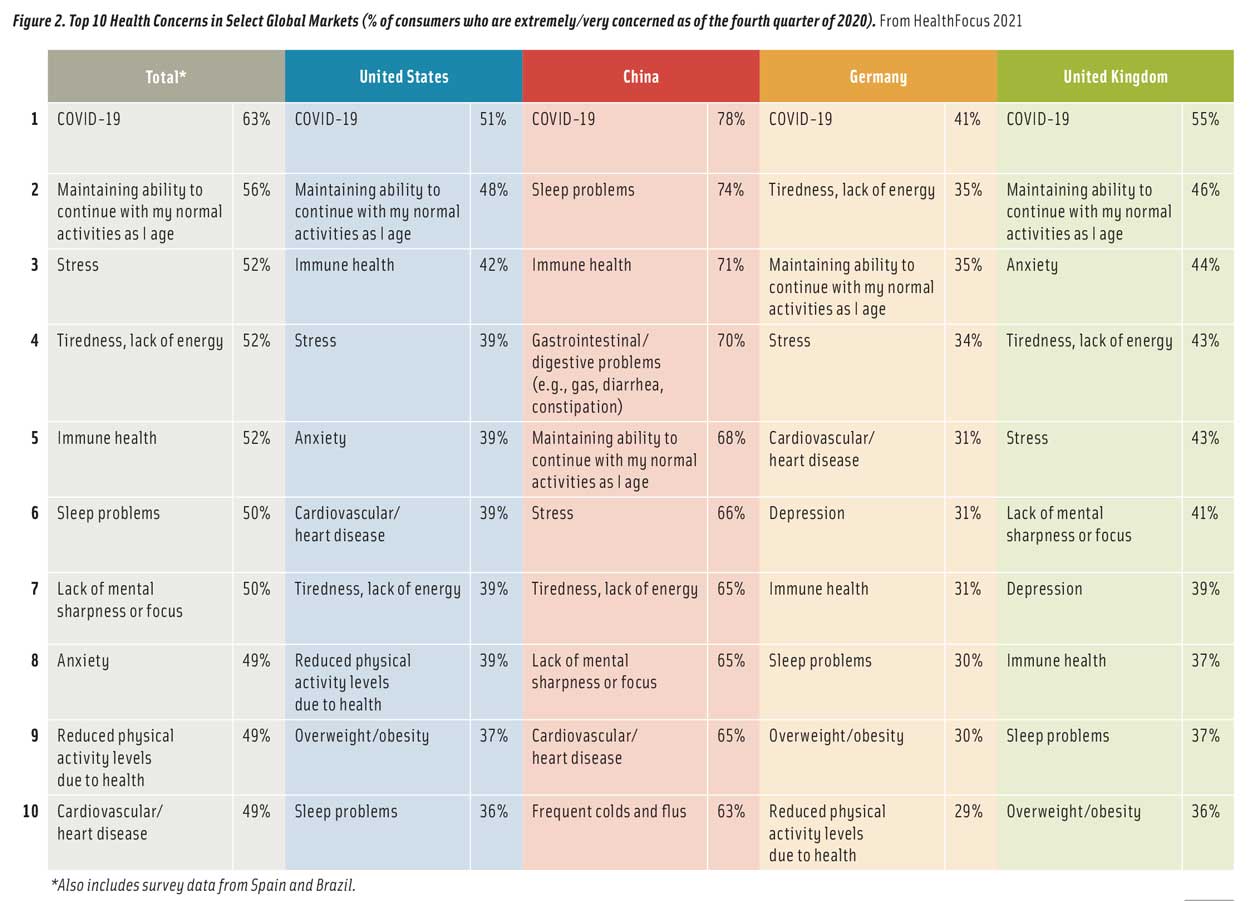

In 2020, the health issues that global consumers were previously very/extremely concerned about shifted away from the effects of aging, eye health, oral health, and appearance (hair, skin, nails) to those related to COVID-19, per HealthFocus research.

Concerns about anxiety, stress, tiredness, and lack of sleep have escalated. Immunity, heart health, and overweight, which had fallen out of the top 10 global health concerns prior to the pandemic in North America and Europe, are now once again mainstream health worries, HealthFocus finds (Figure 2). Not surprisingly, more consumers around the world are looking for foods with multiple functional benefits.

Mental well-being, having a healthy immune system, and feeling good are now the top three criteria global consumers cite when defining health, per Euromonitor’s health/nutrition survey.

One-quarter of global consumers surveyed by Innova Market Insights report consuming food/drink to improve their mood or mental well-being. A third of consumers globally are taking measures to treat anxiety, stress, and mental health, per Mintel research. In Portugal, Lipton offers Calm Head tea formulated with valerian, passionflower, lemon balm, and lavender.

With sleep problems the second-greatest health concern in China, according to HealthFocus, foods/beverages that promote relaxation have strong market potential. Products that provide a benefit while you sleep (e.g., restoring nutrients, building immunity) will be in high demand.

Innova Market Insights reports that hydrating/rehydrating is the top function for which global consumers recently purchased a functional food, followed by gut health, immunity, long-lasting energy, and improving physical performance.

After a year of the pandemic, vitamins C, D, A, and B, zinc, iron, omega-3, probiotics, and protein are the ingredients global consumers most associate with immunity, per FMCG Gurus. Immunity is the third-most-important health concern in China, per HealthFocus.

Nearly two-thirds of global consumers link digestive heath to daily energy, mood, weight management, stress, and aging well, per HealthFocus. Half (55%) of global consumers select foods for digestive health.

Nearly half (47%) of those surveyed in a Kerry global survey were aware of probiotics. China, followed by Mexico, has the highest use of probiotic foods. Brookfarm Prebiotic Paleo Granola in a Coconut and Almond variety in Australia is vegan and paleo friendly.

Globally, 45% of adults are trying to lose weight; one-third gained an average of 13 pounds since the pandemic, per Ipsos. The weight management market in China is projected to grow at a compound annual growth rate (CAGR) of 10.6% to reach $92.6 billion by 2027, per Global Industry Analysts.

The global sports nutrition sector continues to splinter into mainstream fit/active lifestyle consumers and those who are serious athletes and/or diehard weekend warriors. Half (54%) of global consumers choose foods/drinks to improve their overall daily performance versus 40% who make choices designed to improve their athletic performance, according to HealthFocus.

Two-thirds of global consumers exercise moderately or strenuously at least three times a week, HealthFocus says. Those in the Netherlands, Germany, and Romania are the most physically active, per an Ipsos sports survey.

Exercise as medicine (i.e., to control/manage medical and lifestyle conditions), strength training, senior fitness, mobility support, and exercise for kids are among the top global exercise trends for 2021, according to the American College of Sports Medicine.

Around the globe, half of younger adults and 40% of those over age 40 choose foods/drinks to improve muscle, per HealthFocus. Asia has taken the lead in combating sarcopenia, the age-related loss of lean body mass, strength, and function, establishing organizations to address this public health issue, which is treatable with nutrition and exercise.

At-risk individuals remain an important target audience. The World Health Organization reports that heart disease affects 423 million individuals globally. One-third of all diabetics live in Asia; 463 million worldwide are afflicted, according to the International Diabetes Federation. Eye health is a high-potential food/beverage opportunity.

Global supplement sales reached $156 billion in 2020, up 9.7% versus 2019, per Nutrition Business Journal. Amino acids, ashwagandha, black currant, collagen, and specialty mushrooms, are among the ingredients enjoying explosive growth.

Plants and the Planet

Nearly one-quarter (23%) of consumers globally report that they are trying to limit their meat intake, up slightly from 2020; 16% follow a plant-based diet; and 15% try to limit their dairy intake, per Euromonitor’s plant-based eating report. In Western markets, Euromonitor projects sales of milk alternatives and meat substitutes will deliver 6.4% and 6.5% CAGRs, respectively, between 2020 and 2025.

Blended products are attracting interest around the world. In China, one-third (35%) of urban consumers want plant protein drinks blended with whole milk and one in five looks for plant protein drinks blended with two or more types of plants, according to Mintel.

Four percent of consumers are vegans; 7% are vegetarians. Young adults are most likely to be vegan/vegetarian and, alongside those aged 30–44, are most likely to be trying to follow a plant-based diet.

Expect vegan breads and desserts to post strong growth along with plant-based butter and cheese alternatives. Ilchester Vegan Blue features blue spirulina veins to mimic the appearance of blue cheese.

Interest in local foods has grown since the start of the pandemic. In Australia, for example, “Australian made” claims were carried on 35% of all new food/drink launches for the year ended in the first quarter of 2021, according to Euromonitor.

Climate change, air quality, and plastic pollution are now the top consumer environmental concerns. Chobani has launched a paper yogurt container for its single-serve Oat Blend yogurt. In the United Kingdom, the ASDA grocery chain has rolled out more “Refill Zones” to enable shoppers to buy bulk products with reusable containers for rice, pasta, and more.

Upcycling and regenerative agriculture are other sustainability programs being integrated into mainstream food production globally. Happy Planet Smoothies sold in Canada are made with upcycled fruit.

Germany’s Veganz Pizza Vedura, now being introduced in Australia, carries sustainability scores on-pack for climate, water, animal welfare, and rainforest protection.

REFERENCES

ACSM. 2020. Worldwide Survey of Fitness Trends for 2021. Dec. American College of Sports Medicine, Indianapolis. acsm.org.

Broadband. 2021. Key Internet Statistics to Know. broadbandsearch.net.

Datassential. 2021. “Simply Smarter.” Webcast, July 22. Datassential, Los Angeles. datasssential.com.

Datassential. 2021. MenuTrends INFINITE. Aug.

Euromonitor. 2021. Voice of the Consumer Health and Nutrition Survey. Euromonitor Intl., London. euromonitor.com.

Euromonitor. 2021. Passport: Health & Wellness. Aug.

Euromonitor. 2021. Plant-based Eating and Alternative Proteins. July.

FMCG. 2021. COVID-19 Survey. Feb. FMCG Gurus, St. Albans, United Kingdom. fmcggurus.com.

GIA. 2020. Global Weight Management Industry. Dec. Global Industry Analysts, San Jose, Calif. researchandmarkets.com.

Hartman. 2021. Health & Wellness Across the Globe. July. The Hartman Group, Bellevue, Wash. hartman-group.com.

HealthFocus. 2020. Beyond COVID. HealthFocus Intl., St. Petersburg, Fla. healthfocus.com.

HealthFocus. 2020. Global Consumer Survey.

IDF. 2020. International Diabetes Federation, Brussels. idf.org.

Innova. 2020. Innova Market Insights, Arnhem, the Netherlands. innovadatabase.com.

Ipsos. 2021. What Worries the World? Aug. Ipsos, Paris. ipsos.com.

Ipsos. 2021. Global Views on Local Economic Recovery from Covid-19. Aug.

Ipsos. 2021. Global Consumer Confidence Index. Aug.

Ipsos. 2021. Return to the Workplace 2021 Global Survey. June.

Ipsos. 2021. World Youth Skills Survey. July.

Ipsos. 2021. The Future of Fats, Sugar, and the Obesity Crisis. July.

Ipsos. 2021. Global Views on Exercise and Team Sports. July.

Ipsos. 2021. Addressing the Sustainability Say-Do-Gap. July.

Kerry. 2021. ProActive Health Division Global Survey. Jan. Kerry, Beloit, Wis. kerry.com.

Kerry. 2021. Botanical State of Mind.

MarketsandMarkets. 2021. Frozen Food Market Report. March. MarketsandMarkets, Maharashtra, India. marketsandmarkets.com.

Mintel. 2021. The Future of Meals, Pizza and Soup. June. Mintel Intl., Chicago. mintel.com.

Mintel. 2020. Cooking and Baking Habits—China.

Mintel. 2021. Small Kitchen Appliances—China.

Mintel. 2021. Global Health Report.

Mondeleˉz. 2021. State-of-Snacking Report. Nov. Mondeleˉz International, Chicago. mondelez.com.

NBJ. 2021. “Top Trends in a Post-Pandemic Age: State of the Health & Nutrition Industry.” Webcast, Aug. 30. Nutrition Business Journal. newhope360.com.

OECD. 2021. Organisation for Economic Cooperation and Development, Paris. oecd.org.

Packaged Facts. 2021. Pet Supplements. Jan. Packaged Facts, Rockville, Md. packgedfacts.com.

Rees, T. 2021. “Strategic Themes in Food and Nutrition: Coronavirus Update.” Webcast, Feb. 17. Euromonitor.

Research and Markets. 2021. Global Infant Formula Market 2021–2025. March. Research and Markets, Dublin. reasearchandmarkets.com.

Schaefer, M. 2021. “The Era of Food on Demand.” Webcast, June 30. Euromonitor.

T. Hasegawa. 2021. Regional and International Flavor Flash. Jan. T. Hasegawa USA, Cerritos, Calif. thasegawa.com.

T. Hasegawa. 2021. Latin Cuisine Flavor Flash. Aug.

Technomic. 2021. Technomic Top 150 Global Chain Restaurant Report. Aug. Technomic, Chicago. technomic.com.

WHO. 2021. Cardiovascular Diseases. World Health Organization, Geneva. who.int.

World Bank. 2021. World Bank Databank. The World Bank, Geneva. data.worldbank.org.

YouGov. 2019. Global Cuisines Survey. YouGov, New York, N.Y. yougov.com.

YouGov. 2021. Consumer Goods in a Crisis. International FMCG/CPG Report.