Inside the Evolving Food Retail Landscape

As consumers alter their relationship with food, so too is the grocery shopping experience changing. From grocerants and experiential grocery stores to online shopping and meal delivery, today’s marketplace has plenty that is new—and plenty of opportunity.

Article Content

To say a lot’s been happening at retail these days would be an understatement. As consumers have grown more comfortable with technology in their lives—from the iPhones in our pockets to the ease of next-day Amazon deliveries—it only makes sense that it would one day affect the way we purchase food, too. Thanks to technology, access to food is at our fingertips and available 24/7.

In fact, that evolution has inspired one of the most talked-about mergers in the grocery landscape: Amazon’s bid to acquire Whole Foods, which became official in late August. Under this partnership, Amazon Prime members will receive special benefits in store, while Whole Foods’ private label brands will be available on Amazon. In stores, prices on staples like eggs and bananas were slashed, and the world is waiting to see what other changes the merger will bring.

The stakes here are high, and the shake-up has had many wondering just how this combination of tradition and technology will play out in the long run; even before the deal was finalized, the proposed merger “ignited new vigor for brands and retailers everywhere to engage consumers both online and offline,” says Tony Olson, CEO of consulting and analytics firm SPINS.

And that’s not all Amazon’s been up to, either—last year it began testing its Amazon Go concept, a checkout-free grocery store that relies on advanced technology to scan and charge consumers’ products using an app. California Fresh Market in San Luis Obispo provides this service already, and Walmart is testing something similar.

So where does this leave the rest of retail? As we’ll see, this deal is just one more shift in an already-changing world. Brick-and-mortar stores have turned to experiential components like grocerants—prepared food and foodservice stations—to engage and retain consumers as technology has allowed for more convenient options like online shopping and meal delivery. As consumers become more comfortable with the idea, e-commerce will only spread, challenging traditional retailers to think outside the box to claim their share and opening opportunity for these services to evolve, too.

The State of the Market

Although fast casual restaurants and food delivery services like Grubhub make it easy to dine out even at home, most consumers are still buying food to prepare at home. Cooking from scratch remains the most common way of preparing a meal, according to Packaged Facts, with 70% of shoppers doing so three or more times a week (Packaged Facts 2017a). As a result, perhaps, the grocery industry in the United States generates some $800 billion in revenue (Packaged Facts 2017b), and grocery sales are increasing every year (Mintel 2016a).

What’s changed, though, is where and how consumers are buying their ingredients. The average grocery shopper shops 4.4 channels a month, according to the Hartman Group, although the Private Label Manufacturers Assoc. reports that nearly 90% of shoppers they surveyed shop in only one or two stores (Hartman 2017a, PLMA 2016). While 80% of consumers shop at supermarkets, according to the International Food Information Council, New Food Economy reports that the traditional grocery format has been steadily losing dollar share for as long as three decades. Shoppers are visiting superstores, warehouse clubs, convenience stores, and dollar stores to find good deals; these outlets have in turn improved their food and beverage offerings, writes Mintel, “and in doing so, have changed the grocery game forever” (Mintel 2016a).

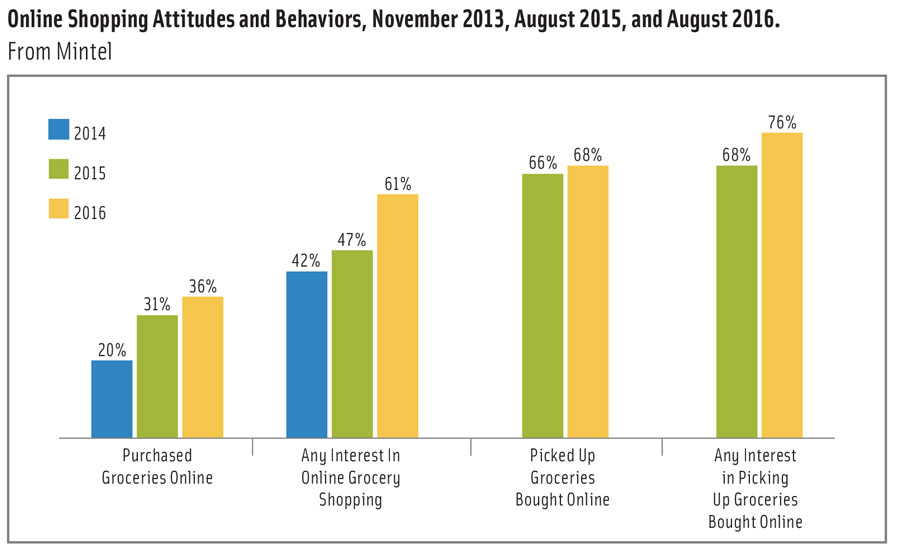

At the same time, there’s been a lot of buzz about online shopping. While online shopping sales have so far been minimal—about 1.2% of the total U.S. grocery market—they are expected to grow at a compound annual growth rate of 8.5% between 2017 and 2020, above the 1.3% compound annual growth rate of the overall grocery market in that period (Kell 2017). Over two years, the percentage of shoppers who’ve bought groceries online in the past 30 days has nearly doubled, according to a 2016 report by Bricks Meets Click, and 20% of consumers will buy groceries online by 2025, says Jordan Rost, vice-president of consumer insights for Nielsen.

The atmosphere for grocery shopping is shifting, and both brick-and-mortar retailers and e-commerce operators are innovating in hopes of drawing in modern consumers. Let’s take a look at what each side has been up to and what opportunities there are for both to claim.

Inside Today’s Grocery Store

So how have these consumer desires affected the typical grocery visit? As you may have noticed in your local chain or independent retailer, the focus has been on fresh—both in terms of an increased store perimeter and in the fresh approach store designers have been taking to create an experience that will keep shoppers coming back.

Fresh and local is a $15 billion market, according to A.T. Kearney partner Dave Donnan, growing 9% a year. The center store is getting smaller (and going online), he says, allowing for an expansion in the perimeter that will continue to grow over the coming years. Grocery stores with extensive fresh departments are leveraging these differentiating areas to increase sales across the entire store, and it’s proving to be a winning factor, writes Nielsen (Nielsen 2017a). Dairy, deli, and bakery departments are popular among brick-and-mortar shoppers, according to the Private Label Manufacturers Assoc., and these departments offer something online shopping can’t typically do: allow the shopper to choose their own products.

At the same time, many stores, including Mariano’s in Chicago and Whole Foods nationally, have been putting an emphasis on turning stores into places that can provide more than just groceries. “As supermarkets try to defend against online rivals and other retail channels, Mintel is seeing many leading brands transform stores into places to ‘hang out’ rather than just shop for groceries” (Mintel 2016a). These “extras,” which range from wine bars to cooking classes to onsite yoga studios, are especially important to Millennial consumers; this demographic would shop at stores offering an experience almost 2:1 compared to the survey population (Mintel 2016a). These bonus components may be one way for traditional retailers to attract Millennials and shift their perception of traditional channels (Mintel 2015).

At the same time, many stores, including Mariano’s in Chicago and Whole Foods nationally, have been putting an emphasis on turning stores into places that can provide more than just groceries. “As supermarkets try to defend against online rivals and other retail channels, Mintel is seeing many leading brands transform stores into places to ‘hang out’ rather than just shop for groceries” (Mintel 2016a). These “extras,” which range from wine bars to cooking classes to onsite yoga studios, are especially important to Millennial consumers; this demographic would shop at stores offering an experience almost 2:1 compared to the survey population (Mintel 2016a). These bonus components may be one way for traditional retailers to attract Millennials and shift their perception of traditional channels (Mintel 2015).

The combined desire for fresh food and in-store experiences has also led to the rise of what’s been called grocerants—departments or restaurants inside stores offering prepared or made-to-order meals for busy consumers to either take away or consume onsite. “The growing and evolving consumer interest in quality fresh products and offerings is transforming the food and beverage marketplace. And nothing is more evident of this transformation than the prepared foods sections of the supermarket,” writes the Hartman Group (Hartman 2017b).

Food consumption from these outlets has grown nearly 30% since 2008 and accounted for $10 billion of consumer spending in 2015 (NPD 2016). Over 40% of the U.S. population purchases prepared foods from grocery stores (NPD 2016), and 62% of supermarkets offer made-to-order stations along the store perimeter, according to Technomic’s Wade Hanson.

Consumer interest is high, and stores can continue to build these programs to appeal to busy shoppers. As with their other purchases, prepared food shoppers are interested in claims associated with health and wellness, like organic, non-GM, and gluten-free (FMI 2016). Older Millennials can be reached with better-for-you positioning, says Mintel, as well as messaging that positively compares the quality of these offerings with that of restaurant foods (Mintel 2015). Stores should consider working with local chefs and produce purveyors to draw farmers’ market visitors and work to create a community vibe the way Whole Foods has in the new stores it has been building, says Juan Romero, president and CEO of design firm api(+), who spoke at the 2017 National Restaurant Assoc. Show’s Foodservice @ Retail Summit.

Design will also play a role in creating stores that serve both grocery shoppers and those looking for an extended experience; store designers need to think about ways to set up stores so that consumers can easily check out with their hot food and create cold storage spaces so consumers’ ice cream and frozen foods don’t melt, says Tre Musco, CEO of design firm Tesser.

The Rise of Private Label

The Rise of Private Label

Of course, consumers are looking for more than just prepared foods from their shopping trips, and when they do purchase staples, they’ve become more comfortable choosing those without familiar branding.

Consumers are becoming more cost-conscious and more comfortable with high-quality private label, says Tony Uphoff, president and CEO of Thomas Publishing Co., whose THOMASNET.com platform tracks North American suppliers. Uphoff says private label sourcing is up 25% over the last month (as of Aug. 15, 2017). And according to Credit Suisse data cited by The Wall Street Journal, private label shelf space has expanded by 3.5% a year since 2012.

“Companies like Trader Joe’s and Aldi have branded the ‘retail experience’ by providing high-quality products at good prices and an enjoyable shopping experience. They have branded the consumer experience, as opposed to focusing on selling individual brands,” says Uphoff.

Aldi, which has been called an industry disrupter, is expanding heavily in the United States and is expected to operate 2,000 stores by the end of 2018. “All consumers want to eat healthy, eat well, and save a lot of money,” Aldi division vice-president Heather Moore told the Chicago Tribune regarding Aldi’s moves (Trotter 2017). In addition to opening more stores, Aldi has invested in increasing its perimeter offerings, introducing fresh seafood and more organic produce. At the same time, Lidl, its European competitor, has entered the U.S. market, and promises to provide even more fresh products, writes Neil Stern in Forbes.

Aldi, which has been called an industry disrupter, is expanding heavily in the United States and is expected to operate 2,000 stores by the end of 2018. “All consumers want to eat healthy, eat well, and save a lot of money,” Aldi division vice-president Heather Moore told the Chicago Tribune regarding Aldi’s moves (Trotter 2017). In addition to opening more stores, Aldi has invested in increasing its perimeter offerings, introducing fresh seafood and more organic produce. At the same time, Lidl, its European competitor, has entered the U.S. market, and promises to provide even more fresh products, writes Neil Stern in Forbes.

“Lidl’s entry is adding more competition to an already robust retail food industry,” observes Uphoff. “Their small-stores strategy featuring many private labels goods reinforces their brand and is particularly appealing to younger shoppers with growing families. It will be fascinating to see if their approach will be a counter-positioning to big box, low-cost stores like Walmart and Costco.”

Although Aldi has been expanding the footprints of its new stores to accommodate more fresh capability, some brick-and-mortar retailers may consider exploring smaller storefronts, such as the smaller urban stores launched by Target and Walmart, which Packaged Facts says have been introduced in part to help fend off inroads made by dollar and other value stores (Packaged Facts 2017b).

Private label innovation could also help drive sales online. New company Brandless sells every product it stocks for just $3, which it says is possible thanks to omitting the “brand tax” that it says drives up the cost of branded products. All of its food and beverage offerings are non-GM and half are organic. It also donates a meal to Feeding America every time someone shops on its site. “We consider Brandless to be a movement as much as a brand,” chief merchant Rachael Vegas told New Hope Network.

Taking It Online

Taking It Online

“We are in the dawn of online grocery,” says Grocery Guru Phil Lempert, and companies like Brandless are tapping into a growing willingness from consumers—particularly Millennials—to put convenience at the top of their list of desires. In fact, 39% of Millennials primarily buy groceries online, compared to only 8% of non-Millennials (Mintel 2015). For this generation, exposure to online shopping for other household staples like paper goods may make the stretch to online grocery shopping feel less risky—52% of online grocery shoppers have an Amazon Prime membership, according to NPD. Consumers have also had experience with specialty online shops and subscription services, such as Mouth.com and Graze.

Recently, grocery stores have begun offering what’s known as “click and collect” services, which let consumers order groceries online and have them either delivered or picked up. These services are one way for supermarkets to retain customers while also offering them the convenience they need. Aldi has joined forces with Instacart for delivery, and Walmart is investing heavily in this area, creating pickup kiosks in stores and acquiring Jet.com to help amp up its e-commerce abilities.

This hybrid approach may very well be the way of the future, and Mintel notes that “supermarkets not offering these services need to catch up quickly or risk further sales slippage, especially among young moms who covet this convenience” (Mintel 2016a).

When it comes to fresh food delivery, though, there are some barriers to consumer acceptance—namely, being able to pick out their own produce (Mintel 2016b). One potential solution lies in the company Shipt, a subscription-based model that allows consumers to communicate with personal shoppers about how they prefer their food (the green or yellowness of their bananas, for example); personalization along these lines might be a way to help get consumers onboard.

The New Food Delivery

The New Food Delivery

When considering online food delivery, nothing may be so ubiquitous as meal kits. These prepacked and portioned meals come with all the components consumers need to prepare their dinners at home, following recipes created by professional chefs and tested by dietitians, in many cases. Meal kits appeal to consumers looking for fresh and convenient meal options, and Packaged Facts writes that “in a sense, fresh food meal kit delivery services move this perimeter (with its prime potential for innovation and growth) outside of grocery retailing altogether” (Packaged Facts 2017a).

Packaged Facts estimates fresh food meal kit delivery services in the U.S. market at nearly $4.7 billion in 2017, up from $1.5 billion in 2016; it also projects that the meal kit category will continue to grow at a robust rate, with an estimated 20% average compound annual growth rate over the next five years translating to an $11.6 billion market by 2022 (Packaged Facts 2017a). Like online shopping, meal kit services are in their infancy, with only about a quarter of adults having tried them (Packaged Facts 2017a). However, once consumers have taken the plunge, they’re much more likely to continue with the services, with 70% buying more after their first purchase (Nielsen 2017b).

Meal kit users skew younger, with Generation X and Millennials 321% more likely to purchase than are Boomers and those older (Lempert 2017). In fact, 71% of meal kit users are aged 25–44, and 79% have kids under 18 living at home (Packaged Facts 2017a). Sixty-three percent of users are urban, and they are also more likely to have purchased something online in the last seven days; they are also heavy users of Amazon (Packaged Facts 2017a).

Meal kit services come in all sorts of forms, with Blue Apron leading with a 17% share of the market. Its recent IPO did not go as well as the company had hoped, though, and its stock prices have fallen along with its profits (Lempert 2017). “Market analysts offered a range of reasons, from the impact of Amazon’s bid on Whole Foods, to an association of Blue Apron with the currently unpopular tech stocks, to skepticism about the potential for actual profits (as opposed to revenues) in the category as a whole,” writes Packaged Facts (Packaged Facts 2017a). This, alongside meal kit companies’ tendency to offer free trials, has left some services on shaky ground. At the same time, though, more and larger companies are entering the game, with Amazon adding Martha Stewart’s branded meal kits to its AmazonFresh channel. These celebrity partnerships can boost a company’s cred, and Packaged Facts expects these collaborations to continue (Packaged Facts 2017a).

Some consumers might be concerned about the cost of these kits. The average cost per in-home dinner meal is $4, while the average cost per person for a delivered meal kit is $10, according to Darren Seifer, The NPD Group’s food and beverage industry analyst. But some would argue that meal kits can help consumers save money by reducing the waste from products like herbs and spices that many cooks can’t use up before they expire. BSR, a nonprofit focused on sustainability issues, earlier this year reported that preparing food at home with a meal kit cut food waste by 62% over using grocery store ingredients (Lempert 2017).

“The outlook for meal kits is uncertain since they’re still in their infancy stages and gaining trial among consumers. One of the main concerns about these services is the cost,” says Seifer. “That said, there are opportunities for continued growth—for meal kit providers to market around the reasons their customers are satisfied, for manufacturers to get in the kit box, and for foodservice operators to leverage their ability to provide on demand delivery and meal variety.”

There remains lots of opportunity for innovation within this category, both for delivery services and retailers. Product innovation and offerings will be key to standing out as the category grows (Mintel 2017), and Packaged Facts suggests operators look at expanding their daypart offerings beyond dinner (Packaged Facts 2017a). Weekend brunch, breakfast, dessert, and snacks are untapped outlets for both channels, as are special occasion kits for events such as Super Bowl parties and holidays; 28% of Millennials say they’d prefer to cook Thanksgiving from a meal kit, notes Rost. Packaged Facts also suggests delivery of kits to extended stay hotels and vacation rentals (Packaged Facts 2017a).

“Rather than worrying whether meal kit delivery services will cut into their business, many retail grocers, foodservice operators, convenience stores, and other types of food marketers are taking steps to offer their own meal kits and/or other products and services that provide greater convenience,” writes Packaged Facts (Packaged Facts 2017a). Home Chef chief revenue officer Richard Denardis agrees, noting that he expects larger meal kit delivery brands to partner with retail locations because it “makes sense to offer meal kits where shoppers are prone to buy food,” he says.

“Rather than worrying whether meal kit delivery services will cut into their business, many retail grocers, foodservice operators, convenience stores, and other types of food marketers are taking steps to offer their own meal kits and/or other products and services that provide greater convenience,” writes Packaged Facts (Packaged Facts 2017a). Home Chef chief revenue officer Richard Denardis agrees, noting that he expects larger meal kit delivery brands to partner with retail locations because it “makes sense to offer meal kits where shoppers are prone to buy food,” he says.

In stores, some retailers are indeed introducing meal kits and more prepared food options in their deli cases and grocerants, and there is opportunity here for stores to create more specialized offerings and to provide consumers with impulse convenience; Millennials dislike the forethought required with ordering delivery meal kits (Lempert 2017). Grocerants could easily tap into different dayparts, and some stores like Eataly and Mariano’s already offer an in-store Nutella bar to sate consumers’ sweet tooth. In-store operators should also consider identifying the health benefits of or at least listing the nutritional information in their mix-and-match kits to give consumers the knowledge and confidence they need to build personalized diets that work for their lives and families.

Some retailers have also introduced their own store-branded meal kit lines, such as Kroger’s Prep + Pared, which can be ordered online and picked up in store, or Publix’s line that features meals with three levels of difficulty in preparing. Gelson’s, meanwhile, introduced kits in conjunction with Salted, an online cooking school featuring 200 celebrity chefs from across the United States. Each kit includes a link to an online video of a prominent Los Angeles chef providing step-by-step instructions.

At retail, mainstream brands are also introducing options, whether by pairing up with delivery services like Peapod the way Campbell’s and Barilla have, or by introducing prepackaged meal kit lines as Tyson has done. Tyson’s TasteMakers is a line of “chef-inspired,” ready-to-cook meal kits it introduced in 2016. Packaged Facts cautions though that manufacturers should not sacrifice fresh in their pursuit of this part of the market. “In the case of delivery service fresh food meal kits, however, the distance between the highly successful Lunchables from the late 1980s and the current fresh food delivery meal kits is good indicator of where, and how far, the food revolution is taking consumer food culture and the companies that feed us,” the company says (Packaged Facts 2017a).

Tomorrow’s Retail Marketplace

As we’ve seen, online shopping is still a very small percentage of the overall grocery market. But it’s growing—and quickly. As consumers continue to become more comfortable with technological improvements that allow them to make their lives easier, e-commerce and grocery delivery should spread even further, especially with younger Millennials and Gen Zers, those preteens and teens who have never known life without the internet. With their interest in cooking and meal kits’ ability to help them learn the skills they may not have been taught elsewhere, these consumers should only help the meal kit market grow. Whether that will be delivered from services like Blue Apron and HelloFresh or picked up from grocery stores or grabbed from an Amazon Go store, one thing seems clear: consumers will be loath to give up the convenience, confidence, and healthfulness that they provide.

“The ongoing turbulence in traditional retail has to have every consumer brand company working on alternative strategies to retain the affinity of the consumer and to assure they are in the right distribution channels for where consumers are going today and into the future,” says Uphoff.

Both brick-and-mortar and e-commerce outlets should focus on building consumer loyalty through excellent customer service, personalization, and the perks that have drawn consumers back to their favorite stores in the past. This could be especially key for brick-and-mortar stores to keep in mind as they expand their technological offerings as e-commerce grows.

Online Exclusive:

Meal Kit Mania: Read more about the myriad meal kit options available to consumers at ift.org/food-technology/current-issue.

Melanie Zanoza Bartelme is associate editor of Food Technology magazine.