Food Technology Magazine | Market Trends

Top 10 Functional Food Trends: Reinventing Wellness

Consumer health challenges, mounting interest in food as medicine, and the blurring line between foods and supplements will spawn functional food and beverage opportunities.

Consumers are seeking foods with functional benefits that support everyday active lifestyles. © Fly View Images/E+/Getty Images

Just over half of the global population—more than 4 billion people—are expected to be living with obesity or overweight by 2035, and the cost of treating related illnesses will be an estimated $4 trillion annually, according to a 2023 World Obesity Atlas report. In the United States, key wellness metrics, including obesity, medically diagnosed diabetes, and eating habits have worsened in the past four years, according to the Gallup National Health and Well-Being Index. The share of those who told Gallup they ate healthfully the prior day dropped 5% during that time frame, falling from 51.7% to 46.7%.

The news about diet and health isn’t all bad, however. HealthFocus reports that the number of global consumers who say they are actively choosing foods and beverages for preventive health benefits and for specific medical purposes is at an all-time high—60% and 40%, respectively, among those surveyed.

Longer term, the future may be brighter. Half of global consumers say they believe in food as medicine more strongly than two years ago, according to HealthFocus. U.S. sales of functional foods and beverages reached $92.1 billion in 2023 and are projected by Nutrition Business Journal to grow at a 5% compound annual growth rate to $106.9 billion in 2026.

Interest in functional foods skews younger. Two-thirds of millennials and households with kids, half of Gen Z and Gen X, and one-third of baby boomers currently buy functional fare, according to Nutrition Business Journal.

In 2023, consumer intelligence company NIQ classified nearly half (47%) of U.S. adults as very proactive health consumers. And consumers have good intentions. FMI, The Food Industry Association, reports that 48% of adults say they plan to eat healthier in 2024. Globally, just over half of consumers are choosing foods to improve their everyday performance, boost mood/mental well-being, and/or to relax and promote good sleep, per HealthFocus.

More than half of U.S. food companies are currently reformulating their products to provide health benefits, and 22% plan to do so in the next two years, according to FMI data. Reducing added sugars, reducing sodium, and adding beneficial ingredients are the top actions being taken.

More than two-thirds of those under age 40 are extremely concerned about access to healthier products that are affordable, according to HealthFocus. They can be expected to drive a new era of multifunctional better-for-you products and claims.

As consumers embrace a new generation of metabolic claims, watch for heightened requirements for clinical support, which are likely to stem from growing concerns about safety and efficacy, the second-most-cited barrier to functional food use, according to Nutrition Business Journal.

Immunity, hydration, performance, pre-workout nutrition, and weight management are among the benefit categories migrating from the supplement category to food forms and food-based solutions, according to SPINS data for the year ending Dec. 3, 2023. Fading supplement sales in the categories of skin and nails, cognitive health, and sleep support may signal additional opportunities for functional food growth.

1. Moving Targets

Products designed to enhance everyday performance were among the best-selling foods, beverages, and dietary supplements last year, according to SPINS and Circana.

Consumers living an active lifestyle dominate sports nutrition sector purchases. Two-thirds buy products to improve health and 39% for sports performance, per the Nutrition Business Journal’s sports report.

Gallup reports that half of adults exercised more than 30 minutes at least three days a week last year, back to 2019 levels, and 82.7 million used the gym, up from 76.5 million in 2021, per IHRSA, the Global Health & Fitness Association.

Half exercise to manage weight, four in 10 to build strength, and one-third to build muscle, according to HealthFocus. Younger adults most often exercise to improve their mood.

Hydration, performance, and energy enhancers were the best-selling functional ingredient categories in multi-outlet channels for the year ended Dec. 3, 2023, with dollar sales up 51.1%, 27.7%, and 7.5%, respectively, per SPINS.

Uncle Matt’s Organic Ultimate Athlete Performance Shot for pre-workout, with organic beet juice and powder; coconut water; and ginger, orange, and lemon juices, was formulated by the Denver Broncos’ chef to boost athletic performance, hydrate, and reduce oxidative stress naturally.

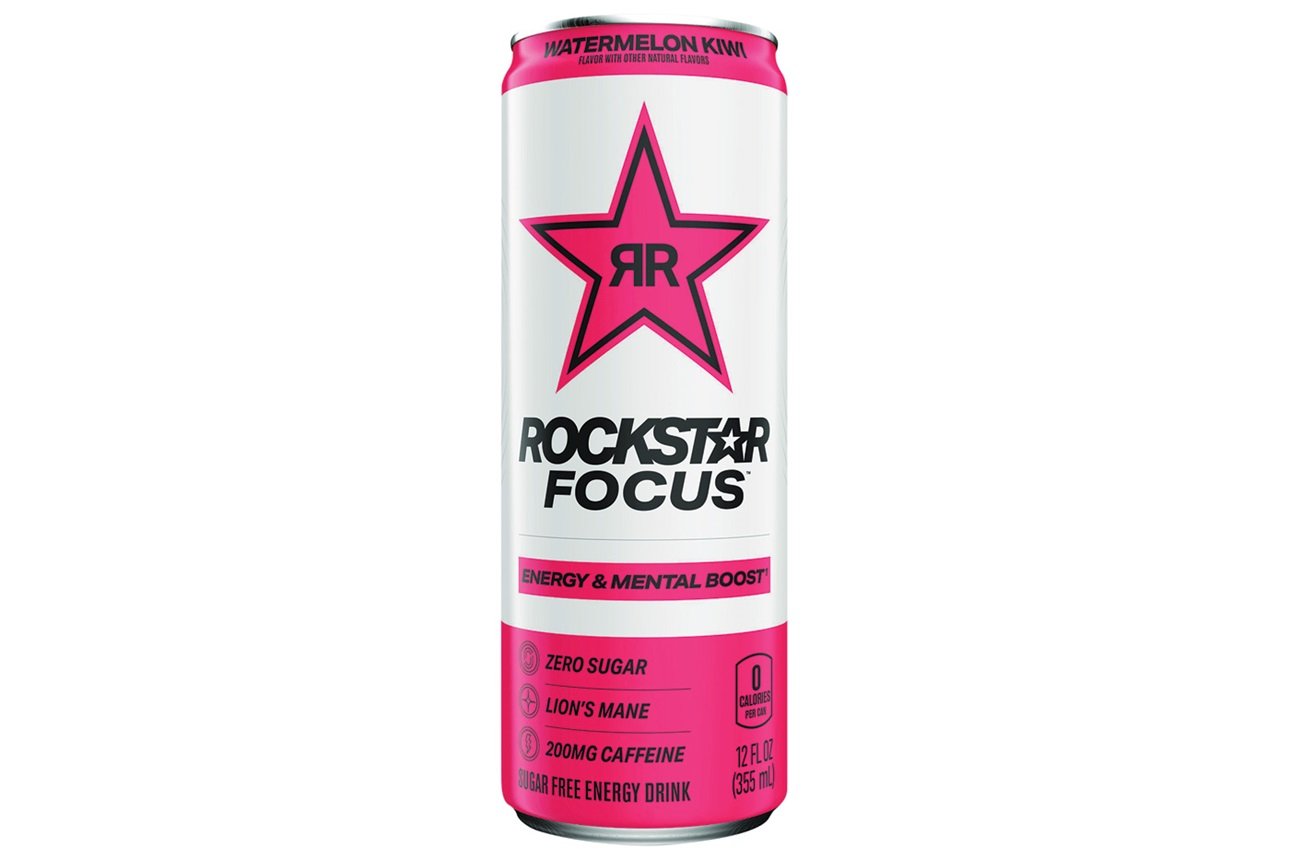

Pepsi’s new Rockstar Focus drink is formulated with Lion’s Mane mushrooms and 200 mg of caffeine for a mental boost. Clean Cause’s Sparkling Pick Me Up energy drink contains organic caffeine, prebiotics, and collagen.

Protein supplements/meal replacement sales reached $5.8 billion, up 14.2%, and wellness bars with more than 20 g of protein rose 10% for the year ended Oct. 8, 2023, per SPINS. Protein, caffeine, creatine, B vitamins, multi-minerals, guarana, the amino acid theanine, and probiotics were among the fastest-growing performance ingredients last year, per SPINS.

2. Proactive Potions

Taste is the top motivation/need state for six in 10 drink occasions, according to the Hartman Group, with hydration chosen by 56%, nutrition 52%, “an experience” 50%, and energy 46%. Nutrition Business Journal projects functional soda, water, and sports/energy drinks will grow from $69.0 billion in 2024 to $80.3 billion by 2026; functional juices from $9.9 billion to $10.9 billion; and functional tea, coffee, and cocoa from $3.3 billion to $3.8 billion.

Recent introductions include Dr. Tea Wellness’ Ashwagandha Tea with Peach Flavor and Healtea’s Non-Sparkling Nettle + Rosemary Botanical Infusion water flavored with maple syrup. Ocean Spray’s new Revl Fruits 100% premium juice line of four flavors, including Tart Cherry, contains coconut water for extra hydration.

Functional alternatives will be a welcome addition to the $1.0 billion drink mix category, where sales increased 14.3% for the year ended Dec. 31, 2023, and the $861 million cocktail mix segment, where sales were up 13.1%, according to Circana. Kraft Heinz’s Crystal Light low-calorie powdered drink line now includes Energy, Immunity, and Mixology, designed to increase use across new dayparts.

Pretty Tasty Collagen Tea, with 40–45 calories and 10 grams of protein per serving, supports joint, skin, and hair health. The tagline for Bae Juice’s Korean Pear Juice for hangover prevention is “Bae before you play.”

One-quarter of those trying to consume more probiotics look for them in wellness drinks, according to the International Food Infor-mation Council (IFIC). Beliv’s Mighty Pop Organic Gut Healthy Soda taps the power of prebiotics, probiotics, and postbiotics to improve digestive and immune health.

For the year ended Aug. 8, 2023, sales of beverages with cleanse/detox claims grew 37%, per SPINS. Pressed Juicery’s Detox Tonic is formulated with probiotics, milk thistle, lavender extract, lemon juice, and sodium copper chlorophyllin.

3. Re-Conditioning

Although heart health; diabetes support; muscle, digestive, and bone health; and cholesterol support remained the top food-as-medicine claims on U.S. foods and beverages last year, according to NIQ, a new generation of physiology-based claims is emerging to help prevent and treat these conditions. Over the past four years, sales of products with food-as-medicine claims for metabolism support, the microbiome, inflammation, blood sugar control, acid reflux, joint support, and pain control outpaced overall food and beverage sales, NIQ reports.

One-third of those who are very proactive about their health say they’re currently eating or drinking a product that claims to lower inflammation, according to research from flavor company T. Hasegawa. One in five consumers (21%) say they are looking for foods that improve metabolism, and 16% seek products that provide blood sugar control, according to IFIC’s health report.

Sales of supplements for blood sugar control grew 7.6% in a very slow supplement market for the year ended Oct. 8, 2023, per SPINS. Sales of functional beverages claiming metabolism support reached $1.6 billion for the year ended Dec. 20, 2023, per NIQ.

The 4:00 Cookie company’s cookies use slow-absorbing whole grains and low-glycemic coconut sugar, along with nuts, fruits, and chocolate, to help prevent blood sugar spikes and the afternoon (four o’clock) slump.

Heart health claims continue to drive food and beverage sales, of course; sales of products making a heart health claim totaled more than $6 billion in multi-outlet channels for the year ended April 23, 2023, per Circana. SPINS reports that magnesium, coenzyme Q10, red yeast rice, and hawthorn berry are among the fastest-growing functional ingredients for heart health in the natural channel.

Nearly half (47%) of all adults have high blood pressure, according to the American Heart Association, so it’s not surprising that interest in sodium reduction is back on the front burner. NIQ reports that sales of foods/drinks with a low sodium claim rose 6% for the year ended Dec. 3, 2023; sales of products with a very low sodium claim were up by 8%.

Better’n Peanut Butter Peanut Spread is lower in fat and calories than regular peanut butter and comes in a low sodium variety. CocoaVia Cardio Health powder contains cocoa flavanols that have been clinically proven to provide heart and cardiovascular system benefits.

4. Sensitivity Training

With just over one-quarter (28%) of adults trying to manage/treat a real or perceived food allergy/sensitivity last year, according to Hartman’s wellness study, allergen-free formulations are increasingly in demand.

Sales of foods labeled allergen-friendly increased 25% for the year ended Feb. 26, 2023, with units rising 8.7%, per Circana. Unit sales of cookies/snack bars free from the top nine allergens grew 11% for the year ended June 18, 2023, per SPINS.

One in five adults are trying to avoid gluten and dairy products, per HealthFocus. Oreo made a splash with its Gluten-Free Golden Sandwich Cookies. Dr. Schär’s Marble and Sch’nack Cakes put gluten-free treats “on-the go.”

Foods that help reduce acid reflux are on the rise. Folger’s Simply Smooth Coffee, promoted as gentle on the stomach, and Yo Mama’s Sensitive Marinara sauce are among the early entries.

Interest in grain-free continues to grow. Sales of cookies/bars labeled grain-free grew 27% in unit sales for the year ended June 18, 2023, per SPINS, while snacks grew 11% and crackers, 7%.

Serenity Kids Grain-Free Puffs are also free of dairy, nuts, and added sugar, and dissolve easily in the mouth. Base Culture’s Simply Bread line starts with a clean-ingredient blend of almonds, flaxseeds, cashews, honey, and chia seeds.

Over one-quarter of consumers want more vegetarian snacks, up 9% from two years ago; and 23% want more vegan snacks, up 6%, per Circana.

IFIC reports that 28% of consumers regularly bought foods/drinks labeled non-GMO last year. Pizza/pasta sauce, creamers, and beer drove growth in non-GMO for the year ended Oct. 8, 2023, per SPINS.

5. Supporting Self-Esteem

Six in 10 U.S. consumers say that feeling good about themselves is now the most important factor defining wellness, a total that’s up by 7% since 2021, per Hartman Group research. Supporting self-esteem can include maintaining mental/emotional well-being, managing weight, and contributing to one’s appearance.

According to Hartman, the most sought-after components of mental well-being include, in descending order: the ability to deal with stress/anxiety, the ability to sustain a good mood, alertness, mental sharpness, and the ability to relax. Sales of functional beverages for brain health reached $1.2 billion for the year ended Dec. 20, 2023, per NIQ.

Supplements for sleep support benefits rank fourth and supplements to promote cognition rank tenth in multi-outlet channel sales for the year ended Dec. 3, 2023, per SPINS. In natural food stores, supplements for mood ranked third in sales and those that offer cognition benefits ranked sixth, per SPINS.

Feel Bars, formulated with ingredients such as dates, pea protein, sunflower butter, and coconut nectar, as well as chia, hemp, and pumpkin seeds, come in varieties that include Calm, Restore, Balance, and Focus.

For the year ended Dec. 3, 2023, melatonin, elderberry, theanine, valerian, and chamomile were the best-selling functional ingredients in supplements associated with sleep support that SPINS tracked in multi-outlet retailers; ashwagandha and magnesium were the fastest growing. For supplements positioned to support cognition, top ingredients were phosphatidylserine and ginkgo biloba. Mushroom, oat straw, and Bacopa were the fastest growing.

SPINS reports that sales of weight loss supplements have declined by 8% over the past three years. Despite the hype, opportunities for high-density nutrition foods and beverages to fill nutrient gaps created by appetite suppression among those taking GLP-1 weight control prescription drugs like Ozempic will remain niche at best. The high cost, limited insurance coverage, supply shortages, and undesirable side effects of such drugs will limit widespread use for the foreseeable future.

6. Healthy Adventures

Having a unique and fun food experience is now among the most influential factors in consumers’ food decisions, according to FMI, and functional foods are no exception. One-quarter of functional food marketers surveyed for Nutrition Business Journal’s innovation report said they’re focused on differentiating with more exciting flavors in 2024.

Clean Simple Eats’ protein powders come in Coconut Cream, Chocolate Peanut Butter, and other dessert flavors. Siete Foods’ new Grain-Free Cookies are available in Mexican Vanilla Chocolate Chip and Fresas con Crema.

T. Hasegawa reports two-thirds of users choose energy drinks for the flavor, not the brand. Circana cites blood orange, blueberry pomegranate, salted caramel, and mango among the fun new functional beverage flavors.

The $221.5 billion specialty food channel presents another opportunity for elevating functional foods to premium. For example, specialty holds a 96% share of the $1.1 billion kombucha market, projected to reach $1.4 billion by 2027, per the Specialty Food Association.

Products positioned for pure indulgence continue to outpace other snacking segments, according to Circana. Nearly one-third of consumers would like to see more functional ingredients/claims in cookies/snacks, one-quarter in frozen treats, and one-fifth in candy/chocolate, per T. Hasegawa.

That’s it mini Double Espresso Energy Bars are a pick-me-up with the punch of two espresso shots. Air-popped popcorn marketer Smartfood introduced Chocolate Glazed Donut Popcorn as a limited-time offering.

7. Whole Food Remedies

Consumers are increasingly choosing supplements and food-based solutions for everyday health issues.

Cinnamon, psyllium/other fibers, turmeric, wheat/barley grass, beet root, and ginger were among the food supplements that experienced high growth for the year ended Oct. 8, 2023, per SPINS. One-third of adults surveyed by HealthFocus said they take a supplement made from real whole foods at least once a week; half of those aged 18–29 do so.

T. Hasegawa reports that more than one-third of consumers say they’re currently eating a product because it contains superfoods. Pineapple, berries, chocolate, lentils, trout, bananas, and coconut are the superfoods chefs will be using to boost mood, health, and flavor this year, according to Flavor & the Menu.

Mushroom ingredients are trending. Sales of snacks and/or drinks formulated with “super mushrooms” (mushrooms associated with wellness benefits) reached $186 million, up 28.7% for the year ended June 18, 2023, per SPINS. After general health, consumers choose mushrooms for benefits related to mood/stress (27%), brain health/cognition (25%), and immunity (22%), according to Nutrition Business Journal.

Peak State Stress Less Dark Roast Coffee Beans are roasted with reishi and chaga mushrooms. Nature’s Fynd broke new ground by creating dairy-free yogurt made with fungi-based Fy protein.

More than one-quarter (28%) of consumers say they’re eating more protein from whole plant sources versus a year ago, IFIC reports. Califia Farms Complete Plant-Based Milk is nutritionally comparable to dairy milk. SPINS forecasts that chickpeas will upstage cauliflower, which is maturing as an ingredient, in popular carb/starch alternative products like pizza crusts due to its higher fiber and protein content.

8. Hassle-Free Health

Just over half of consumers say convenience is important in their better-for-you choices, and that includes fortified foods, per Nutrition Business Journal. Seven in 10 are looking for—and willing to pay more for— foods and drinks with added vitamins and minerals, per Hartman’s wellness report.

Forty-four percent of consumers opt for protein- and/or vitamin-fortified yogurts, 40% fortified juices, and 22% high omega-3s spreads, Nutrition Business Journal reports. New Yoplait Protein yogurts deliver 15 grams of protein per serving.

Two-thirds of consumers are trying to consume more protein, six in 10 more fiber and vitamin D, half more calcium and vitamin B12, and four in 10 more potassium, iron, and folic acid, per IFIC.

While consumers get most of their protein and fiber from foods, most of their vitamin D, vitamin B12, and folic acid comes from supplements, representing a missed opportunity for food product developers. Multivitamins, vitamin D, vitamin C, B vitamins, and calcium were the most frequently taken supplements last year, per the Council for Responsible Nutrition.

Seven in 10 consumers are also willing to pay more for foods/drinks that support their diet/eating plan, according to Hartman. Circana reports sales of center store products labeled keto grew 10% and paleo 6% for the year ended June 18, 2023.

One-third of those on a special diet buy plan-specific snacks, and 10% are looking for diet-friendly frozen appetizers. Crisp Power’s Protein Pretzels contain 6 grams of net carbs and 28 grams of plant-based protein per 1.7-ounce pack.

9. Health Insurance

Six in 10 North American consumers say they’re prioritizing their daily activities with an eye for healthier aging as long-term concerns shift from simply living longer to having a greater number of healthy active days, according to FMCG Gurus.

The Council for Responsible Nutrition reports that more than one-quarter of supplement users took a healthy aging supplement last year. T. Hasegawa notes that 15% of proactive health consumers are currently consuming a product to help with healthier aging.

Maintaining mental sharpness with age is now the top health issue U.S. consumers across all ages are very or extremely concerned about, just ahead of general physical health, according to HealthFocus. Maintaining the ability to continue with normal activities as they age ranks third, and heart health is fourth. Perhaps most interestingly, those aged 18–29 are now the most concerned about these conditions. Globally, six in 10 adults link the health of the microbiome with healthy aging, according to HealthFocus.

The top issues baby boomers are trying to address or prevent include high blood pressure, high cholesterol, aches/pains, overweight, arthritis/chronic joint pain, and cardiovascular health, per HealthFocus.

According to Nutrition Business Journal’s innovation report, those aged 18–24 and adults aged 65-plus have the highest purchase intent for immune-boosting products. NIQ reports sales of functional beverages for muscle health reached $3.6 billion for the year ended Dec. 20, 2023.

10. Conscious Decisions

Consumers are buying products with purpose-driven market positioning, but not consistently.

Unit sales of sustainably positioned foods and beverages in conventional multi-outlet and natural channels fell by 3% for the year ended Nov. 5, 2023, according to SPINS. In particular, unit sales of Fair Trade Certified food and drink brands plummeted—down 26% in that time frame. Sales of products with the following certifications also declined: Certified Plant Based, Certified B Corp, Certified Organic, and Non-GMO Project Verified.

Meanwhile, however, unit sales of Upcycled Certified snacks shot up by 133% for the year ended Oct. 8, 2023, per SPINS. TMK Creamery upcycles whey from the cheese-making process and turns it into vodka at its on-site distillery. Certifications that contributed to sales growth include Certified Grassfed and Certified Regenerative. Products that carry pasture-raised and grass-fed labels have also grown in sales.

Cage-free eggs were a bright spot in the egg segment last year, with sales up 6.6% for the year ended Dec. 3, 2023, according to the American Egg Board. Burnbrae Farms launched Naturegg Omega Plus Solar Free Range Eggs produced by free-range birds who live in solar-powered barns with outside access.

Four in 10 consumers cite the lack of responsibly sourced ingredients as a barrier to their increased use of functional foods, according to Nutrition Business Journal. One-third of consumers believe that foods made with ingredients produced with regenerative agricultural practices are more nutritious than foods with conventionally produced ingredients, per IFIC.

Snacktivist vegan baking mixes are made using ancient grains from farmers who practice regenerative agriculture.

ADM’s re:generations program, which provides financial and technical support to incentivize farmers to adopt regenerative practices, has enrolled producers responsible for 1.9 million acres of North American farmland. Cargill’s BeefUp Sustainability program, which is used on nearly 1 million acres in 24 states, helps ranchers adopt grazing methods that could reduce emissions by 30% across the North American beef industry by 2030.ft