The Top 10 Functional Food Trends

Moving from ‘better for you’ to ‘what’s best for me,’ consumers are personalizing their approaches to healthy eating and reprioritizing their diet and nutrition goals.

Article Content

Today’s consumers are looking for customizable foods, beverages, and dietary solutions that will help them more aggressively meet their own unique nutrition and personal health goals. General health and wellness products and programs no longer fit all.

Over the past three years, consumers have redefined a healthy lifestyle to include regular exercise, relaxation, and attention to mental/emotional health (Mintel 2017). Eight in 10 (82%) now say that mental/emotional balance is as important as physical health (Hartman 2019a). Four in 10 consumers closely monitor what they eat; 43% try to eat healthy but don’t pay close attention; and 9% claim to be on a strict diet (Datassential 2019). Nearly half of U.S. consumers say their diet could be somewhat healthier; 23% say it could be a lot healthier (FMI 2019a).

Fit consumers, who live a healthy, active lifestyle differentiated by integrating frequent physical exercise (three to five days per week) and a focus on enhancing their everyday mental/physical performance, now represent about 40% of the general population (Sloan and Adams Hutt 2019).

With 109 million Americans aged 50 or older and 48 million aged 65 and older, lifestyle issues and conditions of aging will increasingly drive functional food sales (U.S. Census 2020).

Lastly, functional foods are becoming more influential in foodservice. High-protein, vegetable-rich foods and superfoods are the most attractive to diners; heart health, energy, weight management, and gut health are the most influential issues (Datassential 2019).

Globally, fortified/functional food sales topped $267 billion, and naturally healthy food sales were $259 billion in February 2020; U.S. sales reached $63 billion and $42 billion, respectively (Euromonitor 2020). Asia Pacific continues to lead global health/wellness growth in food and nutrition (Barbalova 2019). China tops the list of markets with the highest growth potential for fortified foods; it is followed by Indonesia, Japan, Hong Kong, India, Vietnam, Saudi Arabia, Mexico, Malaysia, and Brazil (Mascaraque 2018).

Global sales of organic food and drink topped $105 billion, up 6% in 2018 (Ecovia 2019). U.S. organic food sales reached $47.9 billion, up 5.9% in 2018 (OTA 2019).

In 2019, 77% of U.S. adults used dietary supplements, an all-time high (CRN 2019). U.S. supplement sales are estimated to have reached $49.3 billion in 2019, up 6.2% (NBJ 2019).

Sales of plant-based foods totaled $4.5 billion for the year ended (Y/E) April 2019 (PBFA 2019). Refrigerated and frozen plant-based meat alternatives, rice cakes, and waters were the fastest-growing U.S. specialty food items last year (SFA 2020).

Retail sales of cannabis edibles are projected to grow from nearly $1.2 billion in 2019 to $4.9 billion in 2024 (Packaged Facts 2020).

1. Eating Well

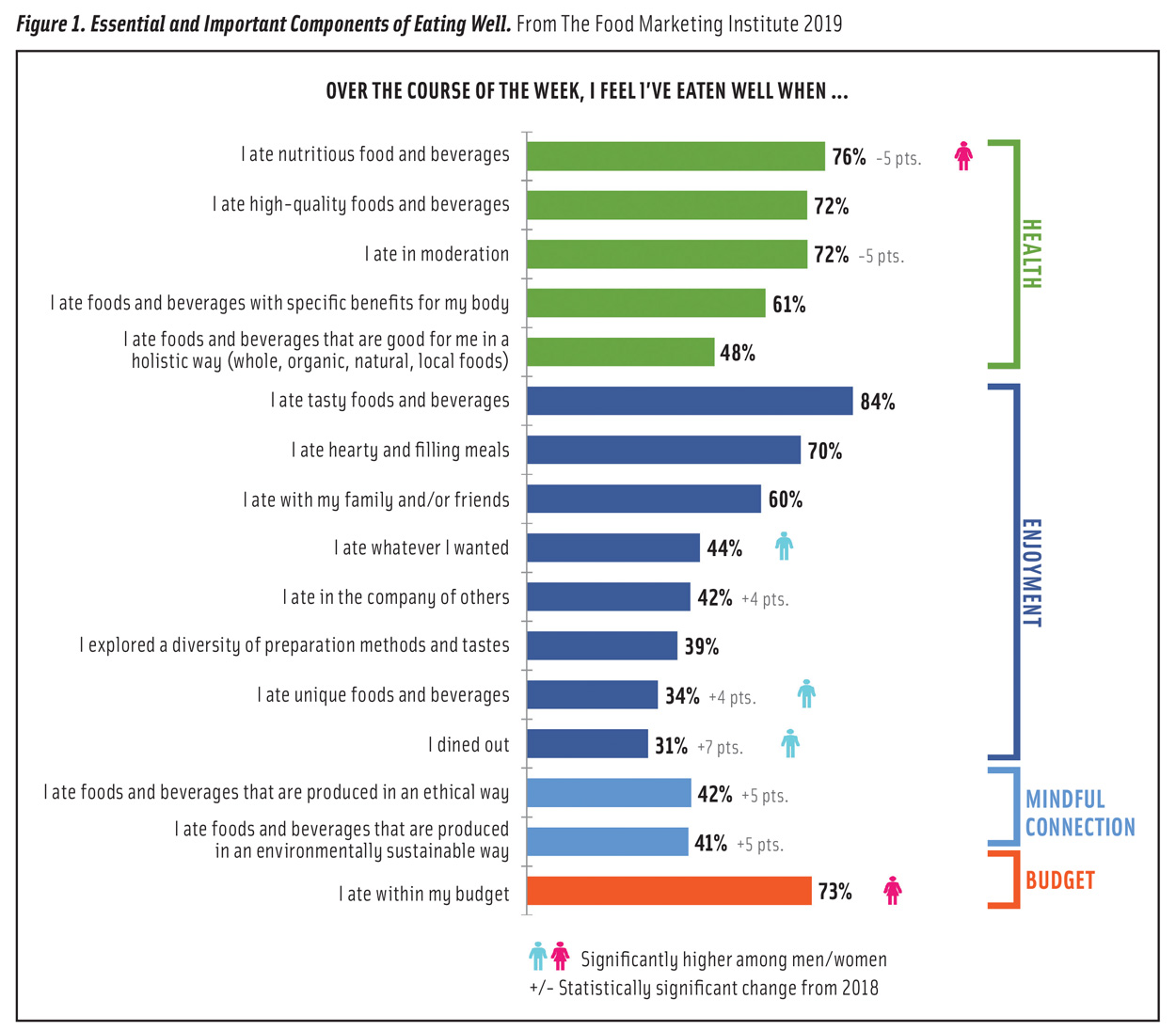

Eating high-quality, nutritious foods and beverages is second only to consuming tasty foods as the criteria consumers use to define that they have eaten well (FMI 2019a; see figure 1). In addition, for the first time, eating foods that deliver “specific benefits for my body” has surpassed consuming foods that are “good for me in a holistic way” as an essential element in eating well.

The concept of eating in moderation as important to eating well has fallen 5% in the past year across all age groups (FMI 2019a). Forty percent of consumers are unfamiliar with the term “mindful eating” (IFIC 2019). Perhaps most revealing is that while millennials, millennials with children, and older Gen Zers are on par with other age groups in citing the importance of eating tasty, nutritious, and high-quality foods and eating in moderation in order to eat well, they are much more likely to choose foods with “specific benefits for my body,” followed by foods that are holistically good for them (FMI 2019a).

Interest in the uniqueness of healthy foods and ingredients is also increasing and paving the way for superfoods and more novel food ingredients. Half of older Gen Zers and over four in 10 millennials cite unique foods as important to eating well versus 24% of baby boomers (FMI 2019a).

At the same time, healthy eating has turned toward finding the right balance—reducing what consumers personally perceive to be “bad” nutrients (e.g., sugar, sodium, or carbohydrates) while increasing those that they believe are “good” nutrients (e.g., fiber and protein). A balanced diet also means that consumers increasingly lean toward the full-fat version of a product but consume less of it. Unhealthy products are thought of as acceptable in moderation, which allows for permissible indulgence (FMI 2019a).

In addition, eating with family and/or friends is an increasingly important component of eating well/healthy eating for 60% of consumers. Eating socially in the company of others has increased in importance by 4 percentage points in the past year (FMI 2019a).

Eating foods and beverages that were sourced ethically and produced in a sustainable way is seen as essential to eating well for four in 10 consumers. Half of millennials include “ethical” and “environmentally sustainable” among their criteria for eating well versus just over one-third of their older counterparts (FMI 2019a).

Lastly, consumers most want to see action taken on major sustainability issues such as waste, pollution, and climate change (Hartman 2019b). Moreover, seals/certifications are playing an increasingly important role. Since 2017, the influence of the non-GMO certification seal has increased by 14% and use of the Rain Forest Alliance icon is up 12%; also showing double-digit increases are delineations for Fair Trade, Humane Certified, and Certified Carbon Neutral (Hartman 2019b).

2. Buying In

Increasingly, consumers are opting in to buying foods and beverages that have specific healthy ingredients. Fiber, followed by protein, vitamin D, calcium, nuts/seeds, and whole grains are the healthy ingredients that more than half of consumers are trying to increase in their diet; more than four in 10 are adding antioxidants, omega-3s, green tea, and probiotics (Hartman 2019a). Half of consumers are choosing to use more olive oil; 41% are using more monounsaturated and polyunsaturated oils; 25%, more coconut oil; 23%, more flaxseed oil; and 21%, more canola oil (Hartman 2019a). Dollar sales of snacks that make a differentiating oil claim jumped 71% in 2019 over 2018 (Lyons Wyatt 2019).

One-third of adults look for sea salt as a preferred ingredient; one-quarter look for prebiotics, chia seeds, or natural sweeteners other than sugar; and one in five looks for ancient grains (Hartman 2019a).

“A good source of vitamins/minerals” was the most loved/liked healthy food claim last year, cited by two-thirds of adults (Datassential 2019). Eight in 10 adults (82%) strongly agree that it is important to eat foods that are naturally rich sources of vitamins/minerals; 57% also strongly agree that it is important to consume foods that are fortified/enriched with added nutrients (HealthFocus 2019).

Moreover, although inherent nutrition is currently in vogue, only one-quarter of adults are aware of and able to explain the concept of nutrient density (IFIC 2019). Over three-quarters of all U.S. adults take dietary supplements; 58% take multivitamins; 31%, vitamin D; 28%, vitamin C; 21%, protein; 20%, calcium; 20%, B complex; 16%, omega-3s; 15%, green tea; 14%, magnesium; 13%, probiotics; 13%, iron; 12%, turmeric; and 12%, vitamin E (CRN 2019).

More than half (56%) of adults are interested in eating more superfoods (Datassential 2019). Fermented foods, followed by avocados, seeds, exotic fruits, ancient grains, blueberries, nuts, nondairy milks, beets, and green tea are the hot superfoods for 2020 (Pollock 2019).

Superfoods, including kombucha, coconut water, matcha, goji, edamame, turmeric, black garlic, dragon fruit, heirloom vegetables, and hemp, are showing triple-digit growth on restaurant menus. Among ancient grains, farro, chia, quinoa, and millet are posting the strongest gains (Datassential 2019).

Half of supplement users now take an herbal/botanical supplement (CRN 2019). Herbals are the fastest-growing supplement category, with sales reaching an all-time high of $8.8 billion in 2018, up 9.4% (Smith et al. 2019).

In descending order, horehound, echinacea, turmeric, elderberry, green tea, ivy leaf, garlic, fenugreek, and black cohosh are the best-selling herbal supplements in mass channels. In the natural channels, the best sellers are cannabidiol (CBD), turmeric, elderberry, wheatgrass/barley, flaxseed/flax oil, aloe vera, ashwagandha, milk thistle, echinacea, and oregano (Smith et al. 2019).

Nearly one-third (31%) of adults now consider herbal flavors highly appealing, up 5% over the past two years (Technomic 2019).

Eleven percent of adults currently use a food or drink that contains THC (tetrahydrocannabinol) and 8% use a hemp-derived CBD food or drink; another 18% and 13%, respectively, have tried them but don’t currently use them (Mintel 2019a). Twelve percent of supplement users take CBD supplements (CRN 2019).

Twenty-eight percent of consumers are interested in trying a collagen-containing food but have not yet done so; 27% are interested in trying hemp-based CBD; 25%, an adaptogen (e.g., maca or ashwagandha); 24%, MCT oils (especially for weight loss); and 16%, THC (Mintel 2019a).

Natto, beets, manuka honey, ginger, maca, primrose oil, lingonberries, mushrooms, cumin seeds, yerba mate, and acerola are other ingredients to watch (Datassential 2018). Turmeric supplement sales are projected to reach $500 million in 2021 (NBJ 2019).

3. Mind Matters

When asked about what healthy means, 57% of consumers cite being able to deal with stress, 47% say being alert/bright minded, and 45% mention being able to relax and have a good time (Hartman 2019a). Brain health ranks sixth among the benefits consumers would most like to get from foods; better emotional/mental health is tenth (IFIC 2019).

Among those aged 50 and over, memory, focus, and cognition ranked fourth among the health benefits they want most from foods; mental/emotional health ranked seventh (IFIC 2018). Retaining mental sharpness with age tops the overall list of health concerns globally, and U.S. consumers are extremely/very concerned about it (HealthFocus 2018, 2019). In the United States, memory ranks third among top health concerns, tiredness is fifth, and stress is ninth; among those aged 18–29, sleeplessness is fourth. Stress/anxiety has replaced being overweight as the top health condition those in U.S. households are trying to manage or treat (Hartman 2019a).

Eight in 10 U.S. adults (82%) have trouble sleeping at least one night a week; 39% report sleep issues five or more nights a week (Packaged Facts 2017). A similar percentage rank “getting enough sleep” as the most important factor for maintaining good health and preventing health issues (HealthFocus 2019).

Four in 10 of those who used a hemp-based CBD food or supplement did so for anxiety; 36%, for pain; 34%, for relaxation; 29%, for sleeplessness; and 24%, for depression (NBJ 2019).

Stress relievers (ingredients that promote relaxation/relieve stress) ranked eighth among the hot culinary trends for 2020 (NRA 2019a). CBD snacks/sweets were the No. 1 hot dessert trend; CBD-infused meals/drinks were the No. 2 culinary innovation trend for 2020 (NRA 2019a).

Four in 10 adults link protein to improved mental energy and brain nourishment; 52% believe that plant-based foods provide mental energy (HealthFocus 2019). Over half of consumers believe that their digestive health and microbiome play extremely/very important roles in mental well-being, aging well, mood, and stress prevention (HealthFocus 2019).

Sixty million U.S. consumers took a traditional supplement for brain health last year (e.g., omega-3s, gingko biloba, green tea, or combination herbs); only 10 million took a proprietary brain supplement, (e.g., Prevagen) (AARP 2019). For Y/E August 11, 2019, dollar sales of brain health supplements jumped 24%, per IRI; sales of supplements to promote sleep and improve mood were up 16%. One in five consumers (22%) took a supplement for emotional well-being (Sanders 2019).

Melatonin, combination herbs (e.g., chamomile, lavender, valerian), magnesium, 5-HTP, kava kava, hops, ashwagandha, and L-theanine (traditionally found in tea) will be getting more attention as sleep or relaxation aids (NBJ 2019).

Lastly, one-quarter of consumers want more functional products (e.g., DHA and choline) for children’s brain development (Datassential 2018). Brain function was the most popular claim on new global infant formula products introduced in 2018 (Innova 2019).

With 50% of consumers experimenting with a new diet/eating plan in the past year, per Hartman (2019a), eating plans that enhance brain health will likely be well received. The Mediterranean diet has long been recognized for its positive impact on cognitive function, Parkinson’s, and Alzheimer’s disease; social interaction and dining with friends are part of the lifestyle.

4. High Octane

Quick, easy, and high-nutrient solutions continue to drive growth in the functional nutrition marketplace. SlimFast’s sales grew 29%, adding $280 million to the bottom line for Y/E August 11, 2019, per IRI (Sanders 2019). Sales of Atkins products increased 27%, +$529 million; Premier Protein sales climbed 18%, +$692 million; and PediaSure sales increased 4%, +$228 million (Sanders 2019). RXBAR led gains in the bar category, with sales up 48%, +$178 million; Clif Bar sales were up 12%, +$724 million; and Kind bar sales were up 3.1%, +$329 million, per IRI (Sanders 2019).

Sales of meal replacement/weight loss beverages are projected to reach $6.6 billion by 2024 (Mintel 2020). Twenty-six percent of households use meal replacement drinks; 19% use weight control beverages. Those aged 55 and older are the least likely to use meal replacement products. Consumers want more meal replacements that boost immunity and aid digestion (Mintel 2020).

High-protein is important to 61% of nutritional beverage users; low sugar/no sugar, low carb, and no artificial sweeteners are also important to them. Only 16% said plant-based was important; 17% considered superfood content important; and 18% said gluten-free was important (Mintel 2020).

Half of those who exercise at least once a week always or usually choose specific foods after exercise, and more than a third (36%) choose specific foods before exercise (HealthFocus 2019). Hydration, protein, and electrolytes are the most important sports product attributes (Mintel 2019b).

Marketers of sports nutrition products may need to reformulate protein-based products in order to offer different options for mainstream fit consumers versus competitive athletes, both of whom have different nutritional needs (Sloan and Adams Hutt 2019).

Just over half (53%) of adults meet the Centers for Disease Control’s Physical Activity Guidelines for aerobic exercise, but only 23% meet the muscle strength goals (CDC 2019). Building strength is now the third most important reason to exercise, after general health and weight management (HealthFocus 2019).

Muscle health/muscle tone is the top benefit consumers associate with a high protein intake, cited by 56% of those surveyed by HealthFocus (2019). Other benefits associated with high protein intake are physical energy; weight management; healthy hair, skin, and nails; mental energy; brain nourishment; bone health; sports recovery; and athletic performance (HealthFocus 2019).

As consumers become more familiar with an ever-widening array of proteins, they’ve begun to focus on the quality and completeness of the protein and on finding the type of protein that is best for their needs. Two-thirds (67%) of adults say consuming a complete plant-based protein is important to them; one in five says it is very important (USB 2019).

Marketers should talk more about the amount and type of protein needed to trigger muscle synthesis, including the presence of essential amino acids (specifically, leucine) and the timing of protein consumption for optimal muscle development.

In 2019, 27% of supplement users took a protein supplement; that includes 30% of men and 24% of women. Those aged 18–24 were most likely to do so. Of those who took a protein supplement, 44% opted for plant protein (CRN 2019). Sales of sports nutrition powder supplements are projected to approach $7 billion by 2022 (NBJ 2019).

5. Reconditioning

The way consumers think about health benefits derived from food appears to be changing. In 2019, heart health fell from first to fourth place among the health benefits consumers would most like to get from foods; weight management, followed by energy and digestive benefits, now tops the list (IFIC 2019). In descending order, muscle health/strength, brain function, bone health, immunity, emotional health, inflammation, and diabetes round out the list. Heart health still tops the list of benefits that those aged 50 and older most want from foods, followed by muscle health/strength, energy, brain health, and weight management (IFIC 2018).

Sarcopenia (age-related muscle loss), diverticulitis, stroke, osteoporosis in men, and mobility are among the conditions of aging that are getting more attention (NIA 2019). Nearly half of U.S. adults have some form of cardiovascular disease; 116 million have high blood pressure; 70 million have undesirably high LDL cholesterol levels; and 46 million have undesirably low HDL levels (AHA 2020). Three-quarters of those aged 50 and older are aware of the natural process of muscle loss with aging; 28% have noticed muscle loss, and 40% have noticed a loss of strength (Abbott 2016). In the United States, 45% of those over 65 years of age already have sarcopenia (NIA 2019).

More than half of consumers are extremely or very concerned about tiredness/lack of energy, especially young adults aged 18–34 and those with children. Products that deliver energy for adults aged 50 and older offer a fast-emerging opportunity for product developers (HealthFocus 2019).

One-third of consumers are trying to manage digestive problems, and one in five is dealing with it daily (Mintel 2019c). One-third (37%) of U.S. consumers are extremely or very interested in the gut microbiome, led by those aged 18–39 and those in households with kids (HealthFocus 2019a). Moreover, 58% believe that digestive health/the microbiome plays an extremely or very important role in weight management, and 57% believe it affects daily energy levels to that extent. In addition, more than 50% believe it is extremely or very important to overall mental well-being, immune function, aging well, mood, and stress levels. Nearly that many (48%) think it is extremely or very important to physical appearance.

One-quarter of adults are regular probiotic food users (Mintel 2019). Nutrition Business Journal projects that probiotic supplement sales will top $3.2 billion by 2022 (NBJ 2019).

Prebiotic supplement sales are projected to top $399 million by 2020; symbiotic supplements are expected to reach $881 million in sales (NBJ 2019). Consumers most often cite the benefits of prebiotics as regularity, fiber, immunity, and brain health (Monheit 2018).

The demand for diabetic-friendly fare continues to grow; 26 million U.S. adults have been diagnosed with diabetes, and 9.4 million remain undiagnosed; there are 1,500 new cases per year. Ninety-two million have prediabetes; one-third of U.S. adults have metabolic syndrome (AHA 2020).

Conditions that consumers say they are trying to treat or prevent via their dietary choices include diabetes, food allergies/sensitivities, high cholesterol, irregularity, fatigue, acid reflux, high blood pressure, and osteoporosis (Hartman 2017).

Four in 10 consumers (44%) would like more foods/drinks that are anti-inflammatory, 42% want more products for detoxification, and 39% seek products to curb hunger (Datassential 2018).

6. Assisted (Healthy) Living

Consumers are looking for easy ways to eat healthier and live a more active lifestyle. Although six in 10 adults are simply motivated to eat healthier by general well-being and the hope of feeling better, 47% want to lose weight, 45% seek to prevent disease, and 37% want to boost energy (Mintel 2019d).

Half of adults (50%) experimented with a new diet or eating approach in 2019, up from 40% in 2017 (Hartman 2019a). Twelve percent tried a low-carbohydrate regimen. A dairy-free/lactose-free diet, intermittent fasting, or a gluten-free plan were each an option for 9% of adults. The Mediterranean diet was the choice for 8%, followed by 7% who opted for either the Whole30 diet or a juice/detox cleanse, and 6% who chose Weight Watchers. The elimination, ketogenic, and paleo diet each attracted 5% of consumers (Hartman 2019a).

But what is different from previous dieting behaviors is that only 3% of those who tried these diets stayed on a specific eating plan exclusively. Moreover, they often interchanged them by eating occasion or daypart to meet their personal diet plans or spur-of-the-moment nutritional needs (Hartman 2019a). Although some marketers are using these diet descriptors on packages to signal a healthy product, it’s important to note that they appeal to a relatively small core of consumers. Additionally, scanner data does not measure intent to buy, just sales of products with a claim.

Similarly, paleo descriptors appeared on 0.7% of U.S. menus last year; keto appeared on 0.2%. But while diners gave them credit for being unique, they received relatively low scores for purchase intent (Datassential 2019).

Nearly two-thirds of adults are simply “not interested” in the keto, paleo, Whole30, or Atkins diet (Datassential 2019). For Y/E August 11, 2019, SlimFast Keto had sales of $63 million, per IRI (Sanders 2019). But with 168 million U.S. adults overweight or obese and 120 million U.S. adults trying to lose weight last year, other new weight control solutions may find fertile ground (Mintel 2019d).

The four major weight loss companies, NutriSystem, WW (formerly Weight Watchers), Medifast, and Jenny Craig, posted sales of $3.2 billion last year, up 3.6% versus 2018; total industry revenues topped $3.9 billion (Marketdata 2020).

Targeted at healthy living with a new focus on mental health, these companies now offer personalized plans based on taste preferences, body type, and DNA testing. Jenny Craig has teamed up with Walgreens. Personalized nutrition diet plans prescribed by various food apps are also trending. It is important to note that the U.S. Food and Drug Administration has not reviewed the efficacy of the algorithms used to support these programs nor have clinical studies been conducted to verify their validity.

DNA-based personalized nutrition kits are on the front burner, despite an accuracy of only 40%, per the American College of Medical Genetics and Genomics (2019).

Programs that deliver health benefits beyond weight control (e.g., energy, anti-inflammation, or gut health), will continue to find a welcome market. But going forward, eating plans must be contemporized and integrated into an active, healthy lifestyle to be sustainable. An expert 2019 meta-analysis of leading diets cited the Mediterranean diet as best for diabetes and best for healthy eating. The keto diet ranked 31st out of 41; the paleo diet was 38th (U.S. News & World Report 2019).

Lastly, with retail pet food sales projected to reach $39 billion by 2023, targeting the owners of the 60% of cats and 56% of dogs that are overweight or obese is a very big idea (Packaged Facts 2019a).

7. Claiming It!

Despite slowing sales in the fresh perimeter of the grocery store, fresh remains the most sought-after food claim by 77% of consumers (Sprinkle 2019).

No artificial ingredients, no preservatives, all natural, and locally grown/locally raised claims positively influenced food purchases by two-thirds of consumers (LEK 2019). Fifty percent said they were fully or casually committed to buying non-GMO, clean label, and antibiotic-free/hormone-free foods.

The number of those committed to buying non-GMO foods and drinks increased 9% last year; the number of those looking for antibiotic-free/hormone-free products climbed by 8%. Meanwhile, the number of those for whom low-calorie claims was a purchase motivator fell 12%, and the impact of low-carbohydrate, sugar-free, and low-salt claims also decreased (LEK 2019).

Eight in 10 consumers buy some form of organic food; 29% of U.S. households are regular organic users. Organic produce, followed by organic eggs, milk, meat/poultry, yogurt, bread, juice, and cheese have the highest U.S. household penetration (Packaged Facts 2019b).

According to the Organic Trade Association, consumers purchase organic foods primarily for reasons of health and to avoid chemicals, preservatives, and synthetic ingredients. Non-GMO has moved up to the fourth reason for buying organic foods; humane treatment of animals is now sixth, and positive impact on climate change is seventh (OTA 2019). Non-GMO is very important to just over one-third of plant-based food purchasers (Hartman 2019a).

Consumers of organic and natural products are much more likely than the general population to be foodies, to eat ethnic foods with a lot of spices, to buy gourmet foods as often as possible, and to prefer foods presented as an art form (Packaged Facts 2019b). Half of consumers are extremely or very interested in clean label (HealthFocus 2019). Nearly nine in 10 private label manufacturers cited clean labels as their biggest growth opportunity for 2020 (FMI 2020).

Members of higher-income households with children and those under age 39 are more likely to choose clean label foods versus organic (Packaged Facts 2019b).

Clean label and organic consumers are nearly twice as likely as the general population to be on a diet plan, especially Atkins, keto, Whole30, paleo, Mediterranean, WW, and NutriSystem (Packaged Facts 2019b). Clean label consumers eat out more frequently; are more likely to say they eat vegan, vegetarian, or gluten-free; and over index for avoiding sugar (Packaged Facts 2019b).

With awareness/understanding of the kosher symbol at 59% (up 6% versus 2017) and halal at 30% (up 8%), these food practices may be a missed opportunity for flagging cleaner fare (Hartman 2019b).

Just over one-third of consumers are committed or casual gluten-free shoppers (LEK 2019). Six percent say they eat gluten-free all the time; 18% of consumers who always buy organic products say they avoid gluten (Packaged Facts 2019b). Trying something new and the belief that gluten-free is healthier are the top reasons for use of gluten-free products (Packaged Facts 2019b).

“Farm fresh” and “seasonal” were among the most loved or liked food claims last year, cited by 60% of consumers (Datassential 2019). Scratch made, house made, hyperlocal (e.g., restaurant gardens and hothouses) remain among the hot culinary trends (NRA 2019b).

Six in 10 consumers believe that hydroponically grown produce is more nutritious than produce that is grown conventionally (FMI 2019b). One-third buy local meat directly from a farmers market and/or farm on occasion (FMI 2019c). Natural/minimally processed, vegetarian, gluten-free, locally sourced, vegan, and eco-friendly are projected by limited-service restaurant operators to be among the fastest-growing healthy menu claims (NRA 2019b).

8. Grazing . . . Semi-Herbivores

Americans’ passion for plant-based foods continues to grow. One-quarter of consumers say they ate more plant-based foods last year versus 2018 (IFIC 2019). A pseudo-vegan movement is sweeping the nation. One-third of adults are very interested in vegetarian and 28% are very interested in vegan foods, although only 5% are strict vegetarians and 3% vegans (Datassential 2019). Of the 50% who tried an eating plan last year, 9% tried a vegetarian and 6% a vegan diet (Hartman 2019a).

Plant-based proteins are the second overall hot culinary trend for 2020; specialty burger blends rank ninth. Vegetable noodles/rice, edamame noodles, lentils, and farro are the hot side dishes; oat milk ranks fourth among 2020’s fashionable beverages (NRA 2019a). Mushrooms, pulses, and new varieties of chili peppers have been recast as on-trend flavors for 2020 (NRA 2019a).

At least on occasion, 73% of meal preparers serve plant protein–based meals for dinner. Beans, chickpeas, lentils, and legumes are used by 49%; nuts/seeds, by 48%; veggie burgers, by 30%; quinoa or other grains, by 29%; and tofu/tempeh, by 17% (FMI 2019b). Just over half of consumers eat legumes at least once a week (Datassential 2019).

Four in 10 U.S. households (39%) now buy refrigerated nondairy milk; 15% buy meat substitutes; 10%, frozen plant-based meals; 9%, plant-based yogurt; 7% each, plant-based ice cream and creamers; and 5%, plant-based protein bars (Grzebinski 2019). Sales of plant-based milks reached $1.9 billion, up 6%, for Y/E April 2019, per the Plant Based Food Association; almond milk holds a 70% share (Grzebinski 2019).

Nondairy creamers and hybrid drinks of milk and nondairy milks are another fast-emerging trend. For Y/E April 2019, sales of nondairy creamers grew 40% to $226 million; nondairy yogurt sales climbed 39% to $230 million; and frozen nondairy dessert sales were up 26% to $304 million. In addition, sales of nondairy cheese grew by 19%, reaching $160 million; and nondairy butter sales were up 5% to $189 million (PBFA 2019).

Meat alternative sales topped $878 million in 2019 (FMI 2019c). Marketers need to pay more attention to cleaner labels, as well as the nutrition profile and price differential of plant-based products versus meat.

Plant-based burgers are the most popular meat alternative, followed by tofu, chicken/poultry, breakfast items, and pizza (Packaged Facts 2019c). Alternative pork products, seafood, and eggs are among the new generation of plant-based products.

Tofu and tempeh sales reached $118 million in 2019 (PBFA 2019). Sales of plant-based dips skyrocketed in 2019 and appear poised for more explosive growth (Grzebinski 2019).

Plant-centric fare is an important opportunity for product developers; consumers are looking for foods that contain more fruits and vegetables. One-third of consumers most associate plant-based eating with consuming more fruits and vegetables, and to a slightly lesser extent, they associate it with consuming more ancient grains (Hartman 2019a). Nine in 10 millennials and Gen Zers want more plant-based items in their foods (Culinary Visions 2018).

One-third of adults define plant-based foods as containing some meat (Datassential 2019). Three-quarters of those who buy meat alternatives also eat meat (FMI 2019c). Two-thirds of consumers are interested in buying blended meat items such as mushroom burgers.

Lastly, among the most familiar plant-based proteins, consumers rate the overall quality of bean/legume-sourced protein the highest with 42% categorizing it as excellent. That compares with 34% who rate soy as excellent, 25% who rate pea as excellent, and 24% who categorize wheat as excellent (USB 2019). Soy, quinoa, chia, and buckwheat are the only complete plant proteins.

9. Basic Upgrades

Although better-for-you positionings have become a proven driver for making basic staples more profitable, consumers’ nutritional/health priorities differ by retail category.

Two-thirds of shoppers are looking for healthier options in the frozen food case. Half of frozen food shoppers look for healthier ingredients (e.g., more vegetables); 47% seek better nutrition (e.g., higher protein/lower in calories); 41% want no artificial colors, flavors, sweeteners, or preservatives; and 39% seek healthier preparation (e.g., grilled or baked) (AFFI 2019).

“Real” ingredients (e.g., cheese) matter to 48% of frozen food shoppers; “fresh when frozen” matters to 39%. Other attributes important to frozen food shoppers include all natural, which is important to 35%; made in the USA, 29%; the type/quality of meat, 27%; non-GMO, 24%; and organic, 22%. Shoppers pay most attention to salt/sodium, calories, protein, and fat/saturated fat, in descending order (AFFI 2019).

When ordering grocery foodservice, 17% of shoppers place a lot of emphasis and 48% place some emphasis on making healthy choices. Six in 10 want more items that include healthier ingredients or are prepared in healthier ways (FMI 2019d).

Although health claims still represent a small share in grocery food-service, GMO-free and gluten-free are driving strong growth; interest in organic products has declined. Two-thirds of prepared food shoppers never look for trendy diet claims. Only 8% of food shoppers want recipes to help meet diet plans (FMI 2019d).

In the meat category, consumers’ health strategies include purchasing leaner cuts, which 53% of shoppers do regularly; avoiding second helpings; and buying smaller portion sizes. In addition, 24% report choosing proteins other than meat/poultry (FMI 2019c).

Just over half of shoppers would like their meat department to carry more grass-fed, all-natural, antibiotic-free/hormone-free offerings, as well as more products raised in the United States. Free-range meats/poultry are important to 47% of shoppers; organic is important to 38%; locally raised, 38%; non-GMO, 35%; and vegetarian fed, 19% (FMI 2019c).

Most consumers associate meat/poultry with nutrients (e.g., high protein, iron, energy, and building physical strength); millennial consumers are most likely to do so. One-third of those aged 65-plus link meat to mind health, which presents an interesting opportunity for marketers to explore (FMI 2015).

More than half of shoppers would like to see more nutrition callouts/claims, origin information, and preparation/storage instructions on produce packaging (FMI 2019b). Millennials prefer packaged produce over pick-your-own produce displays.

When buying bread, rolls, or other bakery products, whole grain is important to 43% of consumers; multigrain is important to 37%; no artificial ingredients, 33%; minimally processed ingredients, 26%; and the absence of allergens, 17% (ABA 2019).

When purchasing indulgent bakery products, “made with real ingredients,” such as chocolate or milk, is important to 50% of shoppers, smaller portions are important to 42%; no artificial colors/flavors, 40%; lower calories, sugar, or fat, each 36%; use of fresh fruit/vegetables, 35%; added protein/fiber, 25%; and no high fructose corn syrup, 11% (ABA 2019).

Eight in 10 operators of in-store bakeries sell gluten-free bakery products; nut-free and egg-free bakery products are also on the rise (Martin 2019).

10. Family Ties

The presence of young children in the home continues to be a significant motivator for healthy eating. Households with kids are much more likely to strongly agree that it’s important to eat foods fortified/enriched with added vitamins/minerals—66% for households with children versus 54% for households without children (HealthFocus 2019).

Healthy kid-specific foods and take-out/take home–oriented menus are becoming increasingly important as parents make separate meals for adults and kids on 49% of family eating occasions (FMI 2019a).

Households with kids are among the most likely to have increased their use of plant-based foods; one in 10 describes their household as vegetarian (FMI 2020).

Moms place a priority on having their children eat a balanced diet; other top concerns among moms are related to developing strong bones/teeth; protection from diseases later in life; mental development; healthy appearance; and proper growth/physical development, including muscle, height, immunity, eyesight, and attention span/concentration in school (HealthFocus 2017).

Two-thirds of adults want more snacks that provide an energy boost; 57% want snacks that contain vitamins/minerals; 50% seek snacks that provide a serving of fruits/vegetables; and one-third want more organic snacks (Lyons Wyatt 2019).

Snacks that are both healthy and indulgent drove growth last year, with sales up 3.9%, followed by traditional indulgent snacks, +2.9%; seriously healthy snacks, +1.6%; and treats, +1.2% (Lyons Wyatt 2019).

Two-thirds of adults frequently have a beverage as a snack (Lyons Wyatt 2019). Millennials regularly consume 10 beverage categories; for Gen X, it is 8.3 categories; and for boomers, 7.1 (Hartman 2019c).

Categorized by need state, 51% of drink occasions are for refreshment, 50% for energy, 48% to fuel or fill up, 47% for health, and 45% for pleasure/indulgence (Hartman 2019c).

Five of the top 10 trending consumables and snacks for Y/E Sept. 28, 2019, were beverages. Unit sales of energy beverages increased by 306 million units; other categories with strong unit growth include value-added water, +130 million units; sparkling water, +76 million units; lactose-reduced/lactose-free milk, +35 million units; and oat milk, +10 million units (Nielsen 2019).

Half of consumers are very concerned about the calories in their beverages; 45% would like their drinks to do more for them (e.g., provide energy, nutrients, or other benefits) (Hartman 2019c). In 2019, sales of beverages formulated with marijuana were up by 49% versus the prior year (Nielsen 2019).

Among candy/chocolate confections that are increasingly showcasing permissibly indulgent offerings, milk chocolate posted $326 million in absolute dollar growth for Y/E Oct. 26, 2019, followed by chewy candy, with growth of $66 million; gummy candy, +$54 million; and dark chocolate, +$27 million (Nielsen 2019).

Despite the widespread trend of avoiding sugar, some “sweet” categories grew last year. For Y/E Oct. 26, 2019, dollar sales of soft drinks were up 4.7% to $19.7 billion; desserts +2.0% to $18.5 billion; chocolate, +2.8% to $11.5 billion; cookies, +2.8% to $5.9 billion; fruit drinks, +1.7% to $5.5 billion; and candy, +2.0% to $5.0 billion. Companies that focus solely on exploiting this growth may gain in the short term at the cost of future potential, however.

REFERENCES

AARP. 2019. AARP Brain Health and Dietary Supplement Survey. American Assoc. of Retired Persons, Washington, D.C. aarp.org.

ABA. 2019. The Power of Bakery. American Bakers Assoc., Washington, D.C. americanbakers.org.

Abbott. 2016. Managing Muscle Loss Survey. Abbott Nutrition, Lake Bluff, Ill. abbottnutrition.com.

ACMG. 2019. “Genetics in Medicine.” American College of Medical Genetics and Genomics, Bethesda, Md. acmg.org.

AFFI. 2019. Power of Frozen. American Frozen Food Institute, McLean Va. affi.org.

AHA. 2020. Heart Disease and Stroke Statistics—2020. American Heart Assoc., Dallas. heart.org.

Barbalova, I. 2019. “Healthy Living; Prevention and Self Care as a Lifestyle.” Webinar. Euromonitor.

CDC. 2019. Exercise or Physical Activity. Centers for Disease Control and Prevention, National Center for Health Statistics, Atlanta. cdc.gov.

CRN. 2019. Consumer Survey on Dietary Supplements. Council for Responsible Nutrition, Washington, D.C. crnusa.org.

Culinary Visions. 2019. Mindful Dining 2018. Culinary Visions Panel, Chicago. culinaryvisions.org.

Datassential. 2018. Functional Foods. Datassential, Los Angeles. datassential.com.

Datassential. 2019. The New Healthy Keynote Report.

Ecovia. 2019. “Global Organic Foods Sales Break $100 Billion.” Press release, April 26. Ecovia Intelligence, London. ecoviaint.com.

Euromonitor. 2020. Health & Wellness 2020. Euromonitor Intl., London. euromonitor.com.

FMI. 2015. Power of Foodservice at Retail. Food Marketing Institute, Arlington, Va. fmi.org.

FMI. 2019a. U.S. Grocery Shopper Trends 2019.

FMI. 2019b. The Power of Produce.

FMI. 2019c. The Power of Meat.

FMI. 2019d. The Power of Foodservice at Retail.

FMI. 2020. The Power of Health and Well-being in Food Retail.

Grzebinski, T. 2019. “The Surge of Plant-based Foods.” Webinar. fmi.org.

Hartman. 2017. Health + Wellness. The Hartman Group, Bellevue, Wash. hartman-group.com.

Hartman. 2019a. Health + Wellness 2019: From Moderation to Mindfulness.

Hartman. 2019b. Sustainability 2019: Beyond Business as Usual.

Hartman. 2019c. Modern Beverage Culture.

HealthFocus. 2018. Global Consumer Health Survey. HealthFocus Intl., St. Petersburg, Fla. healthfocus.com.

HealthFocus. 2019. USA Trend Study.

IFIC. 2018. Nutrition Over 50. International Food Information Council, Washington, D.C. foodinsight.org.

IFIC. 2019. IFIC Food & Health Survey.

Innova. 2019. Trends in Infant Nutrition. Innova Market Insights, Arnhem, the Netherlands. innovadatabase.

LEK. 2019. Consumer Health Claims 4.0. LEK Consulting, Boston. lek.com.

Lyons Wyatt, S. 2019. “How America Eats: The State of the Snack Food Industry.” Webinar, April 9. iriworldwide.com.

Marketdata Enterprises. 2020. U.S. Weight Loss & Diet Control Market. Marketdata Enterprises, Tampa, Fla. marketdata.com.

Martin, K. 2019. “Bakery Review: In-Store Bakeries Still Play Vital Role in Grocers’ Freshness Image.” Progressive Grocer, July 3. progressivegrocer.com.

Mascaraque, M. 2018. Top 5 Trends Shaping Health and Wellness. Euromonitor Intl., London. euromonitor.com.

Mintel. 2017. Healthy Lifestyles—U.S. Mintel Intl., Chicago. mintel. com.

Mintel. 2019a. Functional Ingredients in Food and Drink—U.S.

Mintel 2019b. Sports, Nutrition and Performance Drinks—U.S.

Mintel 2019c. Gut Health is Today’s Hot Health Issue.

Mintel. 2019d. “Live Panel: Diet Trends and Fads.” Presented at IFT19, Institute of Food Technologists, Chicago, July 12–15.

Mintel. 2020. Nutrition Drinks—U.S.

Monheit, L. 2018. “Prebiotics: Past, Present, and Future.” Presented at Supply Side West, Las Vegas, Nov. 9.

NBJ. 2019. Data Sheets. Functional Foods Sales and Statistics. Nutrition Business Journal. Boulder, Colo. newhope360.com.

NIA. 2019. Conditions of Aging. National Institute on Aging, Bethesda, Md. nia.nih.gov.

Nielsen. 2019. “How America Will Eat.” Press release, Dec. 11. Nielsen, Schaumburg, Ill. nielsen.com

NRA. 2019a. What’s Hot 2020 Culinary Forecast. National Restaurant Assoc., Washington, D.C. restaurant.org.

NRA. 2019b. The State of the Restaurant Industry.

OTA. 2019. Organic Industry Survey 2019. Organic Trade Assoc. Washington, D.C. ota.com.

Packaged Facts. 2017. Sleep Management in the U.S. Packaged Facts, Rockville, Md. packagedfacts.com.

Packaged Facts. 2019a. U.S. Pet Market Outlook 2019–2020.

Packaged Facts. 2019b. The Organic and Clean Label Food Consumer.

Packaged Facts. 2019c. Eating Trends: Meat, Dairy, Vegetarian, and Vegan.

Packaged Facts. 2020. Cannabis and CBD: U.S. Retail Market Trends and Opportunities.

PBFA. 2019. “Plant-Based Retail Market Worth $4.5 Billion, Growing at 5X Total Food sales” Press release, July 12. Plant Based Food Assoc., San Francisco. plantbasedfoods.org.

Pollock. 2019. What’s Trending in Nutrition. Pollock Communications, New York, N.Y. lpollockpr.com..

Sanders, R. 2019. “Today’s Dietary Supplement Marketplace.” Presented at the Annual Meeting of the Council for Responsible Nutrition, Carlsbad, Calif., Nov. 9.

SFA. 2020. The State of the Specialty Food Industry. Specialty Food Assoc., New York, N.Y. specialtyfood.com.

Sloan, A. E. and C. Adams Hutt. 2019. “Getting Ahead of the Curve: The Fit Consumers.” Nutraceuticals World 22(2): 28–31.

Smith, Gillespie, Eckl, et al. 2019. “Herbal Supplement Sales in U.S. Increase by 9.4% in 2018.” Herbalgram Issue 123 (Aug.–Oct.): 62–73.

Sprinkle, D. 2019. “Online, Omni Channel, Omni Market.” Presented at the Pet Food Forum, Kansas City, Mo., April 27.

Technomic. 2019. Flavor Consumer Trend Report. Technomic, Chicago. technomic.com.

U.S. Census 2020. U.S. Dept of Commerce. Washington, D.C. census.gov.

USB. 2019. Plant-based Protein and Soy: A U.S. Consumer Perspective Survey. United Soybean Board, Chesterfield, Mo. united soybean.org.

U.S. News & World Report. 2019. “U.S. News Reveals Best Diets Rankings for 2019.” Press release, Jan. 2. usnews.com.