Clearing Up Clean Label Confusion

There’s little consensus about the definition of clean label, but its powerful implications for product development and reformulation are indisputable. Here’s a look at how companies are selecting ingredients and articulating cleanliness.

Article Content

The clean label movement, easily the biggest trend of the decade in packaged and prepared foods, is undeniably a capitalization on the confusion about the meaning of “natural” and “artificial.” Consumer demand for authenticity and transparency is driving the food industry to be discerning about ingredients and clean up supply chains even while both consumers and food company representatives face confusion and misinformation about what exactly clean label means and how one becomes clean label compliant.

Minimally processed and socially responsible ingredients have become a non-negotiable imperative for food labels. The market for clean label products is substantial; Euromonitor estimates that global clean label food sales in 2020 will be worth $180 billion, up from $165 billion in 2015.

Despite the positive outlook, manufacturers and ingredient suppliers remain perplexed because clean label has no legal, scientific, or accepted industry-wide definition. The connotation of “clean” tends to be in the eyes of the beholder. Additionally, what’s perceived as clean today may not necessarily be so tomorrow or whenever another activist spreads misinformation on the Internet.

Understanding What Clean Means

Clean label tends to embrace a wide range of ambiguous terms such as “all natural,” “humane,” “whole foods–based,” “minimally processed,” “GM-free,” and “locally grown,” which are arbitrarily equated with wholesomeness and “better for you” claims without scientific evidence for substantiation. Much of the clean label movement is driven by consumers, who are becoming more discerning about food and are demanding products that satisfy their individual needs and resonate with their personal agendas.

Practically every ingredient supplier and manufacturer has invested in research in order to glean insights on consumers’ perceptions of clean label. Cargill, in partnership with Decision Analyst, conducted a proprietary survey of 302 U.S. grocery shoppers to learn more about which ingredients people wish to avoid. Although more than half of the respondents had heard the term clean label, only one in 10 was confident of its meaning.

Ingredion conducted a global consumer insights study with 30,000 participants in 37 countries to understand the factors that influence consumer choice. “Globally, 82% of consumers find it important to recognize the ingredients in the foods and beverages they buy, and for 81%, a short and simple ingredient list is important,” says Pat O’Brien, Ingredion regional platform leader, clean & simple ingredients, U.S./Canada.

A lack of familiarity with ingredients translates to skepticism. Clean label is clearly an opportunity to educate consumers about the purpose of the ingredient and the story behind it. Ingredient awareness and the acceptability of ingredients can vary by application and region of the world. These two factors are of paramount importance when choosing the ingredients for a formulation or reformulation.

Consumer Concerns

Consumers interpret clean label products to have no negatively perceived ingredients. In Cargill’s survey, respondents identified what’s not associated with clean label: “made with ingredients that sound like a chemical,” “seems highly processed,” “contains artificial ingredients,” “contains GMOs,” and “contains artificial sweeteners.” In Ingredion’s 2019 Global Clean Label Consumer Study of 600 consumers, about 78% said being familiar with ingredients in a product was important.

Chemical-sounding names such as methylcellulose, carboxymethyl cellulose, and monosodium glutamate were definitely not desirable. The most accepted ingredients, according to the survey, include natural flavors, natural colors, flour, vegetable oil, and sugar.

Consumers’ definition and the importance of clean label varies by generation, according to a national survey of 1,000 adults conducted by C+R Research. Baby Boomers are reportedly the most interested in clean label products because of age-related health issues. Millennials seem only slightly interested in the trend because of their youth and good health. Taste and price are priority purchasing factors for Millennials, who seek clean label only if there are no compromises in quality (flavor and taste). Generation Xers appear least interested in clean labels because they have multiple priorities.

Registered dietitian and nutrition communication specialist Mindy Hermann says the definition of clean label has evolved dramatically in just five years—away from organic, natural, vegan, and free from additives and preservatives to include minimally processed foods, dairy alternatives, meat substitutes, and more.

According to data from Innova Market Insights, more than 50% of global new food and beverage launches with clean label claims in 2018 could be found within six defined market categories. Sauces and seasonings was the largest, followed by bakery, soft drinks, snacks, dairy, and ready meals and side dishes.

With increased awareness, consumers want transparency around sourcing and product history. Sustainability and processing methods for the ingredients are of interest, and in addition to ingredient integrity, they seek engaging narratives that resonate. Organic Valley positions its Organic Fuel Whey Protein Powder for clean label shoppers with the claim that it does not contain “unnecessary additives you can’t pronounce, artificial flavorings or sweeteners, GMOs, pesticides, antibiotics, or hormones.”

Unintended Consequences

Health is driving lifestyle diets, such as vegetarian/vegan, plant-based, and keto. Flavor drives the ultimate food and beverage purchasing decisions, while health is driving consumers toward alternatives to bread, meat, or dairy. “Dairy-free is growing at 18% annually, meat substitutes are growing about 17% annually, and the plant-based marketplace shows no sign of slowing down,” notes Hermann, citing data from Innova Market Insights.

Brands are “greening up” their foods and beverages by adding plant-based ingredients to a variety of products, including meat and dairy. Joanne Slavin, a professor in the Department of Food Science and Nutrition at the University of Minnesota, is, however, concerned about the unintended health consequences of clean label. Slavin fears intakes of nutrients of concern—fiber, potassium, calcium, and vitamin D— will decline as a result of clean label adherence. Required vitamins and minerals for enrichment are not compliant with clean label because listing vitamin A and D as “vitamin A palmitate” and “vitamin D3” makes them appear as chemicals and unacceptable by clean label “rules,” Slavin observes.

Clean Label Call to Order

“Clean label isn’t just a trend anymore,” notes C. J. McClellan, global marketing manager, bakery, at Corbion. “It has become an expectation. We’ve [got] to balance consumer clean label checklists with the goals and formulation requirements of our customers and suppliers for whom functionality and cost are supreme in their ingredient selection process.” Clean label options that do not meet the performance of traditional ingredients tend to affect the appearance of baked goods, which in turn lowers the appeal of clean label products in the eyes of consumers.

Differentiating ingredients in the crowded clean label market requires skill and knowledge. Suppliers can differentiate from their competitors by offering better customized solutions and sharing product applications, both of which are particularly helpful to timestarved product developers.

Providing documentation and scientific substantiation is always helpful for claims such as “vegan,” “gluten-free,” “naturally derived,” and “sugar-free,” especially should a plaintiff’s attorney come searching.

To be simple, straightforward, and transparent, protein bar company RXBAR uses sleek minimalist packaging, eschewing imagery for a small brand logo and boldly listing the major ingredients on the front along with the statement “No B.S.” Clean and simple is conveyed by the brand name of the That’s It bar, which displays images of the two or three fruits, vegetables, and spices contained in each bar on the front label and the amounts of each on the back (e.g., “1 apple + 3 apricots”).

Such clear, concise labeling resonated with retailers and consumers but stirred up plaintiffs’ lawyers who questioned the integrity and accuracy of the ingredient lists of RXBAR and That’s It products in a 2018 class action lawsuit. They questioned the equivalency of “egg whites” and “blueberries” on the front of the label with the “egg white protein powder” and “dried wild blueberries infused with apple juice concentrate” in the ingredient list on the back. For RXBAR, this incongruence was corrected when the Kellogg Company acquired the company, but the lessons about clarity and accuracy are clear.

Providing details of how the ingredient is extracted or produced goes a long way to fostering trust and loyalty, especially if environmentally friendly solvents are used with processes like filtration and cold pressing that avoid harsh industrial processing methods. Case in point: a 2017 class action lawsuit against Hint for marketing Hint Flavored Water as “all natural” despite using flavors dissolved in propylene glycol, “a synthetic substance” that is “chemically manufactured and highly processed.”

Clean label demands that the grower, producer, supplier, processor, retailer, and even the consumer double down on responsibly growing, producing, distributing, processing, marketing/educating, and consuming without negatively affecting health or environment. This responsibility mantra includes responsibility to science and evidence.

The clean label movement is a call to action to the food industry and policy makers to put an end to pseudo science and fad nutrition by embracing science. Instead of joining the bandwagon of foods vilified baselessly by uneducated “nutrition gurus” and ingredients demonized by self-styled food activists, it is time to focus on prized connections with consumers, educating them on the basic fundamentals of the science of food and food technology, which are so very essential to making the products that feed consumers.

Clean Label Ingredients

One of the challenges the food industry faces is the fact that so many consumers believe that “fresh” is the healthiest possible form of foods, and they want these fresh foods to be convenient and safe without the addition of anything to preserve or extend shelf life.

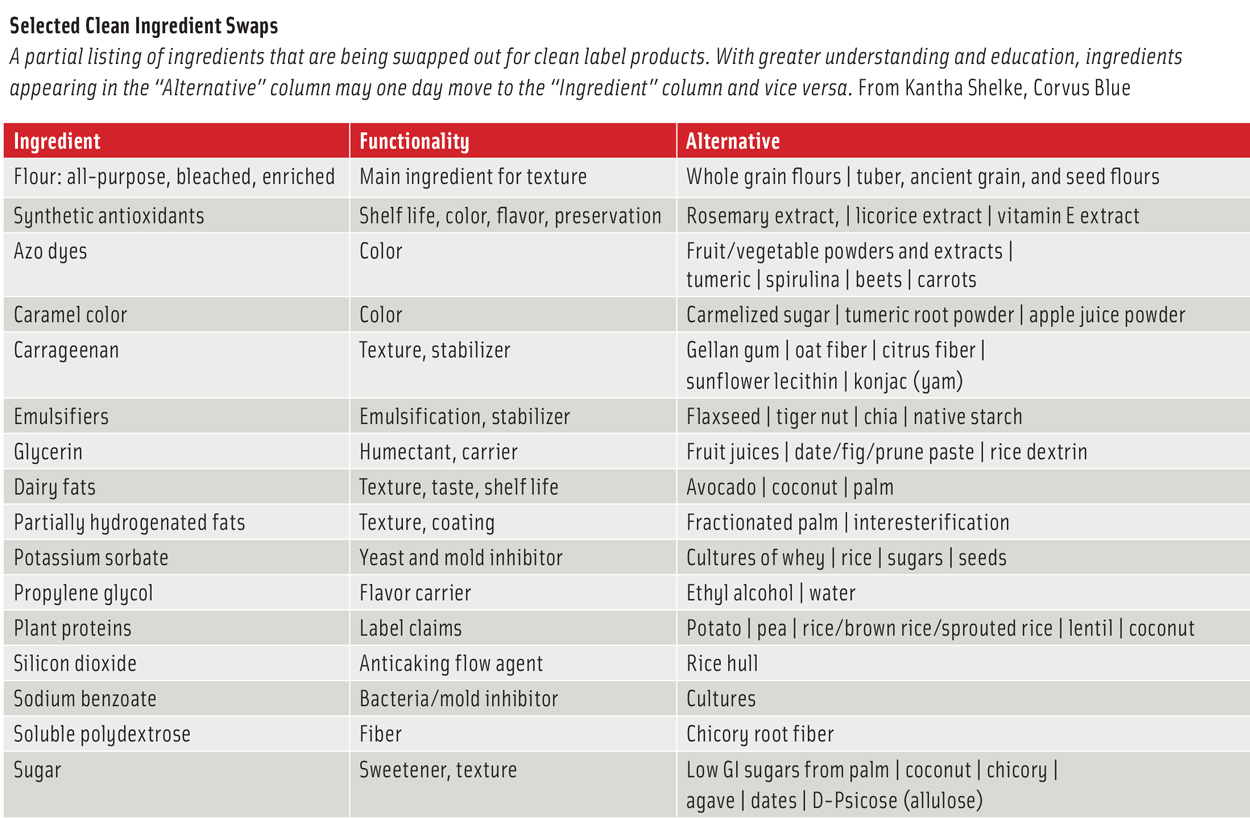

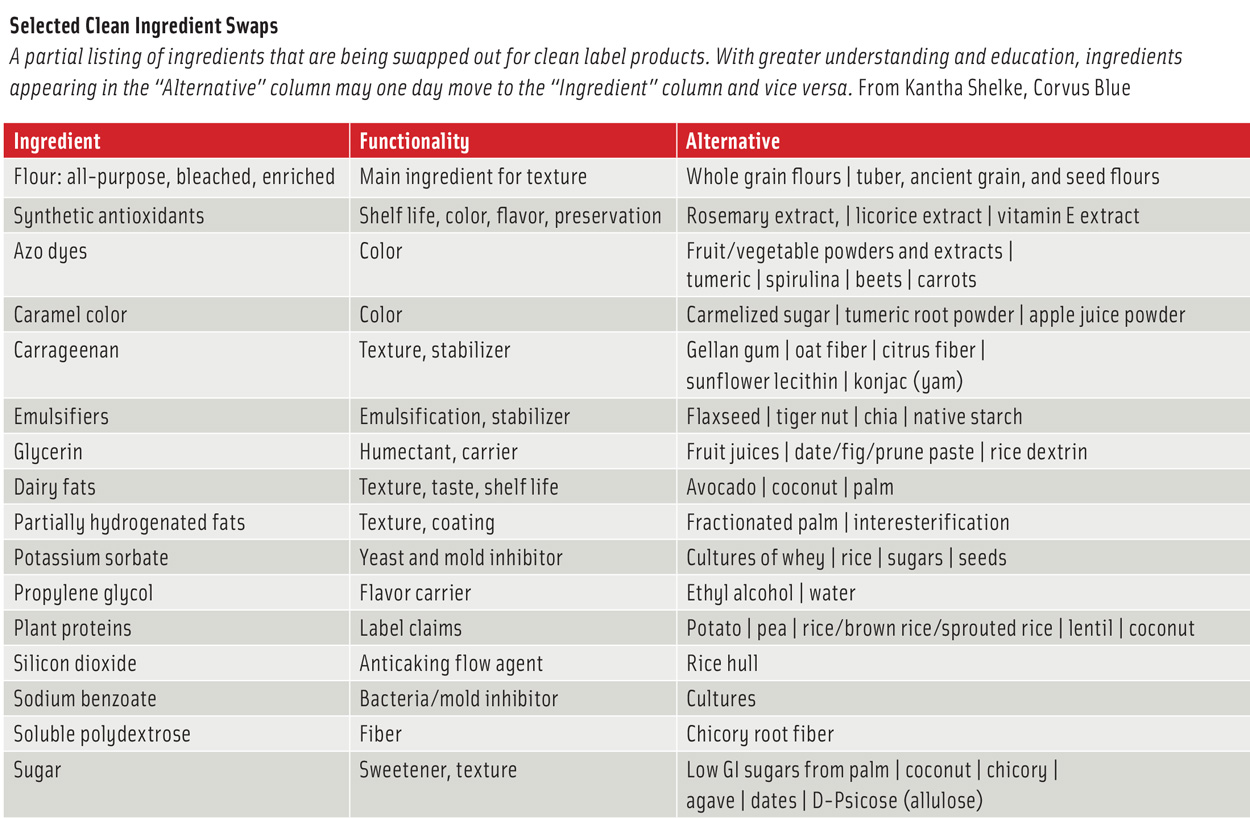

Creating solutions that meet these conflicting needs is particularly challenging, especially if one also has to ensure the robustness of the ingredient portfolio, meet the requirements for simpler, cleaner ingredient labels, and solve formulation challenges—all without sacrificing taste and quality. This is even more complicated when finding clean label alternatives for multifaceted ingredients such as partially hydrogenated fats and sugar.

Ironically, there is considerable science and chemistry behind clean label solutions to help industrial bakers eliminate artificial preservatives, colors, flavors, and chemical-sounding substances without compromising on taste, texture, or quality. An important aspect of clean label substitution is ensuring the solution allows for at par or better control and consistency with substantial error tolerance even while reducing the length of ingredient labels by as much as 40%.

Ingredient suppliers are actively researching cleaner solutions to add to their portfolios and educating manufacturers on ingredient functionalities and applications. The quest for “clean,” with better functionality and without compromising taste or economics, is a continuum.

Corbion offers unique blends of cultured corn sugar and vinegar to preserve food and extend shelf life as alternatives to sorbates and nitrites typically used to preserve dairy and meat products. Synthetic conditioners and strengtheners such as azodicarbonamide and DATEM are being replaced with combinations of ascorbic acid and enzymes in baking applications.

An oil-soluble green tea extract from Kemin Foods is replacing antioxidants such as TBHQ for stability and extended shelf life in fatty and fried foods. A combination of rosemary extract and ascorbic acid is effective for ensuring better oxidative stability.

Plant-based alternatives and extracts are gaining traction as substitutes for synthetic mold inhibitors such as propionic acid (calcium propionate) in baked goods and other products. Native functional starches such as Ingredion’s Novation 3300 provide texture-based functionality for clean label products.

Hydrocolloids, popular for decades as stabilizers in a number of applications, are under consumer scrutiny and are prompting reformulation with alternatives. Gellan gum can effectively replace the controversial carrageenan and pectins; xanthan and acacia gums are being sought for texture and mouthfeel.

Fruit and vegetable powders and extracts provide colors and alter taste profiles in lieu of synthetic colors and flavors. Sugar and sweetener alternatives are also on the rise, with similarity to the taste of sugar, purity, natural sourcing, and cost-effectiveness being keys to success for stevia derivatives, monk fruit extract, erythritol, and allulose.

Emulsifiers and surfactants, perhaps the most technically complicated and chemical-sounding ingredients, are important for tolerance, consistent product quality, and shelf-life extension when manufacturing products like salad dressings, condiments, baked goods, and desserts. Names like mono- and diglycerides, however, do not comport well with modern clean label expectations even though they are being derived from enzyme-treated, naturally occurring triglycerides.

In high-speed industrial baking that is already challenged to maintain quality while processing at top speeds, it can be difficult to satisfy consumer demands without adding significant complexity. The shift toward natural emulsifiers and stabilizers, however, has been a boost for ingredients such as egg yolks and oil seeds, which are naturally rich in phospholipids and lecithin.

The approach of past decades to chemically enhance natural ingredient materials like starches and fats to improve their functionality has shifted today to focus on all-natural, minimally enhanced emulsifiers, and stabilizers that are both label-friendly and effective. Paradoxically, one reaches for emulsifiers when removing unwanted ingredients from a formulation to compensate for the functionality of the ingredients being removed. Tolerance, quality, dough handling, and shelf stability are just a few of the factors bakers can control better thanks to emulsifiers. The consistency and shelf life they make possible reduce product waste and staling, which benefits the bottom line while reducing emissions and natural resource consumption. Although these benefits are not visible on product labels, they can contribute to a brand’s reputation for transparency and sustainability— something important to conscience-driven shoppers.

Several major packaged goods companies have announced clean label changes and revamped formulations transparently. The Kellogg Company, Campbell’s, and Mondelez International have reformulated products to eliminate artificial colors and flavors. Nestlé has reformulated 6,500- plus products for better health and nutrition in the past 10 years.

Articulating Cleanliness

The most obvious and common perception of clean label is reduced number of ingredients, especially those with long, unfamiliar, or difficult-to-pronounce names, those perceived to be artificial or synthetic, and those that serve no obvious nutritional or functional benefit. Simplified ingredient lists highlight the absence of synthetic ingredients for coloring, flavoring, sweetening, and processing, and tout transparency around sourcing practices.

Communication framing matters. The growing interest in understanding ingredients and preferring certain ingredients over others may be attributed to healthy eating motivations, concern for the environment or sustainability, impact of supply chain practices, preference for local food, or avoidance of risks. Food choice is driven by numerous aspects of food quality; which of these are most salient when a consumer scrutinizes a product’s ingredient list depends on the accompanying information and circumstances.

The context in which the ingredient list is presented is crucially relevant because it guides the consumer or shopper to process the information, assess the production, and evaluate whether the product is clean and resonant with their values. Changing the context jars the assessment and the evaluation. The same ingredient presented on differently positioned food products can lead to a different understanding of the role of the ingredient and consequently to a different categorization of the ingredient and a different attitude toward the ingredient. For example, the healthfulness of a product is more favorably received when embedded in claims of naturalness and presented at points of purchase that are in line with naturalness, such as a farmers market or a health-food store versus a quick-service restaurant.

Ultimately, what companies need to take into consideration is what consumers find acceptable. If consumers are educated on what matters most, they will make food purchases wisely to avoid the untenable consequences of a poor diet. Clean label is a call to the food industry to invest in educating itself and consumers on what matters most in food matters. Ideally, ethical and pragmatic considerations, rather than fearmongering, will increasingly shape how we eat.