2024 Technology Outlook

The second in a series of three forecast articles identifies the technologies that will advance food and beverage operations in the year ahead.

© Olemedia/iStock/Getty Images Plus

Around 60 years into the Information Age, it’s perhaps no wonder that the near-term forecast for technological advances—for the food industry and beyond—revolves around just that: making effective use of data like never before. The speed at which data is now collected is driving rapid development of high-tech intelligent solutions designed to help companies sort, manage, and analyze troves of information that can be used to optimize processes and address challenges varying from the complex to the mundane.

Whether it’s automated technologies that help strengthen supply chain procurement, inventory management, or logistics processes, intelligent traceability software that enables more efficient tracking of potentially contaminated or spoiled foods, or smart manufacturing systems that help reduce environmental impacts by optimizing resource use, reducing waste, and increasing energy efficiency, the buzz for 2024 can be summed up in a familiar phrase: “digital transformation.”

The four key concepts of digital transformation—data collection and analysis, connectivity, continuous monitoring, and process optimization—offer numerous touchpoints for a near-term uptick in technological developments, most notably through machine and software automation. The trend toward digital transformation of businesses in the food supply chain will continue through the next few years as technologies such as artificial intelligence (AI) and machine learning, Industrial Internet of Things (IIoT), and tech-enabled traceability move out of their infancies and take their place as the not-so-new next big things.

AI-Powered Tech

Computer giant IBM’s definition of AI is one of the most succinct: Artificial intelligence leverages computers and machines to mimic the problem-solving and decision-making capabilities of the human mind. Although it’s been around since the 1950s, AI is now regularly making headlines as an increasing number of AI-powered consumer goods become available—from Alexa and ChatBot to self-driving vehicles and lawn-mowing robots. McKinsey & Co.’s 2022 State of AI survey showed that adoption of AI models in business applications has more than doubled since 2017—and investment has increased apace.

The use of AI in the food and beverage market is expected to grow from $7 billion in 2023 to $35 billion by 2028, according to Mordor Intelligence. That’s a compound annual growth rate (CAGR) of nearly 40% forecast in the next five years. It’s a big number, but the number of potential AI applications in the food supply chain from farm to fork also is fairly extensive, making the technology one to watch in 2024 and beyond.

Among the most active areas of growth in food manufacturing and distribution applications of AI are supply chain management and logistics, food safety, traceability and transparency, and product development. AI applications that promote more sustainable manufacturing and distribution processes also are expected to experience growth in the next few years as the global food industry works toward instituting more climate-friendly standards and processes for manufacturing and distribution. In 2021, a World Economic Forum report estimated that the value unlocked by artificial intelligence in helping design out waste for food, keeping products and materials in use, and regenerating natural systems could be up to $127 billion a year in 2030.

As a subset of AI, machine learning, which allows computers to “learn” and improve on their own without explicit programming, is becoming well established in food industry applications. Applications abound in the food processing plant, including predictive maintenance modeling for production equipment and sanitation, fresh produce and raw meat quality in-line monitoring and controls to identify potential spoilage or size/shape issues, shelf-life estimation, and camera vision foreign materials control.

Product research and development is one area in which AI is being used to develop more sustainable, clean label, functional, and nutritious foods. In recent years, an increasing number of food and ingredient companies have announced partnerships with food tech companies whose proprietary AI tech is helping renovate some well-known brands as well as innovate offerings in the newer plant-based space.

Some partnerships have concentrated on leveraging AI to produce more functional foods and ingredients, such as Unilever’s work with biotech company Holobiome to further discovery of food ingredients that could have a positive impact on mental well-being by targeting the gut-brain axis and ADM’s investment in bioactive ingredient company Brightseed’s AI platform to decipher the molecular interactions between dietary plants and gut microbes and their potential impact on human health. Other partnerships look to utilize AI to create new products with sustainability in mind, such as Kraft Heinz’s joint venture with food tech company NotCo in 2022, resulting in the launch of NotMayo in the United States. In 2023, cheese brand Bel Group announced that its partnership with biotech startup Climax Foods would leverage AI and data science to co-create low carbon footprint, plant-based portions of Laughing Cow, Kiri, Boursin, Babybel, and Nurishh brand foods that would be indistinguishable from their dairy counterparts. Beverage market intelligence reports note that PepsiCo, Molson Coors, Heineken, and Jägermeister are harnessing AI to inform their flavor innovations, competitive research, and marketing communications.

Another example of the progress in utilizing AI-fueled machine learning applications in food inspection is the U.S. Food and Drug Administration’s (FDA) Artificial Intelligence Imported Seafood Pilot program, a three-phase pilot program that launched in 2019. The pilot program uses AI and machine learning to strengthen import screening and to ensure that imported seafood, which makes up more than 90% of the U.S. seafood supply, is safe. According to FDA, the first phase demonstrated the potential for a machine learning approach to speed the review of lower-risk seafood shipments and still identify higher-risk products. In the second phase, which launched at all 328 U.S. ports of entry for a five-month period in 2021, the agency reported that the real-time model was able to analyze an import entry and return a sample recommendation within seconds. The third phase is expected to be completed in late 2023.

Industrial Internet of Things

Where there are advances in software, there are going to be corresponding advances in hardware. For digital transformation initiatives, that means connected and wireless sensors, motors, controllers, actuators, and other IIoT devices that measure, monitor, track, and collect the data points to be analyzed. In fact, the IIoT and traceability market in the food and beverage industry is expected to grow at a steady CAGR of nearly 4.9% from 2021 to 2027, according to a Research and Markets report. In a recent survey by PMMI, The Association for Packaging and Processing, consumer packaged goods (CPG) companies indicated that they have actively expanded both machine and software automation in the past five years and as a result, expect to incorporate IIoT sensors and devices at some level in the near term.

In the last few years, advances in IIoT technologies have enabled food and beverage companies to leverage data to optimize AI and machine learning platforms and achieve desired efficiencies in production and productivity. In the next five years, market forecasters expect that the industry will see further IIoT developments accelerate as software capabilities grow, including the following:

- Advanced sensor technologies that provide not only real-time temperature, air, and environmental monitoring results in seconds but predictive modeling capabilities to further enhance food safety and quality assessments.

- Wireless connectors and other smart remote devices that enable ever-larger amounts of data from multiple departments or locations to be processed and continuously recalculated within minutes for enhanced decision-making on the plant floor or in the warehouse to better manage production lines, inventory, inflows, and outflows for optimal cost savings.

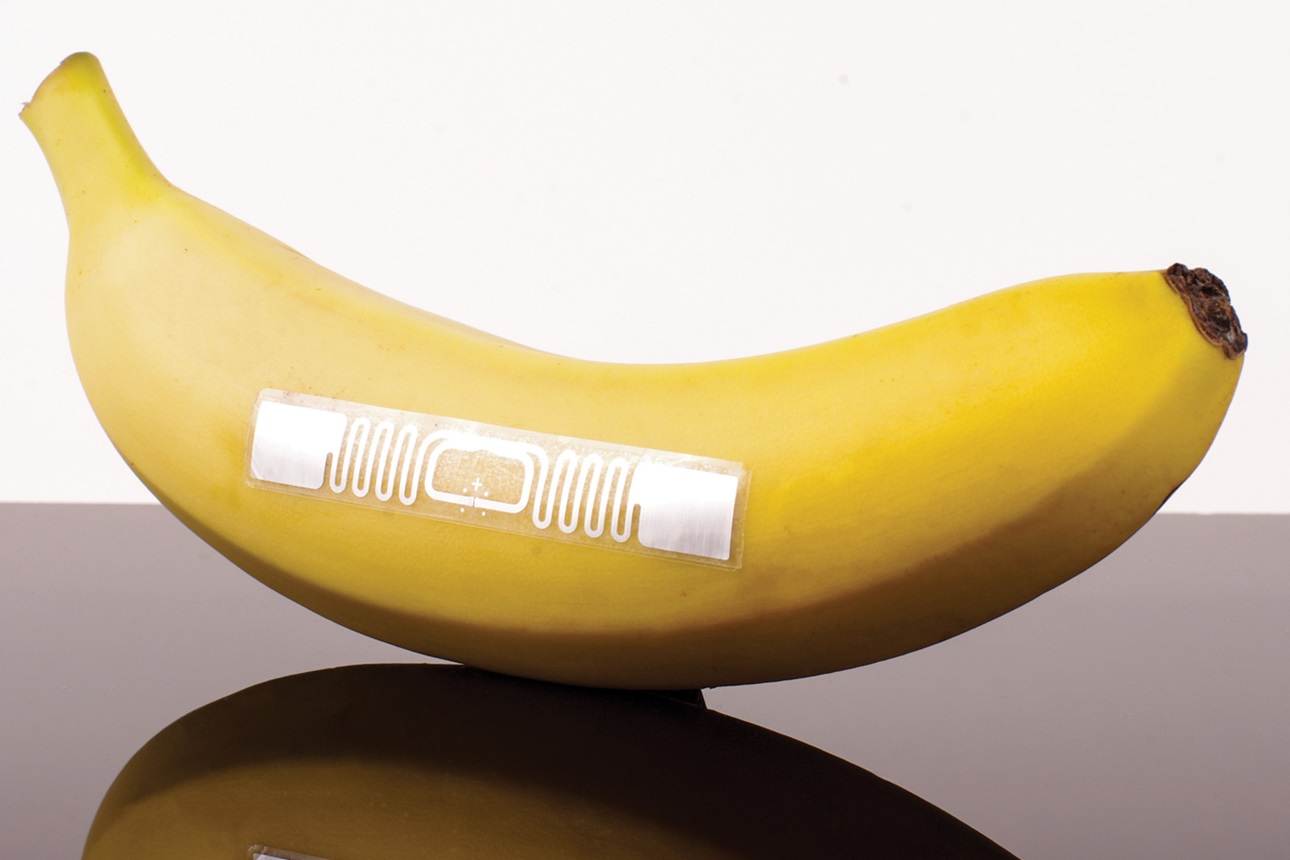

- Even smarter real-time battery-free microcontrollers placed in or on active food packaging that not only serve to monitor the condition of the food inside for food safety and quality attributes but also can communicate a variety of unique tracking and digital marketing codes to consumers.

- IIoT sensors and wireless sensor networks that are able to significantly reduce the amount of resources or optimize the resources applied to supply chain management activities to achieve significant efficiencies across a variety of parameters and across the entire chain.

Traceability Technology

With the publication of the FDA’s final Food Traceability Rule (FTR) last year, the race is on for certain companies that manufacture, pack, or hold foods to institute additional traceability recordkeeping mandates by January 20, 2026. The final rule, which implements Section 204(d) of the FDA Food Safety Modernization Act (FSMA), is designed to reduce the incidence of foodborne illnesses by instituting these new requirements for high-risk foods identified on the Food Traceability List (FTL), including soft and semi-soft cheeses, shell eggs, leafy greens, shellfish, crustaceans, ready-to-eat deli salads, and fresh and fresh-cut fruits and vegetables.

Although the FTR, also dubbed FSMA Section 204, applies only to foods on the FTL, FDA has signaled that it will use the rule as a foundation to encourage the entire food industry to adopt end-to-end traceability as part of the agency’s New Era of Smarter Food Safety initiative. To do that, FDA is working to construct financial models that will support food companies, no matter the size, to achieve full, scalable, and cost-effective traceability through tech-enabled trace-and-track solutions. In 2021, the agency launched its Low- or No-Cost Tech-Enabled Traceability Challenge, which invited technology providers, public health advocates, and innovators from all disciplines to develop traceability hardware, software, or data analytics platforms that are low-cost or no-cost to the end user. Of the 90 participants, 12 were named Challenge winners the following September, with technologies ranging from batch tracking and cloud-based software to geospatial AI-powered machine learning and IIoT technologies, to blockchain platform tools.

In May, the Institute of Food Technologists (IFT) released a report commissioned by FDA that evaluates food traceability trends based on the Challenge submissions. The independent report analyzes recent technological hardware, software, and data analytics developments for traceability end users. With the short time frame in which to comply, IFT experts recommend that smaller enterprises and supply chain partners on the FTL check out the FDA’s Challenge winner’s list and investigate other similar traceability tech platforms and hardware to find digital solutions that align with their needs and budgets.

A Transformative Future

In the coming year, food and beverage enterprises will continue the work to leverage advanced digital transformation technologies and to harness data in ways that benefit the business and consumers. Companies will also need to work on the real challenges of digital transformation, including achieving interoperability between existing and new systems or interfaces as well as between supply chain partners’ systems, maintaining data privacy, retraining personnel, and overcoming gaps in data organization that prevent effective analysis and application of data. Still, the promise of digital transformation is the creation of efficiencies in managing and using data to optimize processes and outcomes, and that promise will spur further digitization in the food and beverage industry for the foreseeable future.ft