A Rationale for Outsourcing

Outsourcing non-core business activities to a contract research organization leaves both organizations better able to leverage their core competencies and maximize resource productivity

Relentless competition in the domestic and international markets is forcing companies to find better ways of doing business with fewer resources. Successful organizations are concentrating on “core competencies” to enhance their competitive position. This strategy requires organizations to identify and retain critical products, processes, or services in the value chain which are close to their core competencies while outsourcing other processes. This article focuses on process outsourcing as a means to achieve competitive advantage.

Properly managed and developed, outsourcing allows a firm to create competitive advantage by focusing on its core competencies. Outsourcing non-core activities enables a firm to better utilize internal resources, mount additional barriers to entry, increase responsiveness to customer needs, decrease financial risks by reducing capital investments, and shorten cycle times. The impact of outsourcing can extend beyond cost reduction to include enhanced quality and service based on partnerships with best-in-class suppliers.

Properly managed and developed, outsourcing allows a firm to create competitive advantage by focusing on its core competencies. Outsourcing non-core activities enables a firm to better utilize internal resources, mount additional barriers to entry, increase responsiveness to customer needs, decrease financial risks by reducing capital investments, and shorten cycle times. The impact of outsourcing can extend beyond cost reduction to include enhanced quality and service based on partnerships with best-in-class suppliers.

Outsourcing of a business function or process is not a new concept. Third-party providers have existed in accounting, information technology, manufacturing, and distribution for decades. Recent industry trends suggest, however, that outsourcing is in a rapid growth stage. By the year 2000, business process outsourcing will be a $282 billion industry (Kiely, 1997). It’s a “buyer’s market,” with the number of providers escalating while expanding their service offerings.

Senior management is often faced with the decision to make or buy. Identifying the appropriate processes to outsource and the best firms to partner with are the two most critical issues to successful outsourcing. The most likely candidate processes for outsourcing are those that have “well-defined boundaries” (Keen, 1997) and do not advance a “critical strategic need nor specialcapability” (Quinn and Hilmer, 1994). A successful partnership is one in which both parties enhance their business position while minimizing opportunities for potential exploitation. Selecting a partner, negotiating a contract, and monitoring performance will be much easier if the appropriate processes have been identified.

Steps to Successful Outsourcing

Outsourcing is simply the assignment of work to a third party for a specific length of time with an agreed-on price and service level (Anderson, 1995). This concept is not new, but not until recently have companies begun to consider outsourcing as a purposeful competitive strategy. The globalization of the economy, rapidly improving technology, and a heightened focus on providing customer value have significantly increased competition in nearly all markets. This, in turn, has been the impetus for a fundamental change in how businesses view their sourcing strategies and has forced them to look for ways to become more competitive. Outsourcing provides this opportunity, as it helps companies to look to the value chain for high-leverage areas and helps them to better utilize their resources to exploit these areas.

--- PAGE BREAK ---

Managers must decide what process dimension or combination of dimensions they want to improve before outsourcing. Process improvement can be judged by many dimensions—cost reduction, cycle time, deliverability, quality, etc. The company must clearly prioritize and weight these dimensions to effectively select a partner. The prioritization must take into account the buying company’s product positioning strategy, market competitors, financial strength, and desired image. This prioritization will help better align corporate cultures and objectives of the future partnership!

Make-or-buy decisions are made every day for many processes performed throughout an organization. Some decisions are obvious and require little consideration, while others require careful analysis. The major stages for successful outsourcing are identification of the process to be outsourced and analysis of internal and external factors.

• What Should Be Outsourced? The best processes for outsourcing “are usually standardized, predictable and have well-defined boundaries and therefore require little active coordination from within” (Keen, 1997). As this article will demonstrate, these characteristics help keep the interface between the supplier and buyer simple. Simplicity enhances the success of the supplier/buyer partnership.

• Internal Analysis. When making a sourcing decision, it is important to determine the strategic value of the activity under consideration for outsourcing. The first step is to establish which activities represent core competencies—those activities that allow the company to provide unique value to the customer and that provide the company with a sustainable competitive advantage. Successful companies concentrate on core competencies—these activities should not be outsourced.

The second step is to consider those activities that are critical to the business but do not represent core competencies. Organizations should maintain processes and services that enable a firm to achieve a competitive edge by performing the process—usually cheaper, better, in a more timely fashion, with some unique capability on a continuing basis (Quinn and Hilmer, 1994). In general, if internal performance of the process meets most or all of these criteria, the process should not be outsourced. Conversely, if the process can be performed by an outside supplier—i.e., if an outside supplier has a competitive advantage in performing that process—the process may be a good candidate for outsourcing. This general rule applies to noncritical processes as well. If the process can be performed more efficiently by an outside supplier, then it represents a good opportunity for outsourcing.

• External Analysis. A thorough evaluation of the market must be conducted once a candidate process has been identified for outsourcing. Evaluating market efficiency, assessing costs, and identifying threats of opportunism are part of assessing whether the market conditions are appropriate for outsourcing. While outsourcing has many advantages, a company must be assured that the market structure will not provide the opportunity for exploitation by outside suppliers. In general, an efficient market is required, characterized by a number of suppliers operating in a competitive environment. An open competitive market provides suppliers the most powerful incentive to provide low-cost, reliable services (Rubin, 1985). Buyers can be more confident that they are receiving inputs as cheaply as possible when an open competitive market exists.

Once efficiency in the market has been assured, the next step is to determine the costs associated with outsourcing the activity. In general, the direct costs associated with managing the market should be less than the direct costs associated with managing in-house supply (Barney, 1996). But it is critical that a full cost–benefit analysis be completed before a decision is made.

--- PAGE BREAK ---

The first step is to determine how much it costs to perform the process in-house. It is especially important to consider all associated costs, including training and hiring of personnel, maintenance, information technology, management, overhead, direct and indirect salaries and benefits, and any other costs directly or indirectly attributable to the process.

Next, it is necessary to estimate the costs of outsourcing. This can be accomplished by requesting bids from potential suppliers and subsequently including estimated transaction and maintenance costs. Once these cost estimates are known, it will be much easier to complete a cost–benefit analysis.

It is important to remember, though, that it is not necessary to have significant cost savings for outsourcing to be worthwhile. Many of the benefits of outsourcing cannot be directly measured on an accounting ledger. The fact that outsourcing allows a company to focus its resources and efforts on its core competencies is clearly a significant benefit, but one which is difficult to quantify. Therefore, it is important that the management team consider the strategic implications of an outsourcing decision along with the traditional cost–benefit analysis before making a final decision.

When making an outsourcing decision, a number of unique costs should be considered. Two of the most significant costs are transaction costs and switching costs. Transaction costs are those costs associated with conducting business with a supplier. In general, the higher the number of transactions associated with a particular process, the stronger the incentive to make the product in-house. The simpler the interface, the fewer the number of contacts, and the more stable the interface, the smaller the transaction costs. This is not to say that an activity that requires a large number of transactions is not a good candidate for outsourcing. Rather, the number of transactions and the nature of the transactions should be factored into the decision-making process.

Switching costs refer to costs associated with making a change in suppliers. These costs include the costs of searching for a new supplier, negotiating a contract, establishing communication, and essentially all other costs associated with re-establishing the efficient performance of an activity. In general, the higher the switching costs, the lower the incentive to switch to another supplier. Therefore, when making a sourcing decision, it is critical to include these costs in the analysis and to consider the impact that each will have on the success or failure of the outsourcing initiative. Examining the duration of other business partnerships, management stability, commitment to customer service, and employee longevity are all organizational attributes suggesting that the need to switch to another supplier will be less likely.

Finally, organizations must consider the threat of opportunism. “Opportunism exists whenever parties to an exchange exploit the vulnerabilities of exchange partners” (Barney, 1996). Transaction cost analysis can be used to determine whether conditions in the market limit opportunism and therefore are favorable for outsourcing. “According to transaction-cost logic, firms should not outsource exchanges characterized by high levels of transaction-specific investment, uncertainty, and complexity” (Barney, 1996). These concepts will be further developed below. None of these conditions individually should drive the decision. However, if all conditions or combinations of these conditions are present, there is a greater chance of opportunistic behavior by the supplier.

Transaction-specific investments result when there are unique people, technology, or location investments made by either the supplier or the buyer. Transaction-specific investments have been made when specific skills are developed for a particular customer, equipment is purchased that has no alternative value, or a supplier and buyer must locate in close proximity. Opportunism is more likely under any of these conditions.

For example, buyers in the nutritional chemistry market have limited threat of opportunism with transaction-specific investments. Nutrient analysis requires people and technology investments, but if these investments are made in broad technologies and experienced personnel, then the customers’ specific analysis requirements can be developed quickly. Skills and technology investments made by CROs are typically spread across multiple industry segments and customers. Buyers who single-source research activities, therefore, can switch to a different CRO provider if opportunistic behavior surfaced.

--- PAGE BREAK ---

Uncertainty and complexity exist when there are high levels of behavioral and environmental instabilities. Unpredictable outcomes, inability to monitor or assess quality, and constant changes in a process can produce uncertain and complex processes. Uncertainty and complexity require continued reassessment and redefinition of the relationship and make contract negotiations more challenging and critical.

The potential for opportunistic behavior exists when there is uncertainty and complexity because it is impossible to write an effective contract that can anticipate all possible contingencies. Therefore, contracts are less-effective tools for managing the partnership, since the uncertainties are not likely to be completely anticipated by the contract.

The general rule of thumb is to keep it simple: know your CRO, develop a relationship with your CRO, and establish performance criteria and measurement. Although the nutrient analysis may initially appear uncertain or complicated, the process is predictable and stable and therefore is suitable for an effective contractual outsourcing relationship. Information technology has further enabled rapid communication and minimized the complexity of interaction.

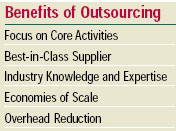

Benefits of Outsourcing

The potential benefits of outsourcing are many. First, it allows the firm to focus its resources and efforts on what it does best—its core competencies. All companies have limited resources and consequently need to allocate them in a way that maximizes their return. Therefore, by shifting more resources into the company’s core activities, the business will be able to leverage resources and enhance its competitive position. Any activities that enhance the competitive position of a firm mount additional barriers to entry by competitors.

Second, outsourcing allows the buyer to take advantage of best-in-class suppliers. It is impossible for any one company to be best at every function it performs. A company that specializes in the performance of a particular task—i.e., its core competency—excels in one or more dimensions of that process (e.g., lower cost, higher quality, decreased cycle time, etc.).

Second, outsourcing allows the buyer to take advantage of best-in-class suppliers. It is impossible for any one company to be best at every function it performs. A company that specializes in the performance of a particular task—i.e., its core competency—excels in one or more dimensions of that process (e.g., lower cost, higher quality, decreased cycle time, etc.).

By outsourcing, a company is also able to take advantage of the capital investment and technology innovation of the supplier (Quinn and Hilmer, 1994). Outsourcing allows the company greater flexibility to convert fixed costs to variable costs. It would be prohibitively expensive for any one company to try to match the investment and functional efficiency of best-in-class suppliers in all of its business activities. Therefore, outsourcing allows companies to pursue best-in-class status in its noncritical functions.

Best-in-class suppliers often have industry knowledge and experience that comes from working with a broad base of clients. For industries with regulatory requirements, the knowledge and experience to meet government approvals (FDA or USDA) or compliance standards (cGMP, GLP) can be a significant asset when trying to bring products to the market quickly. Since many regulatory processes are idiosyncratic, experience is critical to understanding and effectively managing the relationship with regulatory agencies in a timely and cost-effective manner. The benefits of speed to market include leadership recognition and minimization of lost sales.

Outsourcing also allows a company to take advantage of the economies of scale that the external supplier has developed. It makes sense to expect that an external supplier who specializes in the performance of a particular task will have developed certain economies through its experience and investment of resources. These economies allow the supplier to perform the same task more efficiently than the buyer. For example, a supplier is able to shorten the learning curve associated with training and implementing new chemical analysis techniques if its personnel are stable and well trained. In today’s market, where response times often make the difference between success and failure, superior industry knowledge provides a formidable competitive advantage.

Outsourcing can also reduce overhead in a number of ways. Organizations tend to underestimate the costs associated with constantly managing an internal activity. Physical space, administration, and nonresponsive internal groups who have a guaranteed market can prove very costly to an organization (Quinn and Hilmer, 1994). A great advantage of outsourcing is that it frees management time and investment of people and capital to focus on the core of its business.

--- PAGE BREAK ---

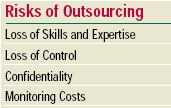

Risks of Outsourcing

Outsourcing creates many indisputable benefits and opportunities. If the supplier markets were completely reliable and efficient, organizations would outsource everything except core competencies or critical processes that support core activities. Careful evaluation of market conditions would alert the buyer to the dangerous or risky partnerships. While there are still risks for both the buyer and supplier, the end result—that outsourcing allows organizations to focus on what they do better, faster, and cheaper—must be kept in perspective. Selection of the appropriate processes to outsource also mitigates risks associated with outsourcing. Evaluation of commonly cited risks should always be considered in the context of the goal, the process, and the market conditions.

One of the greatest risks faced by the buyer is the loss of skills and expertise. Companies fear that by outsourcing an activity, they will lose established skills in that area and subsequently their own flexibility. If the partnership deteriorates, they risk having to quickly reestablish lost skills or to find another supplier to replace the current one. More specifically, management fears that the company will become overly dependent and therefore a captive customer of the supplier.

One of the greatest risks faced by the buyer is the loss of skills and expertise. Companies fear that by outsourcing an activity, they will lose established skills in that area and subsequently their own flexibility. If the partnership deteriorates, they risk having to quickly reestablish lost skills or to find another supplier to replace the current one. More specifically, management fears that the company will become overly dependent and therefore a captive customer of the supplier.

It is true that skills and expertise are often lost in the outsourced activity. But the lost skills and expertise generally will not match those of the best-in-class supplier. Skills and expertise will be redirected to other, more-critical activities of the business, and the dollars saved will be reflected directly on the bottom line. This risk is realized only if the partnership fails, which emphasizes the importance of properly selecting a partner.

Another risk is that the outsourcing company may lose control over the supplier. This can occur if the company and supplier’s objectives are not aligned. In a true partnership, firms cooperate to reach a common objective. Therefore, it is critical to the success of the partnership for the outsourcing company and the supplier to clarify their goals and expectations from the onset.

A third risk is breach of confidentiality. For a supplier to be able to perform the contracted activities efficiently, information must be shared between the outsourcing company and the supplier. For this reason, the outsourcing company must often divulge proprietary information. Therefore, the risk of breach of confidentiality does exist. A confidentiality agreement should be included with the original contract. The possible market damage to a supplier who breaches one of its customer’s confidences would serve as a strong deterrent to such behavior. In general, the best way to minimize this risk is to develop a strong partnership with a reputable supplier. With a good partnership, confidentiality becomes a non-issue.

Another concern with outsourcing is that considerable transaction and monitoring costs may be incurred. Most of these costs are associated with the governance activities necessary for administering the stream of transactions between the buyer and seller and the integration of the product or service back into the value chain. Simplicity of the interface, focused communications, and active management and monitoring of the effectiveness of the suppliers’ organization interface contribute to controlling transaction costs. Additionally, limiting the number of suppliers or CROs used by the buyer will reduce transaction costs.

Another concern with outsourcing is that considerable transaction and monitoring costs may be incurred. Most of these costs are associated with the governance activities necessary for administering the stream of transactions between the buyer and seller and the integration of the product or service back into the value chain. Simplicity of the interface, focused communications, and active management and monitoring of the effectiveness of the suppliers’ organization interface contribute to controlling transaction costs. Additionally, limiting the number of suppliers or CROs used by the buyer will reduce transaction costs.

The rapid improvement in information technology is helping to significantly reduce transaction and monitoring costs, thus providing the opportunity to outsource many functions that previously would have been too cost prohibitive. Electronic data interchange (EDI) is an example of information technology that has reduced coordination costs and created new opportunities for outsourcing. With ongoing improvements in information technology and technology costs dropping at a rate of 40% annually, cost as a barrier to outsourcing will continue to decline (Keen, 1997).

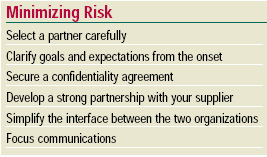

In summary, careful market evaluation and selection of appropriate processes to outsource can minimize inherent risks associated with outsourcing. Proper selection of a partner, adhering to key partnership elements discussed below, along with clarification of goals and expectations from the onset, will minimize conflicts and reduce the risk of the partnership failing. A confidentiality agreement, a simple interface between the two organizations, and focused communications decrease additional outsourcing risk.

--- PAGE BREAK ---

Partnership

Partnership

Adversarial relationships are giving way to channel partnerships seeking to achieve the efficiencies of vertically integrated systems without common ownership (Buzzell and Ortmeyer, 1995). This change may happen unconsciously as buyers and sellers increase the quantity and speed of information exchange to become more competitive. Others are strategically forming closer trading relationships to keep pace with market leaders. In the service industry, partnership can be defined as an ongoing relationship between a buyer and supplier in which both parties agree on objectives, policies, and procedures. The goal of the relationship is defined in terms of satisfying all customer needs while also driving process costs to the minimum.

For a relationship to be a successful partnership, the elements of shared objectives, mutual need, risk sharing, mutual trust, mutual reliability, cooperation, and commitment by senior management must be present. When these elements are present, partnering firms will best be able to maximize the potential synergies of the relationship.

• Shared Objectives. Clearly defined objectives of the exchange lay the foundation and help communicate the goal of the partnership.

• Mutual Need. Both parties must have a mutual need for the partnership. For example, a buyer needs the service provided by the supplier, while the supplier needs the business of the buyer.

• Risk Sharing. Both organizations in the partnership need to assume comparable or nearly comparable risks. When either party assumes more risk than the other, the risk-taking party can be exploited by the non–risk taker. The imbalance of power will eventually create conflicts and compromise the partnership.

• Mutual Trust. Trust begins, grows, and develops over time as both partners establish their commitment to making the partnership work. Successful companies simplify their relationship with suppliers by establishing trust.

• Mutual Reliability. Reliability is necessary to maintain a successful partnership. Parties in the exchange need to know they can count on their partners to stick with them even when difficult decisions and actions must be taken.

• Cooperation. Partners must work together to guarantee the health and success of both organizations. When each organization is successful, both can and should reap the benefits of success. Unilateral decisions or actions destroy the trust and the respect that have been established.

• Senior Management Commitment. Successful partnering inevitably means major changes in the way each party operates. Top management must support the changes in systems, organizational structure, and culture. Management also needs to realign any adversarial attitudes of its staff by communicating a vision while also promoting trust in the new relationship.

--- PAGE BREAK ---

Successful Outsourcing

In today’s food industry, current product leadership is not enough. Competition requires that firms originate, formulate, and market products constantly and quickly (Anonymous, 1997a). In 1996, new product introductions in the food industry dropped by 20%, the largest decline in the industry since the early 1970s (Anonymous, 1997b). In an industry where companies must innovate or lose market share, this trend could be cause for alarm and certainly represents a major challenge.

Strategic outsourcing has been coined as one of the “fastest-growing management tools of the decade (Casalle, 1997).” Organizations find it increasingly difficult to efficiently and effectively manage all the functional areas of a business. As competitive pressures persist, organizations must continually identify better ways of doing business. More and more, successful companies are concentrating on value-added core activities and outsourcing those activities that can best be provided in the market.

Two key success factors of an outsourcing partnership include the appropriate selection of a process to outsource and the selection of a partner who meets the performance requirements. Specific characteristics of an outsourced process—standardized, predictable, and well-defined boundaries—simplify the supplier/buyer interface. Identification of performance requirements—cost reduction, cycle time, quality, etc.—helps match organizational cultures and objectives and enhance the partnership’s success.

Organizations should not outsource core competencies or critical processes that provide competitive advantage. The make-or-buy decision should include careful internal analysis of the core activities and external analysis of the market conditions. If transaction and switching costs associated with managing the partnership and opportunism can be minimized, the process should be outsourced.

Two key success factors of an outsourcing partnership include the appropriate selection of a process to outsource and the selection of a partner who meets the performance requirements.

JENNIFER PATTERSON AND STEPHEN HAAS

Author Patterson is former Assistant Director, Grainger Center for Distribution Management, School of Business, University of Wisconsin-Madison, 5191 Grainger Hall, 975 University Ave., Madison, WI 53706-1323. Author Haas is Senior Marketing Analyst,Northwest Airlines Corp., Dept. A2096, 5101 N.W. Dr., St.Paul, MN 55111-3034.

Edited by Neil H. Mermelstein

Senior Editor

References

Anderson, H. 1995. Innovators in outsourcing. Forbes Magazine, Aug. 28, pp. 2-30.

Anonymous. 1997a. R&D spending on the rise. The Food Inst. Rept., July.

Anonymous. 1997b. New products take steep ’96 tumble. Prepared Foods, Feb.

Barney, J.B. 1996. Vertical integration strategies. Chpt.10 in “Gaining and Sustaining Competitive Advantage,” ed. M. Payne, pp. 316-335. Addison-Wesley Pub. Co., Reading, Mass.

Buzzell, R.D. and Ortmeyer, G. 1995. Channel partnerships streamline distribution. Sloan Mgmt. Rev., Spring, pp. 85-95.

Casalle, F. 1997. Outsourcing: The new Midas touch. Newsweek, Dec. 10.

Kiely, T. 1997. Business processes: Consider outsourcing. Harvard Bus. Rev., May-June, pp. 11-12.

Keen, P.G.W. 1997. The process edge: Creating value where it counts. Harvard Bus. School Press, Boston, Mass.

Quinn, J.B. and Hilmer, F.G. 1994. Strategic outsourcing. Sloan Mgmt. Rev., Summer, p. 42.

Rubin, P.H. 1985. Make or buy? Chpt. 1 in “Managing Business Transactions,” pp. 3-22. The Free Press, a Div. of Macmillan, Inc., New York.