Hitting the Health and Wellness Target

Healthy lifestyle brands help grow sales for both large and small food companies, but achieving success in this market is challenging thanks to consumers’ varied and ever-evolving expectations.

Article Content

Remember when taste, value, and convenience were the holy grail for food and beverage product developers? Meeting consumer expectations in those three areas was never easy, but recently it’s become even more challenging thanks to the addition of another overarching expectation: healthfulness. More than ever before, consumers are seeking out products that deliver health and wellness benefits, but the definition of what constitutes healthfulness varies considerably from one person to the next and changes frequently for many consumers, which can make achieving a successful new product rollout akin to hitting a moving target.

A 2015 survey of 5,000 consumers conducted by New York City–based consultancy Deloitte found that more than half (51%) of survey respondents placed a higher priority on a new set of “evolving value drivers” than the traditional purchase motivators of taste, price, and convenience. And leading that list of evolving drivers was health and wellness, which Deloitte characterizes as “the most important and complex of the evolvingdrivers” (Deloitte 2016).

Healthfulness has become an expectation for a broad array of foods and beverages, not just a “nice-to-have” element for a particular product or product category, explains Barbara Katz, former president of research firm HealthFocus International, St. Petersburg, Fla. “When I started doing this (a decade ago), there was a health and nutrition trend in food,” says Katz. “Now it’s no longer a trend. It is food. Now it’s not that we’re going to launch a healthy food. It’s that we’re going to take every food that we launch and make it as healthy as possible. It’s become inherently expected, and that’s across categories.”

Clearly, health and wellness has been getting some serious attention from food and beverage companies. Campbell Soup Co. CEO Denise Morrison has repeatedly referenced the “seismic shifts” in how consumers think about health and wellness—shifts that have prompted Campbell to realign its portfolio to include more fresh and healthful brands (Petrecca 2014). PepsiCo announced plans to transform its beverage portfolio over the next eight years to ensure that at least two-thirds of its beverages contain 100 calories or fewer from added sugar (PepsiCo 2016). Chicken category king Tyson Foods last year took the bold step of acquiring a 5% stake in pioneering plant-based foods maker Beyond Meat (Strom 2016). And confectionery giant Mars has committed to using all-natural colorings in its iconic M&Ms by 2021 (Jargon and Gasparro 2016).

Niches, Niches, and More Niches

“Health and wellness is probably the most prominent trend going on with consumers today, but what it means, I think, is quite different than what it’s meant inside food companies for many years,” says Laurie Demeritt, CEO of the Hartman Group, Bellevue, Wash., a food industry consultancy. “I think most food companies are going to have to make peace with the fact that there’s not going to be these really huge health conditions or health claims that people are going to coalesce around. What we’re seeing happen is a real fragmentation of needs and desires. And part of that is driven by the consumer belief that we all are different, that we have different needs.”

Consumers are considering a long list of attributes as they evaluate how well a product delivers on health and wellness. Deloitte’s analysis, prepared in collaboration with the Food Marketing Institute (FMI) and the Grocery Manufacturers Assoc., helps to quantify the breadth and depth of consumers’ health and wellness considerations, citing data from FMI’s 2015 U.S. Grocery Shopper Trends survey. That survey found that the average consumer looks for 5.4 claims on the front of the package and characterizes 9.9 nutritional content facts on the back as important. “That is 15.3 pieces of information related to health and wellness that the average consumer wants to know,” the report states (Deloitte 2016).

“People are defining health in their own way … maybe how they and their family and Facebook friends define it, not necessarily how government scientists define it,” observes David Donnan, A.T. Kearney’s food and beverage sector global leader based in the consulting company’s Chicago office.

“There’s a confidence in many consumers that they can figure it out,” says Demeritt. “They believe they have a pretty high level of knowledge about many things these days. … And if they don’t know the answer, they can find it online easily. I think there’s less of a belief that they need to be educated and more of a belief that they are in control.”

That is not to say that consumers always get it right, notes Nancy Childs, professor emeritus of food marketing at St. Joseph’s University in Philadelphia. “The consumer talks about health and wellness, but somehow local, authentic, and artisan have become concepts that are synonymous perceptually with healthfulness. And they may not be in reality,” says Childs. “That’s part of the moving target,” she continues. “Somehow [consumers believe that] if it’s organic, it’s better for you. But we know that organic doesn’t really mean that. It’s certification of a growing process. But not in the consumer’s mind. They would tell you that it’s healthier. Just like they would tell you that local is healthier.”

According to 2016 research from New York City–based consulting firm AlixPartners, consumers are willing to pay a premium for a variety of attributes they associate with healthfulness, and organic and locally sourced are high on that list (Major and Varga 2016, Figure 1). That willingness to spend more for products positioned to provide health and wellness benefits is particularly pronounced among younger consumers; those aged 18 to 34 were 75% more likely than older shoppers to say they would pay “significantly” or “moderately” more for such benefits, according to Deloitte research (Deloitte 2016).

What is more, consumers’ perspectives on healthfulness change frequently; 2016 research from the International Food Information Council (IFIC) Foundation showed that an average of 31% of Americans changed their minds about at least one dietary component in the prior year (IFIC 2016a). And according to Stephanie Mattucci, global food science analyst based in the Chicago office of research firm Mintel, more than eight out of 10 purchasers of healthy snacks (82%) agree that what is healthful changes over time.

A Changing Landscape

Consumers’ specialized and rapidly evolving nutritional priorities are changing the food industry landscape, creating opportunities for small, entrepreneurial companies with the ability to identify and respond to those new priorities, note AlixPartners consultants Brian Major and Imre Varga. “They [entrepreneurial companies] are able to spot the trends a little bit more quickly because they’re not as entrenched in old ways of doing things,” says Varga. Smaller companies can also respond swiftly to consumers’ social media feedback, sometimes utilizing that feedback to revise or revamp product development plans early in the process—something that tends to be more difficult for a larger organization to accomplish, Major adds.

Thus it’s not surprising that a growing number of major players are opting to enter the health and wellness food market via acquisition and investment, putting their capital behind someone else’s bright idea rather than building a new brand from the ground up. Many companies view this as the lower-risk approach, says Varga. “They’d rather pay a premium. They take something that is proven, and they scale it up.”

One model that’s been getting some attention is the venture capital approach of General Mills’ 301 Inc. unit, which has invested in a handful of innovative new food brands like vegetarian snacks maker Rhythm Superfoods and Tio Gazpacho, creator of a line of ready-to-drink chilled soups. In addition to providing financial support, 301 Inc. makes a variety of business resources available, sharing its expertise in areas like distribution and business efficiency strategies (Painter 2016). This past fall, the Hain Celestial Group announced the launch of its Cultivate Ventures platform, which will make strategic investments in and serve as a business incubator for small brands that focus on health and wellness (Hain 2016).

One model that’s been getting some attention is the venture capital approach of General Mills’ 301 Inc. unit, which has invested in a handful of innovative new food brands like vegetarian snacks maker Rhythm Superfoods and Tio Gazpacho, creator of a line of ready-to-drink chilled soups. In addition to providing financial support, 301 Inc. makes a variety of business resources available, sharing its expertise in areas like distribution and business efficiency strategies (Painter 2016). This past fall, the Hain Celestial Group announced the launch of its Cultivate Ventures platform, which will make strategic investments in and serve as a business incubator for small brands that focus on health and wellness (Hain 2016).

Whether it’s venture capital support or an acquisition, it’s important for the fit to be right, the experts emphasize. “The fundamental premise of the acquisition has to be very consistent with the trend that the larger CPG (consumer packaged goods) company is pursuing, whether it be health or wellness or organic,” says Major. “It’s got to be aligned with something that the acquirer is already very, very excited about.” And when the transaction is completed, permitting the acquired startup to operate with autonomy can be critical to its successful assimilation into the larger corporate entity, he adds.

Major emphasizes that consumer attention to health and wellness is driving change at the retail level. “I also think it’s driving retailers to look at their categories differently,” he says. “They’re looking to create much more dynamic assortments, which is creating opportunities for smaller players to get in and to get out more quickly as the retailers are pruning their assortment and very dynamically changing their assortments to absorb these new trends.” Major’s colleague Varga adds that healthful niche offerings can be a perfect fit for private label rollouts, allowing retailers to capitalize on the time- and cost-saving advantages of their supply chains.

Product Development Priorities

Given consumers’ highly personalized and frequently shifting perspectives on health and wellness, what should the priorities be for food and beverage makers? Two areas that deserve particular attention are fats and sugars/sweeteners because the nutrition science in these areas is evolving so much.

While the 2015–2020 U.S. Dietary Guidelines recommend limiting saturated fat intake to less than 10% of total calories consumed daily, the guidelines do not promote a low-fat diet and recommend replacing saturated fat with unsaturated fat. Meanwhile, the U.S. Food and Drug Administration (FDA) is in the process of reevaluating its definition of the term “healthy” to allow for its use as a descriptor on products previously considered to be too high in fat to be labeled healthy. With its original definition of healthy, products like almonds, avocados, and salmon—all sources of good-for-you unsaturated fats—didn’t make the cut. This fall, however, the FDA announced that it will revise the criteria for “healthy” to better align it with the updated science reflected in the Dietary Guidelines and the revamped Nutrition Facts Panel, both of which also draw attention to the inclusion of added sugars in foods and beverages.

Consumer perspectives are shifting as well. More and more, consumers have begun to understand that it’s OK to incorporate fat into their diets (and that some fats are considered healthful), but that they should pay careful attention to the amount of sugar they are consuming. “I think we’re starting to see a shift,” says Mintel’s Mattucci. “Consumers are really shifting to [a focus on] fat composition.” She notes that recent Mintel research found that nearly a third (31%) of consumers agree that you lose more weight by eliminating sugar than fat. “They’re starting to have the perspective that maybe eating fat doesn’t necessarily make me get fat,” Mattucci observes.

Consumer perspectives are shifting as well. More and more, consumers have begun to understand that it’s OK to incorporate fat into their diets (and that some fats are considered healthful), but that they should pay careful attention to the amount of sugar they are consuming. “I think we’re starting to see a shift,” says Mintel’s Mattucci. “Consumers are really shifting to [a focus on] fat composition.” She notes that recent Mintel research found that nearly a third (31%) of consumers agree that you lose more weight by eliminating sugar than fat. “They’re starting to have the perspective that maybe eating fat doesn’t necessarily make me get fat,” Mattucci observes.

She predicts that it may take a while for consumers to fully embrace a paradigm shift regarding fat, noting that the fear of fat is deeply ingrained for many consumers. “Those decades of low-fat diets have left a lot of consumers unsure about what fats are healthy and what ones are unhealthy. … So it will take some education to get them back,” she notes.

Count almond marketers among those who are heartened by changing policies and consumer perspectives. “I do think that consumers’ perceptions on fat are changing,” observes Molly Spence, director, North America, for the Almond Board of California. “With the updated nutrition research that is readily available, consumers don’t equate ‘healthy’ with ‘low-fat’ as much as they did 10 years ago, which signifies that changes are taking place,” she observes. “In fact,” she continues, “when we do focus groups, most consumers now call out ‘healthy fat’ or a ‘good fat’ as an attribute of almonds along with other nutrients rather than almonds’ fat being [considered] a detriment.” She adds that “healthy is such an impactful word that … I think it’s really important and notable that we can now describe almonds that way.”

IFIC survey data also provide helpful insights into consumers’ understanding of healthy fats. According to IFIC, which has been surveying consumers about their perspectives on healthful eating for a decade, the percentage of consumers who rated omega-3 fatty acids as healthful increased from 58% in 2006 to nearly 70% in 2016 (IFIC 2006, IFIC 2016b). Meanwhile, 35% of those IFIC polled for its 2016 survey said that that they view added sugars to be less healthful than they did in the prior year (IFIC 2016b). Low-calorie sweeteners also appear to be losing some luster; 33% of 2016 survey respondents said they viewed low-calorie sweeteners as less healthful than before (IFIC 2016b).

Fortunately, according to Melanie Goulson, principal food scientist, Merlin Development, Plymouth, Minn., sweetener suppliers were among the first ingredient companies to recognize and respond to consumers’ concerns about artificial ingredients with the rollout of natural sweetener options like stevia and monk fruit. “It’s been exciting to watch these products evolve into even more versatile and better-tasting products for use across a wide range of applications,” says Goulson. “Product developers have learned from their work in artificial sweeteners that often the best taste is achieved by blending sweeteners, so I am optimistic that we will continue to see new developments in this space that allow for great taste and natural appeal with even deeper sugar reductions.”

Enduring Values

Consumers’ definitions of health and wellness may continue to evolve, but industry experts expect that a handful of wellness priorities, including minimal processing, clean label, and transparency, will remain constant. “I think it’s very unlikely that consumers will want to go back to a world where they think a lot of things have been, as they say, produced in the lab,” says Demeritt. “So I think we’re seeing a lot of momentum away from artificial sweeteners and flavors and a movement toward things that they would define as more natural.”

“Clean label requirements impact nearly every project we are working on at Merlin Development,” says Goulson. “Considering that our clients include a broad range of companies large and small, across a spectrum of food, beverage, and ingredient categories, it’s apparent that clean label initiatives are high priority across the board.”

Mintel research supports that, according to Mattucci, who notes that 59% of consumers surveyed by the organization agree that the fewer ingredients a product contains, the healthier it is. “Consumers are often looking for shortcuts, and one way that they are doing that is through clean labels,” she says.

In a closely related vein, consumers will be unwavering in their desire for transparency, Goulson predicts. “At the root of the clean label movement is consumers’ demand for an unprecedented level of transparency about food. They want to know what ingredients are used, how it’s produced, whether it’s natural, organic, non-GMO, and local. They want assurance that the farmers were treated fairly, the animals were treated humanely, and the earth was treated respectfully. I can’t imagine that after being allowed to peer through this window, consumers would ever want to pull the shade.”

Making Personalized Nutrition a Habit

Making Personalized Nutrition a Habit

If there’s one thing that entrepreneur Neil Grimmer, founder of Habit, a brand-new San Francisco–based personalized nutrition company, is convinced of, it’s that a “one-size-fits-all” approach to diet and health is not the way to go. In fact, that conviction—based upon scientific research and his own life experience—is precisely what prompted Grimmer to found Habit, which began selling nutrition test kits online for $299 in early January. The company will soon begin offering consumers in the San Francisco Bay Area personalized meal plans and expects to expand the rollout nationally within the year.

Habit has some high-profile support. Campbell Soup Co.—which acquired Grimmer’s other startup, Plum Organics baby food, in 2013—has invested $32 million in Habit (Pranata and Ghersin 2016). The story of Habit dates back some years to the time when, while working long hours to establish his fledgling baby food concern, Grimmer found himself neglecting his own health. After a medical wake-up call, DNA and blood tests gave him insights into the kind of diet best suited to his personal genetics and biology. Grimmer embraced the dietary recommendations, promptly shed 25 pounds, and acquired a profound appreciation for personalized nutrition—so much so that he decided to found Habit with the goal of making personalized nutrition available to a wider audience.

“Habit’s mission is to empower people to take control of their health through food,” says Grimmer. “We believe that understanding what your body craves at the cellular level is key to feeding the best version of you.” He says that Habit takes a “systems biology approach” to diet.

Test kit users provide blood samples drawn with a finger lancet as well as a cheek swab that supplies DNA data. The company’s diet recommendations are made on the basis of numerous nutrition-related biomarkers in the blood samples and how they change after the kit user consumes a “metabolic challenge” shake, which Grimmer says is similar in makeup to a real meal. Analyzing genetic data and biomarkers along with self-reported body metrics data, such as weight, height, and waist circumference, using a proprietary algorithm allows Habit to generate its individualized recommendations.

The process allows clients to “discover their ideal ratio of carbs, fats, and proteins—along with other nutritional recommendations for key nutrition biomarkers like vitamin D, riboflavin, and omega-3 fatty acids,” says Grimmer. The entrepreneur notes that pricing and specifics about meal delivery will be announced later, but he expects prices to be in line with other fresh food delivery services.

Habit has partnered with a team from the Netherlands–based research organization TNO. The team is led by Ben Van Ommen, director of the systems biology program at TNO and founder of NuGO, a nutrigenomics organization.

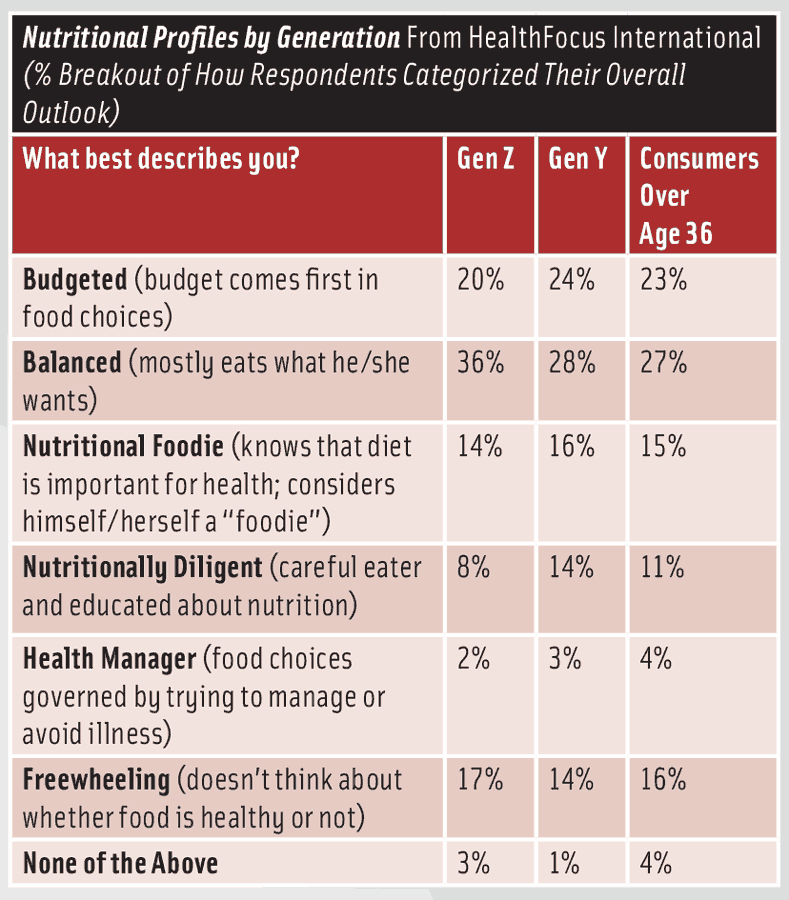

How Gen Y and Gen Z Think About Health and Wellness

Experts agree that Millennial consumers are important marketplace influencers when it comes to matters of diet and health, but new research from HealthFocus International, St. Petersburg, Fla., suggests that members of the next generation—Generation Z—may be more conservative than their predecessors when it comes to their views on healthful eating.

Millennials, or Generation Y, whom HealthFocus categorized in its 2016 study as those aged 21–36, tend to be very vigilant about healthful eating as well as significantly more confident about their nutritional knowledge than Gen Zers, delineated by HealthFocus as those aged 15–20. More than a third (36%) of those in Gen Z defined their approach to eating as “Balanced,” a segment in the HealthFocus study. This means they’re aware of the importance of diet and health but mostly tend to eat what they want, sometimes making healthful choices and sometimes just going for the cookies or the pizza. For Gen Y, the “Balanced” segment accounted for only 28%.

But more of those in Gen Y than in Gen Z described themselves as “Nutritionally Diligent” or as “Nutritional Foodies,” and fewer of those in Gen Z labeled themselves as vegetarians or vegans. Along with being more relaxed in their approach to food than Gen Y, members of Gen Z are also a bit more modest. Less than half (49%) of Gen Z respondents said they thought they know more about what’s in their food than prior generations did while 62% of Gen Yers are convinced of their superior knowledge. So perhaps it’s not surprising that the survey found that specific food attributes, such as gluten-free, no artificial ingredients, low sugar, and low sodium, are more important to Millennials than to Gen Z.

HealthFocus research also turned up some differences in the ways that Gen Y and Gen Z view brands from large companies versus those from small, entrepreneurial businesses. Gen Z consumers are less likely than those in Gen Y to believe that smaller brands are more trustworthy than larger brands, says Barbara Katz, past president of HealthFocus International. “Gen Z may not be as focused on the concept of discovery of new, small brands being a good indicator that a food or beverage is healthy,” notes Katz.

The differing Gen Y and Gen Z perspectives aren’t wholly surprising to Katz. She notes that members of Gen Y tended to be groundbreakers in terms of using online technology to gather information about their food and to create expertise. “Gen Z is now saying, ‘I know I can do that,’ but it’s not as new and exciting since they’ve had an online presence their entire lives,” she points out. Of Gen Z, Katz observes, “They’re not the ones that have effected this change, but they’re the ones that are perfecting it. How they will operate online may be different.”

Mary Ellen Kuhn is executive editor of Food Technology magazine ([email protected]).

Latest News

Vickie Kloeris Shares NASA Experiences in New Book, Consumers Are Confused About Processed Foods’ Definition

Innovations, research, and insights in food science, product development, and consumer trends.

Top 10 Functional Food Trends: Reinventing Wellness

Consumer health challenges, mounting interest in food as medicine, and the blurring line between foods and supplements will spawn functional food and beverage opportunities.

Production Capacity Expands for Food to Fight Malnutrition

Production capacity for ready-to-use therapeutic food Plumpy’Nut at Edesia expands thanks to a Bezos family donation.

Better-for-you products on display at Natural Products Expo West

A photo overview of products shared at the 2024 Natural Products Expo West in Anaheim, Calif.

Natural Product Expo West Attention-Getters: Highlights From the Event

Food Technology Contributing Editor Linda Milo Ohr reports on trends she tracked at Natural Products Expo West 2024.