Food Technology Magazine | Market Trends

A Better-for-You Crunch

Products formulated using pulses and beans, upcycled ingredients, and meat and dairy protein are among the trending alternative savory snack options.

© Fotoatelie/iStock/Getty Images Plus

It has been nearly eight years since the Hippeas brand of organic chickpea puffs launched in 2016 to great fanfare. Since then, there has been an explosion in packaged better-for-you savory snacks, with both startups and large corporations developing new products in this space. Hippeas’ parent company, Green Park Brands, continues to expand and experiment, introducing Hippeas Chickpea Tortilla Chips in 2019 and reintroducing the line with a new crunchier recipe in 2022. That same year saw the debut of Hippeas Veggies Straws, which feature another pulse—yellow peas—as the main ingredient. Available in three flavors, the veggie straws also incorporate tomatoes, red beets, spinach, and kale.

“Innovation in the alternative snack category comes from both indie brands and established companies,” notes Amy Marks-McGee, founder of Trendincite. “Since many of the startups are not established brands yet, they have a bit of an advantage in creating better-for-you snacks that tie into consumer trends such as cleaner ingredients and sustainability. Some of the larger established companies have to retrofit their brands by creating new formulas or new lines to meet current consumer demands and expectations.”

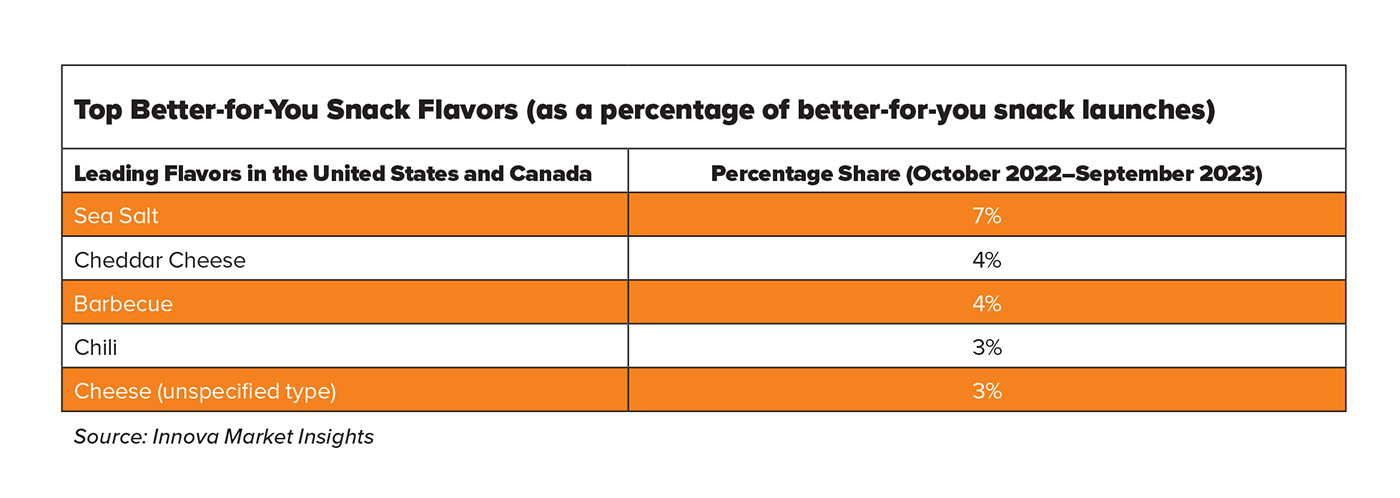

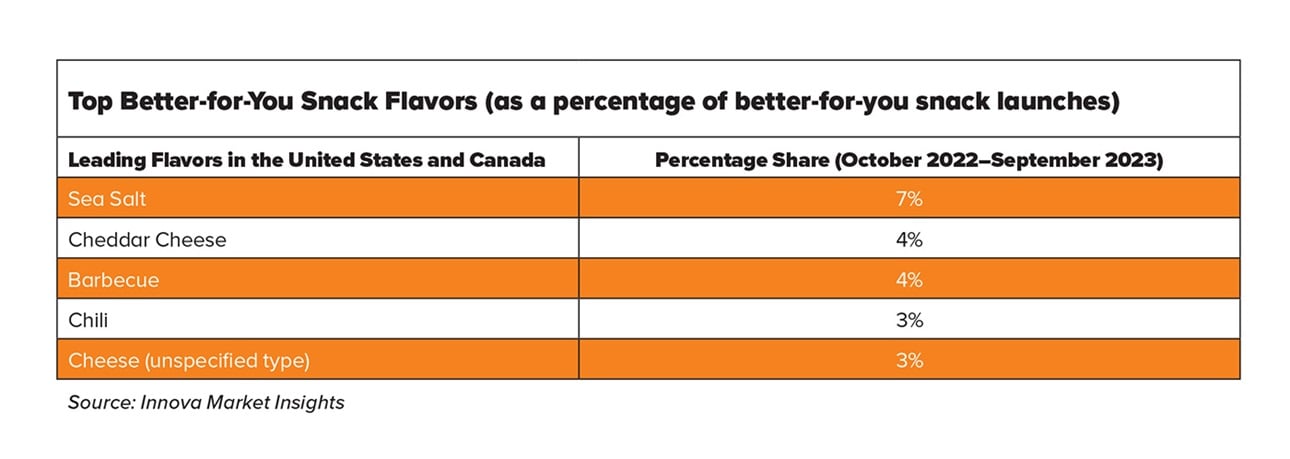

Simply Lay’s Veggie Poppables and Pringles Harvest Blends are two examples of new product launches by established brands, Marks-McGee notes. Introduced by Kellogg’s in June 2023, the Pringles Harvest Blends line features two flavors of crisps with a multigrain base (Farmhouse Cheddar and Homestyle Ranch) and two with a sweet potato base (Smoky BBQ and Sea Salt). Certified vegan and manufactured without artificial colors or flavors, PepsiCo’s Simply Lay’s Veggie Poppables also come in two flavors (Sea Salt and Ranch). Seemingly omnipresent, sea salt is the top flavor in the better-for-you snacks category in the United States and Canada, according to Innova Market Insights.

An Upsurge in Upcycling

A growing number of alternative snack brands champion environmental sustainability and social justice. For example, Uglies Kettle Potato Chips from Dieffenbach’s Snacks are made from upcycled, cosmetically imperfect potatoes. This not only helps reduce food waste but also helps ensure that farmers get paid for potatoes that would otherwise be discarded or plowed over, notes Bob Zender, director of marketing for Dieffenbach’s. In addition, 10% of the brand’s profits go to a charitable organization that combats hunger worldwide.

Founded in 1964, this family-owned company had been selling small batches of “factory seconds” chips for decades to help local farmers, long before “upcycled” became a widely used term and then a fast-growing ingredient trend. Taking this concept nationally, Dieffenbach’s launched the Uglies brand in 2017. In the past year, the brand added Cheddar & Sour Cream and Buffalo Ranch Kettle Potato Chips and Sweets! Sweet Potato Chips to its now seven-flavor lineup.

Other packaged snack brands that incorporate upcycled ingredients include Kazoo Tortilla Chips, formulated with 40% upcycled corn germ, which reduces their water footprint, and S’noods Snack Noodles made with upcycled potato flour and upcycled seasoning powders.

Crunching the Numbers

The global savory snacks category as a whole is projected to grow from $275.6 billion in 2022 to nearly $457 billion by 2032, at a compound annual growth rate (CAGR) of nearly 5.2%, according to market research firm Spherical Insights & Consulting. It’s difficult to measure the market size of the better-for-you or alternative snack segment because it isn’t consistently defined. Nevertheless, consumer interest in alternative savory snacks seems to be increasing at a faster rate than the entire category.

In its 2023 U.S. Salty Snacks Market Report, Mintel notes a significant percentage increase in the number of consumers who had tried alternative salty snacks (for example, chips/puffs made from vegetables, beans, or ancient grains) from 2021 to 2022. In 2021, 21% of respondents said they had tried an alternative salty snack in the past three months. In 2022, that proportion rose to 28%.

Although purely indulgent salty snacks still dominate the market, there remains a largely untapped opportunity to develop functional alternatives to favorite snacks. Among the Mintel survey respondents, 22% would try salty snacks with functional ingredients (such as probiotics or immune-boosting ingredients), while 19% would try salty snacks with mood-boosting ingredients (adaptogens, for example).

Innova Market Insights notes increasing interest in alternative snacks internationally. In 2022, 52% of surveyed consumers said, “I always look for healthier alternatives of snacks”; in 2023, the proportion jumped to 60%.

“More and more consumers are looking for healthier snack alternatives and are becoming more aware of mindful snacking,” says Lu Ann Williams, Innova’s global insights director. “When looking at healthy snacking, one in two global consumers always choose the healthier alternative. More specifically, consumers are often looking for healthy snacks that improve both mental and physical health.”

Williams points out that the definition of healthy differs among consumers. “A third of consumers say that the best way to make indulgent food healthier is to limit nonhealthy ingredients such as sugar or artificial ingredients or to use natural ingredients,” she explains. “Clean means healthy to global consumers, while U.S. consumers see protein, fiber, and vitamin claims as healthy. There are plenty of industry opportunities to promote healthy and indulgent snacks by putting these benefits in the forefront.”

Indeed, Innova reports that over the past five years, there has been “a 14% growth of foods in the indulgent categories with an active health claim,” says Williams.

According to Innova, “gluten free” was the topmost claim for better-for-you snack launches in the United States and Canada in the 12 months ending in September 2023, followed by “no additives/preservatives,” “high/source of protein,” “organic,” and “high/source of fiber.” In contrast, the fastest-growing claims for this segment in the three years ending in September 2023 were “low/no/reduced calories,” “energy/alertness,” “low/no/reduced fat,” and “high-fructose corn syrup (HFCS) free.”

Boom Times for Bean Snacks

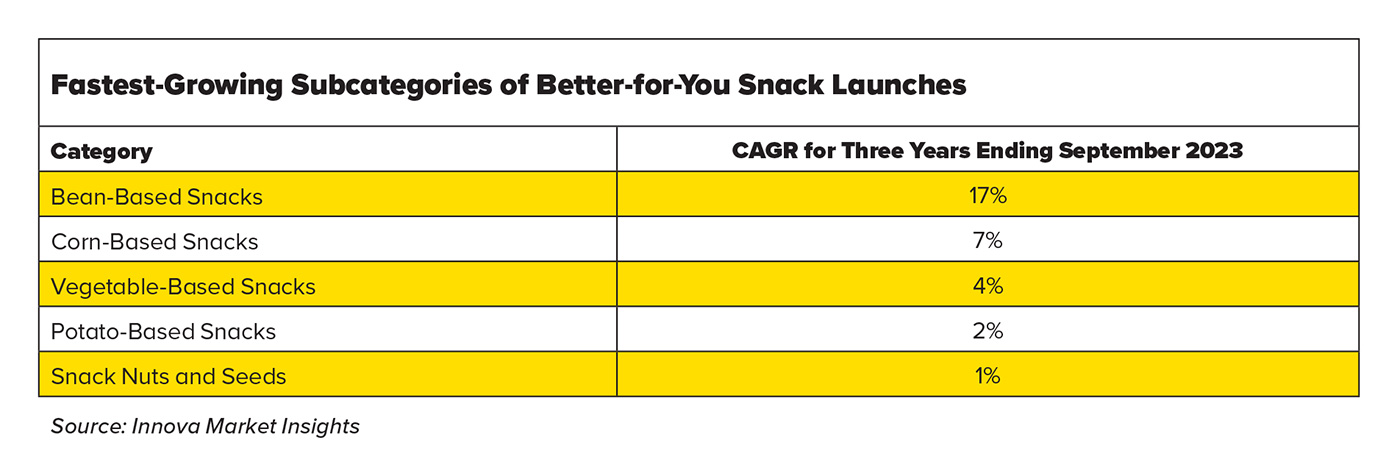

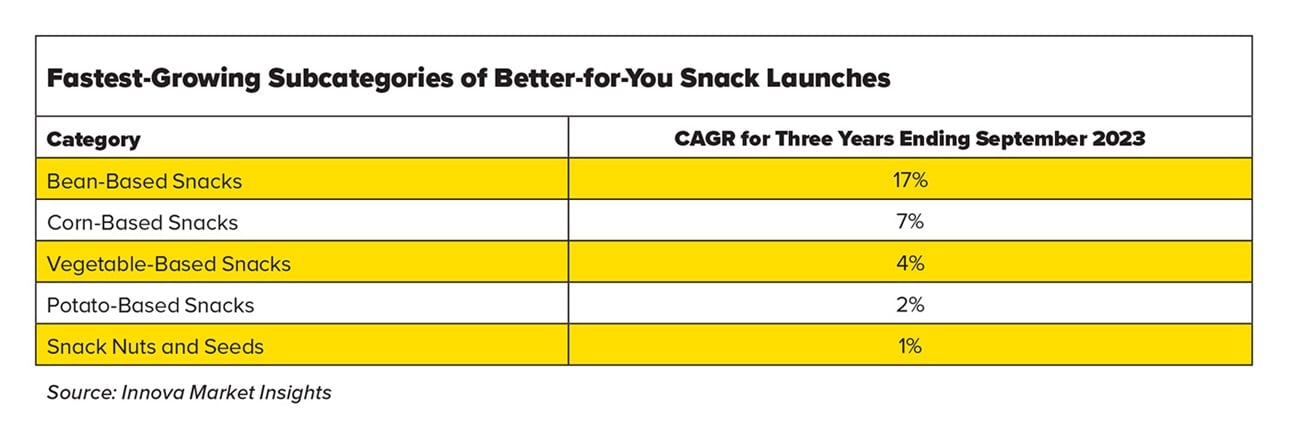

Innova reports that in the United States and Canada, bean-based snacks are by far the fastest-growing subcategory among healthier alternative snacks, with a 17% CAGR in the three years ending in September 2023.

One standout is Bada Bean Bada Boom, a brand of broad bean snacks developed by Beyond Better Foods. Known as The Boom Box, the company’s largest variety pack includes all nine flavors: Sea Salt, Mesquite BBQ, Sweet Sriracha, Garlic & Onion, Buffalo Wing, Zesty Ranch, Sweet Onion & Mustard, Spicy Wasabi, and Sweet Cinnamon. The 1-ounce single-serve SKUs contain 6–7 grams of protein, 3–6 grams of fiber, and 100–110 calories.

Fava beans blended with green peas make up The Good Bean’s Protein Snack Mix, a line available in two flavors: Sea Salt and Balsamic Herb. This product provides 7 grams of protein and 3 grams of fiber. The company’s newest snack line is Black Edamame Snacking Beans in Sea Salt, Thai Chili and Lime Leaf, and Wasabi flavors. The black soybeans are slow roasted to achieve maximum flavor and a crunchy texture, according to the company. The keto-friendly product delivers 11 grams of protein and just 3 net carbs per serving.

Fava bean protein is the main ingredient of Fava Chips, a private label product branded by a number of nutrition and weight-loss companies, including the obesity treatment firm, Robard Corp., a division of Food Sciences Corp. Providing 10 grams of protein per serving, these chips come in both Garlic & Herb and Spicy Cheddar flavors.

Protein on the Go

Although plant-based protein seizes much of the attention in the realm of alternative packaged snacks, the use of animal-based protein in snacks is on the rise as well, observes Marks-McGee. For example, protein bar maker One Brands recently launched One Puffs, a cheese puff product with 14 grams of protein and 150 calories per serving offered in Shreddin’ Cheddar and Spicy Nacho flavors. Milk protein concentrate is the main ingredient in this product.

Similarly, In Good Hands, part of California Dairies Inc., last year introduced Protein Puffs, a gluten-free snack with 12 grams of milk protein. The product is available in two flavors: White Cheddar and Nacho Cheese.

Meat-based chips are an emerging high-protein snack, fueled by the growth of low-carb diets. Marks-McGee calls attention to Wilde Protein Chips, a distinctive product made of chicken breast, egg white, and chicken bone broth. Spicy Queso is the latest SKU to join the now seven-flavor chip lineup manufactured by Wilde Brands.

Carnivore Snax offers many different SKUs of meat chips, from Brisket to Leg of Lamb. Each product contains just two ingredients: meat (grass-fed beef, bison, or lamb, or pasture-raised chicken) and salt. “We only source our meat from farmers who apply regenerative agricultural practices,” the company states on its website. “These farms mimic the wild, making them carbon sequestering and wonderfully humane for all their healthy animals.”ft