The Top 10 Functional Food Trends: The Next Generation

As major nutraceutical markets continue to mature, new growth opportunities will emanate from up-and-coming new markets, mega market sub-segments, and novel niches.

With a global industry approaching $50 billion in sales, functional foods epitomize the old saying, “health equals wealth.” And a new “do-it-yourself” approach to health, a widespread belief that healthy eating is a better way to manage illness than medication, and a crossover effect from dietary supplements to foods are sending the demand for fortified, functional, and medical foods soaring!

Size and Scope

Size and Scope

The global functional foods market is estimated to be $47.6 billion, up from around $30 billion in 1995 (NBJ, 2001a). The United States is the largest market segment at $18.25 billion, followed by Europe at $15.4 billion and Japan—the only country with a regulatory framework—at $11.8 billion. Germany is the largest European functional food market at $5.59 billion, ahead of France at $3.37 billion and the United Kingdom at $2.4 billion. The U.S. market, which grew 8.5% in 2001, is expected to enjoy a similar level of strong growth around 7.5% until 2005, tapering off to 4–5% later in the decade as the market matures. Beverages are projected to remain the largest segment, followed by breads and grains (Fig. 1). In comparison, dietary supplements are projected to grow by 3.7% in 2001 and 3.1%  in 2005.

in 2005.

In the midst of an unprecedented “do-it-yourself ” health-care movement—estimated to be a virtually untapped $42-billion retail opportunity—consumers are using more products than ever to maintain and improve health. Most important, for the first time ever last year, more shoppers opted to use fortified foods and beverages than dietary supplements: 78% used fortified foods, up from 66% in 1999, while the percentage using supplements stayed essentially the same. For comparison, 86% used over-the-counter medications, 68% prescription drugs, 37% organic foods, 35% herbals, and 20% homeopathic remedies, and 55% avoided additives and preservatives (FMI/Prevention, 2001).

With growing awareness that many health-promoting ingredients may be conveniently delivered through foods and with emerging roles for nutrition in nontraditional markets such as dental care and cosmeceuticals (foods, beverages, or supplements that when ingested have a beneficial effect on skin, hair, eyes, and nails), food marketers now have access to an ever-increasing number of large, high-margin markets, including sports nutrition, dental care, internal cosmeceuticals, and eye health.

The Emerging Self-Treatment Segment

With Americans taking more hands-on responsibility for their own health—and half reporting their health status as excellent/very good and 30% as good—the health maintenance and prevention market segments are expected to remain strong (Roper/CHPA, 2001). The “general health” market for supplements was $4.44 billion in 2001 and 76% of adults took a multivitamin pill (NBJ, 2002; STS, 2001). Sales of fortified foods, of which the majority currently represent a health maintenance or preventive positioning, are up 58% since 1998 (FMI/Prevention, 2001).

Two major attitudinal trends will ensure strong growth for fortified foods. First is a diminishing confidence that our diet satisfies all of our nutritional needs—the percentage of women who believed their diet met their nutritional needs decreased from 70% in 1994 to 46% in 2000; and those who believed they need added nutrients increased from 54% in 1994 to 70% in 2000 (MSI, 2001a).

Second, the practice of positive eating continues to grow—86% buy foods because they contain desirable nutritional ingredients; 80% because they don’t contain undesirable ingredients, and 76% choose foods fortified with specific nutritional substances (HealthFocus, 2001). Despite demands to deliver health benefits at a cost on par with other foods, one-third of consumers still agree that foods fortified with extra nutrition are worth paying a slight premium for.

--- PAGE BREAK ---

At the same time, the accelerating self-care movement is generating an unpredicted demand for natural treatment and condition-specific supplements and foods, creating one of the fastest-growing and most-lucrative health markets of all time. The majority of Americans are actively involved in not only treating but also diagnosing their own health-related problems; 96% are confident about these decisions and 58% are very confident (Roper/CHPA, 2001). Six in ten say they are more likely to treat themselves than last year, 73% prefer to treat themselves, and 62% plan on doing so more in the future. By the time they see a physician, 80% have diagnosed themselves. Younger Americans—those of child-bearing ages 18–49—are more likely to express an interest in increasing how much they care for themselves, making this market segment strong and sustainable in the long term.

Rodale (2001) found that self-treatment trends in Europe were only slightly more advanced than in the U.S. Respondents in Germany and Finland were most likely to self treat and have been doing so for the longest period of time. Although 59% of Americans take at least one supplement, compared to a European average of 34%, the number-one European reason for taking vitamins/minerals, as in the U.S., was to ensure health (60%), followed by to prevent illness (20%) and to treat a condition (14%). On the average, 35% of Americans took a calcium supplement last year, compared to a European average of 24%.

Currently, the U.S. dietary supplement market—a prime target for functional food marketers—has two key motivators: health maintenance/prevention and a fast-emerging high-margin-treatment segment. While 72% of users took a supplement last year to “feel better” and 67% “to help prevent getting sick,” a staggering 51% cited their use to “help get better when sick” or to treat a condition and 50% to live longer (Harris, 2001). Roper/CHPA (2001) reported that 50 million consumers used supplements to treat a condition in the past six months—menopause led the list, followed by colds/flu, energy, bones, immunity, and allergies. Users were most satisfied with the supplement’s performance against the common cold, flu, or sore throat (80%); allergy/sinus (72%); and muscle, joint, and back pain (70%).

And the self-treatment trend is being validated by mass-market supplement sales. For the year ending August 21, 2001, which includes Wal-Mart, sales of multivitamins were down 1.2%, single vitamins 2.4%, vitamin C 5.0%, and vitamin E 16.3%, minerals 1.8%, calcium 1.4%, and herbs 18.6%. Conversely, nonherbal specialty supplement sales were up 10.0%, with glucosamine supplements up 17.5% (IRI, 2001). Multi-herbs had the largest growth rate of 100.4%, followed by flaxseed 52.8%, black cohosh 74.8%, antioxidants 30.7%, valerian 42.3%, multi-minerals 19.2%, fish oil/essential fatty acids 18.4%, and glucosamine 14.4% (IRI, 2001). Likewise, specialty supplements were up 1% in the health food and natural channel and represented 9.5% of store sales (Richman and Witkowski, 2001).

Although condition-specific food products are emerging more slowly—perhaps because of the perception of more stringent regulatory barriers—75% of supermarket shoppers tried to lower the risk of developing a condition/illness through their grocery purchases last year (up from 54% in 1998); 65% tried to manage or treat a condition or illness on their own (up from 49% in 1998); and 70% purchased food products acting on the advice from a physician (up from 55% in 1998) (FMI/Prevention, 2001). Moreover, 75% of supermarket shoppers feel that eating healthy to treat illness is better than medication, while 57% believe that foods can replace some drugs (HealthFocus, 2001). And, for the first time, just about half said that coping with food intolerances and slowing down the aging process also affected their grocery purchases (FMI/Prevention, 2000).

While taste remains the top reason for always/usually choosing health foods and beverages, specific medicinal purposes ranks second (36%), closely followed by improving daily performance (35%) and fortification with extra vitamins/minerals and nutrients (27%) (Roche, 2001).

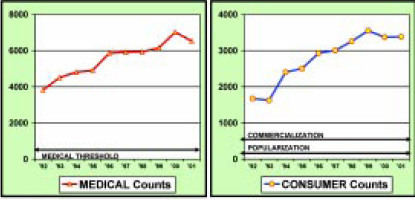

Media Coverage

Media coverage continues to play a key role in product success and sustainability. Late in 2001, for the first time, functional foods became the most covered nutraceutical media topic, taking over from women’s health, which had topped the list for at least the past four years. Functional foods, women’s health, and herbals remain the most covered topics. During the most recent trimester, functional foods continued to increase its lead over these two other mega market segments; equally important, positive media coverage (+) has gone back up to 80% from 75%, while negative coverage is at 8.7%). Positive media coverage of herbals remained near its all-time low: 65.1% positive and 25.7% negative. Media coverage has fallen below 75% positive for amino acids (72.7% positive), isoflavones (68.5%), echinacea (62.2%), and caffeine (46.9%) (STS, 2002a).

--- PAGE BREAK ---

The Top Ten Functional Food Trends

While major nutraceutical markets continue to mature, new growth opportunities will most likely emanate from the following up-and-coming new markets, mega market sub-segments, and novel niches.

1. Broader Nutrient and Specialty Ingredient Fortification

With 30% of those age 18–34—America’s least nutrition-conscious age group—and one-quarter of those aged 35–49 believing their diets fall short of the Recommended Dietary Allowances, the demand for more fortified foods and beverages will continue. Last year, two-thirds of consumers named specific vitamins and minerals they felt were missing from their diet, up from 43% in 1994. Despite the current plethora of nutritionally enhanced products, 38% of adults still think their diet should include more minerals (36% felt they needed more calcium, 19% iron, and 12% potassium); 34% felt they needed more antioxidants (20% vitamin C, 12% vitamin E, and 8% vitamin A/D); and 17% felt they needed more B-vitamins (10% B-complex, 7% folic acid, and 3% vitamin B-12, and 3% vitamin B-6). Just over half of adults (53%) reported making a strong/some effort to eat more fortified foods, and one-third fortified beverages (MSI, 2001a).

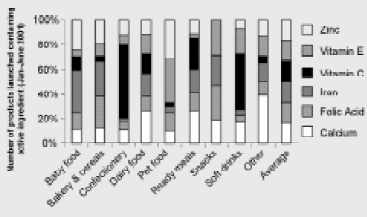

Over the past three years, the range of fortified food ingredients has diversified (Fig. 2). For example, while calcium- and vitamin C-fortified foods accounted for more than 60% of new product launches in 1999, their share fell to 40% in the first six months of 2001. The category profile has also broadened. Dairy food’s share of total calcium-enriched product launches has steadily declined in favor of other categories such as soft drinks and confectionery (Datamonitor, 2001). And the demand for more broadly fortified products will continue.

Over the past three years, the range of fortified food ingredients has diversified (Fig. 2). For example, while calcium- and vitamin C-fortified foods accounted for more than 60% of new product launches in 1999, their share fell to 40% in the first six months of 2001. The category profile has also broadened. Dairy food’s share of total calcium-enriched product launches has steadily declined in favor of other categories such as soft drinks and confectionery (Datamonitor, 2001). And the demand for more broadly fortified products will continue.

In mass food, drug, and merchandiser channels, combination dietary supplements posted some of the highest overall growth rates last year—multi-antioxidants up 30.7%, multi-mineral supplements up 19.2%, and multi-herbals up 100.4% (IRI, 2001). And the nation’s top 200 health food retailers recently stunned their industry by ranking multi-vitamins fifth on their “Top 10” list of up-and-coming best-selling supplements for 2002–04 (Richman and Witkowski, 2001).

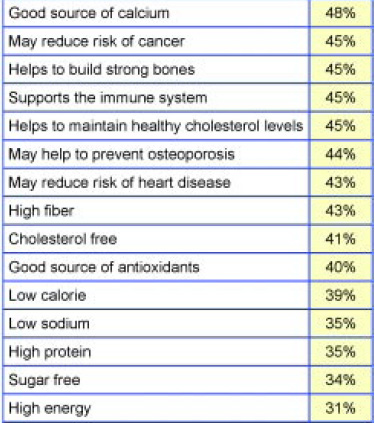

Led by multi-minerals, several traditional nutrients—iron, antioxidants, and B vitamins—will continue to enjoy exceptional consumer attention. “A good source of calcium,” “helpsto build strong bones,” and “may help to prevent osteoporosis” are still among the claims that consumers rank extremely/very important on food labels (Fig. 3). Iron—the fifth most frequently recommended nutrient by physicians, after multivitamins, calcium, and vitamins C and E—was among the few gainers in mass channels, with supplement sales reaching $57 million, up 2.7% (IRI, 2001). USDA (2000) reports that 62% of women aged 20 and older are iron deficient. More than half of consumers are aware of antioxidants, now the third-best-selling specialty supplement category in the health food channel. Four in ten associate antioxidants with cancer prevention, 18% with lower risk of heart disease, and 13% with slowing the aging process; and 52.4 million Americans took an antioxidant supplement daily last year (Roche, 2001).

Led by multi-minerals, several traditional nutrients—iron, antioxidants, and B vitamins—will continue to enjoy exceptional consumer attention. “A good source of calcium,” “helpsto build strong bones,” and “may help to prevent osteoporosis” are still among the claims that consumers rank extremely/very important on food labels (Fig. 3). Iron—the fifth most frequently recommended nutrient by physicians, after multivitamins, calcium, and vitamins C and E—was among the few gainers in mass channels, with supplement sales reaching $57 million, up 2.7% (IRI, 2001). USDA (2000) reports that 62% of women aged 20 and older are iron deficient. More than half of consumers are aware of antioxidants, now the third-best-selling specialty supplement category in the health food channel. Four in ten associate antioxidants with cancer prevention, 18% with lower risk of heart disease, and 13% with slowing the aging process; and 52.4 million Americans took an antioxidant supplement daily last year (Roche, 2001).

With 73% of adults wanting more information on B vitamins and heart disease, with USDA (2000) confirming that 62% of women don’t meet the desired intake levels for vitamin B-6 and 29% for vitamin B-12, and with the majority of consumers associating B-vitamins with enhanced energy, wise marketers will follow suit. While concern about overconsumption of nutrients looms overhead, only 6% of consumersstrongly agreed they were worried about getting too much of some vitamins and minerals from fortified foods and beverages; a total of 23% agreed strongly or somewhat (MSI, 2001a).

Bioavailability: The Next Wave. With marketers of calcium supplements and fortified foods long using specific chemical forms and ingredient additions, including vitamin D, trace minerals, and inulin, to claim superior calcium absorption, it’s not surprising that consumers are beginning to grasp the concept of bioavailability. Cutting-edge marketers such as Danone/Stonyfield Farms’ O’Soy, Yo-Squeez, and Yo-Self yogurts are already promoting higher calcium absorption with the addition of inulin/fructooligosaccharides. Sloan Trends & Solutions’ TrendSense™ market projections indicate that the concept of bioavailability is already well-established in the health food channel and should reach mass market acceptance in 9 months to one year (STS, 2002b).

--- PAGE BREAK ---

Ingredients such as Glanbia’s TruCal™, a combination of natural milk minerals, including calcium, phosphorus, potassium, magnesium, zinc, copper, and iron, derived from whey—already in the proper ratio for absorption into bones or teeth—are well positioned for this emerging market trend. The demand for essential minerals is projected to rise from 1.032 billion lb in 1999 to 1.263 billion lb in 2009 (Freedonia Group, 2001).

Protein. The Natural Marketing Institute reports that 9.1% of the general population are managing their protein intake and 14.3% their carbohydrate intake (NMI, 2002). About half of adults believe that high protein is a sound scientific principle, and 49% believe it helps them lose weight (Gallup/WFC, 2001). Just over one-third of shoppers say a “high protein” claim is extremely/very important on food labels; 13% of women and 6% of men started buying a food product for its high protein content (HealthFocus, 2001; FMI/Prevention, 2001).

Soy protein is presently in the enviable position of receiving the lion’s share of the attention. However, as the dairy industry begins to promote whey protein’s higher biological value, expansive complement of sulfur and branched-chain amino acids, and other bioactive health benefits, the source of protein will become an important consumer issue. Although media coverage of high protein intakes began to turn negative, it has rebounded in the past four months to 85% positive (STS, 2002a).

One of the latest, best-tasting, and innovative high-protein products is Cold Fusion Foods’ Protein Juice Bars (Fig. 4). They contain 11 g of high-quality whey protein, only 130 kcal, no added sugar, and 100% fruit juice and offer 100% of the RDA for antioxidant vitamins A, C, and E, as well as biotin, chromium, and manganese.

Fiber Favored Again. One-third of U.S. food shoppers increased their use of fiber, and 39% their use of whole grains, in the past two years; 45% used oat bran/cereal to reduce the risk of disease; and fiber content became the third most-sought-after health information in supermarkets! More than 40% of American and Australian shoppers and one-third of Western European and Indian shoppers say “high fiber” claims are extremely/very important on food labels (HealthFocus, 2001). And fiber will take the spotlight when the National Academy of Sciences/Food and Nutrition Board releases its recommended dietary fiber intake levels, focusing attention on current intake levels that are only half of the 25 g recommended on the “Nutrition Facts” label. The Food and Drug Administration published a definition of dietary fiber for comment in 2001 (NAS/FNB, 2001).

Although nine in ten consumers cite fiber’s role in maintaining proper bowel movements, 83% link fiber to energy, 77% to prevention of heart disease, 71% to cancer, 70% to helping control weight, and 43% to prevention of diabetes and the trendy “Syndrome X,” discussed below (Gallup/WFC, 2001). A global flurry of new product activity, including major trends to oat drinks, rye-based heart-friendly products, heart-disease-preventive cereals/bars, whole-grain menopause products, and the acceptance of designer fibers, including prebiotics, will open a new world of product options.

2. Condition-Specific Marketing

2. Condition-Specific Marketing

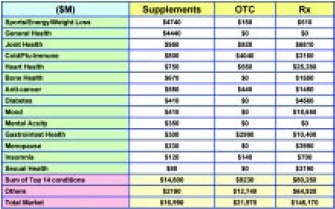

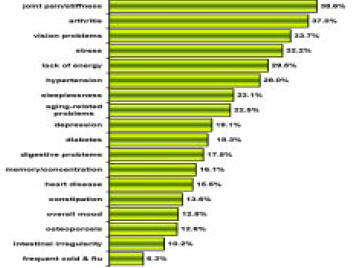

Americans’ new penchant for self care is perhaps best reflected in the exponential growth of the condition-specific market (Fig. 5). With 96 million Americans over age 45 (145 million by 2030), 71% saying that alternative remedies are “in,” and younger Americans under age 49 even more inclined to self-treat than their older counterparts, this market will remain strong and sustainable (Roper/CHPA, 2001).

--- PAGE BREAK ---

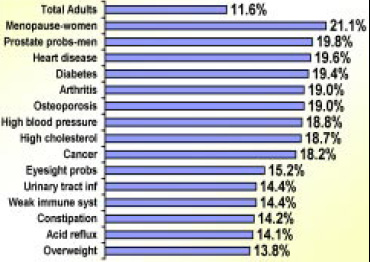

According to NMI (2002), next to weight control, cholesterol and joint pain/arthritis are the most prevalent conditions the general population is trying to manage or treat (Figs. 6 and 7). Consumers are now most interested in trying foods fortified to promote coronary health (75%), provide energy (72%), treat/prevent arthritis and joint pain (71%), improve attention/mental function (69%), promote intestinal health (66%), enhance mood (60%), and promote fetal and infant development (MSI, 2001b).

According to NMI (2002), next to weight control, cholesterol and joint pain/arthritis are the most prevalent conditions the general population is trying to manage or treat (Figs. 6 and 7). Consumers are now most interested in trying foods fortified to promote coronary health (75%), provide energy (72%), treat/prevent arthritis and joint pain (71%), improve attention/mental function (69%), promote intestinal health (66%), enhance mood (60%), and promote fetal and infant development (MSI, 2001b).

In terms of the desires of supermarket shoppers for more food products and information, those addressing high cholesterol and cancer topped the list (each 53%), followed by high blood pressure (52%), weight control and diabetes (each 49%), and osteoporosis (41%) (FMI/Prevention, 2001). Showing continued support for natural treatment options, 35% of supermarket shoppers still used herbal products (36% in 1999) and 20% homeopathic remedies (FMI/Prevention, 2001).

Heart Issues Rising to the Top. With approved health claims for soy protein, cholesterol-lowering plant sterol and stanol compounds, and a limited heart health claim for omega-3 fatty acids, functional food marketers are poised to capture their share of the exploding heart health market. Concern over heart disease is growing, and with good reason. Gallup (MSI, 2001a) projects that coronary heart disease (cardiovascular disease, CVD), high blood pressure (HPB), high cholesterol, and overweight will be among the health problems with above average growth for the decade ahead (Fig. 8). CVD (up 19%), high cholesterol (up 18%) and HBP (up16%) rank one, two, and three on their list of projections for increases in women by 2010. CVD ranks first for men (up 22.5%), cholesterol ninth (up 18.9%), and HBP 12th (up 15.2%) (MSI, 2001c, d).

Heart Issues Rising to the Top. With approved health claims for soy protein, cholesterol-lowering plant sterol and stanol compounds, and a limited heart health claim for omega-3 fatty acids, functional food marketers are poised to capture their share of the exploding heart health market. Concern over heart disease is growing, and with good reason. Gallup (MSI, 2001a) projects that coronary heart disease (cardiovascular disease, CVD), high blood pressure (HPB), high cholesterol, and overweight will be among the health problems with above average growth for the decade ahead (Fig. 8). CVD (up 19%), high cholesterol (up 18%) and HBP (up16%) rank one, two, and three on their list of projections for increases in women by 2010. CVD ranks first for men (up 22.5%), cholesterol ninth (up 18.9%), and HBP 12th (up 15.2%) (MSI, 2001c, d).

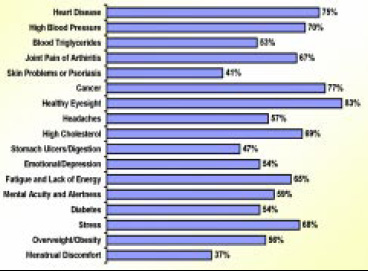

A survey conducted for Omega Protein found that next to maintaining healthy eyesight, Americans were most concerned about heart disease, followed by cancer, HBP, high cholesterol, and joint pain (STS, 2001). The most significant changes in concern between 1998 and 2001 were heart disease (up 5%), HBP (up 4%), digestion/stomach/ulcers (up 6%), and skin/psoriasis (up 10%). The biggest drops were energy/fatigue (down 14%), mental acuity/alertness (down 13%), triglycerides (down 12%), and emotion/depression (down 7%).

Health concerns among current fortified-food buyers are similar (Fig. 9). The American Heart Association reports that 50 million adults have HBP, 60.8 million some form of heart disease, and 100.8 million cholesterol levels above 200 mg/dL (AHA, 1999). Nearly half (45%) of consumers say that a “helps to maintain healthy cholesterol levels” claim is very/somewhat important on food labels; 43% feel that way about “may reduce the risk of heart disease,” 41% about “cholesterol free,” 41% about “fat free,” and 35% about “low sodium” (HealthFocus, 2001).

Health concerns among current fortified-food buyers are similar (Fig. 9). The American Heart Association reports that 50 million adults have HBP, 60.8 million some form of heart disease, and 100.8 million cholesterol levels above 200 mg/dL (AHA, 1999). Nearly half (45%) of consumers say that a “helps to maintain healthy cholesterol levels” claim is very/somewhat important on food labels; 43% feel that way about “may reduce the risk of heart disease,” 41% about “cholesterol free,” 41% about “fat free,” and 35% about “low sodium” (HealthFocus, 2001).

--- PAGE BREAK ---

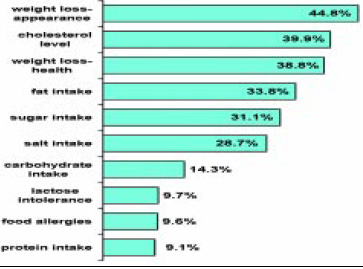

Hypertension is reaching an interest level on a par with cholesterol. Slightly more than half of Americans (52%) would like to treat conditions like HBP and high cholesterol with non-prescription options. HBP ranks fourth among the reasons people changed their diet last year, just after weight, heartburn/indigestion, and high cholesterol (Roper/CHPA, 2001). NMI (2002) reports that 39.9% of the general population is trying to manage/treat cholesterol, 33.8% fat intake, 31.1% salt intake, 28% hypertension, and 15.5% heart disease. Whey-peptide, soy, stanol, omega-3, and nutrient/specialty ingredient combination foods are poised to take a bite out of the $750-million heart supplement market. Heart-directed supplements ranked 19th in sales in the specialty supplement category in the health food channel (Richman and Witkowski, 2001). And there’s likely to be more physician support, too—85% of physicians believe that vitamins are very or somewhat effective in preventing CVD (Roche, 2001).

The National Cholesterol Education Program issued new cholesterol guidelines, advocating the consumption of functional foods containing plant stanols and sterols (Anonymous, 2001a). Altus Foods’ Take Heart line of cereals, snacks, and juice drinks incorporating Forbes Medi-Tech’s Reducol, a natural plant sterol/stanol, has been clinically shown to reduce cholesterol (Fig. 10). Products are low in fat, with vitamins B-6, B-12, C, E, and folic acid. Evolus, from the Finnish dairy Valio Ltd., is another novel product. When milk is fermented with specific natural lactic acid bacteria, Valio’s Lactobacillus helveticus LBK-16H, the bacteria degrade the milk protein into bioactive tripeptides, which lower blood pressure similar to ACE inhibitors. Whey also contains potassium, calcium, and magnesium, known to be important in proper blood pressure control.

Joint Pain, Stiffness, and Arthritis. Dealing with the difficulty of swallowing large pills—similar to the calcium scenario—it’s not surprising that nearly three-quarters of adults are interested in trying foods that help manage/treat joint pain/arthritis (MSI, 2001b). Joint pain supplement sales reached $950 million. Nearly one in four are trying to manage/treat joint pain, and just slightly fewer, arthritis. Dominated by glucosamine and chondroitin sulfate, joint products rank first in specialty supplement sales in the health food channel and jumped 17.4% in mass channels to $404 million. They are ranked second on the health food retailers’ “top 10” list of up-and-coming best-selling supplements for 2002–05 (Richman and Witkowski, 2001).

Arthritis is projected to increase 19.0% in the general population by 2010, an increase of 19.8% for men and 15.2% for women. By 2010, an additional 35 million Americans age 50 and older will suffer (MSI, 2000, 2001c, d). Bars, such as Weider Nutrition’s Schiff ’s Move Free and AtherRx glucosamine chews, along with beverages, are leading the way. The United Nations has named 2000–10 the “Decade of Joint and Bone.”

Diabetes, Syndrome X, and Sugar Free. With 800,000 new cases each year, it is not surprising that diabetes is considered an epidemic. Type II diabetes has increased by 33% since 1991. And recent media attention to “Syndrome X”—characterized by abdominal obesity, high triglyceride levels, low HDLs, hypertension, and insulin resistance—will draw further notice.

NMI reports that 18.3% of consumers are trying to manage or treat diabetes (NMI, 2002). Although not simply because of diabetic concerns, 31.1% of consumers are watching their sugar intake, and 14.3% carbohydrates (NMI, 2002). Just about half are very/somewhat concerned about developing diabetes. Overall, diabetes will increase by 19.4% by 2010 (21.4% for men and 13.5% for women), and 10.2 million additional people age 50 and older will suffer from it by 2010 (MSI, 2000, 2001c, d).

--- PAGE BREAK ---

3. Lifestyle Enhancers

With more than half of Americans reporting their health status as excellent/very good and 30% as good, it’s not surprising that health-directed actions are shifting from mania to moderation. Americans’ interest in having a healthy lifestyle has grown in the past decade, and their priorities are shifting as a result. While consumers say they don’t personally put “a lot of importance” on the amounts and kinds of foods they eat (41% vs 53% in 1990), they are placing more emphasis on minimizing stress (38%, up from 30% in 1998) and getting more exercise and sleep. They are attempting to improve everyday performance, and a host of marketers are following suit.

Energy. This is one of the most established functional food markets. True energy beverages, not including sports beverages or Gatorade™, are estimated at $300–350 million, while energy bars are still synonymous with the majority of the $860-million nutrition bar segment (NBJ, 2001b). Although concern is down 14% since 1998 for energy and fatigue in the general population—perhaps as a result of the plethora of beverages and bars available—65% of fortified food/beverage users and 61% of the general population are still very/somewhat concerned (STS, 2001). The incidence of fatigue/energy loss will increase by 9% among women by 2010 and 7.7% among men; an additional 14.6 million age 50 and older will suffer from it by 2010 (MSI, 2000, 2001c, d). Three in ten adults are trying to manage/treat this condition, and 31% of shoppers say a “high energy” claim on food labels is extremely/very important (NMI, 2002; HealthFocus, 2001).

While Red Bull GmbH, Hansen’s, and other cutting-edge companies have dominated the energy segment, multinational players, including PepsiCo/Quaker/SoBe, Coca-Cola, Procter & Gamble, Anheuser Busch, Kraft, and VeryFine, are diving into the energy market. From Gatorade’s non-herbal energizing juice drink Torq™ and its Propel™ fitness water, to Coke’s KMX and Anheuser–Busch’s guarana-infused 180™, the competition will get tough. Energy beverages are being customized to a variety of subsegments, such as gender, age, sports, etc. More nontraditional bases are being used, including energizing waters, ices, and fortified juices. In Europe, energizing sex-enhancing beverages are proliferating among the younger club set, as well as exotic “signature ingredient” drinks and alcohol-based energy beverages.

Two recent beverage additions are EAS’s super-stimulating Piranha Energy Drinks with caffeine, zhi-shi, guarana, naringin, and green tea, and Dairy Farmers of America’s Sport Shakes, energy milk shakes combining milk with carbohydrates and protein. Lifeline Food’s Energy Cheese Bar, safe for diabetics, offers a novel approach, being high in protein and sugar-free, with reduced fat and 50% of the Daily Value of calcium; it relies on protein for energy, not herbal stimulants.

Immunity, Stress, and Sleep. Closely related, immunity, stress, and sleep are three up-and-coming lifestyle markets catching the eye of creative food marketers. Sales of immune-boosting and cold-oriented supplements reached $950 million last year, and 48% of shoppers say a “supports the immune system” claim is very/extremely important (HealthFocus, 2001). Immune boosters are the tenth-best-selling category of specialty supplements in the health food channel (Richman and Witkowski, 2001). The nation’s leading health food retailers chose immune boosters as number 7 on their “top 10” list of up-and-coming dietary supplements for 2002–05. Beta-glucan—also known for its immune-stimulating properties—was number 8, and colostrum number 10.

While the TrendSense model indicates that the immune segment may have peaked in 1998, new products may be able to cycle in and out of the market. In addition to colostrum, a wide range of whey proteins including immunoglobulins, alpha-lactalbumin, and others have been shown to have immune-stimulating activity. More than 50 published studies suggest that colostrum and antibodies isolated with colostrum, in addition to boosting immunity, are linked to improvements in treating or preventing infantile diarrhea, Escherichia coli food poisoning, traveler’s diarrhea, yeast infections, thrush, dental cavities, antibiotic-associated diarrhea, ulcers, gastritis, and other gastric problems.

--- PAGE BREAK ---

Well suited for gum and candy marketers—because of the de-stressing, relaxing action of chewing—the stress-reduction market is taking off. In fact, of all the performance and lifestyle issues, stress has grown the fastest in the past three years, with 81% of consumers now reporting trying to reduce stress (Roper/CHPA, 2001). Sixty-eight percent of consumers report that they are very/somewhat concerned about stress (STS, 2001).

Although not traditionally a food market, but closely related to stress and an occasional problem for 70 million consumers, sleeplessness has the potential to be a new peripheral food opportunity. A number of ingredients, including herbs such as chamomile, valerian (up 43.4% in mass-market supplement sales), and schizandra candy, tea, and other forms are already on the market.

Mental Performance and Cognition. Despite dramatic losses for the leading herbal mental-stimulating supplements in the mass market—St. John’s wort (down 42.6%, gingko down 33%, ginseng down 27.9%, and kava kava down12.4%—just over half of fortified food and beverage users remain very/somewhat concerned about mental and emotional issues, and more than two-thirds of all adults are interested in trying foods to improve attention/mental function (STS, 2001; MSI, 2001b). Fourteen percent of consumers say they already choose healthy foods and beverages because they improve their mental performance (Roche, 2001).

NMI ranks depression second among the five fastest-growing health issues the population is managing or treating, with a compounded annual growth rate of 13.60%, just behind the leader, diabetes, which has a growth rate of 23.49% (NMI, 2002). FDA has authorized a nutrient content claim for choline, allowing food and supplement labels to “characterize the level of choline,” including “contains X mg per serving or X% of DV (550 mg/day).” FDA approval is anticipated to cause choline’s presence in the functional food market to grow substantially. At the same time, many marketers are relying on caffeine and its natural relative guarana for an added boost. Positive media coverage of caffeine has remained fairly stable over the past two years at about 49% (STS, 2002a).

From highly caffeinated beverages to “Think” bars, mental performance products are proliferating. Hero Nutritional Products’ Focus+ Yummi Bears complete nutritional system for active children (Fig. 11) is scientifically formulated with select nutrients in morning and evening servings to help children to concentrate and to stay focused at home, school, or anywhere and to get a good night’s sleep.

4. Sports Market Crossover

The lucrative sports nutrition market—with average margin ranging from 35% to 52%—is going mainstream, and it’s going to represent an unprecedented opportunity for health-conscious marketers. Wanting the same once–“athlete’s only“ benefits—quick weight loss, short- and long-term energy, recovery from fatigue, lean muscle mass, and fat burners—consumers are reaching for sports-oriented meal replacements, liquid nutritionals, bars, powders, and beverages to achieve their desired results. The demand looks to be strong in five major areas: energy replenishment, protection, and recovery; the weight-loss category coupled with energizing claims; liquid and meal replacement drinks and scientifically more sophisticated bars; building lean muscle mass, and alternative systems to deliver product nutrients other than conventional sports nutrition forms.

Not surprisingly, depending on the definition of sports nutrition and the products included in the calculation, market estimates vary. Packaged Facts (2001a) estimates the sports nutritional retail market at $2.0 billion, up from $1.7 billion in 1996, reflecting double-digit annual sales growth through this five-year period. They project that the retail market will near $3.1 billion by 2005, a compounded annual growth rate for 2000–05 of 9.1%. Sports beverages accounted for the largest share of sports nutritional 2000 retail sales of $1.0 billion, while bars and gels realized the largest growth, 27% over 1999 levels to reach $383 million. Using a broader definition, Euro-monitor (2001) estimated the U.S. market—the world’s largest market—at $8.13 billion and total global sales at $13.5 billion in 1999. In the second and third largest markets—Japan and China—beverages accounted for 100% of total sales. Drinks accounted for more than 90% of total sales in Italy, Spain, Sweden, Canada, and Mexico. Sports nutrition represented 12.4% of all sales in the health and natural food channel, up 21.6%. Muscle protein powders accounted for 22%, sports bars 17%, fat burners 15.2%, endurance 15.2%, supplements 11.5%, and weight gain 9.33% (Richman and Witkowski, 2001).

Simmons (2000) reported that 34% of the U.S. adult population uses thirst-quencher/activity drinks. Gatorade is the most popular brand, with 25% of the population using it. Men, those age 18–44, and nonwhites are more likely to use sports drinks. Proportionately more users are found in the West or South and in households of four or more persons with an income of $40,000–$59,999. The greatest volume of sports drinks is consumed in the South. PowerBar is the country’s most popular sports bar, used by 2.4% of adults, Balance Bar by 1.7%, Clif Bar by 0.7%, and Tiger’s Milk by 0.6%. All four brands are used more by Westerners and by singles. Men are more likely to use PowerBars and Clif Bars, but gender is not a factor in the use of Balance Bars. Those in a slightly older age group, 25–54, are more likely to use Clif Bars, while the other two brands appeal to a younger group.

--- PAGE BREAK ---

Athletes vs Actives. Nearly half (46%) of the U.S. population exercised regularly in 2000, 10% five or more times a week (Simmons, 2000). A switch to gym-based exercise and resistance training from aerobic exercise, significant demographic changes in who is exercising, and a groundswell in young female participation in organized sports will open new fertile mass-market segments in the sports nutrition arena.

Baby Boomers make up a growing portion of fitness enthusiasts, reaching 56% in 1999, up from 39% in 1987 (NSGA, 2001). These new warriors are focused on equipment, gym exercise, and walking. One reason for this is that physicians are recommending resistance training for coronary heart disease prevention and weight loss rather than straight aerobic activity. Home gym purchases are up 400% vs 1998, free weights up 66%, and club memberships up 23% to 30 million. Nearly 25 million adults are involved in weight lifting, 27 million in aerobics, 43 million in equipment exercise, and 81 million in exercise walking (NSGA, 2001). Kids’ sport products from beverages to yogurts are soaring. For example, Good Nature’s Products’ KidSport Nutrition Bar contains 9–10 g of protein plus 15 vitamins and minerals at kids’ level.

Hard-Core Athletes. There are 14 million “power” or serious athletes in the U.S. (NSGA, 2001). These performance-driven athletes tend to be younger and are very experimental, on the average taking seven dietary supplements per day. Packaged Facts (2001) defines five product categories, based on function: Strength and bodybuilding supplements, primarily muscle-mass building substances such as amino acids and protein mixes; fat burners/lean mass products such as muscle and central nervous system stimulants; short-term-energy products with caffeine and/or ephedra, Korean ginseng, or simple sugars; exercise recovery/supportive nutrition/injury–treatment products with anti-inflammatories; electrolyte replacements, lactic acid reducers, or antioxidants; and long-term endurance products composed primarily of complex sugars and carbohydrates.

Sector growth could also be strong for timed-release versions of sports nutrition products. Muscle health and soreness recovery, bone support and bone mass building, and even more energy-increasing products are other market demands.

5. Kids’ Health

5. Kids’ Health

With Boomers having done an excellent job of passing on their health concerns and alternative health practices to their children, it’s not surprising that the kids’ health market is set to explode (Fig. 12). For example, those whose parents took vitamins are more likely than average to be vitamin users themselves. As parents experience the beneficial support of fortified foods/beverages and other alternative therapies for themselves, it is only natural that they’d want their children to equally benefit.

Fortified Kids. Nearly three-fourths of mothers of pre-teen children believe that vitamins can enhance physical performance, 70% enhance cognitive ability, 62% promote healthy skin, 60% improve mental state/relieve depression, and 52% reduce hyperactivity and increase attention span (Roche, 2000). As a result, 68% are making an effort to purchase vitamin-fortified foods and beverages for their pre-teenage children. Moreover, three-quarters of moms agree strongly/somewhat that they “usually choose fortified foods and beverages over those that are not fortified.” Fruit drinks (72%), milk (72%), orange juice (70%), and cereal (69%) are the fortified foods mothers are most likely to purchase (MSI, 1999). And the industry is following suit. From fortified ice pops to bottled waters, juices, and drinks, more than 300 new kid-directed fortified food products have been introduced during the past year!

Mothers are most concerned about monitoring fats, sugar, caffeine, artificial sweeteners, and salt (MSI, 1999). A smaller proportion of moms than in previous years are in the habit of reading the nutrition labels on food packages they buy for their pre-teens; almost half always (18%) or usually (31%) check the labels. Half of pre-teen children and 37% of teens are regular vitamin users (Roche, 2000). Teens living in the West (42%), or South (41%); those dieting to gain weight (44%) or build muscle (41%), those following a vegetarian diet (67%), and those with a high degree of responsibility for preparing their own meals are mostly likely to take vitamins.

There’s no doubt that the nutritional profile of American children is in dire need of attention. The government’s “Healthy Eating Index” (HHS, 2001a), a summary measure of diet quality, consists of 10 components, each representing different aspects of a healthy diet, including nutrient intake. By these standards, most children have a diet that is poor or needs improvement. In 1999, fewer than 5% of American school-age children suffered from severe hunger. However, USDA (1999) reported that nearly 85% of those age 13–18, 75% of those age 6–12, and 65% of those age 2–5 needed improvement, and that 71% of girls and 62% of boys age 6–11 do not meet 100% of their requirement for calcium. Among females and males 12–19 years, 88% and 68%, respectively, do not meet 100% of their calcium requirement, and 85% of children don’t get their recommended servings of fruits and vegetables. Not surprisingly, dietary fiber levels are estimated at less than half of the recommended amount (NAS/FNB, 2001).

--- PAGE BREAK ---

Kids’ Obesity and Worse. With nearly a quarter of children between the ages of 4 and 18 now overweight or obese, it’s clear that children’s weight loss will be a vital up-and–coming segment. The model predicts that the children’s weight-product market will move into mass-market status in about one year. STS (2002b). Just under one-third (29%) of mothers of kids age 6–17 (17% for moms of kids 6–8 and 33% for moms of kids 9–17) say that one of the things they’ve discussed with their child is their child’s weight (Nickelodeon/Yankelovich, 2001). Unfortunately, unhealthy generations will create a new functional food and beverage ”Youth Market” and fill the pipeline with products for decades to come. The American Heart Association confirms that 27 million kids under age 19 have high blood pressure and 2 million or more have high cholesterol (170 mg/dL). Type II diabetes now accounts for 50% of diabetes in kids (NCHS, 1999).

Attention Deficit Hyperactivity Disorder. With 39% of shoppers very concerned about their “lack of mental focus,” it’s not surprising that behavioral and learning issues are gaining more prominence in the children’s market as well. Although true attention deficit disorders affect only 3–5% of children and 2–4% of adults, according to the National Institute of Mental Health (NIMH, 2001), widespread use of Prescription drug stimulants, the identification of nutritional substances which may aid with symptoms/control and the key role That the avoidance of food colors and additives, food allergens, and even antibiotics may play in exacerbating the conditions are spurring a fast-paced market for alternative natural remedies and supplements, although relatively small in numbers.

6. Gender, Age, and Ethnic Positioning

Without a doubt, gender, age, and ethnic differentiation have the potential to become one of the most successful health segments of all time! And savvy marketers are realizing this. In 1998, the U.S. Surgeon General predicted that gender will be the most important factor affecting people’s health in the 21st century (HHS, 2000). Nearly three-quarters of the Fortune 500 CEOs selected “customization of products and services” as the number-one winning strategy for the 21st century. HealthFocus (2001) tells us that 75% of Americans already believe that everyone’s nutritional needs are different! And it’s not just hype—check the RDAs! Moreover, health conditions are often affected by ethnicity. For example, African-Americans have a higher incidence of high blood pressure, and Asians have a higher incidence of lactose intolerance.

Women’s Health. From General Mills’ Harmony cereal to Quaker Oats’ Nutrition for Women line, McNeil Nutritionals’ Viactiv, Clif Bar’s Luna Bars, and PowerBar’s Pria, women’s products have been one of the success stories of the functional food and supplement marketplace. Women’s health already represents some very large market segments. More than half (51 million) of women age 20 and older are overweight, 53 million have cholesterol levels over 200 mg/dL, and 26 million have been diagnosed with arthritis (NCHS, 1999). Women shoppers are interested in learning more about foods that boost the immune system (79%), folate and heart disease (74%), potassium and cardiovascular health (73%), antioxidants (69%), and foods that reduce the risk of disease (78%) (HealthFocus, 2001).

Heart disease, breast cancer, and tiredness are the leading health concerns among women (HealthFocus, 2001). In 2000–10, the number of women who will be in menopause will increase 21.1%, representing the largest growth rate in a health condition/disease for women, followed by heart disease (up 18.9%), high cholesterol (up 18.2%), high blood pressure (up 16.1%), and arthritis (up 15.2%) (MSI, 2001c). USDA (1999) confirmed that 83% of women don’t receive the RDA for zinc, 64% for vitamin B6, 62% for iron, 46% for folic acid, 39% for riboflavin, 38% for thiamin, 32% for niacin, 31% for protein, and 29% for vitamin B-12.

Men’s Health. But women aren’t the only ones shopping for food. Men make up 30% of America’s grocery shoppers. Just about two-thirds of both genders report that they have become more likely to treat themselves for common illnesses before seeing a doctor. But men with an interest in self care are even more likely to treat themselves first—89% of “high-index” male health-care food shoppers vs 79% of females. Nearly half of men said that they purchased some food product in the past month because they believed it had a specific health benefit; 53% said that their grocery purchases are greatly affected by health. Twenty-one percent of male shoppers are trying to manage or treat a specific health condition via grocery purchases on their own, three in ten are trying to reduce the risk of a specific health condition or illness, and one-third are following their doctor’s advice. Slightly more than four in ten believe that food can be a better solution than medication. Seven in ten men purchased fortified foods in the supermarket last year, 66% used dietary supplements, and 54% tried to avoid additives and preservatives (FMI/Prevention, 2001).

--- PAGE BREAK ---

Male food shoppers’ top health concerns are high cholesterol and cancer (each 53%); followed by high blood pressure (52%), weight control (45%), and diabetes (45%). Overweight leads the list of the “top 10 health markets for men,” followed by cold/flu, allergies, high blood pressure, stress, headaches, arthritis, pain/chronic pain, high cholesterol, and energy and fatigue Heart disease has the highest projected growth rate for men’s health problems between 2000 and 2010 (22.5%), followed by cancer (22.4%), other prostate problems (21.5%), diabetes (21.4%), arthritis (19.8%), and memory loss (19.3) (MSI, 2001d).

Over Age 50. With 78 million Baby Boomers turning age 50 at a rate of one every seven seconds, marketing to those age 50 and older is a very good idea. Not surprisingly, those age 50–64 are the most health-proactive segment; 57% of women Boomer and 43% of male Boomer grocery shoppers say they are making “a lot” of effort to eat more healthfully. Mature shoppers (age 65 and older) show an even higher level of commitment to healthy eating; 57% of men and 62% of women are making “a lot” of effort. Only 17% of Boomer women, 19% of mature women, and 14% of mature men say that their doctor’s advice doesn’t affect their grocery shopping (FMI/Prevention, 2001).

Just over four in ten consumers age 50 and older are currently taking supplements “for specific type of stage of life.” Boomers say what bothers them most about aging is not being mentally alert (48%), risk of serious disease (42%), body aches, and arthritis (41%), losing muscle tone (30%), and digestive problems (17%)(RoperASW, 2002a).

In terms of the health conditions that will have the biggest impact on those age 50 and older, arthritis tops the list: by 2010, 33.5 million more Americans over age 50 will suffer from arthritis, 27.9 million from high blood pressure, 25.0 million from obesity, 18.2 million from high cholesterol, 14.2 million from fatigue, and 11.6 million from poor eyesight (MSI, 2000).

7. Weight, Satiety, and Appetite Supression

Positioning weight as an epidemic, HHS (2001b) released a new report, “The Surgeon General’s’ Call to Action to Prevent and Decrease Overweight and Obesity 2001,” in a flurry of media coverage late in 2001. The announcement, which prompted government-funded actions for a national advertising campaign focused on overweight children, offered staggering new statistics confirming that 61% (124 million) of American adults are overweight (69 million) or obese (55 million) obese, and 13% of adolescents and children. Compared to 20 years ago, there are nearly twice as many overweight children and almost three times as many overweight adolescents (HHS, 2001b).

Two-thirds of women (an all-time high) now say they would like to lose 20 lb (NPD Group, 2001). The incidence of overweight is projected to increase by 13.8% in the general population by 2010 (12% for women, 11.6% for men); and 25 million more Americans age 50 and older will suffer by the end of the decade (MSI, 2000, 2001c, d). Nearly four in ten consumers believe that being overweight is harmful to health (RoperASW, 2002a).

NMI reports that 59% of the general population were managing their weight for either health or appearance reasons in 2001. Appearance-motivated dieting jumped from 34.0% in 2000 to 44.8% in 2001; dieting for health reasons from 20.1% to 38.8%. Nearly one-third (29.3%) of consumers purchased a weight-control product within the past three months; 13% reported a net increase in use over the past year (NMI, 2002).

Health and wellness is the number-one reason consumers started using weight loss products, followed by lifestyle change, to treat specific health issues and performance/energy (NMI, 2002).

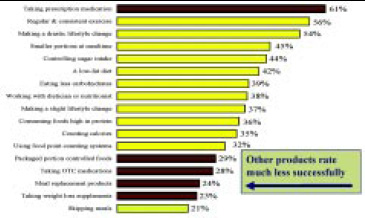

Consumers say they’ve used various types of diets to lose or maintain weight, led by smaller portions at meals (76%), controlling sugar intake (63%), low-fat diets (61%), counting calories (53%), fewer carbohydrates (49%), skipping meals (41%), high-protein foods (34%), and food point systems (18%). As shown in Fig. 13, 61% of those taking prescription weight-loss medications felt that they were extremely/very successful in managing weight. However, of those who have used other products, (represented by brown bars), only 29% felt that packaged portion-controlled foods, 28% over-the-counter medications, 24% meal-replacement products, and 23% weight-loss supplements had been extremely/very successful in managing weight (NMI, 2002). The nation’s top 200 health food retailers project that weight-loss products will be the number-one best-selling category in the next two years (Richman and Witkowski, 2001).

Consumers say they’ve used various types of diets to lose or maintain weight, led by smaller portions at meals (76%), controlling sugar intake (63%), low-fat diets (61%), counting calories (53%), fewer carbohydrates (49%), skipping meals (41%), high-protein foods (34%), and food point systems (18%). As shown in Fig. 13, 61% of those taking prescription weight-loss medications felt that they were extremely/very successful in managing weight. However, of those who have used other products, (represented by brown bars), only 29% felt that packaged portion-controlled foods, 28% over-the-counter medications, 24% meal-replacement products, and 23% weight-loss supplements had been extremely/very successful in managing weight (NMI, 2002). The nation’s top 200 health food retailers project that weight-loss products will be the number-one best-selling category in the next two years (Richman and Witkowski, 2001).

--- PAGE BREAK ---

Although how and why Americans’ “diet” is changing, sales in the $46-billion weight-loss market are soaring (NBJ, 2001b). Weight-loss supplements—which are sold primarily in pill and liquid meal-replacement form—totaled $3.36 billion. Sales of diet pills, led by Metabolife 356, reached $515 million in the mass channels and were the fastest-growing category in chain drug stores last year, up 47.2% for the year ending 12/31/01 (IRI, 2002). Weider International’s MetaboSure™ Metabo-Mints and MetaboGum “for a boost of energy and metabolism” are among the newest candies aimed at dieters. Liquid meal replacement sales, led by Ultra-Slim-Fast, reached $1.3 billion in mass channels (up 13.6%) and $2.3 billion across all mass-market channels (IRI, 2002).

Almost three-quarters of supermarket shoppers confess that their purchases were “at least a little influenced” by their desire to control weight (FMI/Prevention, 2001). Although nearly nine in ten Americans used low-fat foods last year and 85% used low-calorie foods, one-third of all shoppers say they increased their use of low-calorie foods (CCC, 2001). “Low calorie” is still an extremely/very important food claim for 39% of consumers (down 16% since 1992), “high protein” for 35%, and “sugar free” for 34% (down 13% since 1992) (HealthFocus, 2001).

During the past two years, two unique trends have emerged in the food-oriented weight-control market: high-protein and super-satiating foods. An estimated 35 million americans are now followers of high-protein, low-carbohydrate diets, including 10 million on the atkins plan or using Dr. Atkins’ Advantage line (NBJ, 2001b). And a new trend to high-satiety foods has begun to take shape. With lunch and dinner being eaten later, satiety products address a need to stay “full” longer and avoid unhealthy snacking, hunger pangs, and cravings. Satiety is also benefiting from the increased media attention to energy, i.e., avoiding blood sugar highs and lows. Satietrol, a line of natural appetite-control powdered beverages; Functional Foods Inc.’s Lean on Me weight-control snack for women—tested at Baylor Medical School’s weight loss center—Kashi Go-LEAN Cereal Slimming System (Fig. 14), and more-traditional products like Dannon’s Light ’n Fit Yogurt and Blue Bunny Lite 85 (first yogurt with sucralose) showcase the variety of market entries.

Last, but not least, two mega untapped opportunities still exist. First is childhood obesity. The TrendSense model shows the demand for childhood obesity products already well entrenched in the health and specialty store channel and about 9–12 months away from going mainstream (STS, 2002b). Second, the global weight market is exploding. The World Health Organization (WHO, 1999b) announced that there are more overweight people than underweight around the world and that even Ghana had more overnourished than undernourished people. Most countries in Western Europe have an average obesity rate of 12–18% and Eastern Europe up to 40%. Likewise, for the first time, one-third of men in Japan under age 40 are said to be overweight, while childhood obesity gains in concern.

8. Fast-Forward for Functional Snacks

Food marketers are focused on making some of America’s favorite snacks just what the doctor ordered! Scrumptious creamy fruit chews provide as much calcium as a glass of milk or 100% of the day’s vitamin C. Teddy bear–shaped lollipops help soothe a child’s sore throat, while gummy bear candies ensure a good night’s sleep. Antacid and tooth-whitening gums, chocolate glucosamine chews, and serious energizing hard candies—each laced with more caffeine than two cups of coffee—are just some of the cutting-edge products creating just possibly the most explosive segment in U.S. functional food history.

But, it’s not all sweet! From soy nuts and rice crisps to cheese bars for diabetics and calcium Cheddar curls, the nutritionally untapped $20.7-billion savory snack business may harbor the greatest potential of all.

Snacking behavior continues to climb. Nearly one-quarter of adults snacked three or more times a day in 2001 (up 6% over the previous year), 30% twice a day, and 31% once a day. Just over one-quarter of households without children and 17% of households with children are making a strong effort to eat healthy snacks. All ages are interested—39% of those age 65 and older, 23% age 50–64, 20% age 35–49, and 15% age 19–34 are making a strong effort to eat healthy snacks. More than half are making an effort to look for snacks that are low in calories; those age 65 and older (36%) and those age 50–64 (29%) are leading the demand. Just over half (51%) of those dieting for weight loss and 52% of those dieting for health are making a strong effort to find low-calorie snacks. Most important, 60% strongly/somewhat agree that it’s better for you to eat smaller meals or snack throughout the day than to eat three full meals, opening up a new, strong mini-meal, health-driven market (MSI, 2001e).

--- PAGE BREAK ---

A+ for Functional Candy. According to the Adams Candy Div. of Pfizer, Inc., about half of those who purchased candy in the last month were also concerned about nutrition (Anonymous, 2001b). Candy—a $15-billion U.S. business—and other sweet snacks enjoy a 94% U.S. household penetration. In contrast, nutrition/energy bars—not always great-tasting and certainly not fun—have a 20% penetration, totaling $1.4 billion in sales, $860 million of which is due to“nutrition” bars (NBJ, 2001a). The National Confectioners Association estimates that functional candy sales topped $1.6 billion as far back as 1999, representing 10.7% of all non-chocolate SKUs and 1.7% of chocolate.

In drug, food, and mass merchandise outlets, diet candies reached $93 million (up 9.9%), while sugarless gum outpaced regular gum at $611 million (up 11.9%). Regular gum fell to $479 million (down 6.8%) (IRI, 2001). Fortified candy—such as Hi-C and Fruit Gems high–vitamin C chews, Farley’s Dinosaurs with vitamins A,C, and E, Rhino’s Calci-Bears, Viactiv calcium chews, and Natrol’s Calci-Delight™ bars—dominates the functional segment. High–vitamin C and echinacea immune-boosting candies and high-caffeine, ginseng, or guarana treats lare other major market categories.

Moving Toward Medicine. Perhaps the most important aspect of functional candy is its longer-term ability to act as a tasty and convenient carrier for medicinal ingredients. Dimetapp’s Get Better Bear pops offer relief from sore throats. Hero Nutritional Products’ Focus+ Yummi Bears are formulated to help children concentrate and more effectively absorb information. Their other gummy bear products nourish and support children’s immune systems, provide dietary fiber, and promote safe sleep. Quigley Corp’s Cold-Eeze™ offers cold/flu gum and bubble gum for big and little kids, too!

Gum marketers are breaking new ground. Giant Wrigley’s new Healthcare Div. introduced a breakthrough product, Surpass™ fast-acting antacid chewing gum, designed to “chew through heartburn” and targeted at America’s 121 million antacid users. On the average, heartburn sufferers spend more than $1.2 billion on nonprescription relievers each year, with 67% of users preferring immediate forms of relief as opposed to conventional antacids (Anonymous, 2001c). Sales of oral health–care gums reached $715 million last year, up 16.3%, following a 17% gain in the previous two years. Likewise, anti-smoking gum sales hit $304 million in mass-market sales, up 5.1% (IRI, 2001).

Functional Snack, Chips, Dips, and Stix. From crackers to crisps, the functional snack market is exploding. Functional snack foods will reach $2.8 billion by 2005 and $4.8 billion by 2010 (NBJ, 2001a). A comparison of nutrition claims for new snack products in 2000 vs 1999 indicates that snack marketers are concentrating on high calcium (up 640%), added fiber (up 118%), and organic products (up 49%)(Anonymous, 2001d). For a five-year period ending in 2002, the fastest-growing organic categories are expected to be snacks and candy (60%), cereals (54%), dairy (44%), and frozen (40%), according to the Organic Trade Association (OTA, 2001). In general, three snack categories are leading the way: calcium treats, such as Glenny’s lite high-calcium Cheddar Curls; soy treats such as Genisoy Soy Crisps and SimpleSnacks soy nuts; and high-protein chips such as Engineered Nutrition Inc.’s Lean Protein Snack Chips with 38 g of protein per serving (Fig. 15).

Watch Out, Bars. While double-digit annual growth is still projected for nutrition bars through 2010, the advent of both functional candies and savory snacks will bring unprecedented competition. Already bar marketers are in pursuit of better taste and moving more toward candy, in terms of both formulation and flavors. For example, Clif Bar’s Luna bar for women is enjoying great success with such flavors as Chocolate Pecan Pie, Tropical Twist, and Nutz Over Chocolate, while Balance Bar Gold™ can rival even the best gooey-chocolate traditional bar.

All industry segments are in pursuit of functional snacks. From fortified kids’ sports yogurts such as Crowley’s Sportables™ to Med Tech Industries’ freeze-and-eat fortified NutriPops and even Sci Fit’s Fat-Free Beef Jerky Stix, the snack segment will be crowded with a variety of functional alternatives.

--- PAGE BREAK ---

9. Mother Nature Knows Best

Let’s face it, when it comes to health, Mother Nature really has it together. Whey proteins may well help to lower blood pressure, isoflavones offer menopause relief, and fish oil–based DHA helps ensure proper infant development. As evidenced by specialty supplement sales, more than ever consumers are seeking out these natural substances to help achieve their personal health goals.

In the mass market, flaxseed supplements jumped 52.8%, black cohosh 74.8%, fish oils and essential fatty acids 18.4%, and Acidophilus 14.4% (IRI, 2001). An earlier survey (FMI/Prevention, 1999) confirmed that for those food shoppers trying to manage or reduce the risk of a condition or follow a doctor’s recommendation, foods that were naturally a good source of the active ingredient were most desirable (83%), followed by specially fortified foods (72%)—both higher than supplements (60%). Similar patterns were found among food shoppers trying to treat a specific condition on their own, trying to reduce the risk of a specific condition, or following specific professional dietary advice.

Soyfoods Staying Strong. The soyfoods category increased 21.1% in 2000 to $2.77 billion. SoyaTech (2001) projects 20% growth overall in 2001, with some categories, such as cold cereals and soymilk yogurt, growing as much as 75–100%. Soymilk sales grew 33% to more than $470 million, with refrigerated soymilk in mainstream markets driving the category. Soymilk volume was estimated to be about 1% of fluid milk sales. Meat alternatives grew by nearly 15%, and energy bars with soy nearly 40%.

Soyatech (2001) reports that 90% of tofu and soymilk companies use some or all organic soybeans for production, up from 75% in 1995. Two big drivers here are genetically modified organisms (GMOs) and the lack of a coherent and consistent labeling rule for them, and USDA’s organic standard. Watch as unique products such as Coca-Cola’s OdwallaMilk—a blend of organic soy, basmati rice, and oat milks—Glaceau Soywater, and Stonyfield Farm’s O’Soy yogurt gain in appeal.

But while soy sales are booming, the increasing negative media coverage of soy and particularly isoflavones is troubling. Positive media coverage of soy has fallen somewhat to 82.3%, and positive media coverage of isoflavones is down to 68.5% positive, with negative coverage at an all-time high of 24.7% (STS, 2002a).

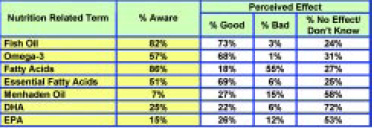

Omega-3, DHA, and Related Fish Oils. With a limited health claim approved for the relationship between omega-3 fatty acids (DHA and EPA) and reduced risk of heart disease and recent FDA support of DHA supplementation of infant formula, it is not surprising that awareness of fish oil products continues to climb (STS, 2001). Most important, the percentage of consumers believing these products are good for your health has grown significantly since 1998; up 12% for fish oil and 14% for omega-3s. And the future looks good—40% of those who are not familiar with omega-3s said they would be very or somewhat likely to use an omega-3 supplement (and 50% an omega-3 fortified food) after learning of omega’s health connections (Fig. 16). Fifty percent of respondents who were unaware of fish oil or omega-3s were very or somewhat likely to use an omega-3 fortified food, and 27% not at all likely. Those very or somewhat likely to try an omega-3 fortified food said they are very or somewhat concerned about healthy eyesight, heart disease, and cancer: It is important to note that a greater percentage of potential fortified food users also are concerned about these conditions than consumers in general.

Omega-3, DHA, and Related Fish Oils. With a limited health claim approved for the relationship between omega-3 fatty acids (DHA and EPA) and reduced risk of heart disease and recent FDA support of DHA supplementation of infant formula, it is not surprising that awareness of fish oil products continues to climb (STS, 2001). Most important, the percentage of consumers believing these products are good for your health has grown significantly since 1998; up 12% for fish oil and 14% for omega-3s. And the future looks good—40% of those who are not familiar with omega-3s said they would be very or somewhat likely to use an omega-3 supplement (and 50% an omega-3 fortified food) after learning of omega’s health connections (Fig. 16). Fifty percent of respondents who were unaware of fish oil or omega-3s were very or somewhat likely to use an omega-3 fortified food, and 27% not at all likely. Those very or somewhat likely to try an omega-3 fortified food said they are very or somewhat concerned about healthy eyesight, heart disease, and cancer: It is important to note that a greater percentage of potential fortified food users also are concerned about these conditions than consumers in general.

Those groups most likely to use an omega-3 fortified food include women, those aged 21–49, those employed, those with some or more college education, and those living in the Midwest, South, and West. Bread, cereal, and juice top the list of the products they would most like to see.

--- PAGE BREAK ---

The Whey Protein Message. The dairy industry is sitting on top of a gold mine of functional food ingredients. Whey protein has a protein efficiency ratio (PER) of 3.2, compared to 2.6 for casein. Soy, peanuts, corn, and wheat gluten have a PER under 2.5. Any protein with a PER of 2.5 is considered good quality. Whey proteins have proportionately more sulfur-containing amino acids (e.g., cysteine, methionine) than casein and a surplus of the essential amino acids lysine, threonine, methionine, and isoleucine, which are often limited in plant proteins; virtually every amino acid present in sweet type whey exceeds the FAO/WHO nutritional intake recommendations.

The high-sulfur amino acid is important because of its ability to enhance immune function and antioxidant status via modulation of the tripeptide glutathione. Cysteine is a rate-limiting amino acid for the biosynthesis of glutathione, an internal antioxidant, anticarcinogen, and immune-stimulating tripeptide. Whey peptides offer food product opportunities related to blood pressure, lactoferrin helps to increase iron and mineral absorption, lactoperoxidase and lactoferrin are antibacterial agents, and countless other whey ingredients have applications in the sports, immune, and weight-loss segments.

Probiotics and Prebiotics. While worldwide markets for gut health are clearly established in both Europe and the Far East, the U.S. remains the ultimate battlefield. Last year, 17.5% of consumers tried to manage/treat a digestive problem and 10.2% intestinal irregularity (NMI, 2002). A number of “gut” problems—heartburn/indigestion, upset stomach/nausea, and constipation/diarrhea—are on the “Top Ten 2001” list of America’s most common ailments (Roper/CHPA, 2001), while concern for digestion/stomach ulcers is up 6% to 47% of adults. In the U.S., food probiotics products are almost exclusively dairy products—fluid milk, yogurt, and kefir—although some bars and candies are emerging. All-channel yogurt category sales reached $2.39 billion in 2000, up 12.8% vs 1999. Yogurt shakes and drinks hit $75.7 million in mass-market sales, up 270% (Heller and Weir, 2001). Nearly three-quarters of adults say they would consider taking a fortified food to promote intestinal health.

Mini-bottles are also emerging. Yakult, arguably the world’s largest functional food brand, is solidly positioned as the global leader in mini-bottle probiotic drinks, considered the fastest-growing segment of the fresh dairy category worldwide. Together with France’s Group Danone—Yakult’s closest competitor—sales exceed $1 billion U.S.

U.S. consumer awareness of probiotics and media coverage are extremely low (Hartman Group , 2002). For the trimester ending July 2001, probiotics ranked in the 5th or lowest level of media coverage monitored—along with potassium, vitamin B-6, and stress—although 93% of media coverage was positive (STS, 2002a). According to STS’s TrendSense market-timing model, probiotics should currently show strong appeal in the natural and health food channel—and among those sophisticated, very concerned, self-care shoppers. If the acceleration level of research activity continues, it will likely take 12–18 months to mainstream. Its market potential is currently on a par with isoflavones and echinacea. Prebiotics are on a par with flavonoids and guarana and are virtually unknown to American consumers.

10. Nontraditional Food Markets

The market for specialty foods and beverages that help prevent, treat, or improve other physical conditions—once solely the purview of OTC products and cosmetics—is quickly emerging. Two-thirds of Americans are only somewhat or not at all satisfied with existing nonprescription options for teeth/gum problems, followed by muscle/joint pain, minor eye problems, menopausal symptoms, allergy/sinus, skin problems, and PMS (Roper/CHPA, 2001).

Eye Health. When it comes to consumer concerns about health, maintaining healthy eyesight is the “gold standard,” with 83% of fortified food and beverage users saying they are very/somewhat concerned (STS, 2001). Vision problems are the fourth-fastest-growing self-treatment market, with a compound annual growth rate of 9.32%; one-third of consumers are currently trying to manage or treat them (NMI, 2002). With eyesight problems projected to increase by 15.2% by 2010, more than one-third of adults not surprisingly are very/somewhat concerned about developing eye problems in the future, 42% about cataracts, and 29% about macular degeneration. In fact, 43% of adults age 40 and older are likely to take eye-targeted dietary supplements this year (MSI, 2001f). Awareness that lutein is good for eye health jumped from 2% in 1999 to 27% in 2000. And physician support should be strong. After osteoporosis, physicians are most likely to recommend vitamins/minerals for macular degeneration, with 67% believing that they are very/somewhat effective for prevention (Roche, 2001). Nearly three quarters of optometrists were aware of lutein’s association with eye health, followed by 54% vitamin E, 50% vitamin C, 42% vitamin A, 30% zeaxanthin, and 24%beta-carotene (AOA, 2001).

--- PAGE BREAK ---

The Silent Epidemic: Oral Problems. Teeth and gum problems have hit the “Top 10” list of America’s most common health ailments (Roper/CHPA, 2001). The first-ever Surgeon General’s report on oral health confirms that dental caries in children age 6–8 and root/crown caries in adults age 55 and older are accelerating (HHS, 2001c). Most young adults have some degree of gingivitis, more than half of those age 35–44 suffer from periodontal disease, and half of those age 55 and older suffer from severe periodontal diseases. As 78 million Boomers turn age 50, the situation will worsen.

Oral-care sales hit $5.2 billion in 2000, and Packaged Facts (2001b) projects they’ll reach $6.7 billion by 2005. Whiteners, products for sensitive teeth, oral pain relief, and oral care gum have all experienced strong double-digit growth. Giants like Wrigley, SmithKline-Beecham, Arm and Hammer, and Colgate have targeted oral-care gum (Fig. 17)—registering $715 million in mass market sales after a 16.3% and 17% gain in the past two years (IRI, 2001).

Interest will continue to climb. Chronic oral infections have been linked to increased risk of diabetes, heart/lung disease, stroke, pneumonia, and low-birth-weight/premature infants. Diabetes, osteoporosis, and arthritis put Americans at greater oral health risk, and more than 400 commonly used medications can accelerate dental issues. Unprecedented consumption of nonfluoridated bottled water and increased snacking are also compromising oral health.

Evidence that nutrition plays a key role in periodontal disease prevention will give scientific support to functional gums/candy. Just about half of consumers say dental gums are better for their teeth and mouth than other gums (MSI, 2001g). Product possibilities are endless. Further evidence that vitamin C, calcium, and antioxidants may help prevent periodontal disease will provide new avenues for functional gums/candy. Chewing gums for sensitive teeth, smokers, whitening for both denture and non-denture wearers, and stain prevention, and gums and candies for oral pain/in-mouth sores, teething infants, nighttime relief, and, potentially, sore throat pain and tongue-directed bad breath are all viable options.

Inner Beauty and Anti-Aging. While the cosmeceutical market—which generally involves topical applications—is projected to grow from $3.0 billion to $4.7 billion by 2020, so will the demand for supplements and functional foods that help to ensure beauty from the “inside out” (Freedonia Group, 2001).

One-third of women believe that taking vitamins can be very effective in promoting healthy-looking hair, skin, and nails, and 47% somewhat effective, while one-quarter think that minerals can be very or somewhat effective and 13% think the same way about herbs (Roche, 2001). Fifteen percent of women have already taken vitamins/supplements to improve skin, 10% nails, and 9% hair/scalp. Two-thirds of women want to learn more about nutrition and health as they apply to healthy skin, and 43% say that stated vitamin content levels on hair care, skin care, or color cosmetics are very important (Roche, 2001).

Women age 45–64—core supplement users—are the prime users of skin-care products. On a different note, milk, fruits, green tea, and grains, including oatmeal, have long been staples in other cosmetic products, such as face masks and baths.

Rx Complements. A potentially lucrative but much smaller segment is the medical foods market. Liquid nutritionals for serious illnesses, diabetic foods, foods for renal patients, candies that stimulate saliva flow for chemotherapy patients, and those with phe-nylketonuria are other important markets. One sleeper market may be that of foods that are complementary to prescription drugs. An example may be a food that complements blood pressure medications that frequently deplete potassium and other important nutrients.

A Global Opportunity

Last year, heart disease took over as the world’s leading cause of death, and more people are now overweight than underweight worldwide (WHO, 1999a,b). While motivated consumers globally are taking action to reduce risks associated with these conditions, a surge in life expectancy and other associated risk factors ensures that they will be part of this global epidemic. European food marketers ranked heart disease first in terms of conditions having a very great influence on the functional food market, followed by cancer, obesity, osteoporosis, gut health, and immunity (Hilliam and Young, 1999).

It is a very different food world than just a decade ago. On the one hand, American companies have a unique opportunity to globally market cutting-edge, nutrient-enhanced, heart-healthy, weight-loss, energizing, joint-pain, sports, and even dental-care foods and beverages geared to a fast-paced and unfortunately unhealthier lifestyle, quickly becoming the norm worldwide. On the other hand, we have the luxury of adopting a wide variety of “pre-tested” natural therapies, ingredients, and creative products from a diversity of countries and cultures. Clearly, we have the best of both worlds!

A. Elizabeth Sloan,

Contributing Editor

The author is President, Sloan Trends & Solutions, Inc., P.O. Box 461149, Escondido, CA 92046 (phone 760-741-9611, [email protected]).

References

AHA. 1999. Heart and stroke statistical update. Am. Heart Assn., Dallas, Tex. www.amhrt.org/statistics/about/html.

Anonymous. 2001a. Third Report of the NCEP expert panel on detection, evaluation and treatments of high blood cholesterol. Food Chem. News 43(14): 18.