Making a Splash With No- and Low-Alcohol Beverages

As health-conscious consumers seek refreshing, flavorful, and satisfying alternatives to traditional alcoholic beverages, no- and low-alcohol beers, spirits, and mocktails are gaining popularity, spurred by innovations in flavor, function, and variety.

Article Content

Alcoholic beverages have played a starring role in social interactions since the beginning of human history, helping to cement friendships, celebrate life’s milestones, and launch longstanding customs and traditions. More recently, however, no- and low-alcohol (no-low) counterparts are making headway as a growing number of consumers embrace a more moderate, sober-conscious approach to consumption.

From beer and wine to spirits, seltzers, mocktails, and champagne, no-low beverages are rising in popularity, with recent research from Mintel indicating that one in five consumers has reduced alcohol consumption in an effort to make healthier beverage choices. Moreover, 55% of consumers who participated in a proprietary study conducted by flavor solutions manufacturer FONA reported drinking nonalcoholic beverages such as zero-proof cocktails and nonalcoholic seltzers at least two to three times a week.

“Globally, we are at the beginning of a paradigm shift in the role drinks play in people’s lives, with several bigger cultural forces at work,” Ben Branson, founder of distilled nonalcoholic spirits brand Seedlip, observes. “This means the timing and need for quality, adult nonalcoholic options has never been more relevant. I think people are also becoming increasingly mindful of their health (now more than ever), the origins of their food and drink, and the influence social-media-led lives have on consumption.”

Currently, no-low beer accounts for over 80% of the total global no-low beverage market and is expected to continue to lead the segment’s strong volume growth over the next few years, according to Sophia Shaw-Brown, senior insights manager at IWSR, a leading source of data and intelligence on the alcoholic beverage market. Shaw-Brown forecasts 15% growth for no-low beer in 2021, with more growth ahead through 2024.

Meanwhile, global no-low spirits consumption is expected to increase by over 70% by 2024, predicts Shaw-Brown. “Lots of startups are entering this space, identifying the significant opportunity which is being presented by the moderation trend as consumers increasingly seek premium alternatives to soft drinks and generic ‘mocktails.’ With powerful players in this segment, the spirits segment is expected to be one of the fastest-growing areas of low- and no-alcohol development,” she says.

Health-consciousness—already on the minds of consumers pre-COVID-19—is now trumping factors such as cost or peer influence when it comes to buying decisions, says Shaw-Brown. “IWSR research shows that for many legal drinking-age consumers under 40, a change in lifestyle due to COVID-19 has played a significant role in their increasing low- and no-alcohol consumption over the last year, while 40% of over-40s reported trying to be healthier as one of the driving factors behind their increased low- and no-alcohol intake,” she says.

Although the global market is still emerging, the outlook for the near future looks promising. Shaw-Brown expects to see over 35% growth in volume consumption by 2024, “driven by significant growth in key markets including the United States, Germany, and Spain. Major brand owners are turning their attention to the low- and no-alcohol space, creating increased category competition and visibility across most markets, in particular throughout Europe and North America,” she notes.

Interest in no-low ready-to-drink (RTD) beverages and beer is relatively low in the United States, with only 21% of U.S. adults who consumed alcohol in the three months prior to July 2020 choosing low ABV options, according to Mintel data. But consumption rose to 29% among U.S. adults aged 22–34 and 30% among those aged 35–44.

Jenny Zegler, associate director for Mintel Food & Drink, believes that the tendency for younger adults to be more likely to choose no-low options “suggests that the low-/no-alcohol segment has long-term potential because adults aged 22–44 are likely to continue their moderate alcohol consumption habits as they get older.”

Not-So-Basic Beer

As the leading segment in the global no-low alcohol category, beer is a natural when it comes to new product development. “Mintel Global New Product Database (GNPD) shows that the small base of nonalcoholic beer is growing, especially as many large and small brewers join the emerging nonalcohol segment,” Zegler says. “The number of global nonalcoholic beers has grown 166% from 2016 to 2020, according to Mintel GNPD. Despite the rise in product launches, nonalcoholic beer accounts for only 6% of global beer launches in 2020.”

The craft space, in particular, is home to considerable no-low beer innovation, especially when it comes to flavor and variety. According to Julie Olson, industry manager, Alcohol, at FONA, “No- low-alcohol beer has expanded to craft beer categories, such as stouts, IPAs, and ales as well as nonalcoholic hop water.” And many craft breweries embody the same commitment to quality, great taste, and innovative brewing techniques.

Athletic Brewing Company is a prime example. After graduating college and embarking on a demanding career in finance, founder Bill Shufelt decided to make health and fitness a priority in his life but was disappointed in nonalcoholic beers, finding them flavorless, watery, and metallic in taste. He teamed up with an accomplished craft brewer, and the duo brewed more than 100 batches using homebrew equipment before settling on a process. The result is a creative selection of nonalcoholic beers that includes Run Wild IPA, made from a blend of five Northwest hops; Upside Dawn, a golden ale brewed with premium organic malts from the United States and Germany, as well as English and traditional American hops; and All Out, an extra dark stout with a full-bodied mouthfeel and toasty finish, accented with coffee and bittersweet chocolate.

Bravus Brewing is another company that prides itself on creating nonalcoholic craft beers with the same high-quality taste experience as their alcoholic counterparts. Founded in 2015, the company lineup includes six offerings, among them India Pale Ale, a medium sweet and bitter variety with earthy, piney, and fruity notes; Oatmeal Stout, which has a nutty, mild oat character along with hints of caramel, chocolate, and coffee; Raspberry Gose, billed as a great pairing for goat cheeses, ceviches, and grilled meats; and Peanut Butter Stout, which offers medium malt sweetness complemented by peanut butter and chocolate notes.

A Spirit of Innovation

The spirits segment boasts one of the hottest areas for new product development. “This category is booming with zero-proof spirits that feature delicious combinations of botanicals, herbs, and spices or flavors reminiscent of a traditional spirit, such as coconut rum or cinnamon whiskey,” says Olson.

A pioneer in the space is Seedlip, founded in 2015 by Branson, who was inspired by the 17th century book The Art of Distillation and began experimenting in his kitchen using a copper still and homegrown herbs.

“When Seedlip launched five years ago, 99.9% of bars, restaurants, hotels, and retailers were not considering those not drinking alcohol, there were just a handful of sub-standard options, and the nonalcoholic category was in its infancy,” Branson recounts. “Fast forward to today; there are supermarket shelves dedicated to no- and low-alcohol options, bar menus dedicated to it, 100+ products to choose from, a dynamic ecosystem of venues, communities, literature, retailers, producers, investors, and societal groundswell all driving at changing what we drink. It has been incredible to witness.”

Today, Seedlip offers three expressions, each of which is unique and does not aim to replicate the taste or experience of alcoholic spirits. Instead, Branson uses traditional methods to create products made from distinct blends of botanical distillates. Seedlip Garden 108 uses a blend of peas, hay, and hops complemented by rosemary, thyme, and spearmint to create an herbal experience. By comparison, a sophisticated citrus blend of blood orange, bitter orange, and mandarin forms the basis for Seedlip Grove 42, which is balanced by ginger root, lemongrass, and lemon peel. Consumers looking for spice will find it in Seedlip Spice 94, an aromatic blend of allspice berries and cardamom accompanied by notes of grapefruit and lemon peel.

Branson understands the value of the cocktail experience. And that understanding has informed his approach to the category. “[Seedlip] allows for the same theater, care, and ritual of crafting a cocktail,” he says. “And it is fundamentally about inclusivity—no matter the reason or duration you’re not drinking, Seedlip offers a sophisticated, complex option. It’s just good hospitality, whether at home or at the bar.”

Ritual Zero Proof takes a different approach to crafting its spirits, offering the “taste of gin, whiskey, and tequila—without the alcohol or calories.” The company’s branding incorporates its philosophy about why consumers might prefer nonalcoholic beverages: “b/c babies. b/c training. b/c meds. b/c work. b/c life. b/c dry january.”

Three spirits make up Ritual Zero Proof’s product line: Ritual Whiskey Alternative, which features all-natural botanicals blended with orange, bitters, and vermouth along with American oak, sugar floss, and vanilla fragrances, finished with peppercorn and hemp; Ritual Tequila Alternative, a blend of agave, charred oak, and Mexican lime, sporting a clean, spicy finish; and Ritual Gin Alternative, which, according to the company website, “tastes just like gin because it’s made using the same all-natural botanicals, like juniper berries, English cucumber, and green herbs.”

Because many flavors, aromas, and production processes used to create nonalcoholic spirits are similar to those used in traditional alcoholic versions, they can help draw new consumers. “Alcohol alternative drinks can be created with signature alcohol ingredients, layered flavors that emulate the wine-drinking experience, or formats that befit celebratory occasions,” explains Doug Resh, director, commercial marketing, for T. Hasegawa USA, manufacturer of custom flavors and fragrances.

“Although most consumers reach for the familiar with their current nonalcoholic consumption, there is room to make the mainstream more diverse, flavorful, and unique,” he adds. “Tapping flavors that consumers are familiar with yet aren’t currently represented heavily in the drink aisle can capture those consumers who are willing to dabble in flavor exploration. Certainly, the foodservice industry may be fueling a lot of awareness and even trial, given the popularity of mocktail menus. Fruit flavors such as peach, mango, watermelon, and blueberry provide a clearly defined flavor expectation yet still a fairly new beverage experience.”

Make Mine a Mocktail

Bartenders can attest to the growing popularity of mocktails, which have been a hit at restaurants and bars for several years among sober- conscious consumers. It’s no surprise, then, that the movement is hitting the ready-to-drink (RTD) market, which is enjoying some of the same innovation seen in the beer and spirits categories.

“Mocktails have been a thriving trend for years due to consumer interest in health and wellness and the growing ‘mindful drinking’ movement,” says Resh. “Nearly half (47%) of consumers under 35 agree that mocktails are just as good as cocktails, indicating opportunities for products such as RTD mocktails and zero-proof spirits, a small but fast-growing trend within the spirits market.”

“Creativity in the ready-to-drink alcoholic beverage is boundless, and it is seen within zero-proof cocktails as well,” agrees Olson, who cites consumers’ desires for “better-for-you as well as an upscale, craft experience or a simply delicious classic” as drivers. And with the advent of the pandemic, she says that consumers have been “unable to go to their favorite bar or restaurant and do not have the aspiration to make [mocktails] at home. They want convenience and they want it to deliver on taste/flavor.”

Distinctive taste and flavor are hallmarks of ISN’T Drinks’ nonalcoholic beverages, called Distinctivos. But make no mistake; Distinctivos are not mocktails. “We embrace the moniker zero-proof cocktails, but strongly dislike the term ‘mocktails,’” the company owners assert on their website. “We don’t intend to mock anything. Distinctivos are original, alternative cocktails, not knock-offs.”

Inspired by complex botanical blends found in alcoholic spirits, and focused on a full sensory experience encompassing texture, aroma, and color, ISN’T Drinks has launched three versions of Distinctivos: Absence, a distillation of angelica root, bergamot, and wormwood, mixing light bitterness with citrus and an accent of white grape; Rédessence, a floral-based mixture of roses, lavender, hibiscus, and elderflowers joined with ginger and spice and accented with rhubarb; and Mazy, a wine-inspired mixture incorporating pomegranate, black tea, gentian root, anise, and tart cherry.

By contrast, California-based Ferm Fatale positions itself as “the world’s first line of zero sugar, wildly fermented, raw, live, and organic ‘ready to drink’ mocktails in classic cocktail flavors.” The company prides itself on “raising the bar,” not only by leaving out the alcohol but by reducing sugar content and adding functionality in the form of B vitamins, good bacteria, yeast, and enzymes. The use of locally sourced, seasonal ingredients also contributes to founder Julie Cielo’s artisan approach and mission to position Ferm Fatale as a social revolution.

All of Ferm Fatale’s mocktails start with throwback lime “shrub” or vinegar-based fruit juice, which is mixed with kombucha and sweetened with monk fruit. Additions of cranberry, mint, and ginger juices complement the basic ingredients and differentiate the mocktail recipes. At zero net sugar, the line, which includes Shrub-Bucha Margarita, Shrub-Bucha Nojito, Shrub-Bucha Cosmopolitan, and Shrub-Bucha Madame Mule, provides probiotic benefits at only 22 calories per serving.

Function, Flavor, Formulation

Companies looking to differentiate themselves in the no-low beverage category are using a variety of approaches to create brand definition and produce a quality sensory experience that also supports good health. Although functional beverages were popular prior to COVID-19, the pandemic has accelerated new product development, says Olson. “Currently, the market is led by innovation within the kombucha or CBD-infused no-/low-alcohol beverages. Though, as consumers’ knowledge of functional ingredients broadens, it is expected to see a shift to include more up-and-coming ingredients, such as adaptogens, nootropics, and more.”

In fact, more than three-quarters (76%) of respondents in a proprietary study conducted by FONA in December 2020 were either very interested or extremely interested in functional benefits within nonalcoholic beverages, she noted, with “interest highest among millennials, as they have always had a strong affinity for better-for-you.”

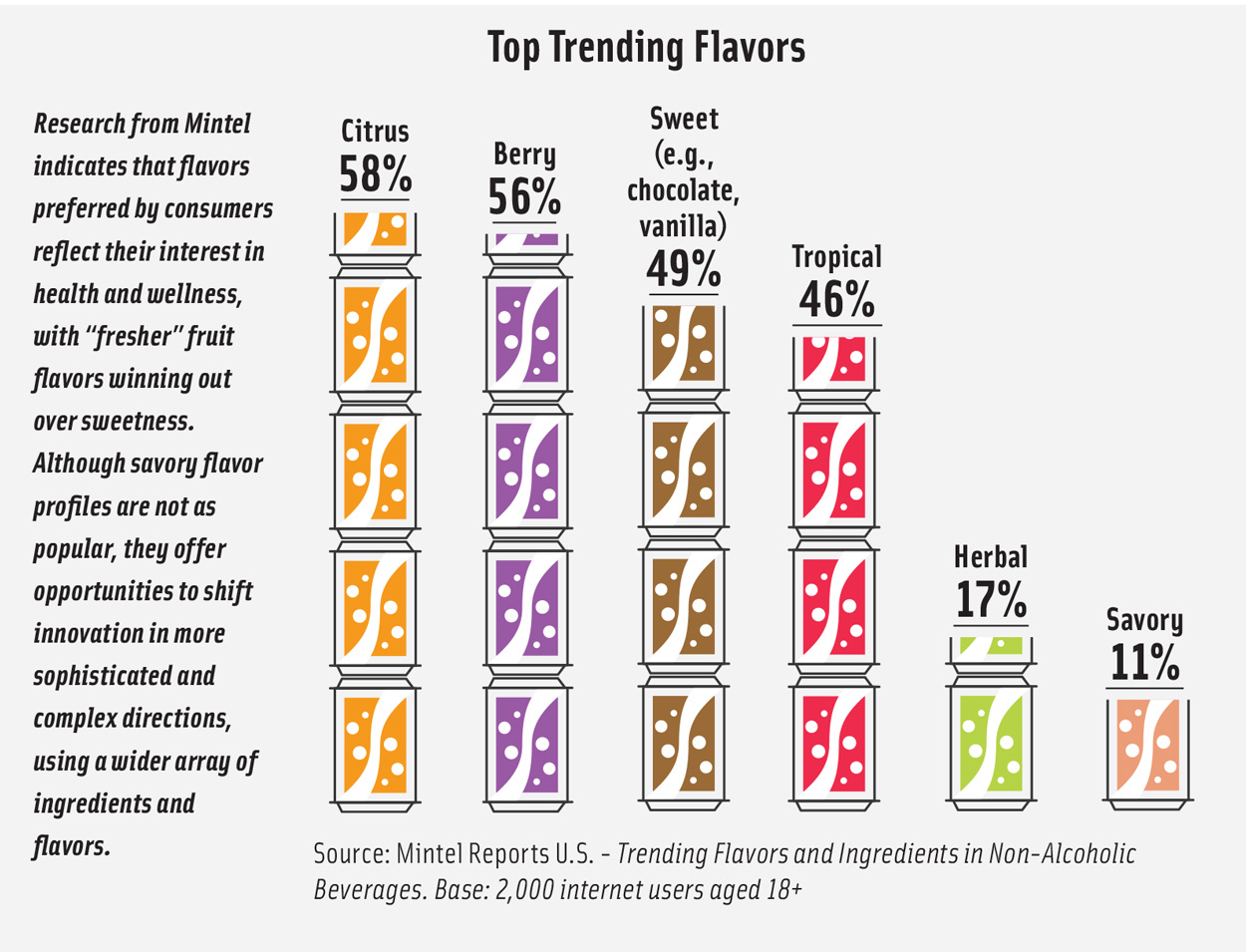

Flavor offers another avenue for differentiation and is a leading factor in consumers’ buying decisions. “As consumers become more health conscious, nonalcoholic beverages should maximize on quality and functionality, all while packing a flavor punch,” says Resh. “Flavor innovation can propel growing categories even further and revitalize lagging categories. Ingredient innovation can also address overall wellness, as well as specific health concerns, as nonalcoholic drinks designed as alcohol alternatives must have better-for-you qualities, including low to no calories or reduced sugar or antioxidant content.”

For Olson, ingredient innovation means creating a beverage experience “that goes beyond a carbonated soft drink or iced tea.” But she cautions that there is no one-size-fits-all solution. “[W]hen it comes to typical alcohol tastes, such as alcohol burn, there is mixed appeal. Forty-six percent of consumers told FONA that they are interested in typical alcohol attributes. On the other hand, there are more than four in 10 consumers who shared that they do not want that. Therefore, innovation does not need to be restricted to one or the other—a positive for such an innovative category.”

Some companies are taking a second shot at innovation by reformulating products that proved disappointing in their initial launch. “Mintel GNPD records of low/no alcoholic launches in 2020 include a small share of reformulated low/no alcohol launches,” says Zegler. “A selection of these reformulated low/no alcoholic beverages highlights on-pack better taste, mouthfeel, and flavor. For example, several Japanese low/no alcohol launches highlighted fruitier flavors on low/no alcohol RTDs, and a reformulated release of Suntory All-Free beer [was] designed for a crisp mouthfeel and a better aftertaste.”

Overcoming formulation challenges is likely to be an ongoing focus for product developers. Jason Mittelheuser, solutions manager, Beverage, at FONA, points to alcohol burn as an example of a taste perception that can be hard to replicate, although “there are maskers and modifiers that can be added during product development to achieve a similar taste sensation,” he says.

Other challenges come mainly in two forms: Because no-low beverages frequently are created with health in mind, Mittelheuser says that typical formulations can “hinder flavor perception since flavor is aided/enhanced by sweet and sour. Therefore, there is a need to add sweetness enhancers and high aromatics to drive consumer acceptance.” The second challenge is related to taste, especially when it comes to spirits. “Delivering on taste attributes of spirits can be challenging due to their complexities,” he explains. “Whiskey, wine, vermouth, bitters, etc., develop robust flavor profiles during the development/aging process that can be hard to mimic.” Arriving at a promising solution requires producers to identify “flavors that can overcome the taste profile of the spirit and/or complement it.”

“The process of creating a clear, shelf-stable nonalcoholic spirit is a feat in itself,” says Seedlip’s Branson. “But the challenge we face outside of production is around education. Seedlip is a novel product. There’s no basis for comparison, as we’re not trying to mimic any traditional spirit or familiar flavor. So, we’ve really emphasized education since launching five years ago.”

Creating and successfully marketing a new beverage, especially one that does not fit neatly into an established niche, also requires observing and listening. In a global marketplace, and in the midst of a pandemic, more factors are at work than ever before. Understanding the changing needs of consumers and actively engaging with younger generations that will soon become a major economic force are essential.

“As the pandemic winds down during recovery, operators will need to refocus on how to sell alcohol to Gen Zs, which includes offering lower- or no-alcohol drink options, but also means crafting beverages with a great taste at the forefront,” says Resh. “Operators should explore alcohol flavors that are of particular interest to this youngest generation, such as chili peppers, yuzu, and hibiscus.”

Zegler agrees that great taste and flavor will need to be priorities for producers looking to capture their share of the market. The good news is that ideas for new ingredients and flavor profiles can be mined from many sources. “This could include looking to carbonated soft drinks and other nonalcoholic drinks for inspiration for innovative flavors, functional ingredients, mouthfeel, and other sensory elements,” she says.