Dairy Disrupted

Consumers are finding more reasons to turn to plant-based milk alternatives, although taste is still sometimes a purchase barrier.

Article Content

With many consumers drawn toward the health and sustainability benefits of plant-based products, sales of nondairy milk alternatives are growing at a faster clip than their dairy counterparts. And it doesn’t hurt that plant-based milk products are becoming more price competitive.

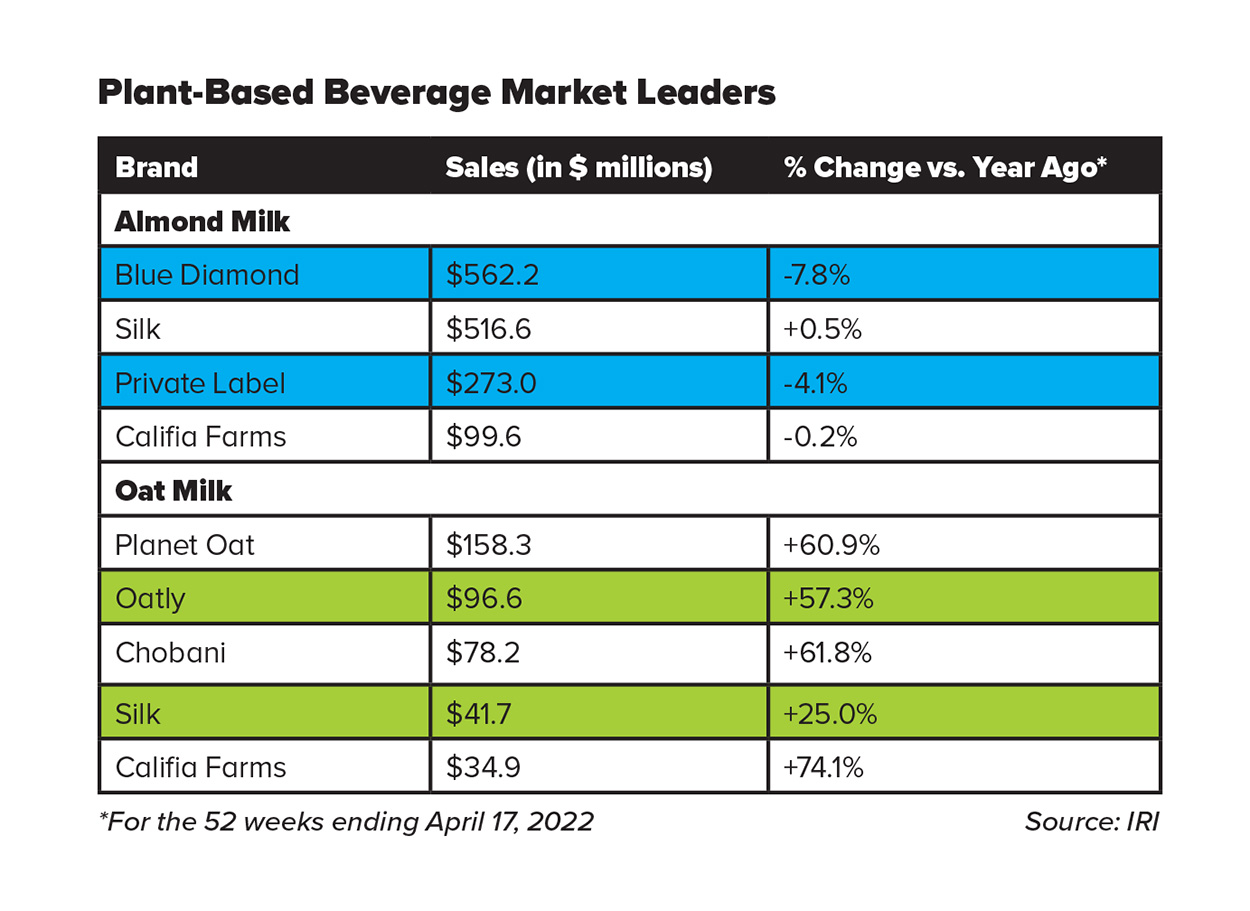

U.S. plant-based milk sales reached $2.2 billion for the 52 weeks ending April 17, about 15.2% of the bottom line for traditional dairy milk, which had sales of $14.6 billion for that same time period, according to data from IRI. Plant-based milk sales grew 3.9%, compared with dairy milk at 1.6%.

Within the plant-based milk category, almond milk remains the leader at $1.5 billion in sales, about two-thirds of the total, although sales fell 3.2%. Oat milk sold the second most, at $432.4 million, up sharply at 57.6%. Other varieties of plant-based milk measured by IRI included soy milk, which saw $150.5 million in sales, down 9.8%, and coconut milk, with sales of $68.7 million, down 10.7%.

The average retail price for plant-based milk fell 2% in 2021, and many plant-based creamers are price competitive with animal-based counterparts, although prices vary across different types of plant-based beverages, according to Julie Emmett, senior director of marketplace development at the Plant Based Foods Association (PBFA).

While shelf-stable plant-based dairy alternatives can be twice as expensive at retail, nondairy milk is close to price parity in the refrigerated section, says Karen Formanski, corporate engagement research and analysis manager at the Good Food Institute (GFI). “Despite higher prices, plant-based milk now serves as the innovation leader across the category because of product development to improve both taste and nutrition,” she says.

Plant-based milk companies are harnessing ingredients as varied as hemp seeds, pea protein, cassava roots, mushrooms, bananas, and a myriad of nuts such as cashews, coconuts, macadamias, pistachios, pecans, walnuts, and hazelnuts, Emmett adds.

Formanski notes that health claims are the top driver for plant-based milk purchases. “We do see an environmental motivation growing,” she adds. “That may drive additional consumption as concerns around climate change grow and sustainability becomes a more important driver.”

Nondairy Product Benefits

Compared with dairy milk, plant-based formulations are free of cholesterol, antibiotics, and growth hormones, and they work better nutritionally for those with either lactose intolerance or dairy allergies, Formanski says. And several players have leaned into nutritional fortification in their formulations.

“You can find plant-based dairy brands that fortify their products with essential vitamins, just as many animal-based milks do as well—for vitamin D, for example,” says Emmett of the PBFA. “The process for making plant-based milks is capable of liquifying nutrients from a wide array of plant sources, so the number of varieties and blends of plant-based milks is virtually limitless.”

“Almond milk continues to meet current or emerging health label claims for dairy alternatives,” says Charice Grace, manager of trade marketing and stewardship for the Almond Board of California. “Almond milk doesn’t contain cholesterol or saturated fat. Commercial varieties are fortified with calcium and vitamin D. But [nut milks] all have different nutritional attributes that, depending on the consumer, can be chosen to complement their personal dietary and lifestyle needs.”

The Silk brand from Danone North America recently rolled out Nextmilk, a dairy-free blend that provides calcium, riboflavin, phosphorus, and vitamins D, A, and B12. The product has 4 grams of plant-based protein per serving, is lactose-free, Non-GMO Project Verified, and has 30% fewer calories than dairy milk, says Olivia Sanchez, vice president of marketing for the brand.

Danone also recently introduced Silk Extra Creamy Almond milk, made with a mix of three kinds of almonds, along with 50% more calcium than reduced-fat milk, zero cholesterol, and vitamin E.

Profiling Purchasers

Purchase of plant-based dairy beverages is fairly evenly split among generations, Emmett says, although consumers aged 35 to 44 have the highest level of interest—about 26% above the norm.

“While millennial and Gen Z audiences may be most interested in plant-based foods, there is broad adoption for plant-based milks,” she says, citing data that 46% of U.S. households purchase plant-based milk and 76% of purchases are repeat. “This can be in part credited to the fact that plant-based milks have been merchandised alongside their animal-based counterparts in grocery cases for years now,” with up to 30% of overall milk retail shelf space and half of the space in the natural channel devoted to plant-based beverages, Emmett adds.

Higher-income consumers and those with college or graduate-level education index highest for purchase of plant-based milk, according to Formanski. Globally, plant-based milk sales are highest in the Asia-Pacific region, while in the United States, Asian American and Hispanic consumers over-index for it.

“It’s very similar to consumers of plant-based foods across categories—consumption is a trend among younger and more diverse groups,” Formanski says. “With plant-based milk specifically, there’s a lot of engagement with young couples and families with children.” Most also still purchase dairy milk, she adds, leaving “more room for growth in the future.”

Silk also has noted interest among younger and multicultural consumers, says Sanchez. A 2021 survey of more than 4,000 consumers conducted by Danone North America found that more than 60% of Hispanic, Black, and Asian American consumers are open to plant-based dairy alternatives. “You may think plant-based interest is only fueled by strict vegans and vegetarians, but our consumers include flexitarians or people just looking to lower their dairy intake,” Sanchez says.

Grace of the Almond Board cites a Food Institute report that shows younger millennials and Gen Zers are most interested in refrigerated, ready-to-drink products. “Almond milk is usually a staple ingredient in those types of new product launches,” she says, citing the examples of cold brews, ready-to-drink coffees, and lattes.

The Almond Breeze brand has noted younger consumers drink plant-based beverages more regularly than other groups, although parents between the ages of 25 and 44 purchase the brand’s products, as well as some Gen Xers and baby boomers, according to Micah Keith, group marketing manager for Blue Diamond Growers.

Millennial households represent the key consumer group for Pacific Foods, which offers seven varieties of plant-based milks, says Tim Goldsmid, vice president of marketing. The top seller has been almond milk, while oat and hemp plant-based beverages have grown in sales.

Marketing Strategies

On the marketing front, Almond Breeze has tapped influencers, Keith says. The brand has for the past few years worked with Fit Men Cook to demonstrate the versatility of Almond Breeze products in both sweet and savory dishes “to show consumers the wide range of ways to use almond milk, in addition to traditional usage in coffee, smoothies, or cereal,” he says.

For Silk, the key has been continued innovation, according to Sanchez. The brand’s “Milk of the Land” marketing campaign and 2022 “Swap it with Silk” program have shown consumers “how easy it is to reach for Silk products, while better understanding where these products come from, and recognizing that they don’t need to sacrifice great taste or texture,” she says.

Messaging around sustainability is important for the Almond Board of California, which represents 7,600 family farms, says Grace. “We’ve been able to reduce the use of water by over 33% over the last 20 years through advances in technology,” she says. “A recent lifestyle assessment found that current practices are offsetting 50% of carbon emissions. That helps us tell the sustainability story to differentiate ourselves from other plant-based benefits.”

Pacific Foods launched the “Specifically Pacific” ad campaign in 2020 to drive broader awareness of the brand and its products, Goldsmid says, “highlighting the intentionality in our ingredient selection and what goes into our products. Given the success of that campaign, we continue to lead with nutritional messaging and build out iterations to reach our younger, target consumer. On digital, we also continue to invest in recipe content that features our plant-based beverages in an array of offerings.”

The PBFA has taken note of a trend toward listing sustainability benefits on the packaging not only of plant-based dairy alternatives but also animal-based dairy, Emmett says. “We know through research that consumers want as much information as possible about the product communicated on the packaging,” she says. “We also know that consumers are increasingly interested in transparency and look to shop their values.”

Formanski of GFI points out that plant-based milk has become more visible in the mainstream media, including a television spot for Chobani’s brand of oat milk and a major ad campaign from Oatly that incorporated a commercial aired during the Super Bowl. In addition, some almond milk brands have focused on promoting the sensory experience as much as the specific ingredients; the Wondermilk brand from So Delicious has highlighted the fact that it has the same vitamins and minerals as dairy; and NotCo touts its use of artificial intelligence to create products that mimic the sensory and taste experience of traditional meat and dairy, she says.

“It’s interesting that there’s more of a move to get conventional milk shoppers on board in that regard,” Formanski says. “Plant-based milk shows potential for other plant-based categories moving forward. It’s definitely the pillar of the category right now.”

Key Takeaways

- Sales of plant-based dairy alternative beverages are growing faster than dairy milk sales.

- Plant-based beverages appeal to consumers in all demographic groups, but the market skews toward younger, affluent, and multicultural consumers.

- Benefits related to health and sustainability drive category sales.