Specialty Foods Go Glam

Gourmet convenience products, upscale side dishes, and global appetizer kits are adding sizzle to premium aisles.

Article Content

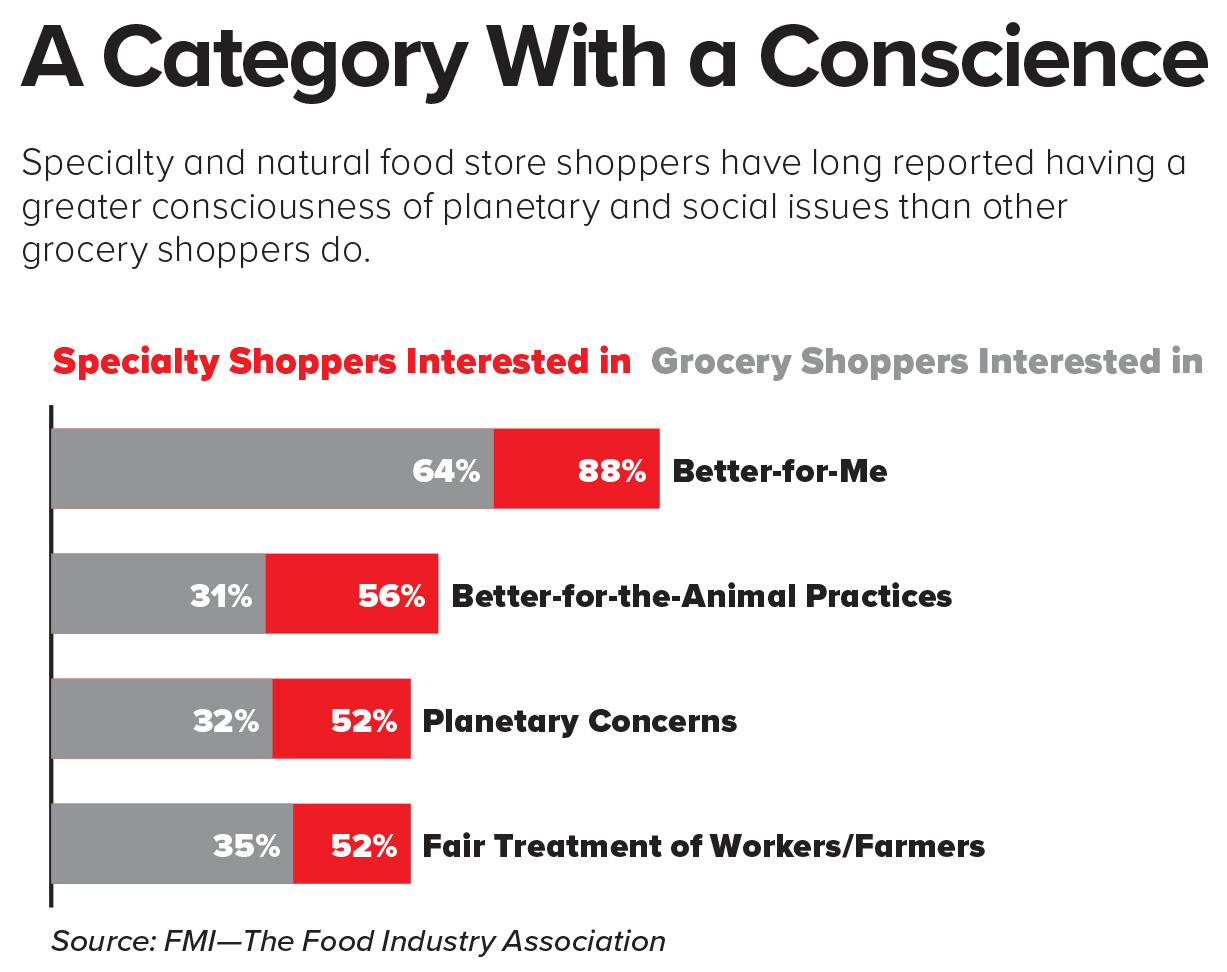

Two years and counting after the start of the COVID-19 pandemic, consumer passion for culinary excitement, healthier eating, and new products that suit a post-pandemic lifestyle continue to generate more premium food and beverage opportunities. In fact, the $170 billion specialty foods category is projected to hit a compound annual growth rate of 4.5% from 2021–2025, according to the Specialty Food Association (SFA).

Despite an increase in value-driven behaviors, indulgence in superpremium/premium purchases as an affordable luxury remains a key industry growth driver across all income levels. Superpremium/premium foods and beverages accounted for nearly one-third (31%) of food dollars spent by high-income households, 26.9% by median income, and 24.6% by low-income households for the year ending March 21, 2022, reports IRI. During that same time period, nearly one-third of those with a household income of $100,000-plus shopped at a natural/specialty store at least monthly, compared with one-quarter of those earning $40,000–$100,000, and one in 10 with incomes under $40,000, according to statistics shared in an IRI webcast.

Natural/specialty store shoppers in particular are significantly less likely to say they’re concerned about high prices (21%) than are supermarket shoppers (82%), according to the 2022 U.S. Grocery Shopper Trend Report: Shopper Landscape from FMI—The Food Industry Association. In addition, only half (52%) of natural/specialty store shoppers adjusted their meat/poultry purchases due to price, compared with 72% of supermarket shoppers, from December 2021 to April 2022, per FMI’s report The Power of Meat 2022.

Natural/specialty channels have gained market share in fresh categories, up from 4.7% of edible sales in 2020 to 5.6% for the year ending Feb. 20, 2022, according to IRI, and have seen dollar sales growth in the early morning daypart of 4% versus two years ago. SFA reports that the fastest-growing categories include plant-based meat alternatives, creamers, pasta/sauces, ready-to-drink tea/coffee, sauces, tofu, seasonings, fruit/vegetables, and beans, grains, and rice, with chilled/refrigerated categories also enjoying strong increases.

In the uncertain near term, specialty food marketers should focus on offering exciting alternatives within high-demand, best-selling categories across the store and in subcategories with proven price elasticity. It’s also important to create a product mix that attracts both high-spending baby boomers/Generation Xers and a broader range of high-income households, since young core specialty consumers are demographically likely to be compromised by inflation.

Fancy Fixins

With 82% of all meals being made at home as of February 2022, according to data shared in an IRI webcast, it’s not surprising that even sophisticated meal preparers are looking for easier fancy fare. Across grocery outlets, dollar sales of fresh prepared entrées jumped 29.6% for the 16 weeks ending Feb. 20, 2022, while gains were also notched by prepared meat department entrées (16.9%), frozen entrées (9.7%), and shelf-stable entrées (8.0%), per IRI.

Cooking meal kits were among the highest volume gainers in 2021 for items distributed in two-thirds or fewer grocery outlets, IRI suggests. Frozen dinner entrées, meat, breakfast foods, novelties, seafood, appetizers/snack rolls, and processed poultry all expanded sales for the year ending Dec. 26, 2021, despite higher prices, but frozen pizza and poultry items (not processed) haven’t been as resilient.

Side dishes are one of the fastest-growing fresh prepared and frozen items, and vegetable sides like Zergut Stuffed Tomatoes with Rice, Silano Grilled Artichokes With Stem, and Auga Organic Pickled Beets in Apple Juice are right on trend. In fact, more than one-quarter of all side dish vegetables now are purchased from the deli department, according to IRI.

Mintel reports that 28% of consumers are baking more now than a year ago, so gourmet shortcuts have high appeal for busy cooks and bakers. Filling in the gaps are products like Michel de France’s ready-to-fill, all-natural French-style crepes and Etalia Nudo Naked Pizza Dough, which is organic, gluten-free, plant based, rolled out, and ready to top and bake.

Regional and ethnic baked goods are gaining too. Southern Living introduced Beer Bread Mix, while Xinca has launched Four Pack Loroco and Cheese Pupusa, a traditional Salvadorian dish made with corn or rice dough that contains a filling. Specialty and international desserts, cakes, premium muffins, cookies, croissants, and rolls are among the bakery categories growing despite increasing prices, according to an IRI webcast: Think beignets, limoncello, patisserie favorites, baklava, and dulce de leche. Consumers also are interested in cardamom, espresso, pretzel pieces, ruby chocolate, matcha, and bourbon flavors for desserts/confections, according to T. Hasegawa’s 2022 Food and Beverage Flavor Trends Report.

Perimeter bakery cakes ranked 11th among the top fresh food dollar gainers for the year ending Feb. 20, 2022, per IRI. Limited edition gourmet cakes like Lady M Peach Cobbler Mille Crepes and ethnic treats like Angela’s Dominican Cake Mix are poised to compete in this market.

Uniquely Different

Different is better when it comes to consumers’ efforts to spice up their dining routines. Six in 10 millennials/Generation Zers, along with 21% of Gen Xers/boomers, say they feel they have eaten well when they eat unique foods/beverages, according to FMI’s grocery shopper trends report.

The Hartman Group reports that half of meal preparers are trying to get more creative with the meals they make, 46% want to offer more unique flavors/different cuisines, and 45% like to prepare meals that include whole foods. Two-thirds of participants in a T. Hasegawa study say prepared meals are a great way to try a new ethnic food/cuisine, such as Italian food specialist Pansardo’s new Panada with Artichokes and Potatoes Italian pie, while 68% like to crack open a frozen meal.

Southeast Asian (Vietnamese, Singaporean, Filipino), South American (Argentinean, Brazilian, Chilean), and Caribbean (Puerto Rican, Cuban, Dominican) are the top three hot global ethnic cuisines/trends for 2022, according to a survey of American Culinary Federation (ACF) chefs.

Among Latin cuisines, consumers’ experiences largely are limited to Mexican food, which is eaten by 89%, followed by Cuban (23%), Puerto Rican (18%), Brazilian (13%), Colombian (12%), and Argentinean (8%), per T. Hasegawa. Authentic Hispanic foods/sauces, such as Franklin Farms Cuban Style Black Bean & Plantain Balls and Verve Culture Los Pacos Black Mole Paste are still a largely untapped opportunity for specialty stores.

Chinese food is first among Asian cuisines, according to a recent Asian flavor trends report from T. Hasegawa. It is eaten by 83% of U.S. consumers, followed by Japanese (48%), Thai (39%), Indian (28%), Korean (23%), Vietnamese (18%), Mongolian (13%), Filipino (10%), and Malaysian/Singaporean (6%). Diners also opt for rice-based Asian entrées (7 in 10), noodle-based main dishes (59%), noodle-based Asian soup (50%), dumplings (40%), and Asian sandwiches (17%).

ACF chefs point to gochujang, Tajin, and harissa as the top seasonings to watch in 2022. Tomatillo, adobo, Thai chili paste, marjoram, paneer, and chaat masala are the top flavors consumers say they would like to try on dinner entrées, according to T. Hasegawa’s 2022 Flavor Flash report, Innovation on the Menu.

Meal sauces like Plentiful Pantry Piccata Gourmet Pasta Sauce Blend, along with soups that provide shortcuts to cooking flavor, are well-positioned for satisfying specialty/premium tastes. Four in 10 consumers say they have experience/interest in curry, Korean barbecue, hot honey, Szechuan pepper, and Nashville hot for protein dishes, according to a recent Flavor Flash report on protein from T. Hasegawa. Haven’s Kitchen has introduced a Coconut Cashew Sauce, while Abby’s Better Almond Butter is livening up sweet dishes with a mint chocolate chip variety. Coco Umami Dressing and PS Seasonings’ Big Dill Beer Mustard also offer easy ways to spice up flavor profiles.

Consumers would be most likely to try out an unfamiliar flavor in an appetizer, followed by a side dish, per T. Hasegawa’s menu innovation report. Top hot appetizer trends for 2022 include upscale potato chips, unique wings/sauces, and globally spiced fries, say ACF chefs who were surveyed. Garcia Baquero Mediterranean Tapas—Pre-Sliced party kit and Cello Simple Pleasures ready-to-serve charcuterie and cheese boards are among the most innovative global appetizer kits on the market.

Snacking Styles

Rewards, indulgence, and treats outpaced wellness as the largest snack category in 2021, per IRI, which reports that volume sales of snack and granola bars jumped 46% in 2021. Grab-and-go refrigerated meat/cheese/cracker/dessert snack packs grew 24% last year. Meat snack unit sales rose 14% as shoppers took home products like Piller’s Black Kassel naturally wood-smoked Picante Salami Chips and Chef Piggy Tail Sassy Red Pepper Microwave Pork Puffies, pork rinds made to be microwaved, air-fried, or baked.

Better-for-you snacks still rate with shoppers, however, and half of U.S. consumers want snacks with health benefits beyond nutrition (e.g., antioxidants), per IRI. Immune-boosting snacks are the fifth overall hot culinary trend for 2022, according to a survey of ACF chefs, while immune-boosting functional ingredients come in at seventh place. New products in this segment include PRI’s Dark Chocolate Patties confections featuring Manuka Honey and immune-boosting That’s it Organic Mini Probiotic Bars with fruit, probiotics, and prebiotics. New Vine to Bar Dark Chocolate Bars are made with spent grape leftovers from wine making, reported to support heart and gut health.

Based on volume sales, produce snacks surged 24% in 2021, according to IRI, with new offerings like Eat the Change’s Cosmic Carrot Chews for kids that delivers a serving of carrots. Apple crisps snacks grew 34% in volume in 2021, per IRI.

Only 10% of U.S. adults say they usually or always look for plant-based snacks, and 28% do so sometimes, according to statistics shared in a 2022 IRI webcast. Food companies luring consumers to plant-based snacking include Lindt & Sprungli, which has introduced Classic Recipe Oatmilk nondairy chocolate bars, and Dream Pretzels, which rolled out Plant Based Protein Pressels.

Meat and Seafood Trends

Natural and organic are big buzzwords in today’s market, especially for specialty products. Specialty shoppers are more likely to buy meat/poultry with production claims—48% versus 34% of all grocery shoppers—and half of specialty shoppers want to see more “raised in the U.S.,” per FMI. Four in 10 specialty shoppers want more labels with no antibiotics/hormones, all-natural, grass-fed, premium quality, and locally raised meats.

Meat/poultry sales in natural/specialty and organic stores reached $2.1 billion for the year ending Nov. 28, 2021, or 2.3% of meat sales overall, reports FMI. Organic meat sales across all grocery outlets topped $9.8 billion in 2021, followed by no antibiotics ($8.3 billion) and grass-fed ($792 million). Deli lunch meat, deli sandwiches, and beef were among the 15 largest fresh sales gainers for the two years ending Feb. 20, 2022, per IRI. In premium meats, lamb and wagyu beef saw strong gains. Den’s Hot Dogs has introduced Fully-cooked Braised Lamb Shanks and Aussie Select offers upscale lamb charcuterie products, while Fabrique Delices unveiled a fully cooked half Smoked Duck Breast along with Duck Prosciutto.

On the sea side of protein, 15% of adults regularly shop for seafood at natural/specialty stores, according to FMI’s report The Power of Seafood 2022. Salmon, fresh tuna, shrimp, and whitefish such as cod and pollock are the most-purchased seafood, but experimentation with less familiar species like barramundi is at an all-time high.

IRI reports that four in 10 adults are regular sushi eaters, including 47% of millennials, and deli entrée sushi grew 38% in volume in 2021. Michel de France’s new Norigami Soy Chili Wrap is a colorful alternative to seaweed for sushi or hand rolls.

Freshened Up Produce

For the year ending March 30, 2022, 4.1% of all produce was purchased from the specialty health/natural channel, according to FMI’s report The Power of Produce 2022. Just over one-quarter (27%) of consumers shop for fresh produce at a natural/specialty market, reports The Packer, with younger shoppers most likely to do so. Specialty/organic store shoppers also are the most likely to buy organic produce—88% versus 59% of supermarket shoppers.

Fresh common fruit posted the largest fresh sales gains across all grocery outlets for the four weeks ending March 20, 2022, versus two years ago, while fresh tropical and specialty fruit ranked 10th, according to IRI. Cherries, tangerines, berries, melons, and kiwis are among the fruits less sensitive to price. Sales of specialty fruit jumped 23% for the year ending March 20, 2022, per IRI, with dragon fruit surging 58% in volume sales, followed by sumo tangerines (up 45%), pomegranates (up 32%), papaya (up 32%), golden kiwi (up 31%), hydroponic salads (up 28%), and pluot plums (up 27%).

In the fresh vegetable category, salad kits drove a mix of growth. IRI reports that dollar sales of fresh herbs increased 18%, fresh recipe starter kits were up 11%, and side dish kits gained 7% for the year ending March 29, 2022.

Plant-Based Branches Out

With specialty/organic store shoppers reporting below-average meat consumption, according to FMI’s meat report, the growing number of plant-based, vegan, and vegetarian options are well-suited for specialty channels. Flexitarians, in fact, are more likely to shop at natural/specialty stores.

SPINS reports that sales of plant-based foods sprang up 6.2% in 2021 to $7.4 billion. Plant milks remain the largest category at about $2.7 billion, and creamers are the third-largest category with sales of $561 million, up 33% last year. Market introductions range from Califia Farms’ limited edition Mint Chip Oat Creamer to Elmhurst’s new shelf-stable Milked Walnuts beverage.

Meat alternative purchases were flat in 2021 with $1.4 billion in sales, per SPINS. According to IRI, 18.6% of U.S. households purchased meat/poultry alternatives in 2021—both refrigerated (63%) and frozen (37%). LightLife has launched whole Plant-Based Chicken Breasts with 9 grams of protein, while Atlantic Natural Foods added a canned Chik’n plant-based alternative under the Loma Linda brand.

Sales of plant-based meals reached $516 million, up 9%, followed by ice cream ($458 million, up 3%), yogurt ($377 million, up 9%), cheese ($290 million, up 7%), and protein liquids/powders ($289 million, up 10%), according to SPINS. Ready-to-use plant-based meal components are gaining momentum, like TD Specialty Foods’ new Veggie Power Cauliflower Pizza Crusts with Violife vegan mozzarella cheese. Shoppers can also pick up Field Roast’s Chao Creamery Cantina-Style Plant-Based Queso, formulated with tofu, and Wicked Kitchen’s nondairy frozen desserts, made with lupini beans.

The younger set are getting more plant-based options too. The Forager Project’s to-go Organic Kids Cashewmilk Yogurt contains probiotics, calcium, and essential nutrients for children. Cerebelly brain-boosting purees, smoothies, broths, and Smart Bars provide 16 nutrients to support proper brain development in babies and toddlers.

Super Sippers

Beyond the seafood and frozen departments, beverage aisles notched the largest sales gains for the year ending Feb. 20, 2022, versus two years ago, according to IRI. Bone broth, carbonated coffee, mushroom beverages, spiked green juices, and canned wine are among the beverage trends cooling off in the culinary world this year, report

ACF chefs.

New coffee and tea products are quenching consumer thirst for specialty alternatives. Italian coffee giant Lavazza has added ready-to-drink cold brew coffees, while Seattle Chocolate Co. created jcoco Orange Blossom Espresso. Marquis’ energizing drink with yerba mate, green tea, and green coffee offers a balanced lift throughout the day. iLOLA has introduced a tea in disc form that is high in antioxidants and botanicals.

From sparkling waters to alcohol alternatives, specialty drinks are bursting with exhilarating flavors. Val de France organic sparkling apple juice comes in flavors including raspberry and pomegranate, and Kayco Beyond has debuted Wonder Lemon cold-pressed juice with zero sugar. Dark Rum Alternative from Ritual Zero Proof is nonalcoholic but still packs a traditional taste.

For better-for-you beverage benefits, consumers can look to HealthVerve’s BBGLO Skin Rejuvenation Collagen Drinks or Bloom Awakening Plant Tonic from Plants by People.

References

FMI. 2022. U.S. Grocery Shopper Trend Report: Part 1. FMI—The Food Industry Association, Alexandria, Va. fmi.org.

FMI. 2022. The Power of Meat.

FMI. 2022.The Power of Seafood.

FMI. 2922. The Power of Produce.

Hartman. 2022. At the Dining Table. The Hartman Group, Bellevue, Wash. hartman-group.com.

IRI. 2022. “What’s Next for CPG Demand, Supply & Inflation.” Webcast, May 3. IRI Worldwide, Chicago. iriworldwide.com.

IRI. 2022. “Top Trends in Fresh.“ Webcast, March 23.

IRI. 2022. “Winning Breakfast, Generation by Generation.” Webcast, Feb.1.

IRI. 2021. “Premiumization – The Balance Between Premiumization and Affordability.” Webcast, Oct. 18.

IRI. 2022. “Unlock Frozen Opportunities.” Webcast, March 2022.

IRI. 2022. “The Seesaw State of the U.S. Snack Industry.” Webcast, April 19.

IRI. 2022. “Fresh Produce in the Era of Inflation and Beyond.” Webcast, April 28.

Mintel 2021. Cooking in America—U.S. Nov. Mintel Intl., Chicago. mintel.com.

NRA. 2021. What’s Hot 2022 Culinary Forecast. Dec. National Restaurant Assoc., Washington, D.C. restaurant.org.

SFA. 2021. Today’s Specialty Food Consumer Report, 2021–22. Dec. Specialty Foods Assoc., New York, N.Y. specialtyfoods.com.

SPINS. 2021. “2022 Biggest Health & Wellness Trends.” SPINS, Chicago. spins.com.

T. Hasegawa. 2022. Innovation on the Menu Flavor Flash. April. T. Hasegawa USA, Cerritos, Calif. thasegawa.com.

T. Hasegawa. 2022. Top Trends for 2022. Feb.

T. Hasegawa. 2022. Asian Flavor Flash. March.T. Hasegawa. 2022. Protein Flavor Flash. Feb.

Technomic. 2021 Center-of -the-Plate Seafood & Vegetarian Consumer Report. Technomic, Chicago. technomic.com.Key Takeaways

- Strong consumer demand for affordable luxuries like specialty foods is driving premium product growth, despite the increase in value-driven behaviors in the current economy.

- Top specialty/premium opportunity areas are high-demand, best-selling categories across the store, subcategories with proven price elasticity, and product mixes that attract a broad range of high-income households.

- Vive la différence: Consumers are looking for exciting specialty/premium alternatives to everyday fare, often with an ethnic, international, or better-for-you twist.

.jpg?mw=500&hash=D1E2E8B94FED0CCA2F5CEA8243FD787B)