Entrées Ace the Freezer Case

Brands old and new vie for space with on-trend SKUs that are plant-based, clean label, gluten-free, high protein, and globally influenced.

Article Content

Two major corporations, each with a large stable of familiar favorites, continue to dominate the frozen entrée and ready meal space: Nestlé with its Stouffer’s, Lean Cuisine, Life Cuisine, and Sweet Earth brands, and Conagra Brands, which boasts a lineup that includes Banquet, Healthy Choice, Hungry-Man, Kid Cuisine, and Marie Callender’s. In addition, privately held Amy’s Kitchen reigns over the natural and organic section of many supermarket freezer cases. But newer companies such as Tattooed Chef, Primal Kitchen, and AYO Foods are gaining traction with innovative offerings that meet growing consumer demand for convenient, clean label, high-protein, internationally influenced meals.

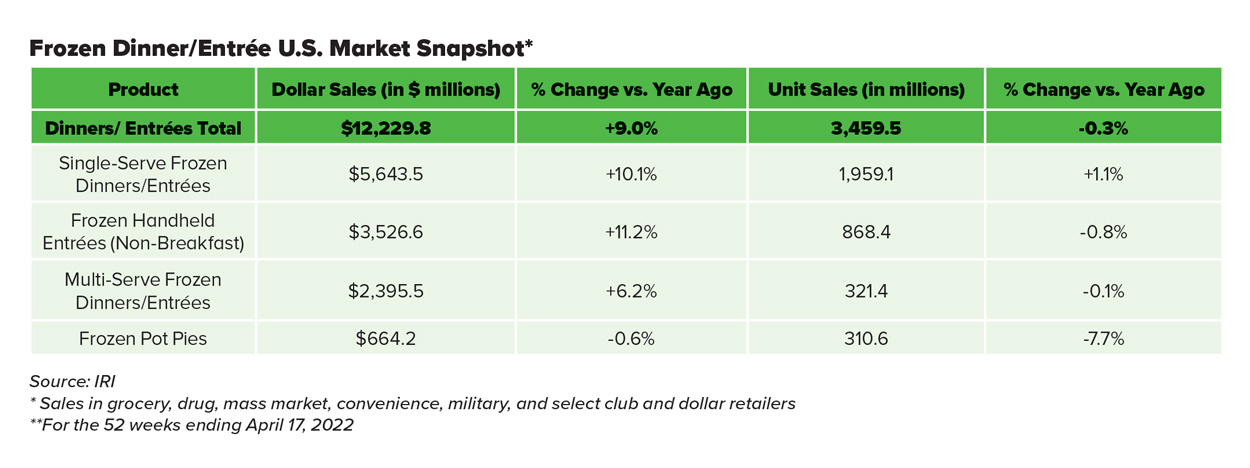

Single-serve frozen entrées and meals grew 10.1% in dollar sales in the 52 weeks ending April 17, 2022, but only 1.1% in unit sales, according to research firm IRI. Sales of multi-serve frozen entrées and dinners followed a similar pattern, increasing in dollar sales by 6.2% but declining slightly (0.1%) in unit sales. (See the table below.) This suggests that dollar sales gains in that period were due primarily to price increases.

However, the seemingly flat growth in 2021–2022 belies the bright outlook for the $12.2 billion frozen meals segment in the United States, which entrepreneurs in the category say has made significant gains since the onset of the COVID-19 pandemic and has attracted new consumers who previously were unaware of the variety of frozen entrée offerings.

“With fast-growing choices in clean label frozen foods—and a discerning palate for ethnically authentic cuisine—older millennials now make up the largest segment of frozen food customers at 48%,” according to the American Frozen Food Institute’s (AFFI) 2021 Power of Frozen in Retail report. As AFFI governing board member Adnan Durrani, president and CEO of Saffron Road Foods, notes on the institute’s website, “What consumers new to frozen entrées discovered [during the pandemic] was the evolution of frozen foods, the abundance of better-for-you options, and the plethora of innovation and ethnic flavors, equating to sustainable category growth.”

Indeed, custom data from Innova Market Insights shows that 67% of U.S. millennial consumers (defined by Innova as those aged 25–44) say they have increased their consumption of frozen ready meals in the past year.

Products for Every Lifestyle

Many different dietary and lifestyle preferences are trending today, and frozen entrée makers have responded with products that address these trends. Cappello’s, which makes almond flour–based frozen pasta, recently introduced three new SKUs: Butternut Squash Ravioli, Five Cheese Ravioli, and Spinach & Cheese Ravioli. “Grain free” is the most prominent claim on the packaging.

Cappello’s ravioli are packaged without added sauce, allowing customers to customize preparation to meet their families’ needs, says Ben Frohlichstein, co-founder and CEO of Cappello’s.

Another brand targeting paleo diet aficionados is Primal Kitchen, purchased by Kraft Heinz in January 2019. Previously known for sauces, dressings, and condiments, the brand debuted frozen entrées and skillet meals in March 2020. The three microwaveable bowls include Chicken Panang Curry, Beef & Mushroom, and Chicken Pesto.

The most keto-friendly of the new entrées, the Chicken Pesto bowl, has only 5 grams of net carbs and includes riced cauliflower, broccoli, yellow zucchini, basil, organic extra virgin olive oil, organic almond butter, garlic purée, salt, organic lemon juice concentrate, and organic black pepper.

Conagra’s Healthy Choice Zero bowls cater to the “low carb lifestyle” of consumers on the keto diet. The newest item in this line is Beef and Broccoli; it features seasoned braised beef, broccoli, and carrots in a savory brown sauce and contains 10 grams of net carbs and no added sugar. Made of plant-based fiber, the bowl itself is compostable, as are the other bowls in the line.

Nestlé’s Lean Cuisine and Life Cuisine brands are also tapping into the demand for gluten-free, higher-protein, lower-carbohydrate products. For instance, the Lean Cuisine Cauli’ Bowls line consists of pasta made with cauliflower and features the tag line “Same Great Pasta Taste Made Carb Conscious!” A new SKU in this line, Fettuccini with Meat Sauce, contains 260 calories, 12 grams of protein, and 15 grams of fiber.

The Life Cuisine brand, which debuted in 2020, touts a flexible focus on four consumer preferences: low-carb lifestyle, high protein, meatless, and gluten-free. “Eating well is no longer ‘one-size-fits-all,’ so our offerings can’t be either,” said John Carmichael, then president of Nestlé USA’s Foods Division, in a statement at the time of the launch.

One new Life Cuisine SKU is the Triple Cheese Macaroni & Cheese Bowl, made with Banza chickpea pasta. This gluten-free product, which has 28 grams of protein and 6 grams of fiber, features chickpea penne pasta with a Vermont white cheddar, Romano, and Parmesan cheese sauce. Another SKU in the line is the Pasta Bolognese Bowl, also made of chickpea penne pasta but with tomato sauce and mozzarella cheese. That item boasts 32 grams of protein and 9 grams of fiber.

The frozen space is a natural place for clean label food products, says Frohlichstein of Cappello’s. “We don’t have to use any preservatives—we get the freezer to do all that work for us,” he says. “So we don’t have to load our products with a lot of things consumers don’t need and aren’t looking for.”

Better-for-you options are commanding more attention in the freezer case. “You’re seeing retailers eliminating redundancy to make room for more innovative products,” emphasizes Matt Williams, chief growth officer for Tattooed Chef, which makes frozen plant-based meals. “They’re becoming much more scrutinizing of the number of SKUs that they carry of a particular brand to make room for emerging brands.”

A Place for Plant-Based

“Plant-based innovation can be seen across markets, and frozen entrées are no exception,” observes Amy Marks-McGee, founder of Trendincite LLC. In fact, global vegan claims in the frozen entrées and meals category increased 29% from 2017 through 2021, according to Innova Market Insights data.

Marks-McGee notes that Nestlé’s Sweet Earth brand has added two new bowls: Korean BBQ-Style Chik’n (made with a soy protein–based chicken analogue, edamame, black and white sesame seeds, and riced cauliflower in a spicy and sweet gochujang sauce) and Cacio E Pepe (made with chickpea pasta in a creamy plant-based Parmesan cheese and black pepper sauce).

As Marks-McGee points out, another notable launch is the entrée-sized Plant-Based Crabless Cake by Handy Seafood, the oldest seafood processor in the United States. This is the brand’s first vegan product.

Also significant, she says, is a move by Mosaic Foods, a direct-to-consumer subscription-based vegan/ vegetarian frozen food company, to open its first brick-and-mortar pop-up store in Brooklyn. Mosaic’s frozen family meals include items such as BBQ ‘Meatloaf’ & Sweet Potato Mash (a nut-free vegan recipe that includes lentil meatloaf, sweet and smoky BBQ sauce, and whipped mashed sweet potatoes with cremini mushrooms, carrots, and red peppers). Among the company’s many frozen veggie bowls is the Brussels & Squash Harvest Bowl, which features brussels sprouts, kabocha and butternut squash, cooked quinoa, black cherry balsamic vinegar, and chili powder, as well as other ingredients.

A dramatic recent success story in the retail frozen space, Tattooed Chef was founded in 2017 and now has a presence in 16,000 stores, according to Williams. He emphasizes that younger consumers relate easily to Sarah Galletti, the company’s founder and the face of the brand. A millennial, Galletti has a passion for environmentally sustainable plant-based food and conveys a contemporary, cutting-edge vibe that older brands can’t replicate.

“In frozen, there are a lot of legacy brands that have been around for quite some period of time,” says Williams. “And I would say that they don’t necessarily have a way to connect with that [millennial] consumer. That’s what Sarah has been able to do with the brand.”

Tattooed Chef bowls and meals include both vegetarian and vegan offerings, and most of the SKUs are gluten-free. Many of the items have global flavor influences, such as the Spicy Thai Bowl, the Plant Based Eggroll Bowl, and the Plant Based Cheese Enchilada meal. Recently added SKUs include the vegan Plant Based Al Pastor Quesadilla (a grain-free tortilla filled with plant-based pork, pineapple, and cheddar- and Monterey Jack–style cheese alternatives) and Plant Based Chicken Mole Enchiladas.

Authentic Appeal

After two long years of pandemic lockdowns, travel restrictions, and supply chain disruptions, trying new global cuisines gives consumers a sense of adventure. Although many of the aforementioned SKUs are globally inspired, AYO Foods stands out with authentic West African frozen meals. (Ayo means joy in Yoruba, the main language spoken in southwestern Nigeria.)

Founded in 2019 by Perteet Spencer, the daughter of a Liberian immigrant, and her husband, Fred, AYO Foods has rapidly expanded and its products are now in Kroger-owned banners nationwide as well as Target, Whole Foods Market, and Sprouts Farmers Market.

“The decision to go into frozen for us was intentional,” says Perteet Spencer. “The flavors of West Africa haven’t scaled to that [broad] audience the way that other global flavors have just yet.” With a cuisine that is still unfamiliar to most American consumers and even to some people of West African descent, “we felt it was important to provide a standard of what you should expect from the food,” she explains. “Starting in frozen allowed us to address all of the pain points of hard-to-find ingredients, food that takes a long time to prepare, and, for the mainstream consumer, not understanding how the food should taste.”

AYO Foods has partnered with two notable chefs of Ghanaian descent to create some of the company’s signature entrées. Most recently, British writer and chef Zoe Adjonyoh, founder of Zoe’s Ghana Kitchen, developed two SKUs for the Spencers: Aboboi, a plant-based vegan stew with Bambara beans, red peppers, chilis, and spice blends; and Groundnut Stew (also known as nkatenkwan and maafe), which is made with peanuts, tomatoes, and chicken.

Previously, AYO Foods worked with Ghanaian American chef Eric Adjepong, a Top Chef finalist, on a line of specialty dishes, including Waakye (red peas and jasmine rice slow-cooked with red sorghum leaves and served with an aromatic red sauce) and the company’s top-selling Chicken Yassa (marinated chicken thighs, caramelized onions, lemon, and Dijon, served over jasmine rice).

“Within our families, you can’t bring everyone together without a big meal,” says Spencer, noting that she and her husband both have large extended families.

“A lot of times, when people taste our food, they are surprised that it’s frozen,” she adds. “You see them go on a very quick sensory journey where they close their eyes and smile. To me, that is a very salient reminder of the power of food in creating connection and memories that transcend nourishment.”

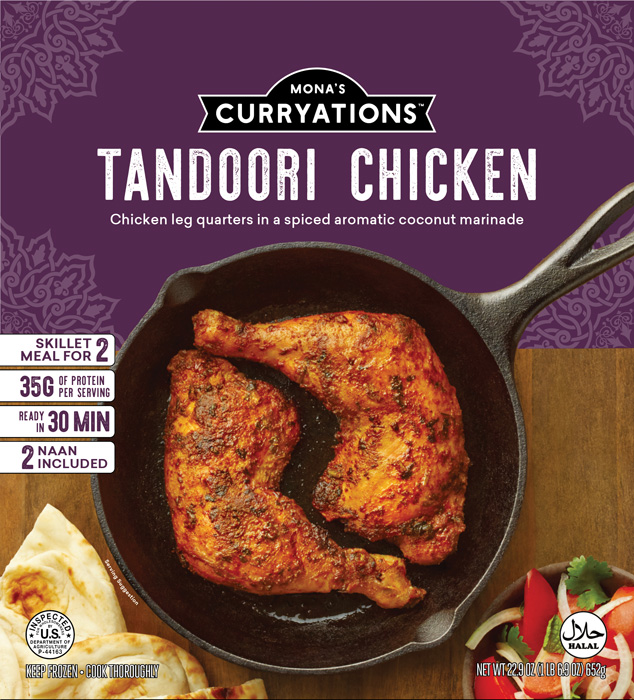

For Mona Ahmad, the founder of Mona’s Curryations, fond sensory remembrances of her mother’s South Asian cooking led her to develop a line of frozen skillet meals that includes three SKUs: Chicken Tikka Masala, Palak Paneer, and Tandoori Chicken. “My father was a diplomat, so we lived around the world,” notes Ahmad. “But one thing that remained constant was my mom’s delicious cooking. It was full of textures, flavors, and aromas.”

Ahmad wants others to experience what she experienced. Unlike microwavable South Asian frozen entrées, frozen meals that require cooking with a skillet or pot preserve the sensory attributes she remembers without the preparation challenges. “You see it. You smell it. You taste it. You hear it. You feel it,” she explains. “Food from our region is considered one of the most difficult to make in the world because it is very time-consuming and requires a multitude of ingredients. These are ingredients that are in my home but may not necessarily be in everybody’s home.”

More Protein, Bigger Portions

Finally, even as many frozen food makers address the market for healthful fare, legacy brands like Hungry-Man, Banquet, and Marie Callender’s remain freezer case fixtures with a comfort food positioning. Conagra’s Banquet brand pioneered Mega Bowls and Mega Meals, larger-portioned frozen entrées and meals that are higher in protein and calories than standard frozen meals, a few years back. A new addition to the Mega Bowls line is Dynamite Penne & Meatballs, which has 27 grams of protein and features meatballs made with chicken, pork, and beef and spicy creamy tomato sauce, layered over penne pasta and topped with mozzarella cheese. The nutrition label states that this 590-calorie entrée contains 1,150 mg of sodium (50% of the recommended daily dietary maximum), 9 grams of saturated fat (45%), and 61 grams of total carbohydrates (22%).

In February 2020, Conagra’s Hungry-Man brand, already known for bigger portions, launched its Double Meat Bowls line, which includes three SKUs: Boneless Pork with BBQ Sauce (with macaroni and cheese), Chipotle Chicken (with rice), and Smothered Salisbury Steak (with mashed potatoes and onion and mushroom gravy). “This is Hungry-Man XL,” Sean M. Connolly, president and CEO of Conagra Brands, said at the time.

Similarly, sister brand Marie Callender’s debuted its Duos line earlier this year—single-serving but double-portion combination meals that come in three SKUs: Chicken Alfredo & Chicken Parmigiana, Creamy Pesto Chicken & Four Cheese Ravioli, and Meatloaf & Country Fried Chicken.

Key Takeaways

- Nestlé and Conagra Brands dominate the freezer case; each has a large portfolio of brands.

- Frozen entrée unit sales are flat, but category players forecast market growth.

- The COVID-19 pandemic brought new consumers to the frozen meal category—millennials in particular.

- Consumer demand for brands that target specific lifestyle needs has prompted a flurry of product introductions.