Top 10 Trends to Watch and Work On 3rd Biannual Report

Here are the top ten food trends that should stimulate thinking and guide food marketers in the decade ahead.

It’s a great time to be in the food business. Anything goes! Fried foods and fresh. Big bites and tasting flights. Healthy and high fat. It’s a trend-trackers nightmare and a marketer’s dream!

In the next few years, the food industry will be challenged by the most mature, wealthiest, and most sophisticated consumer in history. The high incidence of restaurant exposure, the mega-trend to “take-out/take-home,” and the growing popularity of samplers, ethnic buffets, and signature “tasting” appetizers have accelerated upscale culinary tastes mainstream faster than ever before.

The “haute casual” or “fast upscale casual” trend—providing easy, everyday access to more exotic fresh menu items, less familiar ingredients, and ethnic fare—is also escalating our culinary education and widening the gap between fresh and packaged foods. And with dietary fat levels dropping in the United States by almost 20% since 1980, the gradual migration to lower-fat, semi-meatless, and vegetable-rich diets will continue to accelerate the demand for more highly flavored, savory, and often intensely spiced foods.

In the next few years, Americans will continue their search for the new and different, but will forego the culinary complexities and contrasts of the past, seeking out more flavorful but familiar fare. The gap between gourmet and everyday will become smaller as Italian, Mexican, and Chinese become everyday supper “status quo” and marketers upgrade basic foods. While consumers will be more likely to experiment, they will be less likely to care about “authenticity,” getting their excitement from exotic signature ingredients, provocative cooking techniques, and regional trends/varieties—fast becoming familiar flavor descriptors. Look for new food forms and flavors to emerge as chefs try to differentiate themselves within a more limited culinary sphere. Tasting menus and small bites will remain a key attraction, while flavor fortification stays in vogue.

A new trend to “take-out/take-home” casual and upscale restaurants will heighten the demand for betterquality and premium ingredients. Last year, 52% of all meals bought in this country’s mid-scale table-service restaurants/casual dining ($15–25 check range) were taken out or delivered. Likewise, the proportion of take-out in the upscale white tablecloth segment is also growing—6 out of 10 high-end restaurant patrons are more interested in higher-quality take-out than two years ago (NRA, 2000a). Conversely, two-thirds of restaurant operators say customer expectation about food quality has also risen. Seven out of 10 operators with checks of $15 or more say expectations about food quality have increased, compared to 46% of those with checks of $8 or less (NRA, 2001a).

At the same time, overworked consumers will put an unprecedented focus on home, harboring a renewed fondness for the nostalgic, for sharing, for socializing, for family, food, and fun. More in-home dining—and an increased emphasis on interactive family fun—will spur new growth for family-sized and party portions, as casual home entertaining begins to rise. Look for new demands for appetizers, creative casseroles, and desserts worthy of showing off. American cuisine will dominate as comfort foods get even more creative. With the growing popularity of American Bistros, brasseries, and ethnic bars and grills, expect an engaging generation of new “home”-style international and regional fare.

But don’t confuse the desire to dine in with a desire to cook. Americans are in relentless pursuit of pre-made meals. For more and more households, it’s “take-out” tonight. The downturn in the economy, rising restaurant prices, self-imposed spending cuts due to higher gasoline/energy costs, and an over-whelming desire to spend more time at home will put renewed emphasis on simple in-home food preparation, at least temporarily. Marketers of frozen, pre-prepared and pre-packaged meals and components now have a window of opportunity to convert loyal customers. But at the same time, fresh meals offered by supermarkets, pre-prepared/added-value fresh meats, poultry, and fish, and fresh-cut produce items offer formidable competition. With the sales of frozen whole pieces of meat, fish, and poultry exhibiting double-digit growth, a new role for frozen as America’s contemporary pantry may well be taking shape. Last, with Americans constantly reinterpreting their definition of convenience—and an ever-emerging series of new culinary trends and demands—food marketers will be forced to continue their proliferation of new creative meal-time options.

Overwhelmed by choices and stressed beyond repair, Americans continue to take more responsibility for their health and keep trying to simplify their lives. To most, both pleasure and health are paramount. Watch as they seek a greater sense of overall balance and moderation. Gone are the extremes of avoiding red meat, obsessing on fat-free, or overdosing on fiber. The days of pigeonholing consumers as indulgent, health-obsessed, or even “Basic 4” eaters are over. The truth is that almost everyone has a little bit of each in them, and matching and meeting these varied demands is setting off a new generation of products, portions, and promises finding strong sales and sustainable appeal.

--- PAGE BREAK ---

This sense of balance and simplicity is also helping to fuel a move to fresh, pure, and natural. The dramatic influence of the shift in American culinary training from classic French culinary techniques to those of the Far East continues to spur increasing interest in the purity, freshness, and seasonality of foods and ingredients. Likewise, the Asian influence is fueling the trend to softer flavors, gentler cooking, and visually enhanced presentation. From cooking and garnishing with fruits and veggies to light and lively dessert flights, look for lighter colors, sauces, and fragrances to draw consumer applause.

And then there’s health. With 96 million Americans now over age 45 and 113 million projected by 2010, optimizing health and performance may well be one of the largest and most lucrative food markets of all time. During the past five years, Americans have undergone a radical progression in their quest to improve health, moving from optimizing balanced nutrition to a slightly more aggressive approach of positive eating—not just avoiding negative macro ingredients like fat, calories, etc., but ensuring the inclusion of positive ingredients such as vitamins, minerals, fiber, etc. More recently, the acceleration of the “Self Care Movement” is highlighting the new roles of “food as medicine” and “performance enhancer,” spawning the concept of “whole health.” “Do-it-yourself health” is estimated to be a $42-billion supermarket retail opportunity (FMI/Prevention, 2000). In addition, a desire for a purer, cleaner, healthier, environmentally more sensitive, and safer generation of foods has spawned the mega-trend to “clean foods.” Most important perhaps, healthy dieting—although reincarnated from decades ago—once again looms as a major market force.

Creative convenience, sensational simplicity, and quick but quality—often under the guise of fresh—will be essential product criteria for the years ahead. Health, purity, and presentation will also remain strong. With these points in mind, this article will discuss the top ten trends I see as essential to meeting developing millennium demands. While not in order of importance, they should stimulate thinking and guide marketers in the decade ahead.

Trend 1:

“Do-It-for-Me” Foods

There’s no doubt that a personal chef tops everyone’s food shopping “wish list.” Giving up feeling “guilty” and going straight for “give it to me,” Americans are in relentless pursuit of premade meals. And why not? One in four women work more than 40 hours per week, 44% of workers come home exhausted, and we’ve lost three hours of leisure time each week in only the past three years (Labor Statistics, 2000; Wellner, 2000).

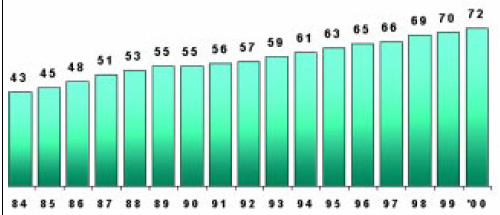

For many households, it’s “take-out” tonight. Last year, Americans took out almost as many meals as they ate at a restaurant, reaching an all-time high of 72 meals/person; half of which were eaten in the home (Fig. 1, following page). While quick-service restaurants (QSRs) have long provided the majority of take-out fare, more than half of all meals bought in mid-scale casual dining restaurants were taken off premises last year. Likewise, six in ten upscale restaurants reported greater take-out activity. Clearly, everyday access to more upscale take-out will not only accelerate consumers’ culinary expectations but also widen the quality gap between take-out and frozen/packaged foods. But QSR take-out is getting more sophisticated, too. While pizza and hamburger chains have dominated (60%) the take-out supper business for nearly 10 years,Asian and Mexican now each have a 6% share (NRA, 2000a; NPD Group/Crest, 2000).

Although take-out/take-home is now a way of life for some, the downturn in the economy, rising restaurant prices, self-imposed spending cuts due to higher gasoline/energy costs, and an overwhelming desire to spend more time at home will put renewed emphasis on simple in-home preparation.

While two-thirds of dinners are still prepared at home, don’t confuse the desire to dine in with a renewed interest in cooking. After all, 79% of consumers say the most enjoyable part of cooking is being done—“serving the finished meal”—and more than half of young married women see cooking as a chore (Stouffer’s, 1999; Reynolds, 2000). So meals will continue to get simpler and easier. One-third of all dinners already include a dish where preparation is simply to heat and eat. Almost half of weekday dinners take between 21 and 30 minutes. There is less watching food cook on top of the stove and more of a demand for unattended oven meals. Even dinner microwave usage is slipping. Most important, fewer dishes are being served at supper time and one-dish, center-of the-plate items—like pizza, Mexican, and bowl meals—continue to gain in popularity (NPD Group, 2000).

--- PAGE BREAK ---

With take-out likely to slow, marketers of frozen, pre-prepared, and prepackaged meals and components now have a window of opportunity to convert loyal customers. Last year, 10% of evening meals contained a frozen main dish and one-third at least one frozen item (NPD Group, 2000). Led by Oriental and Mexican entrees and poultry two-food entrees, almost all frozen meal and entree categories posted significant double-digit growth (ACNeilsen, 2000). Bowl meals jumped 76%, and total entrees were up 14.3% to $3 billion. Oven meals, such as Stouffer’s Oven Sensations™ (Fig. 2), will begin to gain on popular skillet meals. Likewise, frozen uncooked whole pieces of meat and poultry are fast becoming an integral part of America’s new pantry, the freezer. Sales of frozen uncooked poultry pieces jumped 15.2% and frozen ground beef 9.6% for the year ending September 9, 2000 (ACNeilsen, 2000). “Pantryready” unbreaded fish/seafood sales were just shy of double-digit gains.

With consumers demanding more packaged meals—rather than just packaged foods—and with meal assembly becoming even too much of a chore, marketers will need to offer more complete products, meat included. Varied portion sizes such as Uncle Ben’s™ MiniBowl, SuperBowl, and regular bowl meals will also be a key to success. And with pork, chicken, beef, and seafood being among America’s most frequently served main dishes, creative sides can add the necessary excitement to everyday meals. With competition from the fresh sector coming on strong, frozen food marketers would be wise to promote “fresh frozen” technology, such as Heinz’s new FreshLock™ bags, and conduct a media campaign to keep frozen foods “top of mind.”

At the same time, fresh “heat-and-serve” and hot meals offered by supermarkets and mass merchandisers will create formidable competition for packaged foods. With in-store foodservice being viewed by retailers as an image and traffic builder first and a profit center second, it is not surprising that 88% of retailers say they will stay committed to foodservice: 88% will offer more hot entrees, 56% more hot sides, and 84% more cold entrees (Major, 2000a). Three-quarters of in-store programs include full meals pre-packaged for selfservice, 69% a sit-down café, 56% fullmeal centers, 56% dedicated checkout lanes, 28% a foodservice manager, and 33% a chef. Deli take-out quick-order computer systems—like Xpress Deli—are already making supermarket take-out quicker and more convenient (Major, 2000b).

Pre-cut, cleaned, ready-to-cook vegetable items and fresh-cut salads/meals remain the most frequently used supermarket meal solution, with 62% and 48% of shoppers respectively, using them 1–3 times per month (FMI, 2000a). “Fresh-cut” sales are expected to reach $16 billion by 2003 (IFPA, 2000). Fresh pre-cut bagged salads, stir-fry’s, and skillet meals posted sales of more than $1.5 billion in 1999, still growing at 20%/year. The category has expanded to a wide range of fresh meal and snack solutions, including fresh salads containing pre-cooked fresh chicken, fresh skillet meals, stir-fry’s, fresh-cut/diced bagged tomatoes, and fresh dippable snacks.

Value-added, pre-prepared cooked and uncooked fresh meats, poultry, and seafood are also becoming a more-frequent in-home meal option. Last year, pre-prepared fresh fish/seafood accounted for one-quarter of all in-store seafood sales (Major, 2000c). One in four shoppers used supermarket pre-cut, marinated, or pre-seasoned meat or poultry at least 1–3 times per month, 26% used pre-cooked meat, poultry, or other main dishes (FMI, 2000a). During the past year, 68% of meat managers have reorganized their cases to feature value-added products: 18% reset with “meal solutions/food to go,” 15% by cooking method, and 9% by precooked/ processed meats (Major, 2000d). Simple “three-step” cooking methods—now printed on fresh meat, poultry, and fish packages—should make cooking fresh easier. Clearly, condiment marketers have an unprecedented opportunity to provide creative marinades, dry rubs, and sauces, complementary to fresh protein foods. Additionally, the advent of “quick-cook” technology will make these products even more appealing.

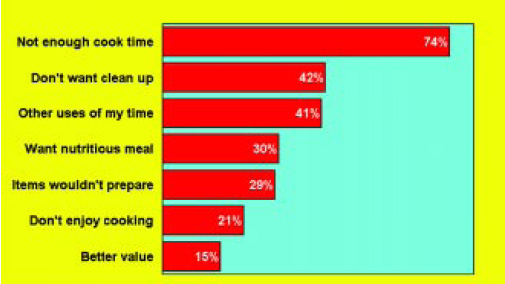

Last, but not least, the most successful products will not only provide greattasting meals, but will also eliminate the need to clean up. Next to a lack of time, “clean up” is the second most frequently given reason for not cooking at home (Fig. 3). One of the most on-trend innovative products is Reynold’s™ Hot Bags™Foil Bags (Fig. 4), available in both heavy-duty family and smaller sizes. The foil bags are sealed on three sides, forming a durable pouch for cooking everything from chicken to seafood to vegetables and beef. Ideal in the oven and great on the grill, the foil bags cook food to moist perfection with no mess to clean up. In addition, Reynold’s“dinnerunplugged. com” provides fun and romantic dinner guidance for young couples plugged into a high-tech lifestyle, complete with recipes and even clever e-dinner invitations. There will also be an unprecedented demand for attractive oven-to-table disposable containers to eliminate cleanup, such as recently introduced disposable stoneware plates.

--- PAGE BREAK ---

Creative convenience will be the name of the game long-term. Food marketers would also be wise to pursue fresh-frozen, extended refrigerated shelf life, and sterilized shelf-stable meal technology. After all, in the United Kingdom, the chilled ready meals category has achieved “destination status.” With the home meal replacement market projected to reach $109 billion by 2002, research and development efforts will surely be a good investment (AFFI, 2000).

Trend 2: Super Savory and Sophisticated

For the next 25 years, the nation’s 78 million aging Baby Boomer “Foodies”—the most culinary literate and food-active generation in history—will dictate food product demands. More well-traveled, more technology-savvy, and with more disposable income, they’ll create a powerful market for more provocative, flavorful—and often healthier—restaurant-quality fare. Look for a major upscaling and overhauling of existing food products as marketers target “empty-nesters”—married-couples without kids under 18—now America’s largest household segment. Empty-nesters will represent one-third of all households by 2010, and savvy single units won’t be far behind (Census Bureau, 2000).

As our population ages, the gap between gourmet and everyday is closing. While more than half of shoppers buy gourmet items in the supermarket, they report that fewer stores are offering them, down 9 points in 2000 vs 1999 (FMI, 2000a). With everything from pasta to mayonnaise being upgraded, it looks like they’re not so obvious any more! Expect “flavor fortification” of cheeses, tortillas, breads, pastas, rice, and broths to continue, with more flavor-de-scriptive product names—“teriyaki-ginger” vs simply “teriyaki.”

Likewise, the edge for ethnic foods is moderating. Italian, Mexican, and Chinese (Cantonese) are now mainstream cuisines and no longer considered ethnic foods. Fear of ethnic foods is also on the decline. In 1994, 56% of consumers said there were a number of foods they would never eat. In 1999, this number dropped to 46%, indicating an increasing willingness to experiment. Consumers are less likely to wait to try a new cuisine on a friend’s or critic’s recommendation—only 20% wait today vs 35% in 1994 (NRA, 2000b). Likewise, “authenticity” is not as important as it was a few years ago, as many ethnic foods are found more often in non-ethnic restaurants. Indian, Thai, and Japanese (sushi) are the exception (NRA, 2000c).

Although the lines between food’s ethnicity are beginning to blur, with sales projected to jump from $50 billion to $75 billion by 2008, they’re still great business (Promar, 2000). Last year, ethnic frozen entrees hit $2.2 billion (AC Neilsen 9/30/00). Six cuisines have enjoyed significant growth in popularity in the past few years—Italian, Mexican, Japanese (sushi), Thai, Caribbean, and Middle Eastern. Four cuisines—French, German, Scandinavian, and soul food—show a decline (NRA, 2000c).

With two-thirds of consumers often or sometimes preparing Italian food at home, there is concern that the Italian segment will lose its luster (FMI, 2000b). Watch for mainstream interest to shift from the red sauce of Southern Italy to specialties of Milan, Venice, and Piedmont in the North. The Olive Garden (Darden, Orlando) is giving a boost to Tuscan cooking right now. What’s next? Chefs are turning south to Rome, the coastal shores of Puglia, and the islands of Sicily and Sardinia. The new venue: Italian steakhouses. Eggplant Parmesan, gnocchi, and other stuffed pastas, stuffed pizza, and calzones are among the up-and-coming menu items (Sheridan and Yee, 1999). Sauces—especially pesto and Romesco—specialty cheeses, stuffed breads, risotto, and prosciutto are getting more attention.

“Fresh Mex” is the new-wave Mexican, now the second most popular restaurant ethnic cuisine. Last year, fullservice Mexican restaurants grew 8.3%, outpacing the 5.9% overall restaurant growth, including QSR. Restaurants like Rubio’s, Baja Fresh, and Chipotle Grill will continue to gain share (NRA, 2001c). Look for Mexican cuisine to upgrade with more regional cuisines and greater availability of hand-held and bite-sized food alternatives, such as empanadas and dessert flautas. Shrimp fajitas, quesadillas, and fish tacos are among the up-and-coming items (Sheridan and Yee, 1999).

--- PAGE BREAK ---

Chinese (Cantonese) is the third most popular ethnic restaurant cuisine. More than 90% of Americans have tried it at least once; 74% have tried Hunan, Mandarin, or Szechwan; more than half Japanese; and more than one-fourth sushi, Thai, and Pan Asian (NRA, 2000c). In chain restaurants, Asian menu items have reached 40% of the level of Southwest and Italian. Asian noodle bowls, sushi/sashimi, pot stickers, tempura, and dim sum are the up-and-coming items. Stir-fry’s and fried rice remain the best-sellers on menus (Sheridan and Yee, 1999). Over the past 10 years, American sushi bars quadrupled, reaching 5,000, and those trying sushi increased 40% between 1994 and 1999 (NRA, 2000c).

Restaurant operators report that “Nuevo Latino” continues to have the greatest impact on non-commercial foodservice menu development (Sheridan and Yee, 1999). Even McDonald’s has introduced a Fiesta Menu with spicy burritos, tortas, and even a Dulce de Leche McFlurry dessert. Our Latin neighbors to the South will make two important culinary contributions. First, Classic Argentinean barbecue sauces and marinades—with “hot ’n spicy” cumin, tropical chiles, saffron, smoked paprika, fiery peppers, and cilantro—will give Americans a welcome change. Second, they will bring the sizzle of skewered Foods. “Rodizio’s”—South American steak houses serving flaming skewered meat and seafood with bold sauces and accompaniments—are already capturing America’s “meat-and-potato” fans.

Portuguese and Spanish cuisine is following closely on the heels of the Mediterranean and Latin trends. Caribbean cuisine continues to mainstream onto non-ethnic menus with its signature high-heat grilling, Island-like “sweet ‘n spicy” zip, and the resurrection of cooking with fruit. Indian foods still suffer from a limited awareness, with the exception of curry, flatbreads, Indian chutneys, and some characteristic spices. As the influence of foreign and regional cuisines matures, chefs will develop a more sophisticated and specific set of flavor descriptors. Terms such as hot, spicy, and zesty have already peaked. Identifying the most attractive cuisine descriptors will be a new challenge.

In addition to ethnic descriptors, cooking techniques have emerged as essential flavor and menu differentiators. Slow-roasted, smoked, grilled, wok-seared, and wood- or brick-oven-baked lead the list of the most appealing mainstream menu descriptors. Rotisserie, baked, and barbecued have begun to fade. The terms sauté, marinade, marinated, and smoked continue to climb. Peppered, braised, cured, caramelized, poached, and toasted are other up-and-coming flavor cues. Mixing cooking techniques on a single plate will stay in vogue. After all, cooking techniques speak their own language. Roasted, braised, and slow-cooked say “home-style, ”wok-seared” or stir-fried Asian. Marketers would be wise to employ these descriptors to provide a contemporary edge to packaged foods. Dry rubbing, cooking en papillote, and crushing/pressing herbs, spices, and seeds will require flavor-directed terms.

Stuffing is another way creative chefs are adding flavor. What’s inside will clearly be as important to flavor seekers as what is outside. Stuffed roasts, stuffed poultry breasts sliced into rounds, fish rolls, and stuffed vegetables and potatoes are offering intensified flavors and textures. Conversely, little “surprise packages” like pot stickers, pierogis, pyroshky, papusas, egg rolls, and empanadas are moving center stage.

Trend 3: Balance

As Americans strive to simplify and enjoy their lives, they will seek a greater degree of overall balance and moderation rather than past extremes like avoiding red meat, or obsessing for fat-free, or overdoing it on fiber. The days of pigeonholing consumers as indulgent, health-obsessed, or even “Basic 4” eaters are over. The truth is that almost everyone has a little bit of each in them, and matching and meeting these varied demands is setting off a new generation of products, portions, and promises, finding strong sales and sustainable appeal.

To some consumers, “bigger” is best, and heartier makes them happier. Consumers are “thinking big,” and restaurants have responded with enormous value-driven portion sizes—witness Denny’s Grand Slams and Signature Skillets, Wendy’s “Biggie” fries and Burger King’s X-treme.™ More than half (56%) of consumers under age 44 agree that larger portions mean a better value, compared to only 30% of adults age 56+ (NRA, 2000b). At the same time, tasting flights, mini-meals, and appetizers are soaring!

--- PAGE BREAK ---

These days, heartier often means meatier, too. Meat consumption was up 3.5% in 1999 for the first time in 20 years (USDA, 2000). Casual steakhouse sales were up 21.5% (Technomic, 2000). Meat snacks jumped 28.5% to $1.32 billion, and pork rinds increased 18.4% to $420.2 million (Anonymous, 2000). Hearty braised and slow-roasted meats are leading the gourmet sandwich category, while long-time low-temperature roasting is back in vogue with chefs, bringing new life to less-expensive cuts (Yee, 2000). There is even talk that the ongoing “meat-and-potatoes” sub-current may eventually cause a backlash and influence frozen food directions, which for the most part contain only small portions of meat.

There is a strong move toward more protein across the board, and the restaurant industry is no exception. In fact, there is concern that the high-protein, low-carbohydrate trend may have a negative effect on pasta popularity. The Atkins diet has been among the most followed and successful regimens in history. Similarly, the trend to high protein may have an impact on what constitutes a meal. A starch, like bread or pasta, won’t necessarily be an automatic part of every plate. One up-and-coming restaurant trend is to mix a medley of three protein dishes on a plate such as a pork chop, a spicy pork sausage, and pork baby back ribs.

Fried food sales are flying high. In fact, the U.S. Dept. of Agriculture claims that fried foods were unaffected by the nutrition revolution, and the French fry is still the most consumed restaurant item (Sheridan and Yee, 1999). Per-capita cheese consumption jumped 1.5 lb to 30.3. Cheese platters, samplers, courses, and fondues are mainstreaming onto menus. Asiago, feta, goat, blue, Muenster, Colby-Jack, and Gorgonzola had the largest gains in the specialty cheeses last year (IDMA, 2000). Cheeseburger sales were up 4% and nachos 12% in the year ending December 1999 (ACNielsen, 1999). Real cheese dipping sticks, cheese-stuffed shrimp poppers, and cheese-dusted entrees/breads enjoyed increased attention. Likewise, hearty soups like seafood bisque and chili, as well as hearty peasant breads, are among up-and-coming menu items (Sheridan and Yee, 1999).

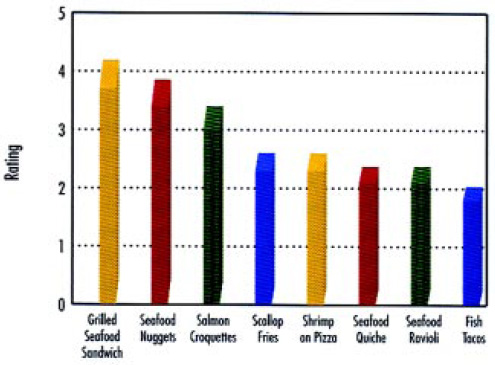

At the same time, orders for fish/seafood are increasing, too. Americans ate 15.3 lb of seafood per person last year, up 3% from 1999, vs 10.3 lb in 1960 (NFI, 2000). In 1999, per-capita consumption of fillets and steaks was 3.2 lb, sticks and portions 1 lb, and shrimp (all preparations) 3 lb. Consumers ordered 6% more broiled, baked, and grilled seafood options last year, while orders for fried shellfish were down 8%. However, fried shrimp logged the biggest gain last year (14%) and jumped 24% in sales in the freezer case (NRA, 2001b). Fish sticks, crab cakes, and raw oysters and clams as appetizers have posted significant gains. Salmon, all forms of shrimp, and crab cakes remain the overall restaurant best sellers (Fig. 5).

Another large group of seemingly more-health-conscious shoppers are looking for greater balance and nutritional convenience in prepared meals. Overwhelmed by nutritional controversies, they are returning to eating the “Basic 4,” and a full serving from the fruit/vegetable group is key. It’s not surprising, as eating more fruits and vegetables remains American’s number-one strategy for improving health through foods. In fact, nearly seven in ten consumers say they’re still trying to eat more fruits and vegetables (FMI, 2000a). While Asian varieties of veggies are expected to be among the ingredients adding signature flare to menus, traditional favorites broccoli, green beans, carrots, onions, and tomatoes still top the list of best-selling restaurant veggies. Expect roasted veggies to find a welcome niche (Sheridan and Yee, 1999).

And then there is the growing vegetarian segment. Although only 1–2% of the U.S. population are true vegetarians and 2–4 million are semi-vegan, 15% of college kids and 6.9% of grocery shoppers describe themselves as vegetarians (NACUSS, 1999; FMI, 2000a). Semi-meatless eating is what’s getting the attention of marketers and the emerging balance between meaty and meatless meals. For example, more than half of restaurants with an average check of $15+ report more frequent ordering of vegetarian dishes and veggie sandwiches (NRA, 2000d). In 1999, one in five households ate four or more meatless dinners per week; more than 50% two or more (VRG, 2000). In addition, veggie meat substitutes, cheeses, and other items are posting record sales.

The continued move to positive eating is perhaps the best indication of the trend to balance. Today, shoppers continue to practice a dual strategy of healthy eating and shopping, adding more fortified foods that offer positive benefits like vitamins, minerals, and fiber, while avoiding negative food components, such as calories, fat, cholesterol, and sodium. However, the tide continues to shift in favor of including the positive. Concern about virtually all natural negative food components continues to fall, and even they’ve balanced out. More people are interested in low-fat products now than fat-free!

--- PAGE BREAK ---

Trend 4:

Form Follows Function—Bits, Bites, and Bags

Without a doubt, appetizers represent one of the most versatile food forms for the decade ahead. They’re bite-sized, and with Americans always trying to do two things at once, that’s a good idea. They provide a vehicle for socializing and sharing and an economical way to sample new tastes. Most important, they provide an excuse for the graceless practice of eating with our hands. Not surprisingly, frozen hors d’oeuvres and snacks reached $490 million in sales last year, up 13.7% for the 52 weeks ending September 9, 2000 (ACNielsen, 2000).

Clearly, breaded and fried characterize America’s favorite finger foods. According to Restaurants & Institutions’ 1999 Menu Census (Sheridan and Yee, 1999), next to French fries—which top the list—chicken strips and nuggets are the best-selling overall restaurant item—even above burgers—in the U.S. today. Along with fried onion rings, they continue to top the appetizer chart, too (Fig. 6). Seafood—much of it fried—represents nearly 50% of all restaurant appetizer sales. From Ranch to Cajun, breadings are now spiked with bolder flavor and also mixed with cheese. Fried mini-morsels are being cross-mixed with traditional meals for added crunch, e.g., fried chicken tenders in salads or fried chicken strips as a new twist to “surf and turf.” Not surprisingly, there’s a move to equate fresh and healthy with fried using lighter batters, including coconut crust, tempura, and potato.

International mini-meals are fast becoming bite-sized favorites, too. Tapas, dim sum, potstickers, and spring rolls are also growing in popularity. Miniskewers, including satay, skewered meats/sausages, and grilled veggies, are coming on strong. And while meatballs are the only meat item on the current “Top 10” appetizer list, they will be joined by nontraditional varieties of riblets, marinated chunks, rolled/stuffed meat concoctions, and mini-meat pies. Surely, it won’t be long before today’s “do-it-yourself” consumer follows suit, embracing egg roll wrappers, rice paper, baby tortillas, flat breads, mini-pita pockets, and other edible packaging staples for hand-held bite-sized bits.

Menuing mini-sandwiches as an afternoon snack is also quickly gaining in popularity. Small panini sandwiches, crustless Italian cocktail sandwiches—tremezzini—and mini-flatbread sandwiches with meat/cheese and gourmet trimmings are enjoying great grab-and-go success. Roulades and pinwheel bread/cheese and bread/meat circular tidbits are popular too. Mini-sandwich samplers—some upscale eateries allow you to select them yourself—are finding mainstream appeal. Even Arby’s has four new panini options. Pita Petites™ is one product line capitalizing on the savory munchable trend, featuring spinach and artichoke, sun-dried tomato herbs, and spicy black bean-stuffed pockets. Literally, a coffee cup of soup and a mini-sandwich are strong lunchtime contenders, especially for working women, now half of all lunchtime away-from-home diners. Baskets are also big for “shareables.” My favorite is a basket full of creative mini-tacos.

With consumers more mobile than ever—eating from desk-side to roadside—hand-held foods are projected to reach $2 billion in sales by 2002 (Kalorama, 1998). Men spend an average of 81 minutes per day in the car, women 64 minutes. With an average commute of 11.6 miles, 100 million Americans drive to work, a three times greater distance than ten years ago (Census Bureau, 1999). Nationwide, two-thirds of all commutes last less than 30 minutes. Not surprisingly, 20% of all take-out meals are eaten in the car: 15 meals per person are bought at a restaurant and eaten in a car; and 6 meals/person are lunches (NPD Group/Crest, 2000). Almost 65% of workers eat a hand-held meal, about 39% sandwiches and 14% burgers.

Wraps and gyros are the most-likely-to-be-added menu sandwiches. However, unique portable forms and packages are emerging, including the chalupa, tamale, and even cones, made from potatoes, tortillas, pastry, or pizza dough, cradling everything from chicken salad to stir-fried delights. With soups, pasta, and Asian offerings most common, bread bowls and mugs are emerging, too.

Trend 5: A New Kind of “Home-Spun”

The “me” generation of the 1990s has quickly turned into the “we” generation of 2000+ with a renewed emphasis on family, friends, and food. More than 70% of men say they would give up some of their pay to spend more time at home with their families, while 80% of workers say a schedule that allows family time is critical (Radcliff, 2000; Univ. of Chicago, 2000).

--- PAGE BREAK ---

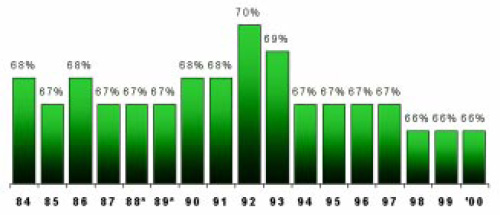

Not surprisingly, home is still the favorite place to eat (Fig. 7). According to NPD Group (2000), 941 meals per person were prepared and eaten in the home last year. Home is also still the number-one venue for lunch and breakfast. In the 25 million married households with kids, on average, the majority of families eat dinner together about 5 days per week (NPPC, 2000). With an increase in family-style dining, family-sized portions—perfect for sharing and customizing portions for the little ones—will increasingly be in demand. It’s no accident that today’s one-dish meals and casseroles—Big Bowls, stirfry’s, and pasta—lend themselves to this friendlier form of communal dining style.

More than ever, diners are seeing the restaurant as an extension of their domestic domain. Interiors are being redesigned for privacy. Communal tables and “living-room” dining are escalating restaurant trends as well (NRA, 2001a). After years of investing in food and service to differentiate restaurants, operators are investing in decor and entertainment. The return of table-side food preparation is one attempt to keep diners comfortable and entertained. And it looks like all their efforts are paying off. Family-style restaurant sales reached $31.6 billion in 1999, with a growth rate of 2.3% (Technomic, 2000). And more restaurants than ever are catering to kids, like the Crayola Café in Kansas City, attempting to entice families away from home.

In addition, socializing is quickly becoming a major motivator for choosing food venues and individual food items. NRA (2000b) identified the following “Eating Out Profiles:” cater to me (32.9%); socializers (17.3%), celebrators (16.2%), impulsives (11%), and busy bees (11.7%). While restaurants are being used more to socialize, so is the home. As a result, the increased frequency of casual home entertaining—“Come on over for sports, movie, or coffee”—is causing a growing demand for appetizers and finger foods, party-sized portions, upscale desserts, and coffees. Gourmet alcoholic beverages are also finding a new receptive audience.

It’s this feeling of comfort, home, and hearth that is keeping American and home-style cuisines strong. “Plain American” is the cuisine that 3 out of 4 say they enjoy most, up 8% since 1995. Seven in 10 Americans say they ate in an American or Continental restaurant in the past six months. The concern over “country of origin,” created by recent food safety scares, a desire for the nostalgic, and the demand for seasonal and regional foods will bring a never-ending generation of American varieties of veggies, grains, and flavors center stage. It’s about time we saw more than a few of the thousands of varieties of peas or strains of rice grown in the U.S. on restaurant menus.

As a result of the strong trend to seasonal and locally grown, it’s not surprising that restaurateurs at all levels are highlighting American regionality and seasonality as flavor and quality menu descriptors. The provenance—typically the farm, ranch, or region where ingredients are grown or raised—is also included, such as Sonoma duck, Nantucket scallops, Napa Valley Dairy, or even Applegate’s local farm. Cowboy, New York, and Chicago are some of the more popular meat-oriented regional terms, while the Gold Coast—hot with the high-end cuisines of South Beach—is among others.

And comfort foods remain strong. Three-quarters of Americans say they are looking for home-style or comfort foods on menus (NRA, 2000b). While mashed potatoes, meat loaf, and old favorites like macaroni and cheese remain strong, the new generation of wood-smoked, slow-cooked, spit-roasted, and traditional barbecue continues to please diners nationwide. Even upscale restaurants like Tavern on the Green are finding ongoing success with comfort foods. In fact, they reported to Restaurant Business that of their typical 800 lunches served, about 20% order the meatloaf. Even Horn & Hardart has brought back the Automat!

--- PAGE BREAK ---

Bistros and brasseries have also regained their popularity as America’s neighborhood restaurants. They have become synonymous with serving just about any food that is simple, affordable, casual, and fresh. A number of trend-setting restaurants have labeled themselves Mediterranean, Latin, and even Asian bistros. With the emphasis on meat and cheeses, charcuteries will be the next important trend. Likewise, with the ongoing proliferation of creative upscale alcoholic beverages, “bar food” will continue to explode—another indication of America’s desire for casualness, creative new tastes, and bite-sized portions. Casual bar and grill concepts were the second leading drivers of restaurant customer traffic during the summer and fall quarters of 2000 (NRA, 2001c).

Last, but not least, the new wave of international peasant and comfort foods will begin to mingle with old American favorites. Expect a number of creative, hearty, one-dish meals, such as paella, bouillabaisse, stews, meat pies, pocket foods such as pierogis and pyroshky, and stuffed and regional breads, such as potato and cabbage breads, to move mainstream. Fondues—not with just cheese and bread but also with meats, veggies, fruits, and seafood—will make a strong return. With “cheese-of-the-day” fondues or sandwiches, there won’t be a shortage of varieties to choose from.

Trend 6: Kid-Influenced

Kids have always been big business. In fact, the first store that most kids ever visit is usually the supermarket, where more than three-quarters make their first purchasing decision. Children influence about 17% and maybe as high as 80% of family spending on foods (Economic Statistics, 2000). And although they may not hold the checkbook, kids today make more purchase decisions than ever before. But along with their growing influence on product selection and the fact that they have money of their own—lots of it—to spend, they now have a growing participation in meal and snack preparation. In addition, for the first time in a long time, young adults age 15–24 will represent an explosive market segment for food marketers. But targeting this special spaceage group will be more than a challenge—it will be an adventure.

Packaged Facts estimated supermarket sales of kids’ foods at $9.847 billion in 1998 and projected it to climb to $12.0 billion by 2003. Kids’ meal items accounted for approximately half of all kids’ food sales in supermarkets, followed by snacks and desserts, 31%, and beverages, 17% (Kalorama, 1999).

Today, there are about 39.7 million kids age 5–14 and another 14 million of high school age. Households with kids—now about one-fourth of all households—will remain flat, although growth will occur (8.9%) in single-Mom households. Some experts believe that kids in one-parent households become independent consumers earlier than those in two-parent households. Others believe that kids make purchase decisions as early as age 4, with a median of age 8. Total annual births, which have hovered around 4 million during the past decade, aren’t expected to change much in the next 10 years. The number of kids under age 5 will increase slightly, up 6.9%, by 2010 (Census Bureau, 2000).

One in three family cooks (38%) report that children always or often dominate dinner grocery decisions. Many always or often influence the purchase of snacks (75%), breakfast (72%), lunch (62%), and dessert (47%) (NPPC, 2000). More important, 88% of kids age 6–17 said they occasionally fix meals for themselves. Half counted making their meals among activities they do around the house, up from 40% in 1995; 26% said making meals for the family was something they did most of the time, up from 15% in 1995 (Nickelodeon/Yankelovich, 1999). Latchkey kids—another important target for food marketers—are estimated at 7 million age 5–14: 9% of kids 5–11 or (2.4 million) and 41% of those 12–14 (4.4 million). These kids have been traditionally targeted for after school-snacks (Census Bureau, 1999).

Another emerging market involving the younger set is the new youth health market. Not surprisingly, many companies have been targeting Moms with fortified foods. But look for more serious health-directed products to come. The President’s Council on Physical Fitness reports that one in four kids in grades K-12 are overweight. The American Heart Association estimates that 27 million under 19 years old have high cholesterol, and 2.2 million high blood pressure, while the USDA Food Consumption Survey shows that 85% of kids don’t meet the “5-a-Day” for fruits and vegetables.

--- PAGE BREAK ---

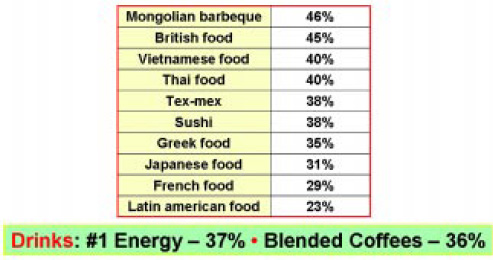

Last but not least, the number of young adults age 16–24 will jump from 34.5 million in 2000 to 38.7 in 2010. Besides being fast-food fans, they also eat out frequently with families. This group not only rarely cooks, but also doesn’t know how to cook. Although they were weaned on fast food, these consumers will most likely suffer from budget constraints and turn to in-home minimeals and snack items purchased by themselves or their parents. Restaurant brands translated into retail products—like the current line of T.G.I. Friday’s appetizers—should be very appealing to these new customers. Most important, young adults will be much more sophisticated in terms of culinary demands than previously anticipated, as evidenced by the cuisines high school students say they are planning to try (Fig. 8). In addition, 15% of college students describe themselves as vegetarians.

Trend 7: Light and Lively

The impending shift of the technical basis for American chefs and culinarians from Classical French techniques to those of the Pacific Rim is already having a significant effect on the American foodservice industry, demanding an increasingly more natural and fresher image for products, ingredients, and presentation.

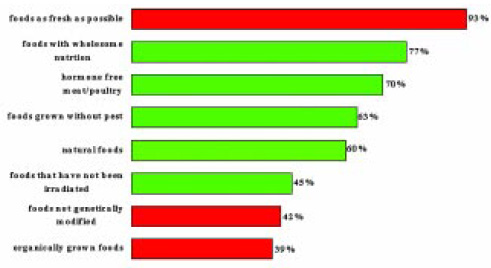

Freshness has been identified by the vast majority of culinary and foodservice trend predictors as the most important restaurant trend of the next decade. As a result, there will be even more pressure on producers and manufacturers to offer fresher—or fresher-looking—products and labels. As shown in Fig. 9, 93% of consumers feel it is important for stores to have foods as fresh as possible (NMI, 2000). Living foods, raw foods, seasonal and regional foods, heir-loom vegetables/beans, and fresh herbs will all be a part of this mega trend. The time from “dock to wok” will continue to emerge as a significant food issue. A number of “light-and-lively” trends will get exceptional attention.

In the next few years, there will be an unprecedented emphasis on visual presentation in an effort to make foods look their freshest and healthiest. Watch for the “layered look” to come into vogue, e.g., plating meat, poultry or seafood, over beans, rice/grains, seeds, and clear noodles for a fresher look. In sandwiches, layered means a wide array of meal components, from healthy-looking greens to colorful spreads and marinated toppings. Textural quality, piece integrity, color, and other physical and sensory properties of foods must be optimal. Only functional garnishes will be used. Even fried foods will be mixed on the same plate with fresh items or topped with fresh veggies to achieve added “freshness appeal.”

Spurred by the popularity of Vietnamese and Singaporean fare among trend-setting chefs, the “lighter touch” to flavors has long been a hallmark of trend-setting California cuisine. Basil, dill, parsley, coriander, ginger, and rosemary have moved mainstream, as well as maple, lemon, lime, honey, mango, and balsamic and red wine vinegars. Simple broths, vinaigrettes, and infused oils will be in more common use, eventually with more fennel, cumin, lemon grass, and star anise. Steaming, poaching, stirfrying, sautéing and simmering will be more prominent. En papillote—or, to consumers, foil-baked—will get even more mass market attention because of its subtle steamed great taste.

Fruit is finding its way onto menus. Lemons, limes, bananas, and apples are finding renewed life. Asian and Island cuisines are giving citrus, pineapple, mango, plantains, blood oranges, and tropical fruit bases more appeal, especially for salad dressing and desserts. Next to fruit and chocolate combinations and fruit-oriented samplers/ flights, banana dessert concoctions are the most popular. Old-fashioned pineapple and other upside-down cakes, as well as caramelized fruit desserts, are also making a comeback. Fruit salsas, chutneys, and compotes are raising the bar in the condiment category, often offering a distinct contrast to hot and spicy or savory flavors or providing cool and hot temperatures in the same dish. Stir-fry’s with mandarin oranges, seared fish topped with fruit salsa, and hot ’n spicy fruit dips for chicken wings are hot.

--- PAGE BREAK ---

With vegetables a dominant force in Far Eastern cooking, look for Asian vegetables to be near the top of the list of signature—and exciting—ingredients. Flavorful but somewhat familiar vegetables such as ong choy (water spinach), gai lan (Chinese broccoli), dau mui (snow pea shoots), and gai choy (Chinese mustard cabbage), long beans, and the wide variety of mushrooms will tantalize diners. Interest in veggies will also spur a trend to premium mildly familiar gourmet and hybrid specialty vegetables such as Mann’s broccolini. From olives and capers to nuts and sun-dried cranberries, all things natural are good.

Look for the trend to fresh, simple, and seasonal food to close the gap toward “living foods.” Watch for farmers’ market look-a-likes—roots and all—local products, and baby versions of old favorites to soar. Selecting fish and seafood from live tanks, the further main-streaming of sushi, and the wide acceptance of products like seared and “black and blue” tuna, carpaccio, and tartare are all part of the emerging “living food” trend.

Salad sandwiches and pizza, bread salads, and lettuce wraps should score big. “Fresh” accompaniment can enhance a light ’n lively image, from fruit salad to coleslaw and German potato salad, too.

Trend 8: Crossover Meal Patterns

Chips for dinner, dinners for lunch. Where did dessert and coffee go? The food nature of America’s day-part “tradition” is changing. Mealtime is anytime, and just about anything goes! More-frequent eating and snacking occasions, shifting priorities within traditional patterns, and truly new eating venues will spur new products, priorities, profits, and problems in the years ahead. At the same time, the accelerating trend to more upscale take-out will facilitate a new “all day, any way” menu attitude!

Americans are stuck in a meal routine. Not surprising, NPD Group (2000) confirms that the “Top 10” items most commonly served for dinner haven’t changed much in the past 10 years—it’s just the order that has been rearranged. For example, old staples like chicken, pork, seafood, beef, potatoes, and vegetables remain, although many of the sides are being served less often. And, of course, there are pizza and pasta. But, surprisingly, sandwiches—most often thought of for lunch—top the list of in-home dinner items. And soup made the “Top 10” list, too. More snacks, carbonated beverages, and water are being served, while coffee, desserts, separate salads, and breads continue to fall.

Believe it or not, the majority of lunches are still eaten at home, and carried meals still outpace restaurant takeout options. At least once a week, 45% bring lunch, 31% skip lunch, 19% eat at a restaurant, 18% eat at an office cafeteria, 11% eat microwavable lunch, 10% have lunch delivered, and 4% eat from a vending machine (Datamonitor, 2000). Today, more than one in four workers (27%) spend their lunch break doing things other than eating, and those who are buying it outside average a cost of $4–5 per day (NRA, 2000a). With more than 90% of workplaces offering access to microwave ovens, it’s not surprising that frozen dinners, pizza, pasta, and chicken nuggets are becoming more popular, but so are yogurt, salad, and fruit. While sandwiches continue to fade, these are the top 10, in descending order: regular cheeseburger, fried chicken sandwich, broiled/grilled chicken sandwich, regular hamburger, steak sandwich, bacon cheeseburger, hero/sub, turkey sandwich, ham and cheese sandwich, and wrap/pita (NPD Group, 2000).

Contrary to popular belief, the vast majority of Americans eat some form of breakfast, and they eat it at home! The most important criteria seems to be no—or very limited—preparation. Most important, Americans appear to be getting bored with breakfast. While breakfast sandwiches and nontraditional sandwiches are up, bagels, granola bars, toast, bread, and hot pockets are down. The increased consumption of more yogurt and fruit reminds us of the potential for portability. And with 53 million kids being bussed to school, backpack options are an opportunity, too.

With 20% of calories coming from snacks, it is obvious that the distinction between snacks and meals is blurring. More than one-third of Americans snack four or more times a day (Anonymous, 2000). Snack and nonalcoholic beverage bars are projected to be the fastest-growing eating-place segment in 2001, with sales projected to increase 7.9%. This segment includes ice cream, frozen custard, and yogurt shops, as well as donut shops, bagel shops, coffee bars, cookie shops, and other snack and nonalcoholic beverage bars (NRA, 2001a). Driven by computer access, increased television and movie watching, and the desire to stay up later, a new late-night eating occasion is developing, with 13% of snacking occurring in the 10 p.m. until midnight time slot (USDA, 1999), when more savory and substantial snacks dominate, including pizza, leftovers, sandwiches, and frozen appetizers, as well as bagged candy. General trends to watch include cheese snacks increasing 13.4% to $919.6 million, snack nuts 13.7% to $1.49 billion, and dips of all kinds posting double-digit growth.

With foodservice accounting for the second largest share (13.9%) of the nation’s 93,000 convenience-store sales (after cigarettes), it will be imperative for marketers to maximize their distribution in these “neighborhood” corner stores. Likewise, frozen vending mega-item machines are gaining favor nationwide and penetrating hard-to-reach but highly receptive market segments. New machines already in use at many plants—and the nation’s first fully automated gas station in Pennsylvania—house more than 200 food items, including frozen, and thaw and heat a microwave entrée in just a few minutes.

--- PAGE BREAK ---

Trend 9: “Do-It-Yourself” Health

Americans continue to take more and more responsibility for their own health, naturally, and are sending fortified, functional, and performance-enhancing food soaring. Over half of the population eats a vitamin-fortified or calcium-fortified food or beverage (NPD Group, 2000). Energy beverages and bars are approaching $4 billion in sales. And, although definitions differ, most analysts put the U.S. functional food market between $15 billion and $20 billion (Sloan, 2000).

But Americans are ready to do more with foods than just “maintain health.” Dubbed the “Self Care Movement,” this new “hands-on” approach to health is estimated to be a $42-billion supermarket retail opportunity (FMI/Prevention, 2000). One in three Americans—74 million—are now more likely to treat themselves first before seeing a doctor, up 26% from last year. And about half of them are more likely to try and treat themselves than they were last year (31%). Most important, 72% of grocery shoppers are trying to “reduce the risk” of a condition, and 58% are trying to “manage or treat a condition.” Not surprisingly, supermarket shoppers’ efforts to greatly or somewhat “slow down the aging process” through foods more than doubled, from 22% in 1998 to 48% in 2000. Fat, energy, weight control, and, recently, food intolerance issues, are also major purchase influencers (Sloan, 2001).

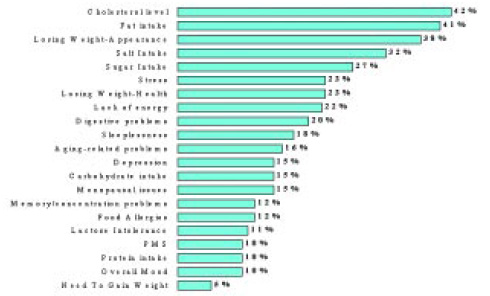

According to NMI (2000), the self-care movement is already in full swing. Forty-two percent of all shoppers have a member of their household trying to manage or treat cholesterol, followed by reducing fat, managing/treating weight, and reducing salt and sugar (Fig. 10). The “benefits of limiting total fat intake” also topped the list of health and nutrition information sought by supermarket shoppers in-store, followed by “appropriate calorie intake,” importance of increasing “fiber intake,” and the benefits of herbal products, protein, and soy (FMI/Prevention, 2000).

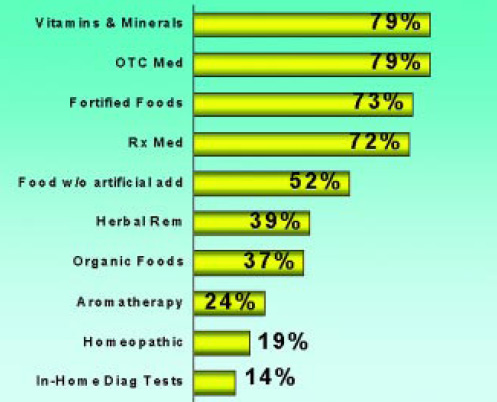

Foods have become an integral part of the self-care movement. Nearly three-quarters (73%) of supermarket shoppers are using fortified foods to maintain health—slightly less than the 79% using supplements and over-the-counter medications (Fig. 11). Moreover, half of all grocery shoppers are turning to natural remedies, like herbal teas, before conventional medications to treat minor illnesses. And for the first time, foods are rivaling OTC drug preparations and supplements as treatment options for some conditions. For example, nearly as many shoppers used foods that are naturally high in nutrients (61%) and fortified foods (59%) as used OTCs (70%) to treat a cold; 68% used naturally high-nutrient foods to prevent a cold. Generation X shoppers (39%) are most likely to try natural remedies first (FMI/Prevention, 1999, 2000).

And the future looks strong. Nearly three-quarters agree that “in most cases, eating healthfully is a better way to manage illness than medication.” The same number agree that they “can make major improvements in their health by making only small changes in what they eat.” More than nine in ten shoppers now think that fruits, vegetables, and grains contain naturally occurring substances that can help prevent and treat diseases, even cancer (FMI/Prevention, 2000). And slightly more than half think foods can replace some drugs (HealthFocus, 1999)!

No wonder food retailers are setting up destination “Whole Health Centers” in their stores, cross-merchandising the pharmacy and foods, and instituting instore diagnostic and health-monitoring programs (FMI, 2000b). Nine in ten retailers offer blood pressure checks, 63% cholesterol testing, and 41% osteoporosis screening. Savvy food marketers like Quaker and Frito-Lay and commodity boards like the Almond Board and Florida’s Dept. of Citrus are using the food/pharmacy interface to further promote their products. And dozens of cutting-edge products like Parmalat’s new fortified and beauty-directed milks Skim- Plus, Lactose-Free Plus, and Milk-E and Gold Circle Farms’ high-DHA, vitamin-E eggs are on the way.

--- PAGE BREAK ---

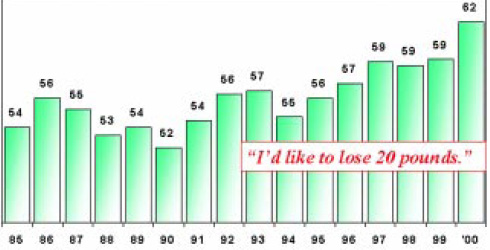

Last, but perhaps most important for food marketers, as consumers keep health concerns top of mind, they are renewing their focus on healthy eating and on controlling weight. In fact, 60% of all meal preparers say that they’d like to lose 20 lb, the highest level ever (Fig. 12)! But ironically, according to NPD Group’s soon-to-be-released breakthrough report, “The Skinny on the Weight Loss Market,” dieting overall is on the decline. Are people simply not concerned about their weight, or is “dieting” simply a taboo word? Over the past decade, a smaller percentage of women claimed to be on both doctor-prescribed and individual-choice diets. Similarly, the low-fat craze peaked in 1996 and has shown a substantial decline ever since. However, it has brought about a slight resurgence in low-calorie and low-sugar diets. Dieting for one’s health has also suffered in the ’90s.

Who is dieting? Women who are characterized as overweight or obese have the largest share of dieters. So, are all dieters equal? Probably not. Almost one-third of women 18 and over fit into a new category defined by NPD Group, the “health active non-dieter category.” These people are not “dieting” but are making a conscious effort to maintain healthy eating habits and are the “perfect target” for food marketers. Health active dieters are committed to doing what it takes to lose weight. They consume diet, fat-free, and reduced-calorie products. They are more mature in age, come from a higher-income household, are not employed, live in a smaller household, and have no children at home.

Trend 10: Clean, Pure, Natural, and Safe

Fueled by mounting media attention to a wide range of issues, from mad cow disease and BSE to food poisoning outbreaks and import contamination, to environmental runoff and GMOs, the demand for cleaner, purer, and more “close-to-nature” foods is accelerating mainstream. Call them what you will, but, collectively, organic, all-natural, additive/ preservative-free, free-range, non- GMO, and even kosher foods represent a strong and sustainable market in the decade ahead.

Two-thirds of mainstream supermarket shoppers said they were trying to avoid purchasing products with artificial preservatives/additives, jumping 56 points since 1995 (FMI/Prevention, 2000). In the Natural Marketing Institute’s Natural Marketplace Trends Report, 71% of consumers agreed completely or somewhat that it is important for stores to have natural foods, 65% no artificial color, flavor, or preservatives, 65% no fake fats, 56% foods free from artificial sweeteners, 47% foods not irradiated, and 46% organically grown foods (NMI, 2000).

One in three (37%) of mainstream grocery shoppers said they purchased organic foods to “maintain health,” and one in four actively sought out information on their specific health benefits while shopping. Health is clearly the driving factor for organic purchases: 57% buy organic foods because they believe they offer positive “long term personal health effects,” 54% because they have a higher nutritional value, 27% because they taste better, and 26% because they are fresher or more “in season.” All of these reasons rank higher than or equal to the 16% who cited organics’ environmental (including pesticides) impact (FMI/Prevention, 2000).

Consumers consider natural and organic products the safest. More than two-thirds call natural food very safe, and 58% give the same rating to organic foods. Sadly, the government gets a 39% confidence rating on food safety, down from 50% five years ago (CMF&Z, 2000).

Organic food sales, with an impressive growth rate of 24%/year, are projected to jump from $6 billion to $13 billion in 2003 (OTA, 2000). In 2000, 44% of shoppers purchased at least one type of organic food in the past six months. Nine out of ten who bought organic foods purchased produce, 20% organic cereals, breads, or pasta, 13% organic meats or poultry, 10% organic eggs, soups, or sauces, and 9% organic milk (FMI/Prevention, 2000).

While editorial and advertising are effectively raising the awareness of these important “natural” industry platforms, key research from NMI indicates that a lack of consumer understanding may make realization of this segment’s potential more difficult without a wide-spread consumer education and information program. For example, while 89% of consumers are aware of the term organic, only 46% feel they understand it completely. Likewise, 97% are aware of natural foods and beverages, but only 46% understand them completely. Terms like sustainable agriculture had 23% awareness and a 15% level of understanding; 12% are aware of phytonutrients, but only 5% understood this (NMI, 2000).

--- PAGE BREAK ---

Forty percent of the general U.S. population can be classified as “GMO Concerned Consumers,” i.e., they agree completely or somewhat that it is important for stores to offer products that are not genetically modified. Of these 40%, the intensity is strong—46% agree completely that stores should not carry these GMO items. Of the other 60% of the population, most do not have an opinion either way; only 11% disagree (NMI, 2000).

When questioned about biotechnology, more than six in ten mainstream grocery shoppers find the following acceptable uses of biotechnology: to grow foods that include substances that may help prevent disease (phytochemicals), 69%; to grow foods that taste better, 66%; to lower the fat content of foods, 63%; to grow foods that are resistant to insects and other pests, 62%; to grow food that will stay fresh longer, 62%; and to decrease the costs of growing foods, 62% (FMI/Prevention, 2000).

A new series of farm-related environmental and agricultural product issues are moving center stage. Consumers perceive that environmental concerns are having more of an impact on their health. They have become concerned about the environmental conditions that crops or animals are raised under. For example, is the water being fed pure and clean? Is there environmental run-off on the land, contaminating the crops? Is the feed well balanced and safe from toxins and environmental pollutants? Are the conditions sanitary? Do the animals receive optimal veterinary care? More and more farmers are creating premium products by stressing environmental and humane conditions. Currently, there are a number of producers benefiting from marketing campaigns that remind consumers that their livestock only drink pure water, are grass fed, or roam free in the fresh air. In California, the state’s dairy association reminds us that the beautiful weather makes for happy cows. Now, who wouldn’t think that milk or cheese tastes better from happy cows?

But all is not doom and gloom. The concern for cleaner foods has given rise to new premium markets. Witness the rise of “farm fresh” and “farm fancy.” “Heirloom” vegetables, fruits, herbs, beans, nuts, grains, and spices—grown from seeds used for generations—are one such category in high demand by chefs and retailers alike. High-nutrient commodities, created by higher-nutrient feeds, such as Gold Circle Farms’ high-DHA, omega-3, and vitamin-E eggs and GoodHabits beef, eggs, and chicken, are another example. Then there’s Mann’s broccolini, a tasty hybrid that created unprecedented demand among high-end chefs and restaurants.

“Made in America” and “Kosher” may well be hot buzzwords for the next few years. By definition, kosher foods are another major market segment benefiting from the desire for cleaner foods. Kosher foods are now estimated at $33 billion and growing. Finally, the current scares over mad cow disease and BSE will drive the “country-of-origin” concept mainstream. Marketers would do well to tout “made and grown in the USA” for some time to come.

Fresh, Flavorful, and Fun

In cordial conclusion, it appears that many of the same mega-trends that were emerging at the end of the past century will now be defined. Creative convenience, freshness, close to natural, quality, and culinary sophistication will remain critical product criteria in the years ahead. As the population ages, concerns for health and weight will dominate, but seeking a greater sense of balance, frivolity, and fun will have a role, too. While there will undoubtedly be challenges, food marketers will have unlimited chances to excel in the most diverse, wealthy, and sophisticated market in history.

by A. Elizabeth Sloan

Contributing Editor

The author, a Professional Member of IFT, is President, Sloan Trends & Solutions, Inc., P.O. Box 461149, Escondido, CA 92046-1149. E-mail [email protected]

References

ACNeilsen. 1999. Food category sales, mass food, drug and mass merchandiser outlets, 52 weeks ending 12/99. ACNielsen, Schaumburg, Ill.

ACNeilsen. 2000. Food category sales, mass food, drug and mass merchandiser outlets, 52 weeks ending 9/9/2000. ACNielsen, Schaumburg, Ill.

AFFI. 2000. Frozen food trends. Am. Frozen Food Inst., McLean, Va.

Anonymous. 2000. State of the industry report. Snack Food & Wholesale Baking 89(6): S3-74.

Census Bureau. 1999. Journeyman study. U.S. Census Bureau, Washington, D.C.

Census Bureau. 2000. Demographic and population statistics. U.S. Census Bureau, Washington, D.C.

CMF&Z. 2000. Food issues survey. CMF&Z Public Relations, Des Moines, Iowa.

Datamonitor. 2000. Changing lunch occasions. www.datamonitor.com.

Economic Statistics. 2000. Children’s spending and influence. U.S. Bureau of Economic Statistics, Washington, D.C.

FMI. 2000a. Trends in the United States: Consumer attitudes & the supermarket. Food Mktg. Inst., Washington, D.C.

FMI. 2000b. Beyond foodservice . . . How consumers view meals. Food Mktg. Inst., Washington, D.C.

FMI. 2000c. Report from the 2000 supermarket pharmacy survey. Food Mktg. Inst., Washington, D.C.

FMI/Prevention. 1999. The growing self-care movement. Food Mktg. Inst., Washington, D.C.

FMI/Prevention. 2000. Self care needs and whole health solutions. Food Mktg. Inst., Washington, D.C.

HealthFocus. 1999. Functional foods and nutraceuticals consumer trend report. HealthFocus, Atlanta, Ga.

IDMA. 2000. Cheese Facts. Intl. Dairy Mgmt. Assn., Rosemont, Ill.

IFPA. 2000. Fresh-cut produce: Get the facts. Intl. Freshcut Produce Assn., Alexandria, Va.

Kalorama. 1998. The hand-held food market. Kalorama Research, New York, N.Y.

Kalorama. 1999. The market for kids food. Packaged Facts, Kalorama Research, New York, N.Y.

Labor Statistics. 2000. Workplace population statistics. U.S. Bureau of Labor Statistics, Washington, D.C.

Major, M. 2000a. Closing in on ground zero. 13th Annual Foodservice Operations Review. Supermarket Business 55(7): 105-120.

Major, M. 2000b. Classic cuts. 18th Annual Deli Operations Review. Supermarket Business 55(5): 109-123.

Major, M. 2000c. Choppy seas. 12th Annual Seafood Operations Review. Supermarket Business 55(11): 87-102.

Major, M. 2000d. Beefing up the meat case. 11th annual meat operations review, 1999. Supermarket Business 55(4): 179-195.

NACUSS. 1999. Attitudes of college students. Natl. Assn. of College and University School Services, Washington, D.C.

Nickelodeon/Yankelovich. 1999. Youth monitor survey, 1999. Yankelovich, New York, N.Y.

NFI. 2000. Market research study. Natl. Fisheries Inst., Arlington, Va.

NMI. 2000. Natural marketplace trends report. Natural Mktg. Inst., Harleysville, Pa.

NPD Group. 2000. National eating trends survey. NPD Group, Rosemont, Ill.

NPD Group. 2001. The skinny on the weight loss market. NPD Group, Rosemont, Ill.

NPD Group/Crest. 2000. Food service. Crest Information Services, NPD Group, Rosemont, Ill.

NPPC. 2000. Consumer kitchen survey. National Pork Producers Council, Des Moines, Iowa.

NRA. 2000a. Takeout food: A consumer study of carryout & delivery. Natl. Restaurant Assn., Washington, D.C.

NRA. 2000b. Consumer restaurant survey, 2000. October. Natl. Restaurant Assn., Washington, D.C.

NRA. 2000c. Ethnic trends II. Natl. Restaurant Assn., Washington, D.C.

NRA. 2000d. Restaurant industry operations report. Natl. Restaurant Assn., Washington, D.C.

NRA. 2001a. Restaurant industry forecast, 2001. Natl. Restaurant Assn., Washington, D.C.

NRA. 2001b. Let them eat seafood. Natl. Restaurant Assn., Restaurants USA 21(1): 37-40.

NRA. 2001c. Crest 2000—Summer-quarter report. Seafood. Natl. Restaurant Assn., Restaurants USA 21(1): 40-42.

OTA. 2000. Organic facts and figures. Organic Trade Association, Greenfield, Mass.

Promar. 2000. Riding the ethnic food tide. Promar Intl., Alexandria, Va.

Radcliff. 2000. Life work, generational attitudes toward work and life integration. Radcliff Public Policy Center, Harvard, Boston, Mass.

Reynolds. 2000. Dinner unplugged. Summary of Harris interactive results for women age 25-34, married, no children. December. Reynolds Metals Co., Glen Allen, Va.

Sheridan, M., and Yee, L. 1999. R&I’s1999 Menu Census: Upbeat classics. Restaurants & Institutions 109(28): 56-98.

Sloan, A.E. 2000. Top ten functional food trends. Food Technol. 54(4): 33-34, 36, 38, 40, 42, 44, 46, 48, 50-52, 54, 56, 58, 60, 62.

Sloan, A.E. 2001. Clean foods. Food Technol. 55(2): 18.

Stouffer’s. 1999. Consumer attitudes on meal preparation and packaged meals. Stouffer’s, Solon, Ohio.

Technomic. 2000. Food service management report. Technomic Associates, Chicago

Univ. of Chicago. 2000. General social survey. National Opinion Research Center, Univ. of Chicago, Chicago.

USDA. 1999. Snacking habits of different income groups. Family Econ. Nutr. Review, U.S. Dept. of Agriculture, Washington, D.C.

USDA, 2000. U.S. food consumption 1979-1998. Agriculture Research Service, U.S. Dept. of Agriculture, Washington, D.C.

VRG. 2000. The new vegetarian. Vegetarian Resource Group, Tempe, Ariz.

Wellner, A.S., 2000. Work without end. American Demographics 32(7): 50-56.

Wishna, V. 2000. Great expectations. Restaurant Business 99(1): 27-32.

Yee, L. 2000. Days of simmer. Restaurants & Institutions 109(23): 31-39.