Prime Time for Fancy Foods

The economic downturn and heightened interest in at-home cooking and entertaining are contributing to an uptick in gourmet/specialty food sales.

With consumers watching cooking shows like soap operas, gourmet/specialty/fancy food sales in the United States topping $63 billion in 2007, and celebrity chefs like Emeril Lagasse creating personal empires in excess of $150 million, the “foodie” revolution shows no signs of slowing down (Schoenfeld, 2005). More than 5 million Americans download recipes from the Food Network Web site each month. Moreover, it’s a global movement; “superchef” Martin Yan has hosted more than 1,800 cooking shows aired around the world.

So despite a sluggish economy, high gasoline prices, and a weakened dollar globally—specialty foods will likely continue to enjoy strong sales. In fact, historically, when times get tough, consumers turn to food as an affordable luxury and view fancy foods as a way to add a bit of adventure to daily life.

So despite a sluggish economy, high gasoline prices, and a weakened dollar globally—specialty foods will likely continue to enjoy strong sales. In fact, historically, when times get tough, consumers turn to food as an affordable luxury and view fancy foods as a way to add a bit of adventure to daily life.

During the current downturn, the opportunity for specialty food growth may be even greater than before. More than 39 million consumers tried to eat gourmet every day last year (Packaged Facts, 2007). Nearly three-quarters (73%) already purchase specialty foods, almost two-thirds (65%) buy such products to treat themselves, and 64% use them in everyday meals at home (Tanner, 2007).

Moreover, the industry will get an additional push from the nation’s 72 million Gen Yers ages 15–30, who are now entering the workforce and becoming consumers in their own right. Those ages 18–24 and 25–34 rank equally as the top purchasers of specialty foods, spending 30% of their weekly food dollars on specialty items (Tanner, 2007). Gen Yers have the highest preference for gourmet, ethnic, and natural foods and for food being presented as an “art form.” They’re also the most likely to try new foods, drinks, and health food items (Experian, 2007).

As the economy forces today’s culinary-savvy consumers to cut back on away-from-home eating and take-out meals—35% are visiting restaurants less often than three months ago—they’ll be more likely than previous generations to want to continue to experience and experiment with new foods and flavors, despite cooking and eating more at home (Technomic, 2008). Some consumers already consider certain specialty foods to be staples, as evidenced by the large number of trips made to gourmet, natural, and ethnic food stores in order to pick up just one or two items (FMI, 2008a).

Economic constraints have also created a boom in home entertaining, fueling the demand for more elegant and unique fancy foods. One-third (36%) of consumers buy specialty foods for a birthday or holiday celebration; 24% do so when having a party or dinner guests (Tanner, 2007).

Those who purchase Fair Trade, green, local, or cage-free products as a means of personal or social expression are unlikely to be deterred by rising prices. Organic food sales across all channels topped $18.8 billion in 2007, up 17% over 2006 (Nutrition Business Journal, 2008). Mainstream retailer Wal-Mart carries gourmet and organic foods, and 89% of supermarkets offer private label versions of specialty and/or organic foods (FMI, 2008a). Thus, it appears that the price gap between traditional and fancy foods is closing, and the availability of more affordable options may well make natural and specialty foods more accessible than ever, even in economically troubling times.

--- PAGE BREAK ---

Specialty Foods Sizzle

Specialty foods accounted for 12.5% of all retail food sales in 2007, reaching $47.9 billion in sales—up 8.7% over 2006 and 24% over 2005. Fancy foods sold through foodservice/restaurants such as Starbucks or Panera Bread added another $15 billion (Tanner, 2008).

Retail sales accounted for 76% of specialty foods sales in 2007; foodservice 24%. Of the retail sales, traditional supermarkets enjoyed 70%, specialty stores 19%, and natural food stores 11%. More than 180,000 specialty products were in the marketplace last year (Tanner/Mintel, 2008).

Nearly nine in 10 supermarket chains (87%) reported putting more emphasis on natural/organic products in 2008; 61% added emphasis to ethnic products (FMI, 2008b). In addition, nearly nine in 10 chains (87%) now offer natural/ organic foods, and 67% offer gourmet foods. More than half (52%) feature an expanded gourmet cheese section, and 29% have a coffee bar, 23% a sushi station, and 22% an olive bar (FMI, 2008b). More than one-third (36%) of primary grocery shoppers visit an ethnic food store at least occasionally, and 31% patronize organic/ natural food stores (FMI, 2008a).

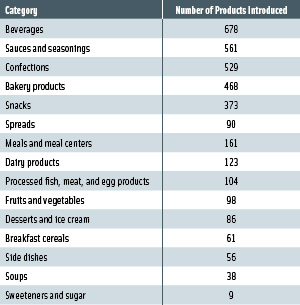

But competition for the specialty food dollar is fierce. Combined new product introductions in gourmet, health food, and specialty stores reached 3,535 in 2007 (Mintel, 2008). Beverages topped the list with 678 new specialty products unveiled, followed by sauces and seasonings with 561 new products, and confectionery with 529 (Table 1).

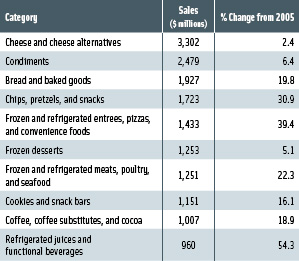

With dollar sales of $3.3 billion, cheese/cheese alternatives are the largest specialty food category, up 12% in 2007 vs 2005, followed by condiments at $2.5 billion, up 6.4%, and bread/baked goods at $1.9 billion, up 19.8% (Table 2; Tanner/Mintel, 2008).

Among specialty segments with annual sales in excess of $1 billion, unit sales of snacks jumped 22.9%, frozen/refrigerated/entrees 19.5%, and meat/poultry 18%. For categories with sales less than $1 billion, candy and individual snacks soared 51.5%; milk, half and half, and cream 29.7%; refrigerated juice/ functional beverages 29.7%; energy bars and gels 29.1%; cold cereals 24%; yogurt and kefir 20.7%; shelf-stable entrees and mixes 18.7%; frozen fruits/vegetables 18.4%; hot cereals 17.6%; ready-to-drink (RTD) tea/coffee and carbonated functional beverages 15.8%; refrigerated sauces, salsas, and dips 14.7%; and shelf-stable juices/drinks 14.3% (Tanner/Mintel, 2008). In specialty food stores, the most frequently purchased items are cold beverages, bought by 62% of all shoppers, coffee/tea purchased by 61%, chocolate 58%, cheese 54%, and olive/ specialty oils 51%.

Those ages 18–24 are the most likely to buy specialty treats, meats, and products that require limited cooking skills, such as items for grilling. Among these young consumers, 65% purchase specialty chocolates, 56% purchase specialty meats, 51% gourmet cookies, and 40% specialty salty snacks (Tanner, 2008).

Those ages 25–34, who are more likely to cook meals than their younger counterparts, are the top buyers of specialty beverages, with 73% purchasing these products. Among purchasers 25–34, cheese is bought by 61%, bread 52%, pasta sauce 49%, salad dressing 48%, frozen entrees 48%, and condiments 45%. It’s important to note that older boomers (those ages 55-64)—commonly mistaken for the “gourmet generation”—did not rank highest on purchases of any specialty food item. Those ages 65+ were the No. 1 purchasers of specialty oils; those ages 45–54 led in specialty coffee and tea purchases (Tanner, 2007).

--- PAGE BREAK ---

Gourmet Megatrends

With specialty foods historically setting the pace for the consumer food products industry, it’s ironic that two mainstream megatrends—convenience and health—are creating lucrative new opportunities in the fancy food world.

Because “young gourmets” frequently have limited cooking skills and older gourmets limited time, it’s not surprising that gourmet frozen/refrigerated entrees, pizzas, and convenience foods, such as Kahiki’s Szechuan Peppercorn Beef or Manchester Farms’ Premium Seasoned Quail are turning in torrid sales. Celebrity chef food kits such as Westwego’s Sauté Your Way kits with Louisiana Gulf wild shrimp and sauces by Chef Paul Prudhomme are enjoying skyrocketing sales.

Délice gourmet, slow-cooked crock pot dinners and soup kits include Southern Italian Pasta e Aioli. Capitalizing on the popularity of U.S. Southern cooking, Simply Southern introduced fully cooked Southern sides and vegetables such as Homestyle Okra & Tomatoes and Blackeye Peas.

Dessert mixes are another fast-growing gourmet convenience category. Lollipop Tree mixes includes Lemon Poppy Seed and Raspberry White Chocolate Bars. Simmering sauces are another emerging product category. Private Harvest offers Orange Teriyaki Simmering Sauce, and from Made in the Napa Valley™, there is Wine Country Simmering Sauce.

Other products just make preparation easier. Fabrique Délices’ Cassoulet includes pork and duck and does not require long hours of preparation. Lactalis USA’s’ President Brie is sold in log form designed to fit on round crackers when sliced. Sorrento’s Fresh Mozzarella Ciliengini are mini cheese pearls that can easily be added to a salad or pasta.

Lighter and lower-fat versions of high-end products represent an important trend that is just beginning in specialty foods. Laughing Cow Light French Onion Cheese from Bel Brands USA contains just 35 calories per wedge. Foxtail’s gourmet pies, including Chocolate Coconut, boast “no added sugar.” Green County Foods has introduced Sugar-Free Petits Fours.

In the past, specialty items were almost always imported, but today the trend is toward quality products produced in the United States, which also aligns well with the interest in locally sourced foods. Birmingham, Ala.’s Porchetta Primata LLC produces “Ariccian” porchetta from an ancient Roman recipe, and the company prides itself on the fact that, unlike some imported products, its porchetta is antibiotic- and hormone-free. BelGioioso Cheese Co.’s new Burrata is a cream-filled mozzarella based on the classic Italian cheese from the Puglia region, but now is being made in Wisconsin.

Products formulated with very old recipes represent another emerging trend. Vienna Beef’s all-natural franks are made with a century-old recipe and smoked with hardwood hickory. Walkers Shortbread touts the fact that the company follows an original recipe and production methods first employed in Joseph Walker’s bakery, which opened in 1898. Britain’s West Country Farmhouse cheddar is produced where cheddar originated more than 500 years ago and is “still made on family farms, by hand.”

With high-spending boomers’ penchant for partying, it’s not surprising that gourmet cocktail snack companions, sophisticated drink mixes, and foods and sauces with wine and spirits flavorings are also enjoying brisk sales. Earth & Vine’s new concentrated Meyer Lemon Elixir creates terrific Italian sodas, martinis, lemonades, and sangrias.

--- PAGE BREAK ---

Wine and other alcoholic beverage flavors are popping up everywhere. Kerrygold’s Aged Cheddar Cheese comes in Irish Whisky and Irish Stout. Finger Lakes Strawberry Chardonnay from Yancey’s Fancy New York Artisan Cheese marries fruit and wine flavors. American Vintage Wine Biscuits from American Vintage are made with wine as their name suggests; the line includes varieties such as Chianti Oregano with Crushed Red Peppers.

And with at-home dinner parties taking the place of going out to eat for all age and income groups, easy-to-make gourmet meals and appetizers will find a welcome market. Sweetypepp are Peruvian mini red peppers with a thick shell that can be filled for a unique appetizer. Jennie-O Turkey Store’s new Artisan Roasted Sage Dressing Stuffed Turkey Roasts make any meal into a gourmet feast.

Small bites and single-serve offerings have also found a place in the gourmet arena. Rising Sun Farms’ mini-cheese Tortlettes come in Key Lime topped with cranberries and other flavors. Corbin Kitchens’ new Mini Tamales, Mini Patty Melts, and Mini Grilled Cheese Sandwiches are a perfect snack or appetizer. Don Miguel Mexican Foods introduced mini Breakfast Empanadas. Van Holten’s Big “O” Snack Olives packaged in a stand-up pouch contain only 40 calories per pouch.

With American Culinary Federation chefs naming bite-sized desserts the hottest culinary trend for 2008, gorgeous gourmet dessert shots and single-serve cakes, such as those created by Galaxy Foods are single-handedly bringing back dessert. Petites Fours are also getting renewed attention (NRA, 2007). Sugar Bowl Bakery’s all-natural Petite Brownie Bites are made from a blend of nine cocoas.

Italian artisan confections such as marzipan, panforte, and torrone are also gaining momentum in the U.S., as is gelato. Cia Bella Gelato Co.’s Select Series Gelato is available in Key Lime Graham Cracker and Maple Ginger Snap flavors. Cia Bella also introduced Gelato Dessert Bars, all-natural round gelato sandwiches. Churros with fruit fillings are another hot ethnic sweet trend. PhillySwirl broke new ground with its Ice Cream Cupcakes.

Crunchiness is another fast-growing gourmet product attribute. John Wm. Macy’s SweetSticks are one of the first crunchy dessert companions; they are sourdough twists designed to complement ice cream in Java Cinnamon or Dutch Chocolate varieties. TH Foods Inc.’s Crunchmaster multi-seed crackers are crunchy and oven-baked. Nonni Food Co.’s New York Style brand introduced Focaccia Sticks in Roasted Garlic.

Functional shapes are another interesting twist. For example, King’s new Hawaiian Snackers’ Rolls are made for mini-sandwiches or sliders. Rubschlager Rye-Ola whole rye breads are round for perfect snacks or hors d’oeuvres. Sara Lee created a round sandwich croissant—Twister Croissant Rolls.

Old Favorites/New Ideas

When it comes to innovation, the gourmet cheese category is on fire. Woolwich Dairy Inc. markets a hard goat cheese, goat cheddar, and goat mozzarella; Meyenberg Farms has a goat cream cheese, and Mt. Sterling offers a Goat Raw Milk Mild Cheddar and Whey Cream Goat Butter. Cabot’s Tuscan Cheddar has layers of Tuscan herbs and spices throughout. Lactalis USA’s P’Tit Pyrenees is 50% sheep’s milk and 50% cow’s milk cheese. Scotland and Wales are the hot import countries. Cave-aged, such as Emmi’s Kaltbach Cave-Aged Cheese, is a new premium label term.

--- PAGE BREAK ---

And the flavors are unprecedented. Montchevre-Betin added Fresh Goat Cheese with Honey. Sartori Foods’ Signature Blends of grated/shaved cheeses come in Sicilian and other flavors. Sartori Foods also is among the cutting-edge cheese makers offering olive oil cheese in Basil or Rosemary Olive Oil flavors. Bel Brands USA’s Kaukauna Connoisseur Cheese Wheels come in Mango Peach and Asiago Pesto. Blazer’s cheeses are offered in Capers & Black Peppercorn and Garlic Chive & Spring Dill varieties.

Duck in any way, shape, or form is the new favorite in the gourmet meat case. King Cole offers fully cooked Peppered Duck Breast and comfit. Alexian™ introduced French rilette prepared with 100% duck meat; Fabrique Délices offers Cured Duck Salami.

Slow-cooked roasted meats are all the rage in gourmet delis. William Fischer Premium Deli meat is now available in Roast Loin of Pork and Roast Eye of Beef Round for slicing. King’s Command Foods introduced a Certified Angus Beef Meatloaf for take-out.

Fancy deli salads have been upgraded too. Tryst Gourmet introduced premium Chicken Salads including Mandarin Orange and Cranberry Apple in single-serve tubs with the mix-ins on top. Sandridge Food Corp. offers a Grilled Chicken and Fennel Salad; Reser’s has a Wild Rice Waldorf.

Superfruits are making their way into the gourmet meat case. Fabrique Délices introduced an all-natural pheasant sausage with goji berries. Balatoni Jus’s Fructa Salami from Hungary contains bits of apricot and has a fruit casing made of apricots, papaya, pear, and pineapple.

Flavor Gone Wild

When you talk about gourmet foods, it’s really all about unique flavors. For at-home gourmets, McCormick’s 2008 Gourmet Collection includes Lavender, Cocoa Chile Blend, and Toasted Sesame Seed; new peppers include Smokehouse and Worcestershire flavors. Saltworks offers Applewood and Chardonnay Smoked Sea Salts.

Sandwich dressings are another hot category. Deano’s Deli Bistro sandwich sauces come in Hot Ginger and Cilantro & Lime. Flavored olive oil spreads are also moving into the spotlight, as are chutneys. Baxters offers all-natural chutneys in Spanish Tomato & Black Olive and Cranberry & Caramelized Red Onion.

With outdoor grilling at an all-time high, rubs, marinades, and barbecue sauces are proliferating. Robert Rothschild Farm markets sauces in a variety of flavors from Plum Garlic to Harissa Moroccan and Tandoori Indian. Hot dip mixes such as Gourmet du Village Hot Parmesan & Artichoke are also coming on strong.

Flavors are also taking the snack scene by storm. Flavored nuts are hot. The Peanut Shop of Williamsburg offers Crab’in Nuts, Salsa, and B-B-Q Nuts. Umpqua Indian Foods introduced Indian-flavored jerky. Flavors also continue to infuse gourmet staples such as Honey Ridge Farms’ Balsamic Honey Vinegar.

--- PAGE BREAK ---

With gourmet food marketers often taking their cues from high-end restaurant chefs, it is important to note that fresh is the most frequent descriptor on fine-dining menus; it has nearly three times more mentions than the second claim, homemade. In descending order, other top claims include crispy, creamy, seasonal, crisp, house/house-made, prime, tender, garden-fresh, special, imported, and classic, according to Mintel Menu Insights (2008).

To create a healthy food halo, fine-dining restaurants are most likely to use an organic descriptor, followed by pesticide-free, natural, low-fat, naturally raised, lean, light, vegetarian, USDA-approved, cholesterol-free, milk-fed, low-calorie, and sugar-free (Mintel Menu Insights, 2008).

Natural Products Retailers

Retailers of natural products sold $17.4 billion worth of organic and natural foods in 2007; mass market sales of organic and natural foods totaled $12.4 billion. However, growth was faster in the mass market, up 15.2% vs 8.7% in natural products retailers (Rea/Spencer, 2008).

Produce remained the largest food category in natural products stores in 2007, with sales of $3.6 billion, up 8.8% over 2006, followed by packaged grocery products at $3 billion, up 7.7%; dairy $1.5 billion, up 11.1%; and frozen/refrigerated $1.4 billion, up 9.9%.

Among those categories with less than $1 billion in sales in natural products retailers, snacks at $846 million in 2007 grew 8.9%; fresh meat/seafood at $962 million was up 15.3%; beer/wine $665 million, up 15%; and non-dairy beverages, e.g., soy, rice, oat, $657 million, up 6% (Clute, 2008).

The four fastest-growing food categories in natural foods supermarkets were carbonated, functional, and RTD tea/coffee drinks, up 29.4%; pet food, up 21.9%, sweeteners, up 18.8%; and beans, grains, and rice, up 18.5% (Rutberg, 2008).

Organic food sales in natural products retailers hit $8.1 billion in 2007, up 11.3%. Produce was the largest organic category with sales of $2.6 billion in 2007, up 9.5% over 2006. Packaged grocery items posted sales of $1.7 billion, up 10.9%; dairy $1.1 billion, up 12.1%; non-dairy beverages $548 million, up 6.3%; and frozen/refrigerated meals/entrees $389 million, up 12.3% (Clute, 2008).

The top 10 fastest-growing organic categories in natural products retailers were pet food, with sales growth of 65.6%; carbonated, functional, and RTD tea/coffee beverages, up 59.2%; meal replacements/supplement powders, up 37.5%; sweeteners, up 27.9%; frozen/refrigerated meats, poultry, fish, up 26.8%; candy/individual snacks, up 26.1%; condiments, up 20.8%; nuts, seeds, dried fruits, trail mixes, up 20.8%; energy bars/gels, up 20%; and cookies/snack bars, up 19.7%. More than half of organic bread/baked goods (56%) and shelf-stable fruits/vegetables (52%) are still sold in the natural channel (Soref, 2008). According to the Hartman Group’s Organics 2008 Report, 42% of consumers now buy organic foods occasionally, 12% do so weekly, and 7% daily; 37% never purchase them. Among recent purchasers of organic foods, 71% bought them in the grocery store, 24% in a supercenter, 20% in a natural food store, and 10% in a club store (Hartman, 2008).

The benefits that consumers associate with organics are also changing. Hartman (2008) reports that the absence of pesticides, artificial flavors, colors, preservatives, and herbicides most define organics to consumers. However, 75% of consumers also cite the absence of growth hormones, 69% cite the absence of antibiotics, and 67% the absence of genetically modified organisms (GMOs).

Two-thirds (65%) of consumers say they’re willing to pay a premium of more than 30% for organic meat, poultry, and deli meats. A total of 64% are willing to do so for fresh fruit, 61% for milk, 61% for fish/seafood, 60% for fresh vegetables, and 60% for eggs (Hartman, 2008).

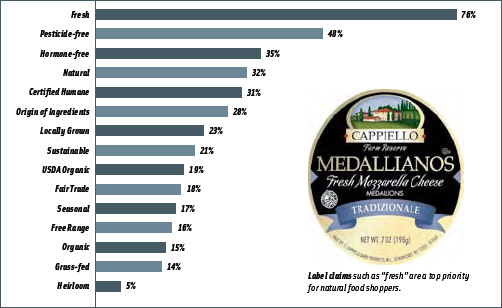

When selecting foods and beverages, fresh still tops the list of the most important food labels or phrases for three-quarters (76%) of consumers (Hartman, 2008). As seen in Figure 1, pesticide-free and hormone-free are now more important than a natural food claim.

Products that are of high quality have always fared well in the marketplace, and so will specialty foods. Moreover, the gap between national branded prices and fancy foods is narrowing. Perhaps, if history repeats itself, consumers won’t feel guilty for spending extra dollars on foods and beverages they really enjoy.

by A. Elizabeth Sloan, a Professional Member of IFT and Contributing Editor of Food Technology, is President, Sloan Trends Inc., 2958 Sunset Hills, Suite 202, Escondido, CA 92025 ([email protected]).

References

Clute, M. 2008. Retailers respond to turning tide Natural Foods Merchandiser. XXVII(6): 22-24.

Experian. 2007. Simmons Consumer Research Study. Nov. Experian Research Services, New York, N.Y. www.experianconsumerresearch.com.

FMI. 2008a. U.S. grocery shopper trends 2008. Food Marketing Inst. Crystal City, Va. www.fmi.org.

FMI. 2008b. FMI Speaks 2008.

Hartman Group. 2008. Organics 2008 Report. June. The Hartman Group, Bellevue,Wash. www.hartmangroup.com.

IRI. 2008. Consumer Trend Watch 2008. Times & Trends. Feb.

Mintel. 2008. NASFT: state of the industry report—the market 2008. Mintel International, Chicago, Ill. www.mintel.com.

Mintel Menu Insights. 2008. Gourmet descriptors in fine dining restaurants. 1st Quarter 2008. Menu Insights, Mintel International.

NBJ. 2008. Organic markets overview. Nutrition Business Journal. March/April. 1, 3-46. www.nutritionbusiness.com.

NPD. 2008. Year round BBQ grilling at all-time high. Press release. May 16, 2008. NPD Group, Port Washington, N.Y. www.npd.com.

Packaged Facts. 2007. Gourmet, specialty, and premium foods and beverages in the U.S. Nov. Packaged Facts, New York, N.Y. www.packagedfacts.com.

Rae, P., and Spencer, M. 2008. NFM’s Market Overview. Natural Foods Merchandiser. XXVII(6): 1.

Rutberg, S. 2008. Customers roll over for healthy pet treats and toys. Natural Foods Merchandiser XXVII(6): 40-42.

Schoenfeld, B. 2005. Emeril’s empire. Cigar Aficionado. Nov.

Soref, A. 2008. Move over Goldfish—natural kids’ snacks are in the house. Natural Foods Merchandiser XXVII(6): 46.

Technomic. 2008. Consumers report trading out dining occasion. Am. Express Market Brief. March. Technomic Inc., Chicago, Ill. www.technomic.com.

Tanner, R. 2007. Today’s specialty food consumer. Specialty Food Magazine 37(10): 49-64.

Tanner, R. 2008. The state of the specialty food industry. Specialty Food Magazine 38(4): 34-48.