Top 10 Food Trends of 2021

COVID-19 has driven changes in how we eat, shop, work, and play that will offer new opportunities for food product developers.

Article Content

Product innovation moved to the back burner in the past year as food and beverage companies focused on keeping their businesses operational in the midst of a pandemic while restaurants fighting for survival all but abandoned their role as drivers of culinary innovation.

In 2020, new food and drink line extensions plummeted by 29% versus the prior three-year average in multi-outlet retailers and convenience stores, per an innovation report from IRI. (Multi-outlet retailers include grocery, drug, mass merchandisers, Walmart, club, military, and dollar stores.)

The number of truly new brand introductions in 2020 was only slightly lower than in 2019, however, due to a surge in very small food companies, including some formerly internet-only operations, seizing opportunities for growth in the chaotic pandemic marketplace. Small and very small manufacturers drove as much dollar growth—$29 billion—as large players for the year ended Dec. 27, 2020, and they increased their share of beverage, alcohol, frozen food, center store, breakfast, and snack sales, according to IRI.

The importance of breakthrough innovation is not lost on big food companies. Major players, including General Mills, Coca-Cola, Kraft Heinz, Danone, and Kellogg’s, have announced changes to refocus and accelerate their new product innovation programs for 2021, while moving to improve efficiencies by eliminating poorer performing stock-keeping units (SKUs). Kraft Heinz expects to have 20% fewer SKUs by the end of 2021, and Mondeleˉz International will cut back by 20% as well, executives told analysts at the February Consumer Analysts Group of New York Annual Conference.

Meanwhile, restaurant operators remain challenged. One-third say they plan to reduce the number of items on their menus in 2021, according to Datassential.

It’s time to rev up the product innovation engine. Consumers are demanding it: Datassential notes that three-quarters of U.S. adults say they are looking for new food and beverage ideas in 2021.

This year’s top 10 food trends analysis offers a road map for focusing product development initiatives. To win in the current marketplace, product developers must innovate around the new macro trends of self-care, disease prevention, home-centered living, and creative ways of celebrating special occasions. It will also be important to keep pace with the emerging narratives in planetary and societal care and to focus on high-potential cohorts, especially millennials and high-income households. Meanwhile, longstanding macro trends, including indulgence, convenience, plant-based eating, and health/wellness, will continue to be market drivers. Because at-home cooking and on-the-go needs will further evolve during the next few years, product recipes/cooking instructions and more focused online search terms will become increasingly important to consumers.

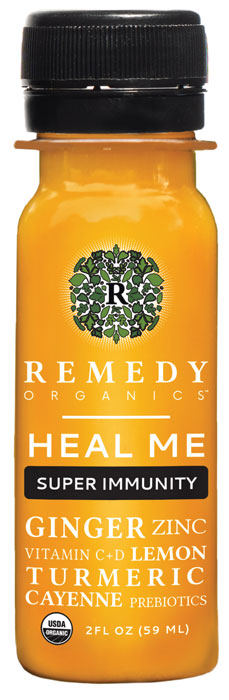

1. Rx Food

Consumers have turned to food to help manage and treat conditions. For the period from May to October 2020, sales of foods and beverages that help control hypertension grew 11%, weight control products were up 13%, and diabetes care product sales climbed by 14%, according to IRI’s innovation report.

Products touting an immunity/antioxidant or a botanical/oil claim each rose 12% for the year ended Dec. 27, 2020, IRI reports, and those carrying a nutrient claim grew by 10%. One-third of adults were more likely to buy a food or drink with multiple health benefits.

Nearly half of consumers would like more functional foods for managing stress and anxiety. Other top concerns include sleep/rest, hydration, bone/joint health, brain function, cholesterol management, eye health, skin/hair/nails, and energy, according to a functional foods report from the Hartman Group. One-third of consumers seek functional foods for mood enhancement, anti-inflammation benefits, and detox, per Hartman.

Dark green vegetables are the most sought-after fortification for functional foods, followed by fiber, antioxidants, probiotics, omega-3s, and superfruits, according to Hartman. Citrus fruits, dark leafy greens, superfruits, broccoli, tea, garlic, nuts, root vegetables, fish, and yogurt are the foods consumers most associate with immunity, per Datassential.

Fermented foods top the list of trendy superfoods for 2021, according to an annual nutrition survey from Pollock Communications; blueberries, green tea, exotic fruits, seeds, avocado, spinach, kale, nuts, and salmon are also trending. A HerbalGram market report shows that horehound, echinacea, elderberry, turmeric, cranberry, ivy leaf, ginger, garlic, CBD, and green tea lead sales of botanicals in the mass market.

Market Movers

• Chobani Complete Advanced Nutrition Yogurt touts protein completeness, enhanced digestibility, and the presence of all nine essential amino acids.

• Nestlé’s Natural Bliss plant-based coffee creamers deliver oat-based prebiotics, pea protein, and coconut oil with MCTs (medium-chain triglycerides).

• Bel Brands USA’s new Babybel Plus+ Probiotic and Babybel Plus+ Vitamins are among the first nutraceutical snacking cheeses.

• Herbalife Nutrition has introduced a Protein Baked Goods Mix for healthier baked goods.

• Ready-to-drink Tazo Calm tea is available from Unilever.

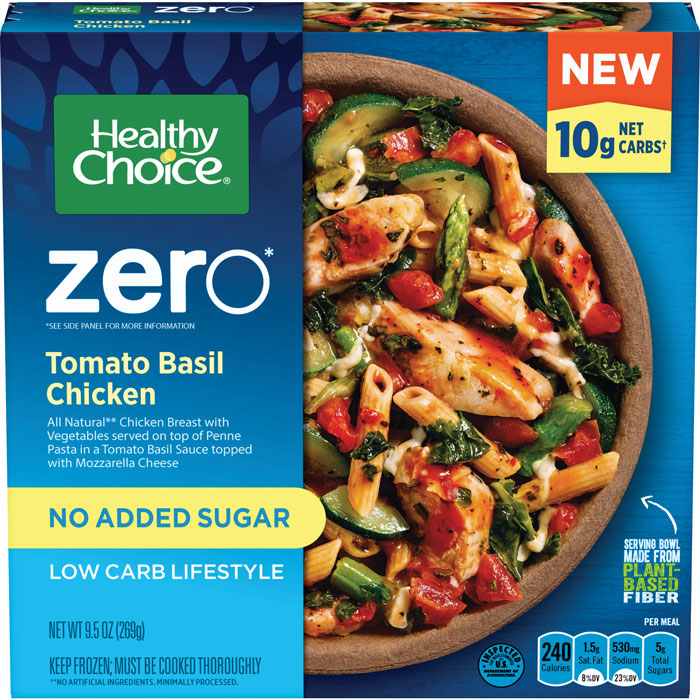

2. Alternative Formulations

Increasingly, consumers are seeking alternative food and beverage formulations that help them avoid unwanted ingredients and/or perceived allergens. They’re tapping into specific diet plans in order to align their food and beverage choices with personal nutritional or ethical goals.

Dollar sales of foods and beverages carrying a “lifestyle” diet claim grew 13% for the year ended Dec. 27, 2020, per the IRI innovation report. Sales of foods with a low-carbohydrate positioning reached $136.9 million; ketogenic, $68.5 million; paleo, $56.9 million; the Whole30 Diet, $54.2 million; and low-glycemic, $19.3 million.

Just over one-third of adults are currently following a flexitarian eating plan, 5% are true vegetarians, and 3% each are true vegans or pescatarians, per Packaged Facts. One-third of mainstream adult eaters are interested in vegetarian or vegan fare, says Datassential.

Products promoting benefits related to allergens and/or intolerances grew 13% in dollar sales, per IRI. One-third of consumers are trying to manage or treat a real or perceived food allergy, Hartman reports.

Sales of foods positioned as clean label or non-GMO each grew 12%, per IRI. The International Food Information Council (IFIC) reports that four in 10 consumers try to avoid GMOs, and one-quarter avoid bioengineered foods.

Six in 10 consumers look for minimally processed foods. Only 9% of adults are looking forward to seeing more lab-grown proteins in 2021, according to Datassential.

Market Movers

• Partake Foods’ multipurpose baking mix does not contain any of the big eight allergens and is gluten-free.

• NestFreshintroduced Free-Range Non-GMO eggs.

• That’s it fruit barsare non-GMO, vegan, gluten-free, and free from the top 12 food allergens.

• Coconut Whisk Chocolate Chip Cookie Mix is vegan and gluten-free.

•The trend to grain-free continues. Nature’s Path Grain Free Hot Cereal is also paleo friendly.

• Longève Breadless Crumbs deliver7 grams of pea protein per serving and are gluten-free.

3. The Kid Continuum

With pandemic constraints keeping kids tethered to their homes, households with kids have never offered a greater diversity of new food/beverage market opportunities. Adding to the opportunities is the fact that as a result of COVID, more young adults have taken up residence in their family homes—at least for now.

As of January 2021, 55% of school-aged children and 61% of teens were still learning remotely, according to data presented in a webinar by IRI’s Sally Lyons Wyatt. Only one-third of college students were living away from home. And the Pew Research Center reports that as of July 2020, half (52%) of those aged 18–29 were living with a parent.

Smoothie bowls, ramen noodles, savory pancakes, s’mores, cookie dough, and mochi are among Gen Z’s favorite foods, according to Datassential. Slushies, boba, iced lattes, horchata, and peanut butter shakes are their favorite beverages.

One-quarter of those aged 18–24 eat meat alternatives. They are the most likely to be on the paleo, Whole30, or a lactose-free/dairy-free eating plan, per FMI. Six in 10 choose foods with health benefits; half want foods that are unique. Stress, tiredness/energy, sleep, and mental sharpness are their top health concerns, per HealthFocus.

Half of families make separate meals for their kids often or sometimes when eating together, per FMI. Nearly two-thirds of family households increased their frozen food purchases in 2020, peaking among those with kids aged 7–12. Dinner drove frozen food purchases for 77% of parents; lunch, 59%; snacks, 48%; breakfast, 46%; desserts, 31%; and beverages/smoothies, 15%, per the American Frozen Food Institute (AFFI).

Lyons Wyatt reports that one-third of moms are treating their family more often, serving up special meals and desserts. Four in 10 households are snacking more.

Members of households with kids are more likely than those without kids at home to say it is important to eat fortified foods (66% versus 53%), per HealthFocus. For the year ended Nov. 29, 2020, sales of vitamins/minerals for children jumped 34%, according to SPINS. An immune boost was the top reason for increased use.

Per the Dietary Guidelines for Americans, vitamin D, calcium, dietary fiber, and potassium are the nutrients of public health significance deficient in children aged 1–8. Nutrients underconsumed but not a public health issue include vitamins A, C, E, K, magnesium, and choline.

While the anticipated COVID baby boom did not take place, with 30% of families delaying planned pregnancies during the pandemic, per the Brookings Institution, babies remain big business. Baby foods were the fastest-growing frozen items for the year ending Oct. 4, per IRI.

Market Movers

• Gerber’s meals for toddlers now include a Mashed Potatoes & Gravy with Roasted Chicken variety.

• Horizon Organic’s Growing Years Milks deliver DHA omega-3, choline, and prebiotics as well as protein and calcium.

4. Global Modifications

One-third of consumers are looking forward to trying new global foods and/or flavors this year, and 42% seek out spicy foods, according to Datassential.

Japanese was the fourth most eaten global cuisine for the three months ending in August 2020, per flavor company T. Hasegawa. It was followed by Greek, Thai, Latin other than Mexican, Middle Eastern, Indian, and Korean. Southern Italian is the global regional cuisine U.S. consumers have most often “tried and liked,” followed by Sicilian, Tuscan, Szechuan, and Oaxacan fare, according to T. Hasegawa. Consumers rank Japanese and Mediterranean as the healthiest cuisines, followed by Thai, Korean, Chinese, Indian, and Caribbean, per Datassential.

Two-thirds of adults buy frozen foods to try a new cuisine, according to AFFI. Both Conagra Brands and Good Food Made Simple have added a global flavor to some of their products. Conagra’s Evol Vitalized Be Energized bowl meal is topped with a tahini and feta sauce, and Good Food Made Simple adds a tangy touch to breakfast with its Tomatillo Salsa Verde Scramble Bowl.

Spicy Asian sauces, along with furikake, shiso, miso, sambal, aji amarillo, piri piri, salmoriglio/agliata, chamoy (made from pickled fruit), and chintestle (a smoked chile paste), can be expected to move mainstream.

Substituting global look-alikes—Indian kheer for rice pudding, Chinese rou jia mo sandwiches for traditional burgers, and Italian panzerotti for a new twist on popular handheld pocket meals—will remain a very strong trend. Ethnic stews and ragus are well suited for slow cookers.

Market Movers

• CLO-CLO Vegan Foods introduced new frozen Caribbean, Moroccan, and Tuscan pizzas.

• Fifth Taste Foods brought oo’mämeˉ Chile Crisp spicy umami condiments in Szechuan, Mexican, and Moroccan flavors to market.

• Saffron Road brings flavor from around the globe to its line of simmer sauces and on-the-go meal pouches in Chickpea Masala and other flavors.

• Zelo’s Greek Cuisine Classics spice blends include Greek Shepherd’s Souvlaki + BBQ and Greek Granny’s Tzatziki mixes.

• Fazlani Foods introduced hummus in Peri Peri and Black Olives varieties.

5. Planetary Transparency + Societal Care

Products with origin claims (e.g., “made in the USA,” “artisanal,” or “local”) posted the highest dollar sales growth among foods/beverages carrying a benefit descriptor for the year ended Dec. 27, 2020, according to IRI’s innovation report. “Real ingredients” was the most sought-after descriptor on frozen foods, per AFFI.

Claims supporting societal care (e.g., “B-corporation,” “eco-friendly,” or “fair trade”) grew 14%. One-quarter of consumers say knowing where their food comes from is very important, according to IFIC.

Foods touting humane treatment of animals grew 21%, ethical claims were up 19%, and recyclable claims climbed by 12%. Packaged Facts reports that six in 10 consumers are more concerned about humane treatment of animals than they were two years ago.

Expect a new trend of hydroponic production with labeling as “regionally grown produce.” Fresh herbs and salad kits from Living Greens Farms are dual labeled “indoor grown” and “Midwest local produce.” Pictsweet Farms has added “100% grown on American soil,” which 87% of consumers say they prefer. Hartman reports that half of consumers are aware of/interested in regenerative agriculture.

Upcycled ingredients are also grabbing attention among consumers concerned about food waste. Renewal Mill uses organic okara, oat milk, and sunflower cake flours in its upcycled baking and cookie mixes.

Nearly a third (30%) of U.S. consumers believe that the pace of climate change will increase in 2021, according to Ipsos. While one-quarter of consumers think that animal agriculture has some impact on the environment, only 10% believe it has “a lot of negative impact,” according to FMI. Humane treatment of animals and regenerative agriculture resonate with consumers, but they are not strong purchase motivators unless a product satisfies other top consumer priorities (e.g., taste).

Market Movers

• Maple Leaf Foods is labeling its Lightlife and Field Roast Grain Meat Co. brands as “carbon zero.”

• Panera advertises that its Cool Food Meals “come with a lower carbon footprint.”

6. A New Crop of Plant-Based Foods

Sales of foods and beverages positioned as plant-based reached $5.6 billion in multi-outlet, specialty, and natural channels, up 29% for the year ended Dec. 27, 2020, according to SPINS.

Sales of alternative meats and poultry are projected to grow from $1.3 billion in 2020 to $2.0 billion by 2024, per a Packaged Facts report on alternative meat. Beef, followed by pork and chicken, will be the largest categories, enjoying yearly double-digit growth. Sales of alternative seafood will reach $62 million by 2024.

Plant-based dairy will grow from $4.3 billion to $5.2 billion by 2024, according to a Packaged Facts alternative dairy product report. Milk, followed by ice cream, yogurt, creamers, and cheese will be the largest categories; spreads, dips, sour cream, sauces, and cheese will have double-digit growth. Sales of egg alternatives will reach $50 million by 2024.

One-quarter of adults eat plant-based meat or poultry. Millennials, Gen Z, members of upper income households, urbanites, and those with kids at home are most likely to do so. Forty-two percent use plant-based milks; 9%, ice cream; 8%, creamers; 8%, yogurt; 7%, butter; and 5%, cheese.

Plant-based product consumers are foodies, three-quarters enjoy cooking, and 69% regularly seek new products to try, per Packaged Facts. Ener-G’s Egg Replacer is well positioned for the half of plant-based product users who enjoy home baking.

Seven in 10 adults want more frozen meal options that contain fruits and/or vegetables; 58% want more plant-based carb/starch alternatives (e.g., riced cauliflower); 52% want more blended meat/vegetable items; and 51% seek more plant-based entrées, per AFFI.

Lunch, snacks (beyond chips), and desserts are untapped alternative opportunities. Think Gardein plant-based soups, Fresh Cravings nut-based dips in varieties like Kickin’ Queso, and Boomerang’s plant-based Australian meat pies.

Plant-based marketers need to close the nutrient parity gap, provide instructions and/or recipes for optimal preparation and cooking, and pursue cleaner labels.

Market Movers

• Plant-based ground veggie dinner mixes from Urban Accents come in Korean BBQ and Street Taco varieties.

• Haven’s Kitchen plant-based sauces include a Red Pepper Romesco variety.

•Danone’s Silk Ultra with 20 grams of complete plant protein is targeted for muscle performance, maintenance, and repair.

7. Coping With Kitchen Burnout

The high level of cooking engagement seen earlier in the pandemic gave way to cooking fatigue and time pressures later in the year. According to a Hartman report, 26% of all dinners in 2020 involved heavy preparation, up 3% versus 2019; 27% of lunches included moderate preparation, up 6% versus 2019.

Sales of value-added fresh preseasoned and precooked meat and poultry, up 29% during the pandemic, per FMI’s meat report, will continue to grow. Infused meats (e.g., Hormel Black Label Premium Ranch Thick Cut Bacon) and those involving sous vide technology are among the innovative new offerings.

Frozen ready-to-use meal components and ingredients like Expresco’s seasoned fully cooked Grilled Chicken Breast Skewers and Pacific Seafood’s raw shrimp in Honey Jalapeno and Scampi flavors will be in high demand.

Over half (55%) of households bought frozen side dishes more than twice a week last year, per AFFI. Side dishes were the fastest-growing fresh prepared food category for the year ended Jan. 27, 2021, according to the International Dairy Deli Bakery Association (IDDBA), up 8.8%. Stuffed items like Bantam Bagels’ pretzel bagels stuffed with cheddar Dijon cream cheese and Rösti Melted Swiss Raclette Crispy Filled Potatoes are tempting consumers.

Six in 10 restaurant operators that are offering meal kits and take-and-bake casseroles will continue to do so post-pandemic, per Datassen-tial. Tyson Instant Pot Creamy Chicken & Noodle Casserole Kit is right on target.

Frozen sandwiches are fast-emerging lunch solutions. Devanco Foods introduced Gyros Sandwich Kits and Schwan’s Consumer Brands unveiled a Red Baron Pizza Melt sandwich.

For convenience-seeking dessert lovers, thaw-and-serve frozen cookies like Feed Your Soul’s Drivin’ Me Coconuts cookies and “no bake” cookie kits are an untapped opportunity.

Market Movers

• The Green Giant brand has added several veggie combos made with Dash salt-free seasoning to its Simply Steam frozen veggie lineup.

• Lundberg’s quick-cooking Traditional Italian Risotto mixes require minimal stirring.

• Single-serve Philadelphia Cheesecake Crumble comes in four varieties.

• Laughing Cow & Go portable cheese and breadstick snack cups add a snackable dimension to the spreadable cheese brand.

8. Everyday Specials

The demand for more premium/specialty foods to create restaurant-style meals and coffee shop experiences at home continues to grow. Moreover, with movie/date nights, social entertaining, gaming, and special occasion celebrations now centered around the home, the demand for entertainment-worthy foods will be stronger still.

Lyons Wyatt of IRI reports that Mexican foods, wine, beer, spirits, frankfurters, cheese, spaghetti sauce, energy drinks, and candy were among the foods experiencing greater premiumization as the pandemic wore on.

Demand for fresh fish/seafood was up 39% in January 2021 versus a year earlier, according to IRI’s Consumer Demand Index. Frozen Annasea Authentic Hawaiian Poke Kits and AquaStar Shrimp Ramen MicroSteam Bowls will make any day a special occasion.

Specialty, pre-sliced, and grab-and-go cheeses each enjoyed sales growth of more than 20% for the year ended January 25, 2021, per IDDBA. Rumiano Cheese Co.’s Redwood Coast Wild Arabian Nights Monterey Jack cheese includes Za’atar seasoning.

Brooklyn Cured’s salamis are inspired by cocktails; the lineup includes a pork salami chub that evokes a classic Manhattan cocktail with bourbon and a maraschino cherry garnish.

Grab-and-go deli meat sales growth topped 50.7% for the year ended January 25, 2021, pre-sliced deli meat sales were up 27.1%, per IDDBA. Fiorucci’s new Italian Chorizo Cantimpalo is perfect for antipasto.

Charcuterie boards now include breakfast, dessert, candy, and fruit combinations. The Roth Easy Entertaining Cheeseboard features three varieties of cheeses, a bamboo cheeseboard, and wooden cheese markers.

Sales of upscale appetizers such as The Fillo Factory Bacon Wrapped Wagyu Beef & Gorgonzola Skewers are on the rise, according to the Specialty Foods Association.

Refrigerated desserts grew in dollars, volume, and units for the year ended Jan. 25, 2021, according to IDDBA.

Market Movers

• Act II microwave popcorn comes in a Mac & Cheese variety.

• Orville Redenbacher’s Pop Kit with Movie Theater Butter is perfect for family movie nights.

9. Winning Combinations

With four in 10 meal preparers looking for unique foods and ingredients when preparing meals, per FMI’s grocery shopper cooking report, products that combine unexpected foods, flavors, and even dayparts are a very big idea.

Consumer interest in having plant/meat blends in the meat case (76%) exceeds the level of interest in meat alternatives (62%), per FMI’s meat report. Applegate Well Carved Organic Asian Style Meatballs pair pork and veggies and deliver ¼ cup of vegetables per serving. Mexican restaurants, including QDOBA Mexican Eats, are actively adding meat alternatives to their menus.

Nearly one-third of consumers think that fusion foods such as Korean tacos are a good way to try new international flavors, per T. Hasegawa. Foods are doing double duty as flavors. SeaPak introduced Everything Bagel Butterfly Shrimp. The Safe + Fair Food Co. offers Dill Pickle Seasoned Popcorn, and Arizona Beverages has rolled out Arnold Palmer Half & Half Fruit Snacks.

Kellogg’s cereals (e.g., Froot Loops), star as flavors in Nestlé’s nutritional meal replacement drinks. Post Cereal’s single-serve cereal snack packs are ready to munch throughout the day.

American regional preparations, including Pizza Hut’s Detroit-style Pizza, have met with great success. Regional barbecue sauces, such as Alabama’s white or Carolina’s mustard and vinegar–based varieties, are an overlooked market opportunity.

A mix-and-match approach in which technologies traditionally associated with one product category are applied to a new and different category is a hot trend for 2021. Think whipped milks and coffees and fermented honey.

Brand crossovers have strong marketplace potential. Bush’s Bean Chips have been well received. And the Sonic restaurant chain has partnered with Conagra Brands to bring its Chili Cheese Coney flavor to the meat sticks category under the Slim Jim label.

According to Datassential’s Flavor Database, only 19% of consumers have tried trendy mashups like chaffles, which are waffles made of cheese and eggs.

Market Movers

• Laughing Cow Blends combine spreadable cheese with beans, chickpeas, or lentils.

• Strong Roots switched out potatoes in its Cauliflower Hash Browns.

• MOR snack mixes contain dried cheese along with nuts and fruit.

• SNAX-Sational Brands’ Candy Pop snacks pair popcorn with popular candy brands.

10. Four-Legged Family Members

Expect 2021 to be a blockbuster year for the pet food (including functional pet food) and supplement businesses. Sales of pet foods and treats reached $39 billion in the United States in 2020, per the American Pet Products Association (APPA).

Pet supplement sales jumped 21% in 2020 to $800 million and are projected by Packaged Facts to top $1.2 billion by 2025. Pet CBD product sales are fast approaching $100 million.

U.S. residents aren’t the only pet lovers. European pet food market sales topped $23 billion in 2020, per APPA. Pets food sales in China are projected to reach $24.5 billion by 2024.

Nearly two-thirds (63%) of U.S. households own at least one dog and 43% have at least one cat, per Packaged Facts. One-quarter of dog owners and 21% of cat owners added another dog or cat to their household during 2020.

In addition, since the pandemic began, four in 10 dog owners and 42% of cat parents say they are paying more attention to their pet’s health. Immunity and anxiety top their pet health concerns.

Functional food/functional pet treats are poised to compete with pet supplements. One-third of owners say they are willing to spend more for food with extra health benefits. Supplements for joint health/mobility lead the list of most purchased pet supplements, followed by multi-vitamins and supplements for skin/coat and immunity.

Watch for more human-grade and fresh pet foods and superfoods as well as the use of exotic/novel proteins and alternative grains in formulations. The U.S. Food and Drug Administration’s most recent results of an investigation into canine dilated cardiomyopathy failed to show a link with grain-free foods. The focus in the future may be on digestibility and taurine status.

Meat/poultry as the first ingredient, grain free, limited ingredient, high omega-3, probiotic, antioxidant, and allergy formulations are currently the most popular ingredient-driven formulation trends.

Market Movers

• Nulo Challenger hearty stews for dogs are human grade and paleo inspired.

• Plato Pet Treats Thinkers sticks are meat sticks and include a variety made with New Zealand lamb with EPA and DHA for brain, skin, and coat benefits.

REFERENCES

APPA. 2021. Data and Statistics. American Pet Products Assoc., Stamford, Conn. americanpetproducts.org.

Brookings. 2020. Report: Half a Million Fewer Babies? The Coming Baby Bust. June. The Brookings Institution, Washington, DC. brookings.edu.

CAGNY. 2021. Consumer Analysts Group of New York Annual Conference. Feb. 16–19, Boca Raton, Fla.

Datassential. 2021. “Trending Upward.” Webcast, Feb. 19. Datassential, Los Angeles. datasssential.com.

Datassential. 2021. FB FoodBytes Trend Forecast Issue.

Datassential. 2021. “Simply Smarter.” Webcast, Jan. 21.

FMI. 2020. The Power of Meat Mid-year Report. Food Marketing Institute, Alexandria, Va. fmi.org.

FMI. 2020. U.S. Grocery Shopper Trends: Cooking.

Hartman. 2019. Health + Wellness 2019: From Moderation to Mindfulness. The Hartman Group, Bellevue, Wash. hartman-group.com.

Hartman. 2020. “Functional Food and Beverage & Supplements.” Webcast, Sept 2.

Hartman. 2021. Eating Occasions. Jan.

HealthFocus. 2019. USA Consumer Survey. HealthFocus Intl. St. Petersburg, Fla. healthfocus.com.

HerbalGram. 2020. “Market Report: U.S. Sales of Herbal Supplements.” 127 (Aug.-Oct.): 54–67.

IDDBA. 2021. “COVID-19 Impact.” Webcast, Feb. 16. International Dairy Deli Bakery Assoc., Madison, Wis. iddba.com.

IFIC. 2020. Food & Health Survey. International Food Information Council, Washington, D.C.

foodinsight.org.

Ipsos. 2021. “Personal Concern and Expectations About 7 Key Issues in 2021.” Ipsos, Paris. ipsos.com.

IRI. 2021. Innovation for a Post-Pandemic World. Feb. IRI, Chicago. iriworlwide.com.

Lyons Wyatt, S. 2021. “Consumer Trends: BakeryTech.” Webcast, Feb. 17.

Packaged Facts. 2020. Meat, Poultry and Seafood Alternatives. Oct. Packaged Facts, Rockville, Md. packgedfacts.com.

Packaged Facts. 2020. Plant-based Dairy Products. Dec.

Packaged Facts. 2020. Pet Food and Pet Food Consumer Trends. July.

Packaged Facts. 2021. Pet Supplements. Jan.

Parker, J. and B. Moreles. 2021. “Fresh Produce in 2020 and Beyond.” Webcast, Feb. 24.

Pew. 2020. 2020 Survey of the Current Population. Pew Research Center, Washington, D.C. pewresearch.org.

Pollock. 2021. What’s Trending in Nutrition, Jan. Pollock Communications, New York, N.Y.

pollockpr.com.

SFA. 2020. “Understanding Category Trends & Consumer Insights.” Webcast, June 2. Specialty Foods Assoc., New York, N.Y. specialtyfoods.com.

SPINS. 2021. Immunity Focus Continues: Plant-based. Jan. SPINS, Chicago. spins.com.

T. Hasegawa. 2021. Regional and International Flavor Flash. Jan. T. Hasegawa USA, Cerritos, Calif. thasegawa.com

USDA/HHS. 2020. 2020–2025 Dietary Guidelines for Americans. U.S. Dept. of Agriculture and U.S. Department of Health and Human Services, Washington, D.C. dietaryguidelines.gov. FT