Center Store Moves Center Stage

As pandemic restrictions ease and more consumers begin to eat outside the home, convenient, restaurant-quality, and seriously healthy fare will be critical for maintaining center-store sales momentum.

Article Content

COVID-19 stay-at-home behavior in 2020 had a devastating impact on the foodservice sector, but for marketers of pantry staple products—both shelf-stable and frozen—it was a catalyst for unprecedented sales growth. IRI statistics for the pandemic 26-week period ended Oct. 4, 2020, versus the same period a year ago, tell the story: During those months, the dry grocery and frozen food departments combined added nearly $17 billion to multi-outlet retailers’ bottom lines. (Multi-outlet includes sales in grocery, drug, mass market, military, and dollar stores.)

The challenge now for retailers and food companies will be to maintain that momentum. Focusing on three key tactics—upgrading everyday fare, doubling down on convenient meal solutions, and tapping into the “food as medicine” mindset—will be critical success strategies.

As of mid-October, eight in 10 meals were still prepared at home. Over half of working adults and school-aged children worked/schooled remotely. Grocery trips were less frequent than a year ago; basket size remained above average, according to IRI.

Thus, in the near term, center-store sales are expected to continue to show strength, particularly for easy dinners, breakfast fare, new forms of snacks, kids’ meals, and baking/seasoning ingredients. Now is the time for action as it will take some time for product development. Center-store brands should reposition to deliver the contemporized meal solutions and more-sophisticated product assortments that will attract millennials, Gen Z adults, and high-income households—those segments most likely to return to dining out behaviors when it is safer to do so. Better targeting the condition-directed, more aggressive health demands of baby boomers will also be essential.

The timing of widespread inoculation with COVID-19 vaccines will impact future center-store performance. The longer it takes for the general population to be vaccinated, the more sales of center-store grocery merchandise will likely grow this year. Assuming widespread vaccination by June 2021, IRI projects 2021 omnichannel sales of edibles will increase 10.1% versus a year ago; with widespread vaccination not taking place until December 2021, sales growth is projected at 12.4%. (Omnichannel includes multi-outlet sales + sales in convenience stores, Costco, and e-commerce.)

Let’s take a look at three ways for food and beverage marketers to win in a post-COVID world.

1. Mainstream Premiumization

Months of in-home culinary exploration, elevated cooking skills, and a pent-up demand for restaurant meals are driving a new mainstream, mass market premiumization opportunity for everyday fare.

Despite pandemic-triggered financial pressures, consumers are buying more premium foods. Low-income households are splurging on small food indulgences at the same rate as others, according to IRI. In fact, the Specialty Food Association has increased its projection for 2020 specialty food sales upward and forecasts year-over-year sales growth of 16.5%.

Millennials, Gen Z adults, Asians, Blacks, and low-income consumers are twice as likely as others to buy more premium foods to create restaurant-style meals at home or to mimic coffeehouse specialty drinks, IRI reports. Pasta sauce, frozen meals/entrées, frozen meat, bottled water, Mexican foods, sports/energy drinks, coffee, ready-to-drink tea/coffee, frozen breakfast food, and nonchocolate candy are the center-store categories that have experienced the greatest premiumization since the pandemic, per IRI.

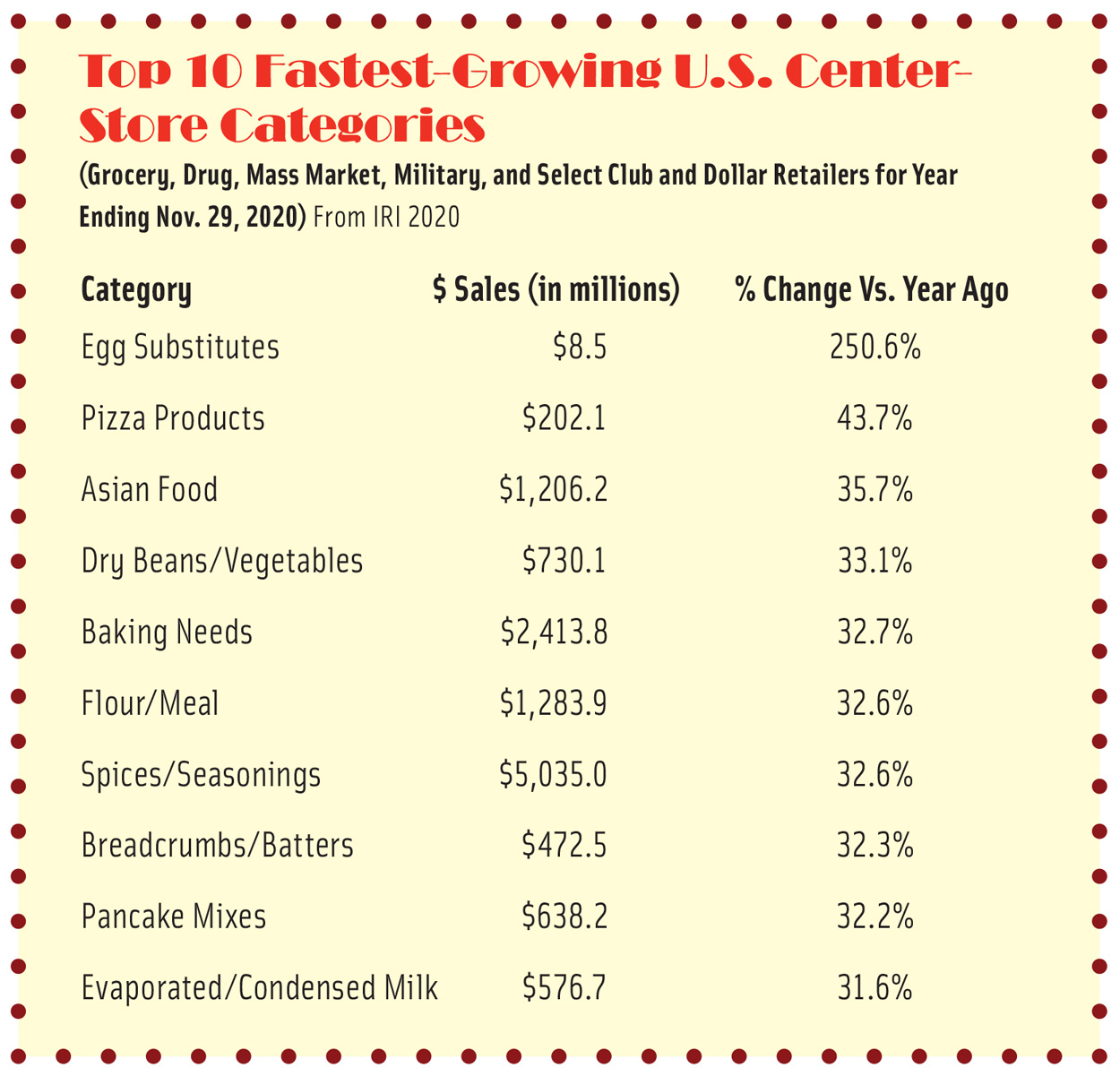

In an apparent bid to capitalize on the growing premiumization trend, marketers of Classico pasta sauces created an upscale companion brand called Riserva. Sales of other sauces, including barbecue and Mexican, syrups, gravies, mustards, ketchup, mayonnaise, pickles/relish, vinegars, and oils, all grew more than 20% for the 11-month period ending Nov. 29, 2020, versus the same period a year ago, according to IRI. Sales of spices/seasonings grew 33%.

With Asian center-store food sales up 35.7%, Mexican product sales up 22.8%, and frozen Asian meal sales up 51.5%, for the 11 months ending Nov. 29, 2020, per IRI, an expanded multicultural regional assortment will be another ticket to center-store growth. Lee Kum Kee’s new ready-to-eat gourmet Rice and Noodle Bowls include Chinese Style Dan Noodles, Hong Kong Style Chow Mein, and Peruvian Style Fried Rice. Happi Foodi’s frozen handheld street foods such as Carnitas Street Tacos are right on target for culinarily curious millennials.

Plant-based options like Sweet Earth Bulgogi or Paesana Bolognese Sauce made with Beyond Meat plant protein target those seeking meatless cultural cuisine options. Nissin’s new Hot & Spicy Fire Wok cup noodle line features a Molten Chicken Chili variety. And Lucky Foods’ Korean Style Pancakes are a new snack or appetizer option.

The center-store bakery aisle has a chance to take a bite out of perimeter bakery sales. Sales of fresh breads and rolls sold in the center store climbed by 12.9% for the 11-month period ending Nov. 29, 2020, per IRI. Once considered exotic, croissants, biscotti, and scones have become everyday fare. To support the global trend to open-faced handheld sandwiches, retailers should offer unique bread products. Other value-added bakery products and mixes with potential include French beignets, pretzel bread, Italian cornetto, and Mexican pan dulce breakfast pastries and tres leches cake.

In addition—and likely in response to the pandemic-prompted surge in home baking—specialty baking ingredients such as Mexican vanilla and unique flours, including cassava, hazelnut, and potato, are grabbing customer attention. Sales of baking needs products and meal/flour grew 32.7% and 32.6%, respectively.

Restaurant-branded retail offerings and chef-inspired fare will continue to command a premium price. The Panera Bread at Home line now includes signature packaged sliced breads, salad dressings, and coffee. Cinnabon has entered the frozen breakfast market, and Auntie Anne’s At Home Classic Pretzel Dogs target the lunchtime eating occasion.

2. Easier Eats

With more than eight in 10 family households aiming to eat meals together more often post-pandemic, it is time to make home cooking easier and a lot more fun. Fully prepared frozen or precooked meal components that enable quick “mix and match” meal assembly are well positioned to compete with fresh prepared side dishes and entrées, up 22% and 15%, respectively, for the pandemic 26-week period ended Oct. 4, 2020, per IRI. And with more than half of U.S. households now owning an Instant Pot, starters/sauces designed for easier use will find a welcome market as will “no prep, no mess” freezer-to-oven cook-in-the-bag and prepared foil packet meals.

Making vegetables easier and more exciting is a winning formula. PictSweet Farms’ frozen preseasoned Vegetables for Grilling come with a grilling pan. Green Giant Veggie Tots, Rings, and Fries deliver a flavorful serving of vegetables. Green Giant Marinated Mushrooms are one of the first frozen vegetable sauce toppers for meat, burgers, or poultry.

Sales of instant potatoes, rice, stuffing mixes, dry packaged dinners, pasta, and spaghetti sauce posted sales gains in excess of 20% for the 11 months ending Nov. 29, 2020, per IRI.

Lundberg Family Farms’ fully cooked and ready-to-heat rice line includes Spanish Style, Coconut, and Turmeric varieties. Williams Sonoma offers Focaccia and Sourdough stuffing mixes. La Tortilla Factory’s new side dish mixes, including options such as Ancho Rice + Beans, will help move Mexican flavors onto the dinner plate.

Breakfast products provide another option for growing center-store sales. Nearly half of consumers say they plan to eat breakfast out of the home less frequently even after the pandemic has passed, according to data from Acosta.

Sales of pancake mixes jumped 32.2% for the 11 months ending Nov. 29, 2020, sales of frozen breakfast items climbed by 18.4%, and cold cereal sales were up 8.9%, per IRI. Unique flavors such as Lemon Blueberry Granola from Bob’s Red Mill and Larabar Apple Pie cereal are a new trend in the cereal aisle.

Unique frozen items, including frittatas, breakfast pizza, and egg bites, drove gains in the frozen breakfast aisle, followed by on-trend breakfast bowls and portable handheld fare, per IRI. Dole’s frozen Açai Bowls, Spoonable Smoothies, and fruit-based Boosted Blends that deliver a boost of energy, protein, or extra vitamin C are right on target for trendy millennials. Good Food Made Simple’s Pancake Puffs and waffles that deliver plant protein and 20 or more grams of whole grains are hot additions to the frozen case.

With the exception of Mexican, multicultural foods are notably absent from the early morning daypart. Where are the unique frozen savory avocado toasts, adult toaster pop-ups, or breakfast bruschetta?

Nearly half of those surveyed in September reported eating more snacks and treats since the pandemic, and 40% expect to continue to do so—statistics from Packaged Facts and Kelton Global that should not be overlooked by snack food marketers.

Chicken of the Sea Tuna Infusions, which come in seven flavors, including Lemon & Thyme and Thai Chili, are packaged with a small fork for anywhere snacking. Some varieties of Campbell’s Slow Kettle soups are bundled with crunchy toppings, repositioning soup as a snack. And Lundberg Family Farms’ Thin Stackers puffed grain cakes are set to drive a new trend in open-faced snacking.

Sales of frozen snacks/appetizers grew 30.1% for the 11 months ending Nov. 29, 2020; 70% are eaten as a meal, according to IRI. Smucker’s Uncrustables frozen sandwiches have enjoyed 15 consecutive quarters of double-digit growth. Frozen sandwiches, including grilled specialty cheese sandwiches, are a virtually untapped idea for product developers.

Finally, as of mid-May, households with children accounted for 36% of food and beverage product sales and 41% of sales growth since the start of the pandemic, per IRI. Kellogg’s Fruit Loops Cereal Bars, Pillsbury Funfetti Pancake & Waffle Mix, and frozen Gerber Freshful Start Organic Veggie & Grain Bowls are among the new kid-specific entries.

3. Food as Medicine

COVID-19 has accelerated an already aggressive approach to healthy eating for many and has focused grocery shoppers’ attention on prevention and/or treatment of health conditions. Interest in vitamins and minerals, immunity-boosting products, and support for at-risk individuals, including hypertensives and diabetics, has also grown substantially.

There’s a clear move toward taking responsibility for one’s own health. As of September, 44% of consumers report eating more healthfully since the start of the pandemic, per Packaged Facts. In July, two-thirds (63%) of grocery shoppers were regularly buying foods for “specific health benefits for their body,” and half (53%) for more holistic health benefits, (e.g., clean, organic, natural, or local), according to the Food Marketing Institute.

One-third of adults surveyed by The Hartman Group in April said they ate functional foods daily. One-third told HealthFocus they are willing to pay up to 10% more for functional food, which is double the percentage from earlier in the year.

Immune health and weight issues have returned to the list of top 10 health concerns among U.S. consumers, per HealthFocus; COVID-19 anxiety, sleep problems, and reduced physical activity levels due to health are new additions. The ability to maintain normal activities with age, stress, heart health, and lack of energy also make the list.

Food and beverage products that boost immunity or contain vitamins and minerals linked to preventing or treating the virus have been strong. During one eight-week period this spring, for example, foods and drinks touting a “good source” of magnesium grew 12 times faster than in the same period in 2019, and those with vitamin D grew 11 times faster, per IRI. Sales of products calling out vitamin C jumped 20%, and those that flag antioxidants grew by 18%. Overall, according to The Hartman Group, nearly two-thirds of adults surveyed in April said they were seeking out foods and drinks with added vitamins and minerals.

Four in 10 Gen Z adults, one-third of millennials, and one-quarter of baby boomers say they’ve gained weight during the pandemic, per information cited in a Natural Marketing Institute webcast. It’s time to call out lower calories, carbs, and sugar on product packaging.

With dark green vegetables topping the list of the most sought-after food fortifications per the Hartman Group, it is also time for food marketers to stop talking about “hidden vegetables.” Ragu+ pasta sauce claims a “hidden blend of 6 super veggies.” The brand would be better served by boldly calling out its veggie content on the label.

Antioxidants have moved up behind fiber as the second and third most sought after food fortifications since the pandemic, according to Hartman. Probiotics, omega-3s, superfruits, tree nuts, honey, beans/legumes/pulses, and seeds round out the list.

With underlying medical conditions linked to poorer COVID-19 outcomes, it’s not surprising that during an eight-week period this past spring, sales of center-store foods and drinks that offer diabetes support increased nine-fold versus the same period a year earlier, according to IRI; for weight loss products, it was an 11-fold increase. Foods that help control hypertension posted a 22% sales increase during that period, and sales of those with immunity claims were up 19%.

The fast-emerging trend to “exercise as medicine,” indicated by American College of Sports Medicine data, will drive a new generation of multifunctional, condition-specific performance foods and drinks. Weight, anxiety, fatigue, heart health, diabetes, and cognitive decline are the conditions consumers are most trying to prevent or treat with exercise.

Use of emerging ingredients will help attract younger consumers, according to The Hartman Group. Think probiotics, prebiotics, and postbiotics for gut health, maca and ashwagandha for energy, and elderberry for immunity.

Looking Ahead

It is clear that going forward many consumer shopping and eating behaviors will be different than prior to the pandemic. While some new e-commerce users may switch back to shopping in-store in 2021, IRI projects that e-commerce’s share of omnichannel edible sales will grow 6% if vaccination is widespread by June 2021. If it’s not widespread until December 2021, e-commerce’s share is expected to grow by 9.2%.

Whether they shop in the store or online, consumers will likely continue to seek value-added pantry staples, convenient meal solutions, and products that deliver functional benefits. It will also be important to address the needs of the millions of shoppers who have been hard-hit by job loss and other financial setbacks during 2020 with innovative value-priced offerings at retail and online.

REFERENCES

Acosta. 2020. “COVID-19: Reinventing How America Eats.” Sept. Acosta Sales & Marketing, Jacksonville, Fla. acosta.com.

ACSM. 2020. Worldwide Survey of Fitness Trends for 2020. American College of Sports Medicine, Indianapolis. acsm.org.

CRN. 2020. 2020 CRN Consumer Survey on Dietary Supplements. Oct. Council for Responsible Nutrition, Washington, D.C. crnusa.org.

Datassential. 2020. MenuTrends Update. Sept. Datassential, Los Angeles. datassential.com.

FMI. 2020. The Power of Meat. Mid-year Edition. July. Food Marketing Institute, Alexandria, Va. fmi.org.

FMI. 2020. Family Meals Survey. Sept.

FMI. 2020. U.S. Grocery Shopper Trends—Cooking. July.

FONA. 2020. Food & Beverage Convenience. Nov. FONA International, Geneva, Ill. fona.com.

French, S. 2020. “State of Fitness & Sports Nutrition During Covid.” Webcast, Oct. 10. Natural Marketing Institute, Harleysville, Pa. nmi.com.

Gelski, J. 2020. “Uncrustables Offer Significant Growth Opportunity for Smucker.” Food Business News, Dec. 11. https://www.foodbusinessnews.net/articles/17479-uncrustables-offers-significant-growth-opportunity-for-smucker.

Hartman. 2020. “Functional Food and Beverage & Supplements.” Webcast, Sept. 2. The Hartman Group, Bellevue, Wash. hartman-group.com.

Hartman. 2020. “The Future of Food Technology.” Webcast, June 22.

HealthFocus. 2020. Now & Beyond the COVID-19 Pandemic: The Changing World of Nutrition and Wellness—2020 USA Report. HealthFocus International, St. Petersburg, Fla. healthfocus.com.

IRI. 2020. “Top Trends in Fresh.” Webcast, Nov. 17. IRI, Chicago. iriworldwide.com.

IRI. 2020. “Charting the Course for Continued Center Store Growth.” Webcast, June 17.

IRI. 2020. “Harness Growth in 2021.” Webcast, Nov. 30.

IRI. 2020. Total U.S.—Multi Outlet (Grocery, Drug, Mass Market, Military and Select Club & Dollar Retailers). Time: Building Calendar Year 2020 Ending 11-29-20.

IRI. 2020. The Premium Opportunity. Nov.

IRI. 2020. “Tap into the Right Opportunities to Attract SNAP and WIC Consumers.” Webcast, Sept. 15.

Kelton. 2020. Snacking Survey. Kelton Global, New York, N.Y. keltonglobal.com.

Leathers, D. 2020. “Asian Foods up 51.5%.” Frozen & Refrigerated Food Buyer 12(2): 42, 45–45.

McCormick. 2020. Flavor Forecast: Looking Back to Look Forward. McCormick & Company, Hunt Valley, Md. mccormick.com.

Packaged Facts. 2020. Vegan, Vegetarian and Flexitarian Consumers. Packaged Facts, Rockville, Md. packagedfacts.com.

Rueter, T. 2020. “Specialty Foods Set for Robust 2021,” Oct. 30. Specialty Food Assoc., New York, N.Y. specialtyfood.com.

Sloan, A. E. 2020. “Remodeled: The Home Kitchen Takes on New Life.” Food Technol. 74(9): 17.

Sloan, A. E. 2020. “Kids Change Things.” Food Technol. 74(11): 14–17.

Sloan A. E. and C. Adams Hutt. 2020. “Getting Ahead of the Curve: Exercise as Medicine.” Nutraceuticals World. Dec.