Solving for Sugar Reduction

INGREDIENTS

Consumers are staying sweet on products that reduce or eliminate sugar, but they’re getting fussier about which alternative ingredients replace the ubiquitous sweetener. Natural sweeteners that look good on a label are the flavor of the moment—as long as they can meet or exceed expectations for taste.

“Today’s consumers are pressuring developers to reduce or eliminate sugar in their products, but they’re unwilling to sacrifice sweetness, mouthfeel, and delicious taste—benefits that sugar is often largely responsible for delivering,” says Nancy Hughes, president of Apura Ingredients, which produces a variety of high-intensity sweeteners.

Stevia continues to be the star player among natural and plant-based sweeteners, but up-and-coming ingredients like allulose and monk fruit are also catering to the healthy consumer demand for sugar alternatives.

“We predict a continued push toward all-natural sweeteners, with new ingredients raising the bar in terms of being truly all-natural and responsibly sourced,” says Amy Targan, president of Malt Products Corp., which manufactures malted barley extract, oat extract, and other natural sweeteners.

Sugar reduction ingredient trends also are piggybacking on clean label trends, says Sarah Diedrich, ADM marketing director, sweetening solutions and fibers. “Our research finds that sugar reduction becomes 61% more important for shoppers searching for products with a clean label,” she says. “Plant-based, high-potency sweeteners like stevia can help meet this demand as consumers easily recognize it on labels.”

Sugars Add Up

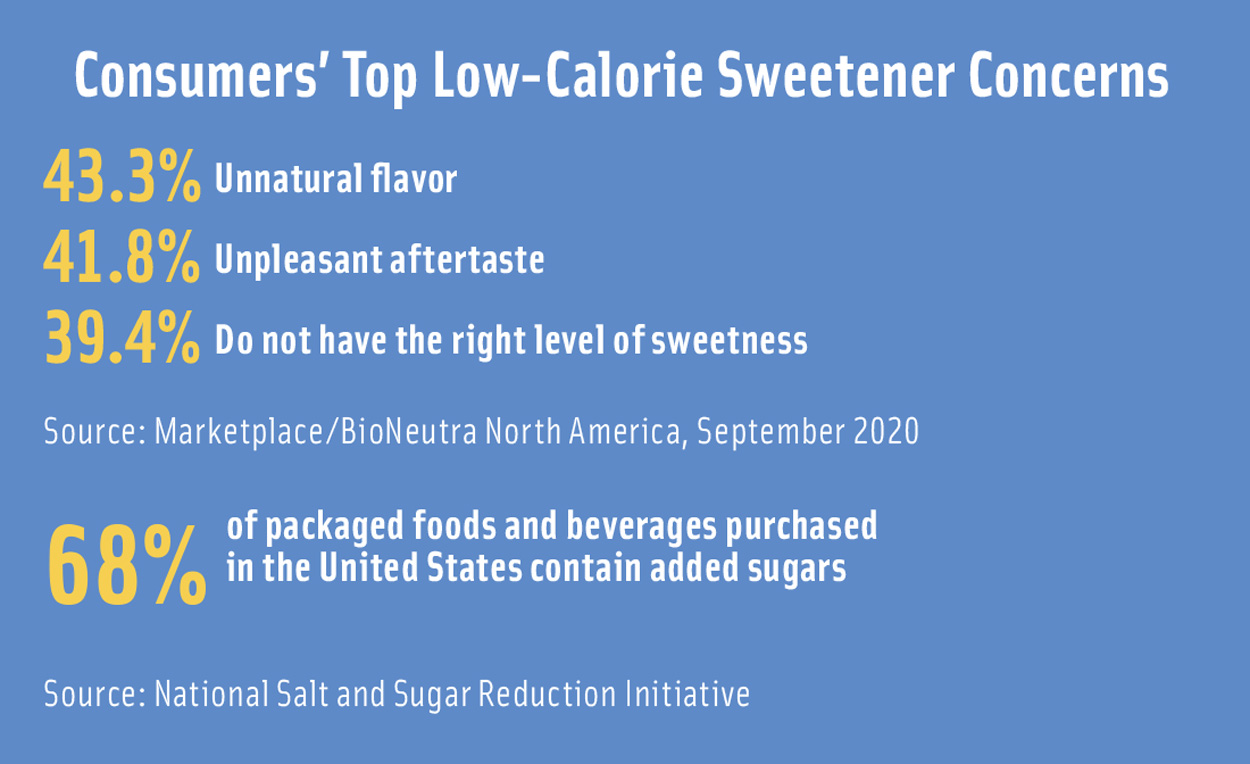

Currently, 68% of packaged foods and beverages purchased in the United States contain added sugars, according to the National Salt and Sugar Reduction Initiative (NSSRI). The U.S. government’s 2020–2025 Dietary Guidelines for Americans calls for limiting added sugars to less than 10% of calories per day, but added sugars account on average for more than 13% of Americans’ total daily calories.

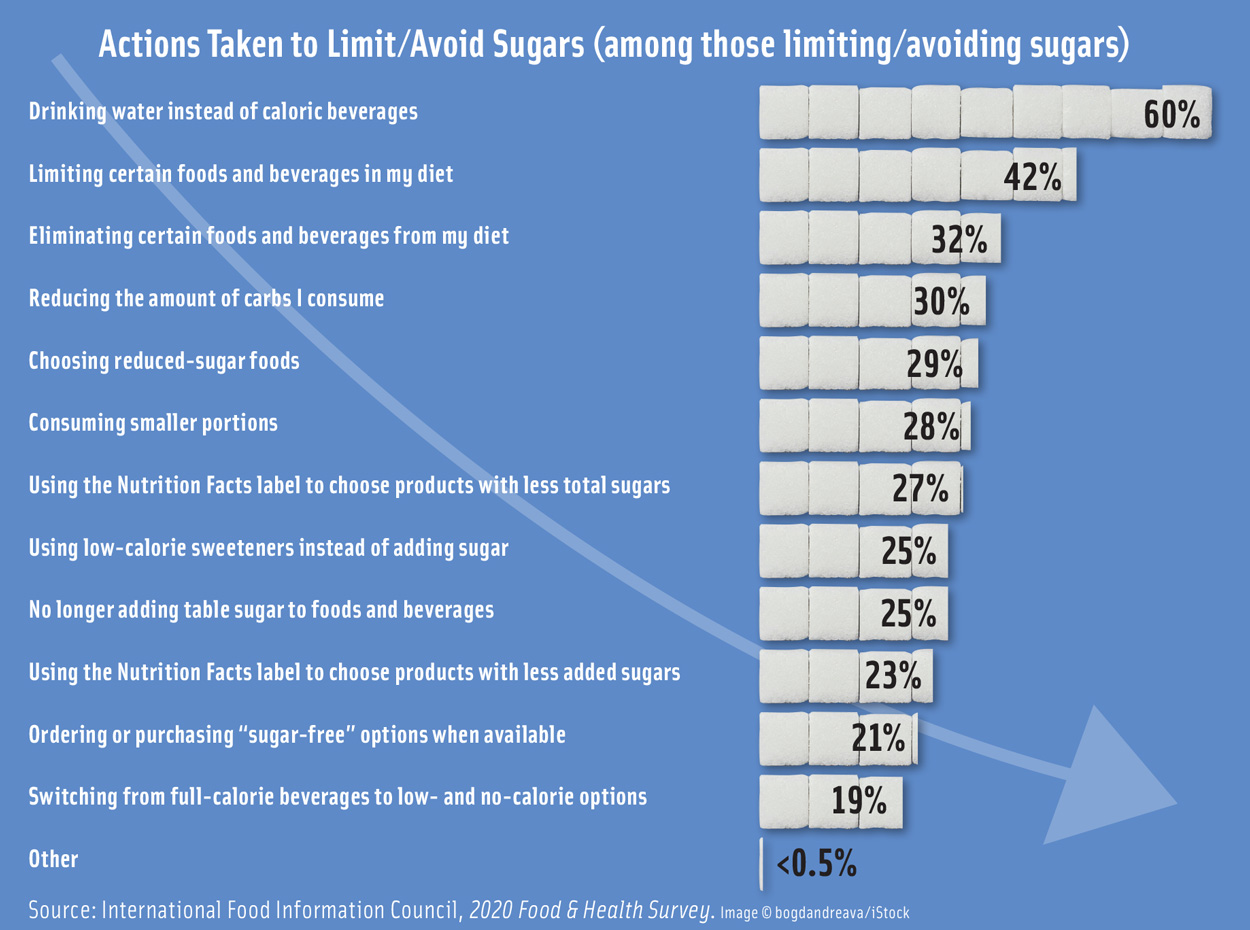

Consumers are paying attention to their overindulgences: 87% are trying to reduce their sugar consumption or are aiming to use sugar in moderation, according to 2018 Kerry ConsumerFirst research, and sugar is the top item that consumers who read Nutrition Facts labels look for (57%), reports NPD. In fact, U.S. household purchases of foods and beverages with caloric sweeteners declined between 2002 and 2018, while purchases increased for products that contained a mix of both caloric and non-nutritive sweeteners during that same period, according to a study in the Journal of the Academy of Nutrition and Dietetics. Among non-nutritive sweeteners, products containing aspartame and saccharin declined in prevalence, but the prevalence of households buying products with sucralose increased from 38.7% to 71.0%, and products with rebaudioside (Reb) A jumped from 0.1% to 25.9%.

“Almost two-thirds of global consumers (61%) say no artificial sweeteners is an extremely or very important statement on food labels,” says Andrew Ohmes, global director, high-intensity sweeteners at Cargill. “Nearly a third (30%) say they’d pay more for a beverage made without them.”

Food companies are using more natural sweeteners and new combinations of these ingredients, especially for beverages. “New product activity has surged for reduced-sugar varieties of beverages, with manufacturers using natural sweeteners like stevia and monk fruit, real fruit, honey, and erythritol,” according to Packaged Facts’ U.S. Beverage Market Outlook 2020.

“We’re seeing a major trend in better-for-you low- to no-alcoholic beverages created with natural sweeteners, where stevia is the foundation for building an indulgent, refreshing, clean-tasting, low-calorie alcoholic beverage,” says Casey McCormick, director of product development at SweeGen.

In February, Hershey teamed up with American Sugar Refining, a member of ASR Group, to invest in Bonumose, a startup company that has developed and patented a production process for high-purity rare sugars, including tagatose and allulose, from low-cost, abundant, plant-based starches. NadaMoo! has beefed up its line of dairy-free ice cream with four no-sugar-added flavors—Vanilla Bean, Strawberry, Chocolate, and Mint Chip—sweetened with organic allulose, organic erythritol, and stevia extract. And in January, Danone North America debuted Oikos Pro high-protein dairy cups and drinks sweetened with stevia leaf Reb M. Oikos Pro drink flavors include Strawberry Banana, Mixed Berry, Caramel Macchiato, and Coffee.

Getting It Right

As much as consumers like the concept of sugar alternatives—natural or not—they don’t always like the reality. Their top concerns about low-calorie sweeteners in general are unnatural flavor (43.3%), unpleasant aftertaste (41.8%), and “do not have the right level of sweetness” (39.4%), according to a September 2020 survey conducted by Marketplace for BioNeutra North America.

“Appealing taste is just as important as less sugar, with 82% of consumers marking both attributes as highly important,” according to ADM Outside Voice research, says Diedrich. “Maskers can help product developers ensure that the end product packs the right flavor by hiding off-notes that some sweetening solutions provide.”

Taste issues, however, are just the tip of the iceberg for formulators reducing or eliminating sugar from foods and beverages. Sugar’s wide range of functionalities includes freezing point depression, crystallization, browning, viscosity/body, solubility, and starch gelatinization.

“For more complex food systems, like ice cream or sweet baked goods, sugar replacement requires the use of multiple ingredients to make up for the functional losses of removing sucrose,” says Allison Feriozzi, a marketing manager at Tate & Lyle.

In nutrition bars, for example, removing sugar can also remove its control of hardening effects from high protein and some fibers. “Carefully choosing a combination of ingredients such as allulose and the appropriate soluble corn fiber can provide cost-effective solutions to extend textural shelf life and maintain great taste,” says Feriozzi.

Sugar also impacts shelf life, playing key roles in water management and microbial control, says Wade Schmelzer, principal food scientist at Cargill. “As a result, in frozen dairy desserts, when formulators replace sugar with a high-intensity sweetener like stevia, they need to adjust stabilizer and emulsifiers selections to provide more effective water control.

“Ice cream is especially difficult because sugar brings so much to the table, impacting freezing point and many sensory characteristics,” he adds. “Erythritol can help replicate some of sugar’s functional roles, especially freezing point depression. But to replace all of sugar’s sweet taste, it’s often paired with stevia, along with other bulking agents like inulin to help with mouthfeel.”

Plant-Based Challenges

Replacing or reducing sugar in the increasing array of plant-based foods and beverages presents its own set of formulation challenges for product developers.

“The shift away from animal-derived food products is having a significant impact on sweetener choice, because food and beverage formulators are looking to pair natural, plant-based products with suitably natural, plant-based sweeteners,” says Malt Products Corp.’s Targan.

Bitterness and chalky mouthfeel, however, are common formulation and taste issues with plant-based applications that traditionally were resolved with sugar, says Kerry Kenny, chief technical officer at Apura Ingredients.

“Natural, plant-based sweeteners such as stevia and monk fruit extract offer formulators a sweetening option that perfectly aligns with the label their consumers are seeking and the functional benefits needed to overcome challenges in formulation,” says Kenny.

Natural bulk sweeteners can play to plant-based product strengths by combining mild sweetness with fiber.

Later this year, BioNeutra will be launching VitaFiber DX, a sugar replacement with the highest composition of dietary fiber and prebiotics within the company’s portfolio, says Sheri O’Brien, vice president, sales and marketing at BioNeutra North America.

“Formulators can boost a food or beverage application’s fiber content while simultaneously reducing sugar and calories, all while keeping the taste, texture, and mouthfeel intact,” she says. VitaFiber’s IMO and PLUS plant-based sweeteners can be used as standalone ingredients or combined with high-intensity sweeteners to mask bitter aftertaste.

Stevia Solutions

Stevia continues to benefit from its name recognition as a natural alternative to artificial sweeteners. Tate & Lyle research suggests that 42% of consumers are aware of stevia, 29% would be likely or very likely to purchase a product with stevia, and purchase intent for stevia was similar to purchase intents for sugar, says Feriozzi.

“Product launches containing stevia reached more than 7,470 new food and beverages globally [in 2020]—up 8.67% over the previous year,” says Cargill’s Ohmes. Stevia is especially popular in beverages, he says, with flavored waters, sweet teas, ready-to-drink coffees, and flavored milks all seeing growth. “But stevia is also gaining traction in spaces like dairy, confectionery, nutrition bars, and more,” says Ohmes.

The steviol glycosides in the stevia plant, which are heat stable and have zero calories, are 150 to 300 times sweeter than sugar. Stevia usage is evolving as stevia ingredients expand beyond the steviol glycoside Reb A, which imparts off-notes that are bitter or licorice-like.

“Recent innovation in stevia sweetener technology is addressing the taste challenges associated with sugar reduction, and formulators are seeing positive results,” says Feriozzi. “Rare rebaudiosides (Reb M and Reb D) exhibit the most sugar-like taste and are now available at commercial supply levels.”

“As a result of food science advancements, we will see emerging and great-tasting commercial-scale rebaudiosides, which will only increase the appeal of stevia,” adds Swee-Gen’s McCormick. “As the [stevia] industry grows in size and scale, this will lower multiple barriers of entry.”

SweeGen expanded its natural sweetener portfolio in October with commercial production of Bestevia Reb I for a variety of applications, including dairy, beverages, nutritional bars, and other confectionery and savory products. SweeGen also offers Bestevia Rebs B, D, E, and M.

Blending In

Allulose, a monosaccharide isomer of fructose, is referred to as a “rare sugar” because it is found in small quantities in maple syrup, brown sugar, and caramel sauce and in fruits like raisins and figs. In 2019, the sweetener got a boost when the Food and Drug Administration ruled that allulose can be excluded from total and added sugars counts on Nutrition Facts labels.

“Allulose has proven itself as a breakthrough ingredient for many applications, and I believe we will continue to see formulators leveraging the combinatorial benefits of allulose and high-potency sweeteners,” says Tate & Lyle’s Feriozzi.

Blending allulose, stevia, erythritol, monk fruit, and other natural sweeteners in specific combinations, in fact, is an effective way to overcome functionality and taste issues with these sweeteners, say experts. For example, because stevia sweeteners generally provide a later onset and more lingering sweetness to food products when compared with sucrose, adding allulose can help formulators achieve higher levels of sugar replacement and improve sweetness quality, says Feriozzi.

“To build back the functionality of sugar, such as browning, bulking, and freeze point depression, stevia needs to be used in concert with several other ingredients,” says Christina Coles, associate marketing manager, sugar reduction and specialty sweeteners at Ingredion. “Allulose works well in this instance. . . . [Allulose] is a reducing sugar that can provide browning characteristics in baked goods, as well as freeze point depression in frozen desserts.”

“Developments that target sugar reduction or replacement include sweetener blends . . . such as Batory Sweet Essentials blends that generally consist of erythritol, allulose, steviol glycosides, and stevia leaf extract,” says Melissa Riddell, head of innovation and technical services at Batory Foods. Launched in January, the Batory Sweet Essentials line of five high-intensity sweetener blends includes B-TRU, B-INTENSE, B-FIBER, B-CLEAR (E), and B-CLEAR (A). The interchangeable sweeteners can be used for virtually all dairy, frozen, snack, baked, and beverage applications.

Monk fruit and stevia is another pairing that can resolve some flavor issues, says Thom King, CEO and president of Icon Foods. “We have found that using a combination of stevia and monk fruit helps mask each other’s respective off-notes . . . [with] monk fruit having off-notes reminiscent of melon rind and stevia having off-notes reminiscent of licorice,” says King. “The combo results in a very neutral sweet flavor without off-notes.”

“As allulose and monk fruit—the rising stars in the sweetener space—appear in more applications, consumer familiarity will increase, which will drive demand,” adds Apura’s Kenny. “Monk fruit extract is one of the fastest-growing alternative sweeteners on the market today.”

New natural sweeteners coming to the forefront may also be able to contribute to blends, in addition to standing on their own. “Rare sugars like tagatose are expected to follow a similar path as allulose in the upcoming year,” says Riddell. “I suspect we will see more of these rare sugars presented to the market as technology continues to evolve.”