Kidfresh gives classic kid-friendly fare a healthy halo by using healthful ingredients and adding extra veggies into product formulations. Photo courtesy of Kidfresh

Catering to Kids—and Their Parents

Food products targeted to school-aged kids must first entice discerning parents, then delight fussy youngsters. Leverage these nine trends to accomplish both goals.

Article Content

Prabal Chaudhri, founder of alternative jerky company Brave Good Kind, knows something about how millennial moms want to feed their kids. He’s heard from many of them since launching his company’s lineup of Tender Chicken Bites and Tender Chicken Bars last year. They want products that are both convenient and nutritious, Chaudhri emphasizes.

A millennial himself, Chaudhri sees “a huge cultural shift underway” among millennial parents, many of whom are food-focused label readers who aren’t eager to take their kids out to McDonald’s regularly or feed them packaged foods that are high in sugar and fat and low in important nutrients.

It’s not surprising that millennials are demanding better-for-you food products for their kids.

But this preference is tempered by reality: You can’t force youngsters to eat what they don’t like, and many children are picky eaters.

“A child won’t eat something that doesn’t taste good simply because it’s better for him or her,” notes Matt Cohen, founder and CEO of frozen food manufacturer Kidfresh. “Parents want solutions that are healthy and nutritious but that are going to be eaten by the child.”

In addition to taste, mouthfeel and texture influence kids’ consumption decisions, as do experiential traits such as play value and tie-ins to children’s movies and television shows. Smart food manufacturers leverage a variety of attributes to win over both children and their parents in the launch of new kid- or family-friendly products.

Tracking Product Launches

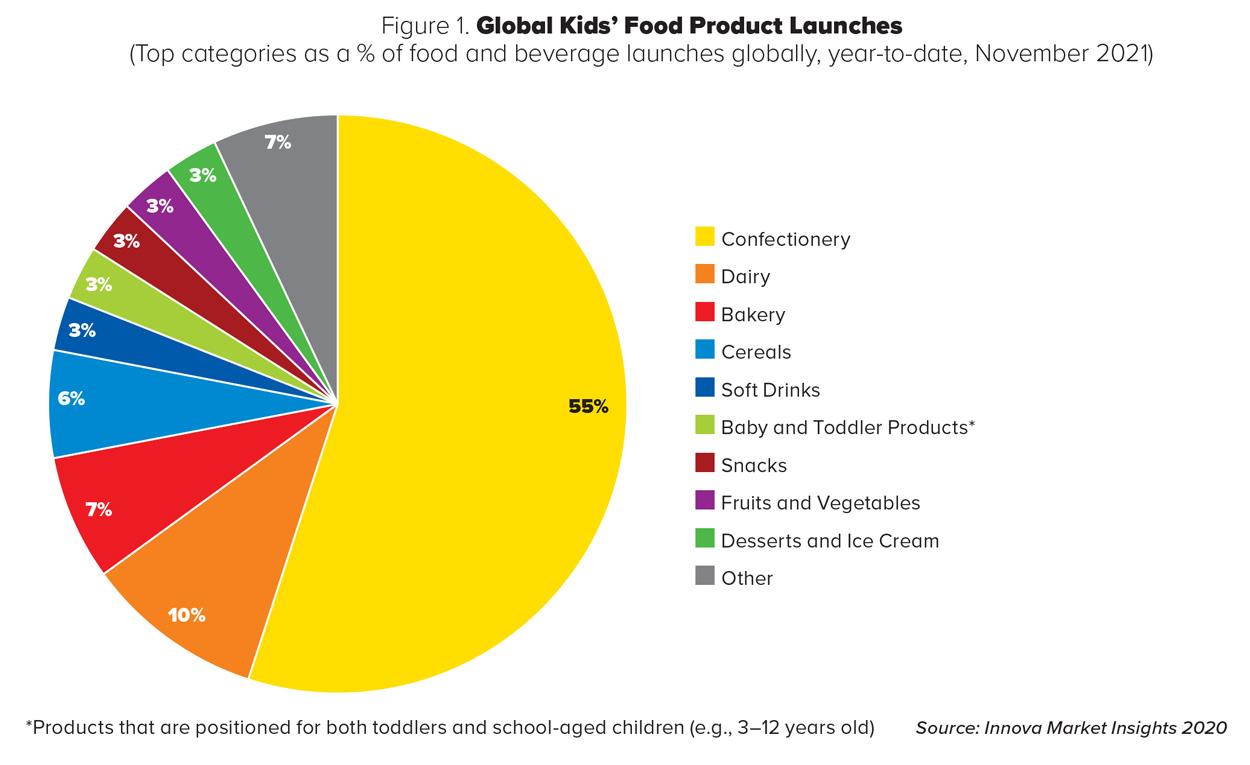

As Innova Market Insights makes clear in an exclusive November 2021 report for Food Technology, food items targeted to children span many different categories. But the majority (55%) of global launches last year were confectionery products—despite prevailing parental interest in feeding their kids well. Because the prolonged COVID-19 pandemic has been difficult for kids, even with in-person learning resuming in the 2021–2022 academic year, parents are giving their youngsters more treats to brighten their mood. Indeed, candy sales in the United States soared in the month before Halloween, with the National Confectioners Association reporting a 48% increase compared with 2020 and a 60% increase over 2019.

According to Innova, the runner-up category, dairy, accounted for 10% of kid-oriented launches in 2021, followed by bakery at 7%, fruit and vegetable products at 7%, and cereal at 6%. Soft drinks, snacks, and baby and toddler foods each constituted 3% of the total. (See Figure 1.) (Note: This article does not address the baby and toddler foods category.)

Innova also identified the fastest-growing subcategories of child-focused product launches, ranked by percentage increases over a two-year period: wheat and other grain-based snacks, +63%; rice-based snacks, +37%; fruit pouches, +31%; finger foods, +23%; and fruit products, +23%.

Across all categories, clean label products with simple ingredient decks gained momentum. “The top claims within packaged food products for school-aged children are related to natural and clean label positioning, with ‘no additives or preservatives’ being the No. 1 claim,” notes Lu Ann Williams, global insights director for Innova. What’s more, ethical concerns such as sustainability and humane animal treatment are driving parental purchases.

From Innova Market Insights’ research, as well as interviews with food industry experts, here are nine trends worth noting.

1) Better-for-You Indulgence

The dominant category in the kids’ market, confectionery, is arguably the least healthful. However, within this category, better-for-you options are emerging. For example, consider Golly Lolli’s, a line of organic lollipops manufactured by Project 7, which also makes a wide range of gummy candy and chewing gum SKUs. The company’s founder, Tyler Merrick, emphasizes that Golly Lolli’s suckers have 75% less sugar than traditional lollipops of the same size, with just 1 gram of sugar and 2 grams of carbohydrates per lollipop. In addition, the product has no artificial colors, flavors, or preservatives.

Packaged in a 16-count variety bag, the lollipops come in four flavors designed to captivate kids: Blue Razz, Watermelon Wizard, Fairytale Fruit, and Rainbow Ice. More likely to impress parents, the listed ingredients include organic monk fruit concentrate, organic carrot concentrate, organic apple concentrate, black current concentrate, turmeric, and organic annatto, among others. “We try to give more depth to the flavor, a little bit of whimsy and wonder to the candy, because candy is something that should be a fun experience for kids and adults,” Merrick says.

Typically targeted to children, frozen novelties are another category not often prized for wellness attributes. But a growing number of healthful choices stand out in the freezer case. Kidfresh Real Fruit Pops, for instance, contain no artificial colors or flavors or high-fructose corn syrup. “The first ingredient is actually fruit,” says Cohen. Strawberry Real Fruit Pops consist of strawberries and 100% apple juice (not from concentrate), while Berry Cherry Punch Real Fruit Pops are made of apples, raspberries, and 100% fruit juice (not from concentrate).

Chloe’s is another company distinguishing itself in this space. Chloe’s offers a line of frozen fruit pops co-branded with Marvel Comics, plus a line of vegan Oatmilk Pops in several flavors: Brownie Batter, Chocolate Peanut Butter, Cookies & Cream, Mint Chip, Salted Caramel, and Raspberry Chip. The Oatmilk Pops are also certified gluten-free and kosher and Non-GMO Project Verified.

2) Classic Flavors Prevail

Millennials may be known for being food adventurers, but for younger school-aged children, the familiar is generally preferable to the exotic, at least when it comes to entrées. “Looking at the savory launches for children (ready meals, sauces and seasonings, snacks, and soups), the traditional flavors continue to be the most common,” Innova’s Williams points out. “The top flavors consist of the classic flavors, with chicken and cheese being the most prevalent.”

The newest SKUs in the Kidfresh line of frozen meals bear this out: Kidfresh Homestyle Chicken Strips and Kidfresh Ranch-Seasoned Chicken Strips. The rest of the line includes such items as White Meat Chicken Nuggets, Wagon Wheels Mac & Cheese, and Spaghetti Loops Meat Sauce.

“We’ve tried to push the envelope in our history, but we’ve learned the hard way,” Cohen concedes. “As long as kids are exposed to the same staple foods in school cafeterias and restaurants—chicken nuggets, mac & cheese, burgers, and the like—and not much else, that’s where we need to start. I was born and raised in France, so I don’t mind food adventure; we tried that at first. But, again, parents at the end of the day are looking for something that kids will eat, and that’s based on a fairly finite list of things.”

3) Plant Power

Sales of plant-based animal product alternatives reached $29.4 billion in 2020. And according to a Bloomberg Intelligence report, the worldwide market could increase fivefold by 2030. Thus, the increase in “vegan” claims on kids’ food product launches—40% from 2018 to 2020 per Innova—should come as no surprise. “Plant-based products are positioned to expand in the children’s marketplace, and vegan claims may continue to grow,” Williams predicts.

Dr. Praeger’s Purely Sensible Foods’ frozen line for kids recently debuted Peas & Carrots Chick’n Littles—a new vegan nugget SKU in barnyard shapes. “Consumers of all ages are reducing their meat consumption and increasing their intake of vegetables,” says Danielle Praeger, the company’s vice president of research and development. The product features 13 grams of protein per serving (five nuggets); four types of vegetables, including butternut squash and sweet potato puree as well as pea protein and carrot puree; oat fiber; raisin juice; and other ingredients.

4) Food as Fuel for Developing Minds, Bodies

In the adult market, functional foods contain ingredients that promote digestion, reduce inflammation, enhance heart health, or help attain other wellness objectives. These items are often consumed with particular healing properties in mind. Although food manufacturers have long recognized kids’ nutritional needs, the food as medicine movement is just beginning to make inroads in children’s CPGs.

“Parents increasingly may look for products that support specific aspects of children’s health, including protein for growth, calcium for strong bones, and vitamins and probiotics for immunity,” notes Williams. “Omega-3 fatty acids, including DHA (docosahexaenoic acid), appear to be expanding into children’s products from their original base in infant formula. Marketing for brain health benefits is likely to continue as well.”

Praeger agrees that functional foods are gathering strength in children’s brands. “We are seeing an increased focus on foods that are ‘brain fuel’ like oats and oatmeal, which are excellent sources of energy,” she observes. “Oats are packed with fiber to help keep kids feeling full, so they don’t snack on junk food.”

With its first SKUs rolling out in April 2020, Mavericks Kids is a new cookie and cracker brand for children that aims to “fuel the next generation of changemakers and risk takers,” notes Tina Pate, vice president of marketing for Mavericks Snacks. “I’m really excited to be a part of this new product, which celebrates kids’ greatness and, more importantly, empowers them to want to eat better,” emphasizes Pate, who previously worked for KIND Snacks and Whole Foods Market.

The brand targets children aged 4 to 11, “a time in childhood when kids color outside the lines and when ignoring the impossible really comes naturally,” she explains.

The cookies are available in three varieties: Double Trouble Choc Cookiez (made with double the chocolate), Non-Stop Choc Cookiez (made with real chocolate chips), and Birthday Cake Cookiez (made with real sprinkles).

“These kid-first flavors have 40% less sugar than competitors’ cookies in the natural space and 60%–70% less sugar than cookies in the conventional space,” Pate says. Chicory root fiber is the key ingredient providing natural sweetness, and as a prebiotic, it has functional benefits as well, she notes.

5) Focus on Fun

As with the cookies, the three SKUs in the Mavericks whole-grain crackers line—Eazy Cheesy Crackerz, Itza Pizza Crackerz, and Str8-up Original Crackerz—are intended to be playful and fun for school-aged children. All the company’s snacks are shaped like lightning bolts, each small cracker or cookie a tilted “M” for Mavericks.

The fun factor was also top of mind for Dustin Finkel, CEO of Awakened Foods, when he launched the brand Ka-Pop! Snacks in 2018. Not long after founding his company, Finkel appeared on season 11 (2019–2020) of Shark Tank, impressing judges by shedding his business suit for a superhero costume and fighting comic book representations of the “villains” Gluten, Allergens, Empty Calories, and GMOs, which descended from the television show set’s ceiling.

Ka-Pop! snacks come in six flavors of popped chips and five flavors of puffs, with some overlap. The chips include Vegan Cheddar, Sriracha, Rosemary Garlic, Sour Cream & Onion, Olive Oil & Sea Salt, and BBQ, while the puffs are available in Sriracha, BBQ, Dairy-Free Cheddar, Cinnamon Churro, and Sweet & Salty Kettle flavors.

“What we’re doing is using three ingredients: 100% ancient grain sorghum, cold-pressed oil, and seasoning,” Finkel explains. “There’s nothing else. We’re just leveraging the inherent nutrition of our ingredients to deliver a delicious product that naturally has protein, that naturally has fiber, and that’s naturally healthy whole grain.”

Finkel notes that it’s usually moms who buy Ka-Pop! snacks for their children. “Because our product is dairy-free, allergen-free, and non-GMO, people often discover it due to some dietary restriction and then introduce it to the rest of the family. One of the main ways we’re seeing traction with kids is that a lot of schools don’t allow snacks with allergens in them. In fact, that was the reason we chose to introduce a non-allergen-based product when we first launched. I wanted my kids to be able to bring a healthy snack to their school.”

6) Double-Duty Snacks for Parents and Kids

Ka-Pop! popped chips and puffs come in a variety of flavors to satisfy every family member. For example, says Finkel, Cinnamon Churro Puffs are a bigger hit with children than adults, while Sriracha Popped Chips tend to be enjoyed by parents more than youngsters. The idea of having a versatile snack to please various palates is a trend that is gaining momentum. And parents are demanding such flexibility.

Brave Good Kind’s Chaudhri was looking to develop a jerky that would appeal to women, who, he says, are typically turned off by the masculine aura surrounding jerky—in everything from advertising and the color of the packaging to the product’s “tough chew” and where it is typically sold (convenience stores). However, in his market research, Chaudhri made an important discovery.

The millennial women he spoke with wanted something tender, something healthful to keep them energized, and something convenient for their on-the-go lifestyles. But they also had another expectation: “We want to share what we eat with our kids.”

The resulting products—Brave Good Kind Tender Chicken Bites, which launched in March 2021, and Brave Good Kind Tender Chicken Bars, which launched in May 2021—come in three flavors: Original, Teriyaki, and Hot Honey. Each 2.5-ounce bag of Chicken Bites contains 9–10 grams of protein, 5–7 grams of carbohydrates, and less than 6 grams of sugar per serving. Each bar features 8 grams of protein, 4–5 grams of carbohydrates, and less than 6 grams of sugar.

As Chaudhri notes, “I can’t tell you the number of times I’ve gotten a note or a communication from a parent who says, ‘My picky eater loves your product and doesn’t want to eat anything else.’ People with five-year-olds and other young kids are buying loads of our product now and putting the items in lunch boxes for school.”

7) Caring for the Planet

Whether consumed as a snack or a main course, the popularity of chicken as a finger food for kids continues to increase. For millennial parents, one of chicken’s main advantages is that it is much more environmentally friendly than beef, Chaudhri asserts. “Chicken is the most sustainable protein,” he maintains. “If you look at the whole process, producing chicken results in 90% less greenhouse gas emissions than producing beef.” Chaudhri notes that the millennial women who took part in Brave Good Kind’s market research “want to do right by the planet.”

Founded in 2008, Project 7’s mission has always been to donate a portion of its proceeds to humanitarian causes such as fighting hunger, ensuring clean drinking water, and sheltering the homeless. However, warns Merrick, a humanitarian mission isn’t enough for a brand; the product needs to be something consumers love and would repeatedly purchase.

In 2019, the Case Foundation published Millennial Impact Report: 10 Years Looking Back, which analyzed millennials’ activism. The report emphasized that this generation is “passionate about issues, not institutions.” It is important to engage millennials in their key areas of concern when tying kid-targeted food products to ethical causes.

8) Delivering Value

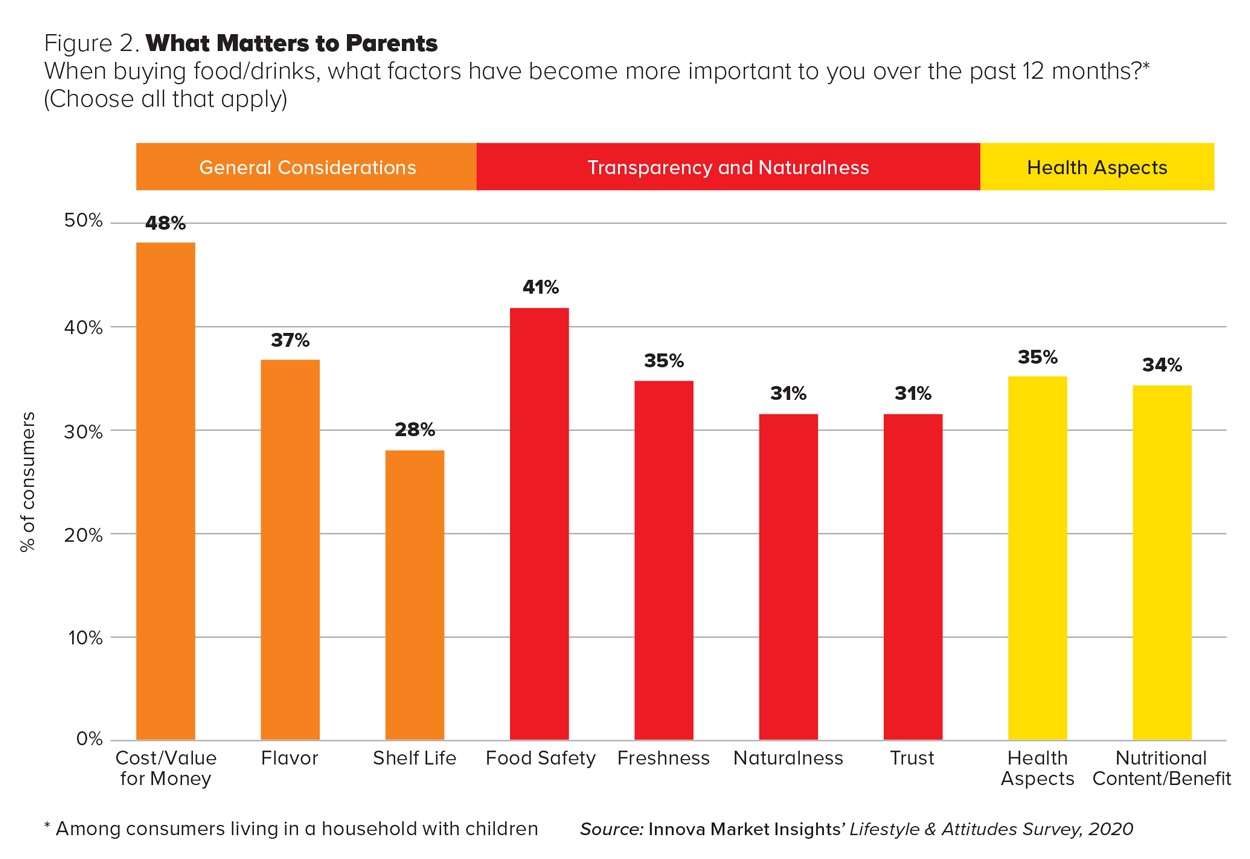

According to Innova, 48% of consumers (the largest proportion of consumers surveyed) consider “cost/value for the money” to be the most important variable influencing the purchasing of kids’ food products. And the value proposition has become ever more important during the pandemic. (See Figure 2.)

Pate points out that Mavericks Snacks completely reassessed its packaging when COVID-19 hit around the same time the brand launched. “We launched with individual snack packs, eight to a box,” she explains. “But because COVID changed consumers’ shopping behavior so much, we made the decision to relaunch the product in a multi-serve snack package.”

Even though children are back in school now and other aspects of life have resumed a degree of normalcy, consumers still prioritize value because of rising inflation. That’s why Mavericks Snacks is going to stick with the 7-ounce multi-serve package size for the time being. Pate adds that millennials are known to share kitchen organization hacks online and frequently empty shelf-stable packaged food into more conveniently sized reusable containers for the pantry. For that reason, it’s important for product and packaging developers to keep in mind the way in which parents store food products for their kids.

9) Thinking Inside the Box

Due to precautionary measures taken to minimize the spread of COVID-19, enticing supermarket customers to sample new products in the store has become a thing of the past. However, food startups such as Mavericks Snacks have found an appealing alternative for encouraging trial. The organization MomsMeet.com promotes healthful, eco-friendly child-rearing by inviting parents to join the network, connect with one another, and sample new natural and sustainable products. Food companies can get their clean label products included in sample boxes sent each month to members, who share their sampling experiences in blogs and on social media.

Shelf-stable products account for 88% of all children’s launches, according to Innova. Because these items have a long shelf life and don’t require refrigeration, use of shipped sample boxes to drive trial makes sense. It is also especially easy for shelf-stable products to be sold online, either from a company’s website or an e-commerce platform such as Amazon.com.

Key Takeaways

- Millennial parents seek products with clean labels and no artificial ingredients.

- Nonetheless, confectionery is the category with the most product launches targeted to kids.

- Kids favor familiar flavors and product types.

- Many savvy product developers are adding veggies to their formulations.