What’s Novel in Frozen Desserts

Ice cream sales have slowed, but frozen novelties are coming on strong as consumers scoop up innovative new treats, including nondairy options.

Article Content

Although traditional, old-school ice cream has seen retail sales melt a bit over the past year, perhaps due to consumers venturing out to their favorite scoop shops again, other types of frozen desserts have continued to gain palate share. To achieve growth, brands have branched out with new flavors and formulations, some of which address consumers’ wellness concerns.

“The whole frozen category, in its own right, is up and to the right [on sales charts], especially with what we’ve experienced over the last couple of years as it relates to COVID,” says Brian NeVille, CEO of Tru Fru, which makes frozen chocolate-covered fruit concoctions. “We’re not going out to eat as much. ... The frozen dessert buyers within retail have appreciated that we’ve brought innovation and uniqueness in that category.”

Sales Stats

Subsegments of the U.S. frozen desserts category enjoyed disparate fortunes for the 52 weeks ending January 23, 2022, according to multi-outlet data from IRI. The ice cream/sherbet category saw sales fall 7.2% to $7.5 billion, while frozen novelties rose 5.4% to $7.1 billion, and frozen desserts/toppings—a subcategory that includes whipped toppings, cheesecakes, other “sweet goods,” and puddings/mousses—rose 4.6% to $855 million, IRI found.

Data from NielsenIQ for the 52 weeks ending January 29, 2022, put the overall frozen desserts category at $15.2 billion, down 1.2%. Along with similar data for the ice cream and frozen novelty subcategories, NielsenIQ reported that sales of frozen cakes rose 8.2% to $549 million, frozen pies were up 2.4% to $567 million, shakes gained 7.1% to $95 million, dessert bars spiked 22.2% to $70 million, and specialty desserts (mostly cream puffs and eclairs) shot up 12.5% to $49 million.

“This is a category where innovation for retail often comes from small, trend-forward ice cream operators,” says Claire Conaghan, associate director at Datassential. “Think of how, years ago, Jeni’s was a smaller company and is now one of the top-growing dessert chains—and is featured on shelves in pints at Whole Foods. The same was true for brands like Coolhaus, which is now available broadly. Many of these small operators now ship nationwide and offer very unique flavors and will quickly expand their brand to retail as they build a following and work out those connections that allow for distribution.”

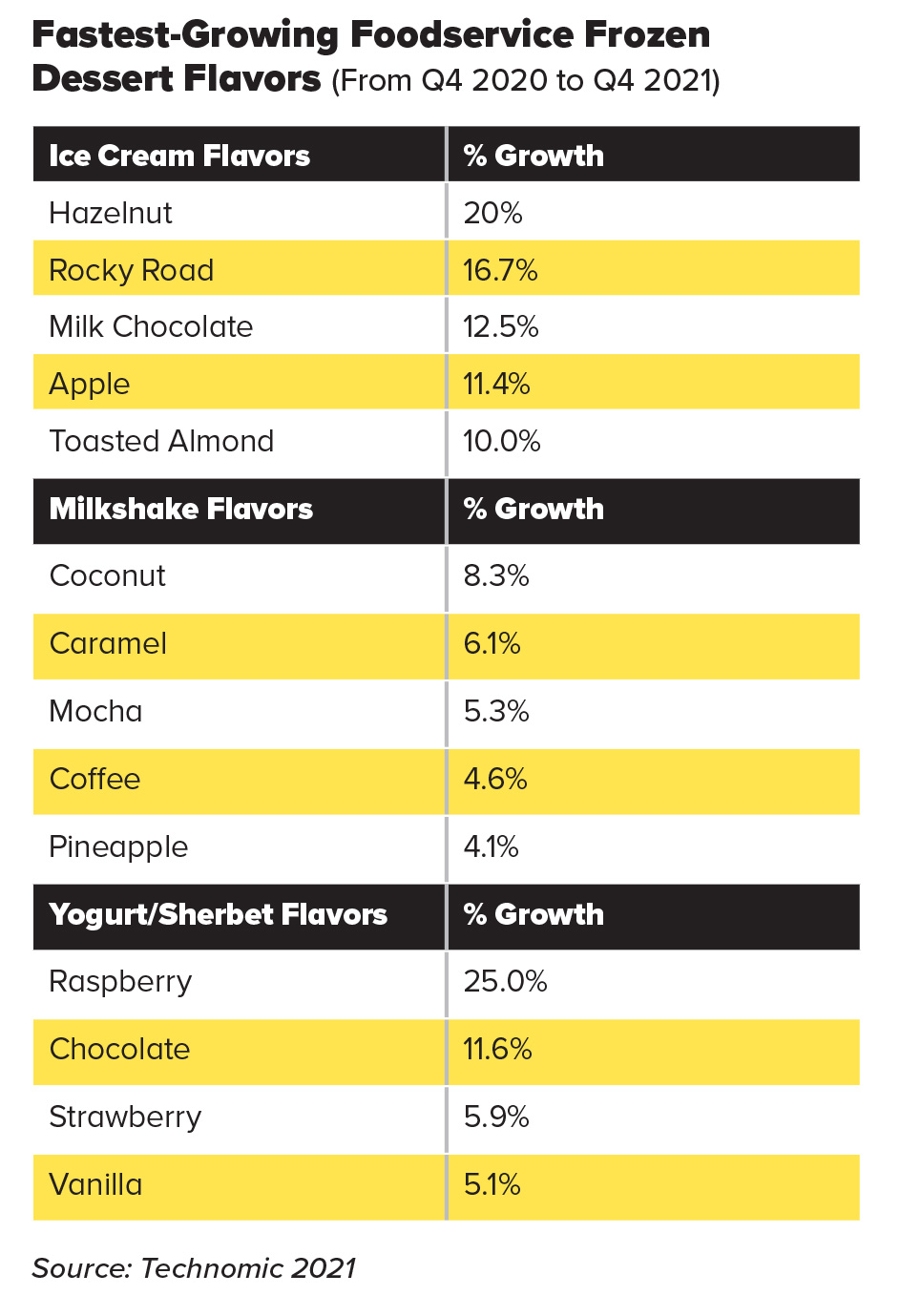

Data from Technomic’s Ignite Menu database show that ice cream incidence on menus fell 0.9% from the fourth quarter of 2020 to the fourth quarter of 2021, while milkshakes and malts increased by 1.1%, and frozen yogurt and sherbet declined by 1.2%. “With the shift to takeout and delivery, many frozen desserts have declined on menus over the past year, with the possibility of making for a less appealing off-premise option,” Technomic notes. “As an already portable option, milkshakes/malts have seen a slight menu increase.”

What’s Trending

The incidence of various health claims on frozen dessert packages at retail led to differing results during the 52 weeks ending January 29, 2022, according to Nielsen. Those that claimed “free from artificial flavors” sold $8.8 billion, down 1.1%; “free from artificial preservatives,” $4.4 billion, exactly the same as a year earlier; “free from dairy,” $1.2 billion, up 4.5%; “reduced calorie,” $591 million, down 17.3%; and “contains soy protein,” $456 million, up 5.9%.

Innova Market Insights found that the “gluten-free” claim was used on 30% of new ice cream and frozen dessert launches in 2021, while “GMO free” appeared on 22%. Plant-based was the fastest-growing claim, with an average 67% compound annual growth rate (CAGR) between 2018 and 2021. Innova’s Trends Survey for 2021 revealed that 27% of U.S. consumers say they consider natural ingredients when indulging, and 48% say they look for healthy indulgent options in foods and beverages.

Indulgent and premium claims appeared on 22% of all ice cream and frozen dessert launches in 2021, Innova found. The top flavors focused on traditional favorites like milk chocolate (18% of new launches) and vanilla (11%), with chocolate chip, strawberry, and fudge rounding out the top five, and other indulgent flavors like coffee, cookie dough, and brownie remaining popular.

Datassential has tracked a number of health and flavor claims growing quickly at foodservice, including vegetarian (up 139% over four years), chocolate ganache (+126%), vegan (+124%), sea salt caramel (+122%), hibiscus (+119%), and Irish cream (+119%).

Technomic tracked health claims at foodservice outlets between Q4 2020 and Q4 2021, including dairy free (0.4% of ice cream menu items, 0.4% of milkshakes and malts, 2.0% of yogurt/sherbet) and vegan (0.3% of milkshakes and malts, 0.8% of yogurt/sherbet). The firm’s 2021 Dessert Consumer Trend Report found that 21% of consumers are eating more desserts with plant-based ingredients, and 40% are finding them at least somewhat appealing. “By including plant-based desserts on their menus, operators can appeal to a wider variety of consumers and eliminate the veto vote,” Technomic reports.

Technomic found that the top ice cream flavors at foodservice from Q4 2020 to Q4 2021 were vanilla, chocolate, strawberry, banana, and fudge. Leading milkshake flavors were vanilla, chocolate, strawberry, banana, and peanut butter. (See the table above for a look at the fastest-growing flavors.)

Ben & Jerry’s has seen growth in superpremium and health-oriented offerings both in supermarkets and in its scoop shops, says Rebecca Robinson, head of operations. “We’re seeing this modern moderation trend, which is all around indulgence but also balancing consumption,” she says. “Total transparency is a big trend we’re seeing; people are looking for real information on ‘What are the ingredients?’ ‘Where are they sourced?’”

Nondairy frozen desserts have enjoyed a significant elevation in taste and texture thanks to improvements in technology and recipe development, according to Robinson. “They’re not compromising on the quality,” she says. “People are making the right choice for their lifestyle. ... We found that flavors are the No. 1 reason people are looking to purchase something in nondairy. It’s no longer just about a dietary need.”

Ben & Jerry’s also has noticed a trend toward consumers wanting to try flavors that tie into international cuisines—and tie back to their childhoods. “This is about wanting to experience authentic flavors around the world,” explains Robinson. “Also from a flavor lens, nostalgic is another big trend we’ve seen—kicking back to flavors from when you were a kid, or something that reminds you of different moments.”

Unilever, which owns not only Ben & Jerry’s but also brands like Breyers, Magnum, and Talenti, saw mid-single-digit growth in its ice cream line for 2021, according to Bryan Kotwicki, senior brand manager. While indulgence has remained a trend during the pandemic—including “reimagined takes on classic flavors”—the company also has noted an expansion in nondairy options. “An increased consumer interest in a more balanced, nutritious lifestyle seems to be a driver behind the nondairy, carb-conscious, and even miniature-sized product trends,” he says.

Healthy Innovation

NeVille notes that the Tru Fru team also sees consumer interest in healthier formulations that still provide the indulgence factor, which is what inspired the company’s “clean ingredient product” made with fruit, chocolate, and no additives or preservatives. “There’s a trend of permissibility making its way into frozen dessert,” he says. “There’s a younger demographic that wasn’t there before—that’s spawned additional innovation. You see retailers growing their set sizes within frozen desserts.”

NeVille hasn’t observed plant-based catching on within the category, necessarily, but he believes claims like non-GMO and gluten-free are growing. “What the consumer is looking for is real products, things that are made by nature,” he says. “Pack size is really important. They want larger on the family front, but also things that are convenient and grab-and-go are on trend. Smaller pack sizes and smaller price points are seeing an uptick as well.”

The Dream Pops brand team has noticed a few different camps in terms of those seeking healthier formulations from frozen desserts, including fans of keto, plant-based, and stevia and other no-sugar mixes, says David Greenfield, CEO and co-founder. “There are also [consumers] who are looking for the opposite, which is that dairy indulgence category. Obsession with product quality and differentiation is another trend.” And, he adds, “We’re seeing growth in snackability formats, momentum outside of traditional pints into ice cream sandwiches, cones, and bites.”

Carlos Altschul, CEO of Nick’s, which makes keto-friendly Swedish-style light ice cream that contains no added sugar and is lower in calories than regular ice cream, also has noted growing interest in what he describes as “exciting new formats—cones, bars, [and] sandwiches with layers, inclusions, swirls, textures.” Unique flavors and flavor combinations are also trending, he adds.

Altschul identifies three trends significantly influencing the category. These include the marked increase in at-home consumption during the pandemic, which the company expects will continue; consumer orientation toward speedy shopping, e-commerce, and grocery pick-up; and the impact of inflation, which has affected frequency and depth of promotions but not consumption as of yet, he says.

New in the Freezer Case

Dairy-based ice cream and frozen yogurt accounted for 70% of the category’s product launches during 2021, followed by nondairy ice cream and frozen yogurt, at 26%; “other frozen desserts” comprised the remaining 4%, according to Innova. The nondairy subcategory is growing the fastest—at an average 52% CAGR between 2017 and 2021.

Ben & Jerry’s has been active on the new product front in recent months. Mint Chocolate Chance ice cream, offered through a partnership with Chance the Rapper, includes fudge brownie chunks and comes in dairy and nondairy varieties. Also new from Ben & Jerry’s are two nondairy offerings, Boom Chocolatta and Bananas Foster; two sundae-like SKUs, in Chocolate Milk and Cookies and Dirt Cake flavors, part of its Topped line; and two flavors of nondairy “doggie desserts,” created “for people who want to share a moment with their pets,” Robinson says.

In 2022 Unilever has rolled out new creations from Breyers, Magnum, and Talenti that dovetail with the various trends the company has noted, Kotwicki says. Breyers has prompted consumers to “take a stroll down memory lane with new flavors inspired by some of America’s most beloved desserts,” he says, by introducing the Very Berry Cobbler and Banana Split SKUs. For those in search of carb- and calorie-conscious items, the brand also has added Brownie a la Mode and Mint Fudge Cookie options to its CarbSmart line, which have 130 calories, 5 grams of net carbs, 4 grams of fiber, and 4–5 grams of total sugar per ⅔-cup serving.

The company has released the Magnum Duets line of chocolate-dipped ice cream bars in Almond Duet, Chocolate Duet, and Cookie Duet varieties and a Mini Variety Pack with six bars per pack, each with 140 or 150 calories, while also expanding the nondairy offerings from Magnum to include a new Hazelnut Crunch flavor.

In February, the Talenti brand introduced four flavor combinations as part of the new Talenti Pairings line, two of which are based on classic cocktails. The combos include Strawberry Margarita, Bourbon Fudge Brownie, Salted Chocolate Churro, and Caramel Pretzel Blondie.

Nick’s has rolled out “renovated” keto and low-calorie ice cream, ice cream sandwiches, and six new flavors of the brand’s high-inclusion premium ice cream, each of which has between 5 and 9 grams of net carbs and 260 to 420 calories per pint. Varieties include Rocky Fjord, Campfire S’mörgs, Swedish Munchies, Raspbär Swirl, Hazelnöt Kram, and Strawbär Cheesecake.

Flash-frozen Dream Pops, which are soy-free vegan popsicles and chocolate-covered bites made from coconut milks and creams, are on shelf in about 3,000 mostly natural and specialty grocery stores in the United States and Canada, Greenfield says. A vertically integrated manufacturer, the company focuses on real and simple ingredients, Greenfield claims, using only coconut sugar to sweeten its products, which include berry and vanilla bites, along with six flavors of popsicles.

Tru Fru has launched its entire line within the past couple of years and has eclipsed 100,000 distribution points at retail, NeVille says. The hyper-chilled line combines vine-ripened fruits like berries, bananas, and pineapple, coats them with white and dark or milk chocolate, and freezes them at -300˚F. “We want the fruit to be the star,” he says. “The white chocolate helps neutralize the flavor of the milk or dark chocolate and allows the fruit to stand out.”

NeVille expects the growth of the frozen dessert space to continue. “The trend of people consuming more on the home front, rather than going out, is not going to go away anytime soon,” he says. “You’re going to find more and more innovation in those areas, where people are trying to care for themselves, take care of their families, and at the same time, find moments of escape and enjoy dessert.”

Key Takeaways

- Frozen dessert sales trends vary by category subsector: Ice cream sales were down slightly, but frozen novelty sales grew.

- Dairy-based ice cream and frozen yogurt accounted for 70% of the category’s product launches in 2021.

- Consumers pursue “modern moderation,” balancing indulgence with healthfulness.

- Fans of frozen desserts are seeking fun and snackable product forms, including bars, bites, and sandwiches.