Generational Market Opportunities

Smaller households, younger adult consumers, and urban dwellers will have an outsized impact on the food and beverage industry.

Article Content

The aftereffects of the extended COVID-19 pandemic and crushing food price inflation aren’t the only factors reshaping the U.S. food and beverage landscape. Major demographic transitions are playing a significant a role as well.

Consider the following facts and figures from the U.S. Census Bureau and research/consulting firm Circana:

- The average U.S. household size is now 2.5 people, the smallest ever.

- Seven in 10 U.S. households do not have children present.

- One-person households account for more than one-quarter (28%) of all households.

- While the number of U.S. adults over age 50 and under age 50 are still relatively equal, households headed by those under age 40 will outnumber their older counterparts by 2030.

Here’s a look at some priorities for product developers related to current demographic trends.

Catering to families with kids is critical. Although household size has shrunk and the U.S. birth rate remains flat with fewer babies born in 2022 than in 2021, according to the Centers for Disease Control, households with kids and teens spend the most on food, Circana reports.

Parents are the most willing to spend on healthier foods, are more likely to be scratch cooks, and are the heaviest buyers of meat and poultry, FMI, The Food Industry Association, reports. They’re also most likely to shop for groceries online, to buy organic, and to make a special trip to purchase deli prepared food.

America’s 73 million children area a diverse group, so incorporating authentic, globally inspired foods and flavors into product development is essential.

One-third of restaurant operators told Datassential that the nation’s youngest consumers, members of Generation Alpha, are already impacting their business. Uniquely family-focused due to the COVID lockdown, socially conscious, and highly tech savvy, the oldest members of Generation Alpha will become teenagers this year.

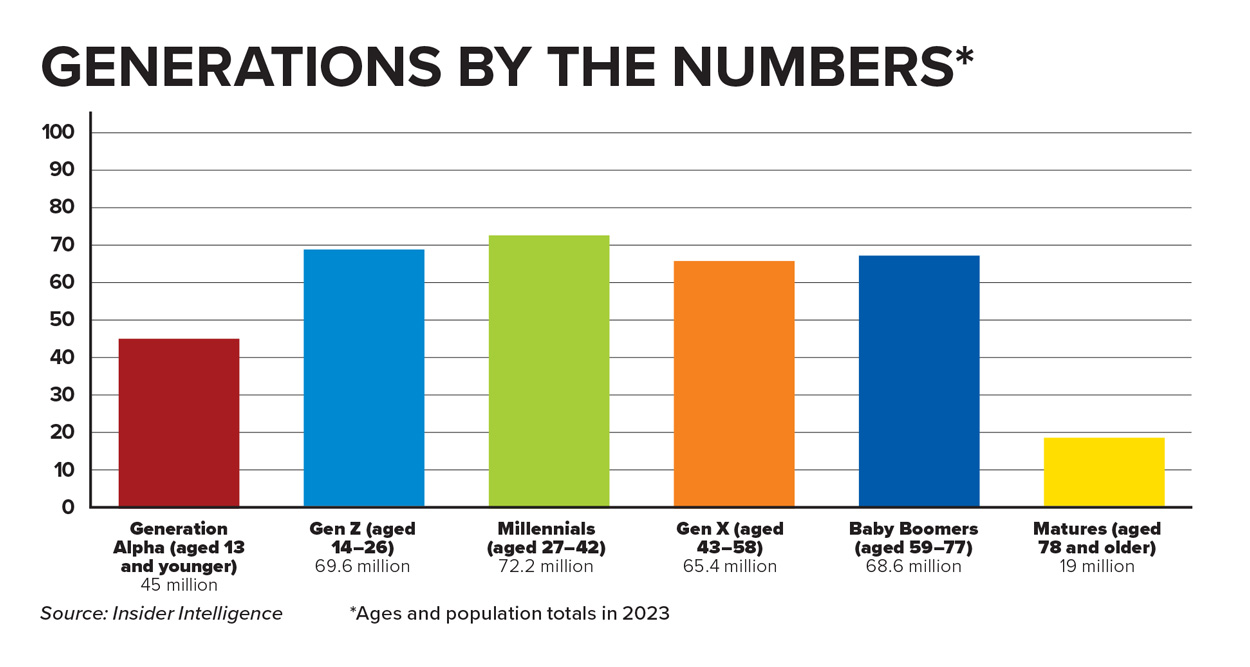

Don’t count out the baby boomers. Representing the third-largest generational cohort, baby boomers number 68.6 million. With some marketers already refocusing their product development on younger consumers, they’re continuing to miss out on the lucrative opportunities associated with the emerging food and health needs of aging boomers. Those aged 65-plus accounted for over half of all drug store channel revenues in 2022, per Circana.

Urbanites are an increasingly influential food demographic. They’re among the most likely to be buying fresh prepared foods and to be flexitarian, vegan, or vegetarian. They are heavy users of seafood, frozen foods, and specialty desserts and are among the largest groups of online-reliant shoppers, per FMI.

Americans are on the move. Nine of the 15 fastest-growing cities in the United States were in the South, according to Census Bureau data. Florida, Texas, and North Carolina had the largest population gains in 2022.

This creates opportunities for product developers to bring exciting and often unexplored regional cuisines, flavors, and food customs into the spotlight. Duke’s Southern Sauces from Sauer Brands are a good example of such an approach; the lineup include varieties inspired by Southern bodies of water—Creamy Chesapeake Cocktail Sauce, Tidewater Tartar Sauce, and Gulf Coast Lemon Garlic Aioli Sauce.

Market Movers

- The Pringles potato chip brand has added two flavors established in the Mexican market to its U.S. lineup, Enchilada Adobada and Las Meras Meras Habaneras.

- Tucson Foods introduced Tamale Bites frozen snacks in Chipotle Chicken Diablo and Sweet Corn & Cheese varieties.

- New Lean Cuisine Balance Bowls frozen dinners include four varieties that meet the nutritional guidelines of the Better Choices for Life program from the American Diabetes Association.

Dinner Plans

U.S. consumers eat a home-cooked dinner 4.6 times each week, on average, according to FMI. For Gen Z consumers, it’s 3.6 times weekly; millennials, 4.2; Gen X, 4.8; and boomers and older consumers, 5.1.

Hybrid meals that “mix and match” scratch, retail-prepared, and restaurant items represent the most popular way of preparing dinner for half of younger adults as well as four in 10 Gen Xers and baby boomers. Nearly equal percentages of younger and older meal preparers cook dinner primarily from scratch (43% versus 47%), per FMI. One in 10 boomers relies exclusively on prepared meals.

Convenience is king for most consumers, and products like chopped Spice World Easy Onion, which contains the equivalent of four onions, and Il Villaggio Grana Padano Gourmet Cheese, which comes in easy-to-use Twist & Grate packaging, help simplify meal preparation.

On average, consumers prepare meat/poultry for dinner about four nights a week, according to FMI; for Gen Z, it’s 3.2 nights weekly. Millennials are driving sales of value-added, pre-prepared fresh meat/poultry, fully cooked meats, frozen cooked meats, and meal kits, per FMI.

Men, millennials, urbanites, those with incomes of more than $91,000, and parents are the most frequent seafood eaters, according to FMI data. Younger consumers are the most likely to eat sushi, T. Hasegawa reports.

Younger consumers, men, urban dwellers, hybrid workers, parents, and high-income consumers are buying more deli prepared foods. Gen Z consumers and millennials are buying more fresh prepared pizza, entrées, sides, soups/salads, dips/salsa/hummus, and specialty desserts than they have in the past, according to a survey from Category Partners. The InnovAsian Carry Out Cuisine for Grab & Go frozen line brings fully cooked “slack and sell” Asian fare with a 14-day refrigerated shelf life to the deli’s fresh prepared case.

Boomers and upper-income consumers are the most likely to buy frozen sides for a main entrée, according to the American Frozen Food Institute. Millennials are the most likely to purchase frozen baked items. Younger consumers are the heaviest users of frozen beverages/smoothies, breakfast foods, desserts, appetizers, sauces, and dishes for home entertaining.

According to Ypulse, 70% of Gen Z consumers and millennials say they eat out or order takeout three times a week on average. McDonalds, followed by Chick-fil-A, Starbucks, and Taco Bell are the favorite restaurants of those aged 13 to 39.

Hybrid home/office workers and baby boomers are the most likely to complement restaurant takeout with convenience items liked bagged salads or fresh prepared sides. Younger and lower-income/middle-income adults are the most likely to try to re-create restaurant meals at home, according to FMI.

Tyson Spicy Chicken Breast Sliders and Pound of Ground Burger Thins add restaurant-style forms and flavors to home meal making. Uncured Pepperoni & Hot Honey Pizza with a “croissant-inspired crust” is a new addition to the California Pizza Kitchen label.

Younger consumers take an experimental approach to food prep. Experimenting with new foods and drinks is very or extremely important for nearly six in 10 of those aged 18–29; that’s nearly twice the interest level of boomers and three times that of matures, according to research from HealthFocus. For experimental eaters, Brownwood Farms Dill Pickle Ketchup With Bourbon adds a dash of fun to the condiment category.

Young adults report that they most enjoy a meal if it incorporates a diversity of preparation methods or contains unique foods and ingredients, according to FMI. Gen Z consumers and millennials far over index for recipe searches for air fryers and devices like Instant Pots, per FMI.

According to the Specialty Food Association, 81% of millennials, 80% of Gen X consumers, 70% of Gen Zers, and 60% of boomers purchased specialty foods in 2022.

Nearly six in 10 Gen Zers (58%) ate globally inspired foods other than Italian, Mexican, or Chinese in a recent week; that’s versus 48% of millennials, 34% of Gen X consumers, and 19% of boomers, Datassential reports. Japanese, Korean, Thai, Greek, and Middle Eastern are among the cuisines with the highest Gen Z appeal, per T. Hasegawa.

Those under age 40 are the most likely to entertain at home, Circana reports. Special entertaining event/holiday deli meals, party trays, and grill- or appliance-ready party solutions are enjoying brisk sales. Hormel brings together multiple brands with its new Columbus Craft Meats Handcrafted Charcuterie Board product.

Market Movers

- New Local Bounti Salad Kits are made with produce grown indoors and include animal protein, with options including Memphis Style BBQ Chicken.

- Cascadian Farm Ready to Roast Vegetables are packaged with a roasting pan included.

- The Dr. Praeger’s brand added frozen Cauliflower Broccoli Veggie Fries to its lineup.

- Farm Rich has debuted frozen Budweiser Beer Battered Cheese Sticks.

Snacks and Treats

Millennials (47%), parents (46%), and those who work from home at least some of the time (42%) increased their salty snack consumption last year, according to Mintel research.

For those aged 25–34, early morning snacking rose 16%, late evening snacking was up 13%, and evening snacking climbed by 11%, according to a 2023 Circana survey. Among those aged 35–44, early morning snacking was up by 9%, morning snacking climbed by 10%, and late evening snacking increased by 7%.

Circana also reports that dollar sales of vegan snacks shot up by 103%, albeit from a small base, for the year-long period ended Jan. 3, 2023. Sales of immune-boosting snacks were up 82%.

Popular street food connections and foodservice/CPG crossovers continue to grab younger snacker’s attention, Circana says. Dill pickle, BLT, churro, espresso, Gorgonzola, and hot honey are among the emerging snack flavors they’d like to try, according to research by T. Hasegawa.

Gen Zers say that complex and decadent flavors make a snack seem more premium, according to T. Hasegawa. For millennials and Gen X consumers, superfoods, premium salts, and local ingredients connote premium. Older consumers see collagen and turmeric as premium ingredients.

Urbanites, millennials, and larger households with kids want more culturally diverse baked goods and desserts, FMI reports. Limoncello, beignets, mochi, tres leches cake, and churros are among the fastest- growing globally inspired desserts on menus, and panna cotta is a menu favorite for males, according to Datassential.

Almost one-quarter of those aged 18–34 are eating confections at lunchtime or as a midday treat, according to Circana.

Market Movers

- For protein-seeking consumers, Wilde Barbeque Protein Chips made from chicken offer 10 grams of protein per serving.

- ONE Shreddin’ Cheddar Puffs boast 14 grams of protein per serving.

- Lakeview Farms offers Fresh Creations Street Corn Dip.

- Recent new product introductions from Hershey include Hershey’s Kisses Milklicious Milk Chocolate Candy with a creamy chocolate milk filling, Kit Kat Churro Candy Bar, and a limited-edition Hershey’s Popping Candy Bar featuring popping candy and sprinkles in white chocolate crème.

- Cheetos Mac ‘n Cheese in single-serve microwaveable cups comes in two new flavors, Cheesy Bacon and Four Cheesy.

Healthy Living

Millennials and households with kids are the population segments most likely to be making a lot of effort to eat healthier (41% versus 31% of the general population), per FMI.

Interest in functional foods and drinks is highest among those aged 18–29 (60%) and declines with age to 34% of those aged 65-plus, according to HealthFocus. Six in 10 consumers strongly agree that beverages can provide the same nutrition as foods.

Young adults are also driving a new trend to whole food supplementation; 47% of those aged 18–29 use supplements made from real food once a week or more, according to HealthFocus.

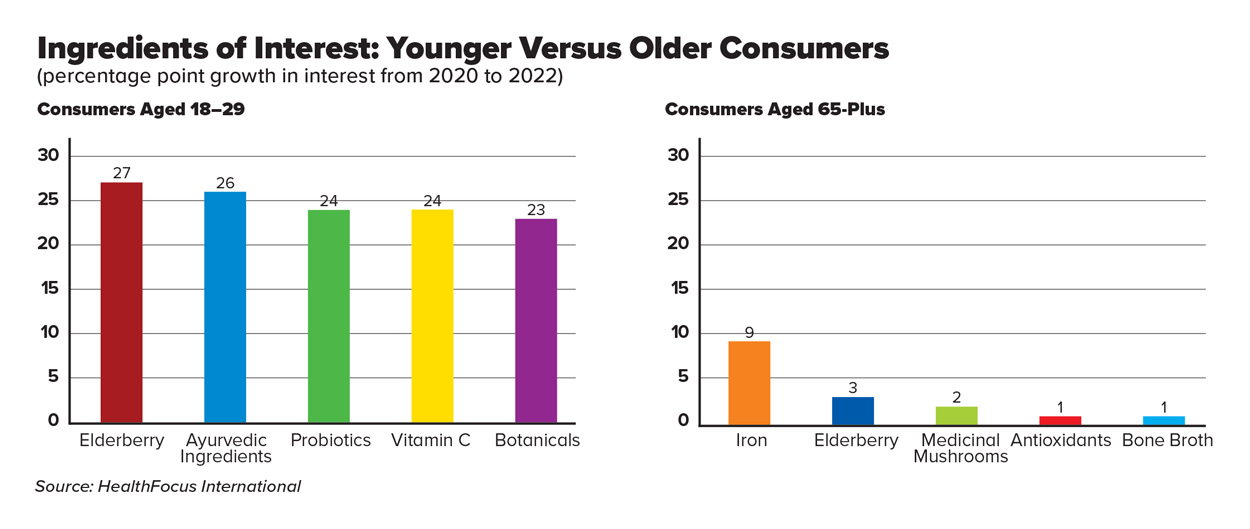

Those in this age group are most interested in elderberry, ayurvedic ingredients, and probiotic ingredients, HealthFocus says. For seniors, iron, antioxidants, and medicinal mushrooms are ingredients of interest. (See figure on page XX.)

Two-thirds of those aged 18–29 use nutritious beverages, including smoothies and green juices, as a meal or snack, according to HealthFocus. Half of baby boomers do so.

Three-quarters of young adults report that they are often stressed, anxious, or worried versus 56% of Gen X and 42% of baby boomers, according to the International Food Information Council (IFIC). Two-thirds of Gen Zers say that mood/mental health benefits are extremely important in their food/beverage selection.

Weight management and mental health are the benefits young adults most want to get from foods and drinks, according to IFIC. Support for healthy aging is the product benefit most sought after by baby boomers, followed by weight management, heart health, and energy. For Gen X, the most sought-after benefits are energy, weight management, healthy aging, and heart health, per IFIC research.

Two-thirds of young adults, half of Gen X consumers, and four in 10 boomers report following a specific diet or eating plan in the past year. High protein, calorie counting, clean eating, and intermittent fasting topped the list, according to IFIC. The number of those who say they follow a plant-based diet program fell for the second year in a row, IFIC research shows.

One in five millennials and 17% of Gen Zers say they regularly drink plant-based beverages, per Ypulse. Only 6% of Gen Z and 12% of millennials say they are regularly eating plant-based meats. All-natural, local, and eco-friendly are the top callouts that would make them more likely to buy a grocery item, YPulse says.

HealthFocus reports that two-thirds of those aged 18–29 say they are extremely interested in eating clean—twice the level of those aged 65-plus. In addition, 42% of those aged 18–29 are interested in lab-grown animal products, which is seven times the number of those aged 65-plus who are interested in such products, per HealthFocus.

According to YPulse, 12% of millennials describe their diet as dairy-free; 11% are vegetarian; 8%, vegan; and 6%, pescatarian: For Gen Z, the figures are 8%, dairy-free; 7%, vegetarian; 5%, vegan; and 5%, pescatarian. Taco Bell is testing a vegan version of its popular Crunchwrap menu offering.

While carb avoidance skews younger, replacing traditional starches with vegetables is most common among Gen X/boomers, urbanites, parents, and online shoppers, according to FMI.

Perceptions of the healthfulness of fats vary by age. For example, HealthFocus found that older consumers are more accepting of the use of vegetable oils than younger consumers are. Nearly 40% of those aged 18–29 are very concerned about vegetable oils versus just 29% of those aged 50–64 and 22% of those aged 65-plus. On the other hand, just 36% of those aged 18–29 consider animal-based tallow/lard a “bad fat” while 60% of those aged 50–64 and 70% of those aged 65-plus think of it in that way.

Forty percent of those aged 18–29 have become more physically active over the past two years as well as one-third of those aged 30-49, and one-quarter of those aged 50–64, per HealthFocus. Mood-boosting and socializing are among the top reasons mentioned for choosing to exercise.

Market Movers

- Blue Bear Sleep canned ready-to-drink bedtime teas contain 5 mg of melatonin along with lavender, ashwagandha, L-theanine, gamma-aminobutyric acid, and chamomile.

- Morinaga America’s Chargel is a new caffeine-free athletic gel drink for “instant energy” formulated with a blend of B vitamins, carbohydrates, and fruit juice.

- Dr. Praeger’s Birthday Littles snacks in fun shapes for kids are made with hidden zucchini, sweet potatoes, cauliflower, and other vegetables.

- Lactose-free Good Culture Probiotic Milk is a good source of vitamins A and D and delivers 1 billion probiotic cultures per serving.

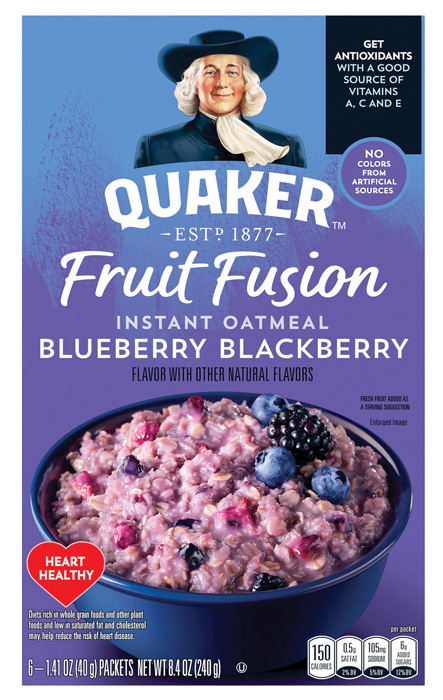

- Quaker calls out heart health on packaging for its Fruit Fusion Instant Oatmeal.

Healthy Planet

There are more environmentally conscious 18–34-year-olds than in all other age groups combined, per Nielsen IQ. Moreover, sales of food/beverage products carrying multiple claims, such as animal welfare and environmental sustainability or social responsibility are growing twice as fast as those with a single callout.

One-quarter of millennials say claims related to how a product is produced (i.e., organic, grass-fed) are the most important factor when purchasing fresh meat/poultry, according to FMI.

Six in 10 consumers (60%) shop farmers markets at least occasionally, according to FMI research. They do so to seek fresh products of good quality and also to show support for local farmers. Support for farmers is driven by boomers (70%) versus just 46% of millennials and 41% of Gen Z. Younger generations, parents, and those with higher education are more likely to say that climate-friendly has an impact on their choices, according to IFIC.

Kroger added Seeded Multigrain Bread and Multigrain Quinoa Bread made with ReGrained SuperGrain+, an upcycled ingredient, to its Simple Truth line.

REFERENCES

AFFI. 2023. Frozen Fruits & Vegetables Survey. American Frozen Food Institute, Arlington., Va. affi.org.

BLS. 2023. Bureau of Labor Statistics. Washington, D.C. bls.gov.

CDC. 2023. “Births: Provisional Data for 2022.” Centers for Disease Control. cdc.gov.

Circana. 2022. “SNAP What a Difference a Day Makes.” Webcast, Nov. 1. Chicago. circana.com.

Circana. 2023 ‘The Snacking Supernova: How to Win in the 2023 Snacking Universe.” Webcast, April 11.

Circana. 2023. “Fresh for 2023 and Beyond.” Webcast, Feb. 28.

Datassential. 2023. “Decoding the American Diet.” Webcast, Feb. 2. Chicago. datassential.com.

FMI. 2022. The Power of Foodservice at Retail. FMI, The Food Industry Association, Alexandria, Va. fmi.org.

FMI. 2022. The Power of Seafood.

FMI. 2023. The Power of In-Store Bakery.

FMI. 2023. The Power of Produce.

FMI. 2023. The Power of Meat.

FMI. 2023. U.S. Grocery Shopper Trends.

HealthFocus. 2022. U.S. Consumer Trends Report, HealthFocus Intl., St. Petersburg, Fla. healthfocus.com.

IFIC. 2023. Food & Health Survey. Intl. Food Information Council, Washington, D.C. foodinsight.org.

Insider Intelligence. 2023. New York. insiderintelligence.com.

Mintel. 2023. Salty Snacks—U.S. Jan. Mintel International, Chicago. mintel.com.

NielsenIQ. 2023. “2023 Consumer Outlook.” Webcast, Feb 14. Chicago. nielseniq.com.

RFA. 2023. Refrigerated Foods Association Consumer Survey. Marietta, Ga. refrigerated foods.org.

SFA. 2022. Today’s Specialty Food Consumer. Specialty Food Assoc., New York, N.Y. specialtyfoods.com.

T. Hasegawa. 2022. Flavor Flash: Regional and International. T. Hasegawa USA, Cerritos, Calif. thasegawa.com.

T. Hasegawa. 2023. Food and Beverage Flavor Trends Report. March.

T. Hasegawa. 2023. Flavor Flash: Salty Snacks. May.

YPulse. 2023. New York. ypulse.com.

U.S. Census. 2023. U.S. Dept. of Commerce, Washington, D.C. census.gov.

KEY TAKEAWAYS

- Although the average household size has shrunk, families with kids remain an important market for food and beverage makers.

- Consumers make dinner at home more often than not, and they’re seeking products to simplify meal preparation.

- Millennials and members of households with kids are most likely to be striving to eat more healthfully.

- Salty snack consumption has increased for millennials, parents, and those who work from home at least part-time.