Pizza Sales Cool Off

Faced with slowing sales, pizza makers are targeting specific slices of the market, including both indulgence seekers and consumers with special dietary concerns.

Article Content

Frozen pizza sales have tapered off somewhat as the pandemic has done the same, with dollar sales remaining high but mostly due to inflation. However, consumers remain enamored of pizza in the deli as a fresher option that’s closer to restaurant quality at more affordable prices.

The U.S. frozen pizza subcategory gained 10.7% in dollar sales to reach $6.8 billion in grocery, drug, mass market, and other channels, although unit sales fell 2.8% to less than 1.4 billion, according to data from Circana for the 52 weeks ending April 23, 2023. The price per unit rose 13.9% to $4.94. The much smaller subcategories of frozen pizza crusts/dough and pizza kits/toppings fared even worse, falling in dollar sales, respectively, by 1.5% to $44.1 million, and by 11.2% to $6.2 million.

“Frozen has taken a hit in unit sales,” says Sally Lyons Wyatt, executive vice president and practice leader for Circana. “There’s a whole lot underneath that: in-stock availability difficulties due to supply chain, the shifting of assortments with more brands reducing certain types of flavors, and the other piece that drives that is price increases. So frozen has a lot of complexity.”

Circana data showed that deli pizza fared considerably better than the frozen category. Dollar sales of whole pizzas rose 16.3% to $1.2 billion, while unit sales were up by 8.7% to 160.7 million as prices rose 7.0% to $7.50. Sales of pizza slices were up 18.3% to $630.2 million as volume rose 8.5% to 240.5 million and prices were up 9.0% to $2.62 per slice. Sales of pizza sauce rose 13.9% to $179.6 million, according to Circana, while shelf-stable kits/mixes were up 0.6% to just under $30 million and crust mixes were up 18.3% to $17.7 million.

Lyons Wyatt believes deli has had success due to the potential variety, perceived freshness, and less dramatic price increases. “Some retailers are allowing you to do a bit of customization,” she says. “There’s a perception that deli is a little more fresh, and some consumers have gravitated toward that. … This plays into one of the trends we’ve seen on and off the past few years: premiumization. Some consumers will opt in for a higher-priced item, if they feel like it’s restaurant-quality at home.” Sauce and crust mixes are growing well because they also provide customization possibilities as well as the at-home preparation option, she adds.

A Roller-Coaster Ride

A report on the category released in 2022 by Mintel described “a roller-coaster ride” with sales spiking during the pandemic, easing somewhat in 2021, rebounding last year due to inflation, but expected to return to more modest growth as inflation tails off this year. Continued growth in the category could come from options that touch on a combination of better-for-you and premium/indulgent positioning and targeting nontraditional dayparts like breakfast.

“Store-bought pizza, frozen in particular, is more utilitarian, more likely to be consumed on weekdays or when eating alone,” the report says. “Retailers and store-bought competitors should explore ways to capture a little of the festiveness of other pizza types, either to inject a little fun into routine meal occasions or to claim a bigger share of the pizza party market.”

Inflation has definitely impacted the category like so many others, which has led consumers to switch away from restaurant delivery to premium frozen pizza, and some also to tack in the direction of value pizzas, says Roger Galloway, senior director of marketing for pizza at Schwan’s Company. “Even the most premium pizzas in the frozen pizza category are substantially less expensive” than delivery, he says, adding that “consumers can purchase a Red Baron pizza for under $5 and a Tony’s pizza for under $4.”

Nestlé USA—which owns such brands as DiGiorno, Tombstone, Jack’s, California Pizza Kitchen, Sweet Earth, Life Cuisine, Stouffer’s, and Lean Cuisine—believes that while most sales are found in mainstream offerings, growth opportunities exist in both the indulgence and dietary management directions, says Adam Graves, president of the Pizza and Snacking Division at Nestlé USA.

“Our approach to pizza innovation is twofold: One, we’re doubling down on our core product portfolio. Two, we’re innovating quickly to deliver on ever-changing consumer tastes,” he says.

Focusing on Health

Data from Innova Market Insights reveal that no additives/preservatives (16.0%), vegetarian (14.0%), and high source of protein (5.8%) are among the top claims featured globally on new pizza products. The fastest-growing claims include “high source of fiber,” “low/no/reduced sodium,” “low/no/reduced carb,” “lactose-free,” and “no additives/preservatives.”

Pizzas with vegan and vegetarian claims saw growth in dollar and unit sales from 2019 to 2022, although that hasn’t been the case thus far in 2023, says Lyons Wyatt of Circana. However, gluten-free, vegan, and plant-based have all done well over the past several years. “During COVID, many of us were learning more about what it takes to stay healthy,” she says. “That has fueled a lot of what we’re seeing with claims.”

Gail Becker, founder and chief innovation and brand officer of Caulipower, says she was inspired to create the brand because her sons have celiac disease and she wanted to find better-tasting gluten-free food. Coming out of the pandemic, consumers have turned toward healthier eating because they want to fit back into their jeans or are identifying as a flexitarian, she says. “We’re seeing people make more balanced choices that fit their lifestyle.”

Cauliflower crust has gained more mainstream acceptance, even at foodservice, in the past five years, according to Becker. “When I started, I approached foodservice with a cauliflower crust, and they looked at me like I had a third eye,” she says. “Now, you’re hard-pressed to go into a restaurant and not find a gluten-free option—and you’re seeing cauliflower crust more and more, particularly in regional pizza chains.”

Melanie Domer, chief marketing officer for Daiya Foods, which offers dairy-free, plant-based pizzas, agrees that cauliflower crust has taken hold and also has opened the door to more acceptance of other crust types. She sees continued consumer interest in gluten-free pizza. “People’s values have continued to evolve,” she says. “They know that eating plant-based is good for them and good for society.”

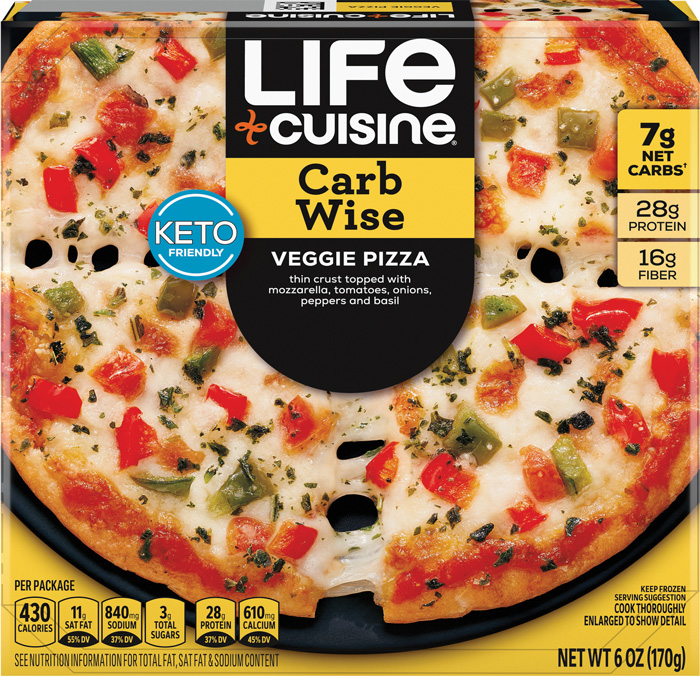

Nestlé USA has attempted to address specific dietary preferences through SKUs like DiGiorno Gluten Free Pizza and Life Cuisine Carb Wise Veggie Pizza, Graves says. “People’s dietary preferences are constantly evolving, and they are looking for convenient options to meet those lifestyle changes,” he says.

Citing Circana data, Galloway of Schwan’s notes that sales of products with better-for-you crust types like plant-based, gluten-free, and whole grain total a little more than $400 million, or 6.2% of the category. Plant-based crusts, 88% of which are made from cauliflower, have grown 24% in sales in the past two years, he says, while gluten-free crusts have declined 6%.

Indulgence Still Claims Share

Innova data show that “traditional” and “premium” rank as the fourth- and fifth-most common claims on pizza packages, showing that brands feel the need to impress consumers by touting those qualities, according to Innova’s analysis. The top two flavors across most regions have been ham (5.9% of product launches) and red tomato (5.2%), Innova found.

Nestlé USA has targeted the indulgence sector with offerings like the DiGiorno Fully Stuffed Crust Pizza and Jack’s Max, which has added toppings and flavor, Graves says. “People are craving indulgent options at all parts of the day,” he says. “Some of our latest offerings provide fans with over-the-top comfort.”

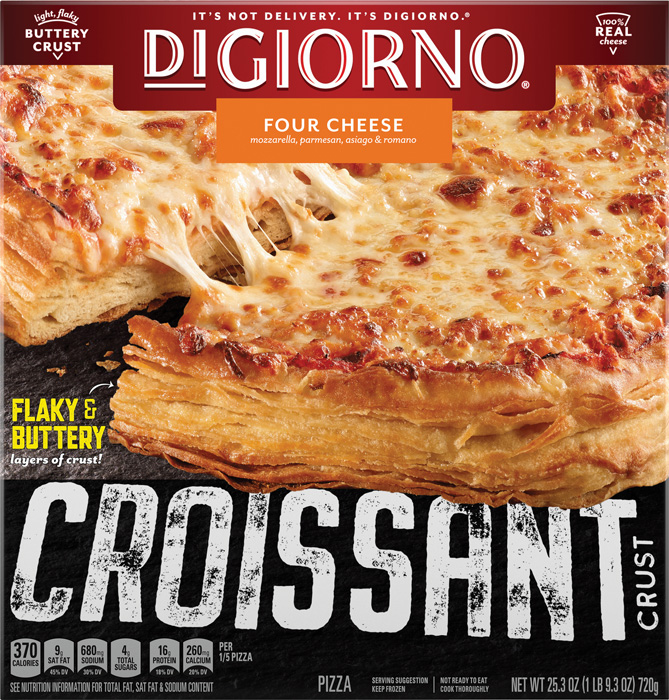

The DiGiorno brand also has been looking to compete with restaurant quality pizza through take-and-bake options, he adds, and Nestlé sees opportunities for growth in products positioned for consumption as breakfast fare or as a snack, which has led the company to roll out DiGiorno Croissant Crust Pizza and DiGiorno Stuffed Pizza Bites, respectively.

“Mainstream indulgence” has represented the bulk of successful taste innovation during the past couple of years, Galloway says, although “some brands have tried to push into elevated flavors like hot honey cheese, Buffalo-style chicken, or quattro formaggi—featuring mozzarella, Gorgonzola, Parmigiano-Reggiano, and goat cheese.”

Becker of Caulipower says indulgent pizzas appeal to those who want comfort foods but can’t afford to eat out given inflation. “Going out to dinner is expensive,” she says. “How can I create that quote-unquote ‘gourmet’ experience at home? They may spend a little bit more on it, but it’s still cheaper than going out to dinner.”

Given that three-quarters of U.S. households buy frozen pizza, and they buy it on average once every five weeks, they’re constantly looking for different flavor, ingredient, and crust varieties, Domer says. “They’re coming to the shelf, looking for options, and they have a really broad consideration set when they’re shopping the category,” she says.

Mintel notes that while consumers remain interested in premium toppings and unique varieties, if the crust isn’t right, they will lose interest in a brand.

What’s Trending

Innova data show that Europe accounted for more than half of new pizza products (54.3%) developed between 2020 and 2022, followed by North America (12.5%) and Latin America (7.8%), the latter of which is the fastest-growing region for pizza product launches.

Among the newest offerings from Nestlé is California Pizza Kitchen BBQ Chicken Recipe Pizza with a thin crust made with grilled white meat chicken, red onions, cilantro, mozzarella, hickory smoked Gouda cheeses, and barbecue sauce, which hit stores in April, the same time as the company’s Life Cuisine Carb Wise Veggie Pizza, which contains mozzarella, tomatoes, onions, peppers, and basil.

To aim for those who want higher-quality retail pizza, Schwan’s last August launched four varieties of Hearth & Fire pizzas that start with a minimum 20-hour fermentation process to add flavor and texture to the crust, then are baked over an open fire at more than 1,000°F, and finally are vacuum-sealed to preserve “craft quality,” Galloway says. Varieties include Margherita, Pepperoni, Mushroom, and Bianca, which is made with fontina, sharp cheddar, goat, and Asiago cheeses, a Parmesan white sauce, and a pinch of oregano.

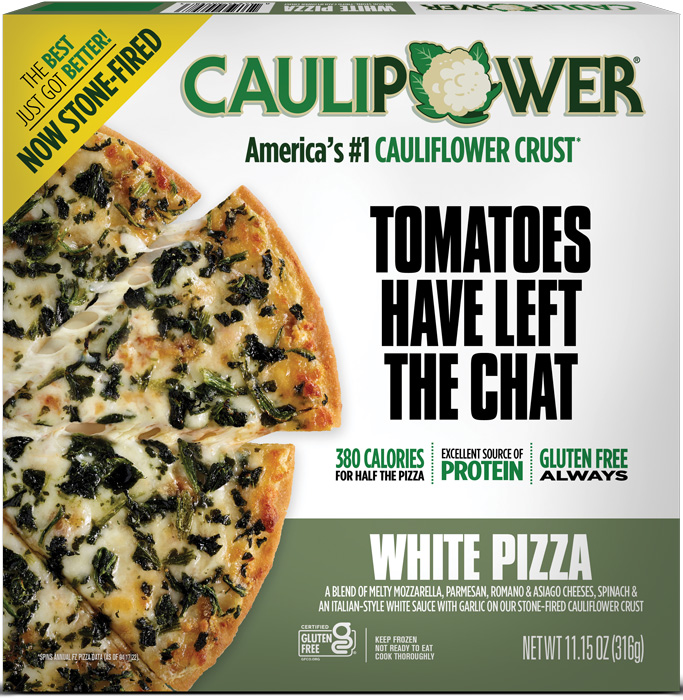

Caulipower has released a new White Pizza SKU that’s “just been taking off,” Becker says. “It has quickly skyrocketed to become one of our most popular SKUs.” The packaging informs consumers that “Tomatoes Have Left the Chat.” And Daiya released a new pizza SKU earlier this year: BBQ Plant-Based Chick’n Style Pizza.

What Do Consumers Want From Retail Pizza?

A category report on retail pizza released in 2022 by Mintel offers a number of insights about what consumers would like to see. Among them:

- Nearly three-quarters of those surveyed said they had eaten store-bought pizza in the past three months, especially younger adults and those in larger households.

- Young adults aged 18 to 34 are significantly more likely to consume frozen pizza for breakfast, lunch, or a snack.

- Convenience and value define the category, but brands looking to grow should go beyond that, especially in the direction of “craveability.”

- Growing market share is challenging given that consumers are often stuck in routines when they are shopping the pizza category.

- Consumers often find retail brands skimpy on toppings; nearly half say they’d like to see more toppings.

- While consumers believe retail pizza has improved in taste, more than three-quarters still think delivery pizza tastes better.

KEY TAKEAWAYS

- While inflation has buoyed dollar sales of frozen pizza, unit sales have dropped.

- Both fresh deli pizza and ingredients for make-your-own pizza have performed well.

- CPG companies have focused product development on both better-for-you and indulgent pizza varieties.

- Younger consumers in particular are interested in eating pizza for breakfast and snacks.