Mix-and-Match Protein Products Target Flexitarians

STARTUPS & INNOVATORS

The flexitarian movement by consumers has raised an interesting question for corporate innovators and entrepreneurs: If more shoppers are conscientiously putting some meat products and some plant products on their plates to balance their diets, why not just combine animal and plant ingredients in a single item and save them the trouble?

In fact, that’s what an increasing number of CPG players are doing, from giants such as Perdue to startups like Seemore Meats & Veggies. And yet big hang-ups remain among many consumers—meat eaters who don’t want to adulterate their hamburger or chicken nuggets with vegetables and vegetarian shoppers who can’t countenance any contamination of purely plant-based products with meat.

“We’re in a great age of experimentation; no one really knows what the ultimate interest level is for combined products,” says Ken Harris, managing director of Cadent, a CPG consulting firm. “But companies have every reason to try them out. There may be something there, and they don’t want to be left behind in this movement.”

Americans have been sending strong signals of an embrace of flexitarian diets and, by implication, all-in-one products. In the United States, 38% of consumers can be described as flexitarian, and the percentages are much higher in many European countries, according to research by Innova Market Insights. Parents making flexitarian choices for their kids represent a key target audience.

“You have to take a Venn diagram approach,” says Sara Foley, partner in SWAT Equity Group, an early-stage venture capital firm whose food investments have included healthy protein products maker Powerful Nutrition and chickpea formulation innovator Banza. “Vegan is small; paleo is small; vegetarian is larger. And those who want to migrate to more ‘plant-forward’ are doing flexitarian and can move in and out. So the convenience factor of ‘all-in-one’ is huge.”

Perdue joined with startup Better Meat Co. to field Chicken Plus nuggets a couple of years ago, and the line already accounts for about 20% of all frozen nonorganic chicken nugget sales in the United States. Chicken Plus products include cauliflower, chickpeas, and plant proteins.

“In the same way that most plant-based meat is consumed by people who also eat meat, they won’t be upset by our product,” says Paul Shapiro, founder and CEO of Better Meat, a three-year-old company that supplies Perdue with the main component of Chicken Plus. Better Meat has attracted about $10 million in venture investments from sources including Johnsonville Sausage, a major meat processor. The company supplies plant protein formulations that blend into animal meat without noticeably affecting the taste and texture, at much higher concentrations than the industry has been used to.

Another major meat company, Hormel, has leapt into flexitarian products. Its Applegate Farms unit introduced Well Carved “blended” burgers and meatballs last spring, calling it “a new line to satisfy conscientious consumers who are being mindful of their meat intake and nutritional, ethical, and environmental impact.”

And after Nestlé bought the Freshly home delivery meals outfit in late 2020, one of the first development projects accelerated by the CPG titan was a flexitarian meatball that quickly appeared on Freshly’s menu.

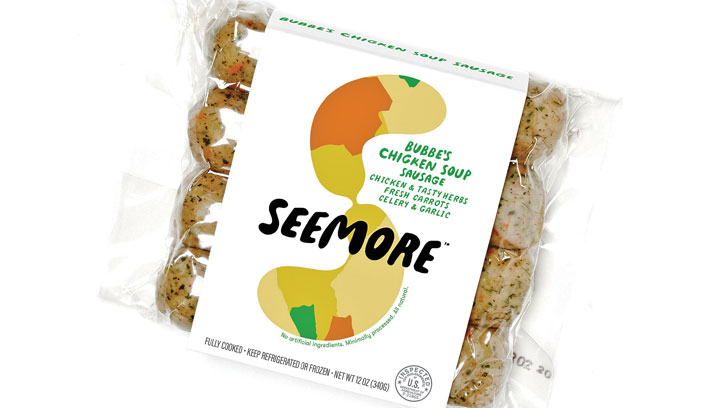

Cara Nicoletti is a fourth-generation butcher who co-founded Seemore Meats & Veggies in 2018 to sell “vegetable-forward” sausages that consist of half meat, about 35% vegetables, and spices and cheese that she concocts into precooked, visually interesting products with all-in-one flexitarian appeal. So far, they’re available regionally in the Northeast.

Hema Reddy took a similar approach by offering two lines of nuggets after she founded Crafty Counter in 2017: One was plant-based, the other a flexitarian offering that boasted of a meat-plant balance. But by last year, Reddy pulled the combination offering from the market.

“We thought we were making the planet a better place by reducing the animal footprint halfway,” Reddy says. But consumer feedback showed that the company’s customers weren’t on board. “It didn’t convert into a clear value proposition for the consumer,” says Reddy. “The consumer wants to take a stand. Reducing the animal footprint only halfway doesn’t work for them.”

So, for now, it seems that while the jury may still be out on consumers’ appetite for hybrid products, innovative formulators will likely continue to offer plenty of opportunities for them to be flexible in their protein choices.