Success Strategies for the Center Store

Culinary adventures, ultra-convenience, and high-performance health are poised to drive purchases in the center store in an uncertain economic climate.

Article Content

Although food and beverage dollar sales—up 8.7% in multi-outlet retail channels* for the year ended Oct. 30, 2022, thanks to inflated prices—may suggest that business is booming, that is not the case.

Just two items in the center store (frozen cookies and energy drinks) posted double-digit unit sales growth in that time frame, per IRI data. Of 130 center-store categories tracked, only powdered milk, pastry/doughnuts, bagels/bialys, Asian food, rice/popcorn cakes, candy, baby formula/electrolytes, dry beans, and nut butters gained 1% or more in unit sales.

While retail food/beverage dollar sales are projected to grow 5%–7% in 2023, according to IRI, unit/volume sales are expected to be flat to slightly down (0% to -3%). Prices for food and beverage products sold in the center store were up 14.9% over the prior year in November of 2022, but price inflation appeared to be leveling off after climbing throughout most of the calendar year, IRI reports.

Given the likelihood of continued economic instability in the year ahead, savvy marketers and product developers should consider focusing on three areas: products to create experiential dining occasions, super easy eats, and foods/drinks that deliver whole health benefits.

Experiential Meal Occasions

With chefs surveyed by the National Restaurant Association citing “experiences” as the top culinary trend for 2023, foods and drinks that offer a culinary adventure or special treat will be positioned for marketplace success.

Half of Gen Z/millennial consumers eat global cuisines other than Italian, Mexican, or Chinese every week, per Datassential. Next on the global cuisine popularity list are Japanese, Greek, Thai, Latin, and Middle Eastern fare, according to T. Hasegawa USA, which suggests that product developers might consider incorporating these influences into formulations.

Star performers among the traditionally popular international cuisines include center-store Mexican foods with sales of $4.0 billion, up 9.8% for the year ended Oct. 30, per IRI, and center-store Asian food at $1.5 billion, also up 9.8% for that time period. Sales of frozen Asian entrées jumped 14.7%.

Pairing emerging flavors and ingredients with trusted flavors or cuisines can help promote consumer trial. Fusion flavors have grown 39% on menus since 2021, per T. Hasegawa. Consumers are most likely to try fusion flavors in juice, soda, or tea.

Consumers increasingly are turning to do-it-yourself options for more customized and often more affordable culinary experiences with an international flavor. Wonton/egg roll wraps and pizza kits were among the items enjoying positive growth for the year ended Oct. 30, IRI reports.

While sales of products for home entertaining are outpacing sales in many other product categories, consumers are refining their guest menus to reflect ease, affordability, and sophistication, according to IRI. The Sea Best Shrimp & Crab Pot from Beaver Street Fisheries offers culinary/regional excitement and three pounds of seafood. Savorly has added plant-based Puff Pastry Dogs to its lineup of upscale frozen appetizers.

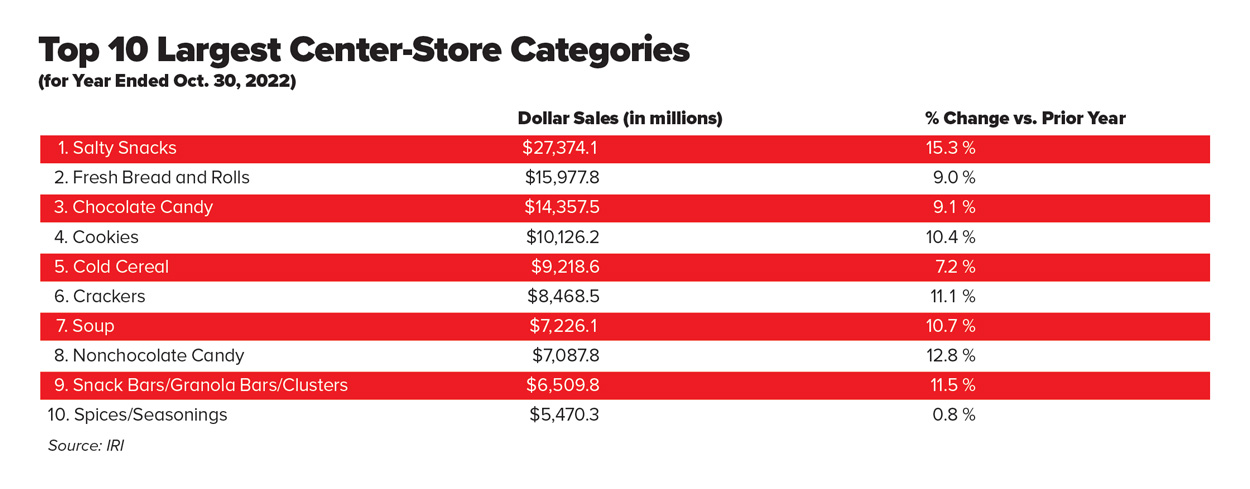

Snacks remain the largest center-store category, with dollar sales of $27.4 billion, up 15.3% for the year ended Oct. 30, while unit sales were flat, per IRI (Table 1). Sales of small indulgences, including cookies, nonchocolate candy, pastry/doughnuts, and bakery snacks all posted double-digit sales growth.

Roasted, toasted, grilled, and smoked are the flavor preparations consumers would most like to try as a snack. Six in 10 snackers are interested in sesame, coffee, truffle, pickle, ginger, and mushroom flavors, according to T. Hasegawa research.

Plant-based jerky/vegetable snacks, zero-sugar candy, and high-protein cookies are the fastest-growing healthy snack segments, according to SPINS, which tracks sales of better-for-you products. SPINS also reports that sales of chips and other snacks touting 15 to 20 grams of protein grew 64% for the year ended Oct. 30.

Evolved Chocolate’s Dark Chocolate + Quinoa snacks are high in protein and low in sugar, making them a good fit for protein-seeking snack lovers. And for those who are looking for gluten-free treats, indulgent frozen treat maker Delizza now offers Gluten Free Mini Eclairs.

Sales of mainstream frozen novelties/ specialty desserts jumped 9.8% for the year ended Oct. 30, per IRI. Tiramisu, baklava, churros, cannoli, carrot cake, and flan are among the top 10 desserts delivered by Grubhub this year.

Water/sparkling water, salty snacks, ice cream/frozen novelties/specialty desserts, juice, and carbonated soft drinks are among the top 10 most purchased gourmet food categories in 2022, per the Specialty Food Association.

Products from celebrity chefs, restaurant-branded retail foods/drinks, and branded inclusions continue to generate customer excitement. WokAsia has introduced frozen Asian sides created by noted chef Martin Yan.

Market Movers

- Korean food maker CJ Foods USA offers Bibigo Mandu Beef & Vegetable Dumplings.

- Simple Mills has added Nut Butter Stuffed Sandwich Cookies made with organic coconut sugar to its product assortment.

- Tomato Chips from Just Pure Foods are made from real tomatoes using a low-temperature drying process.

- IWON Organics Protein Popcorn is formulated with organic coconut oil and pea protein.

- Sustainably sourced salmon is the main ingredient in low-carb Salmon Chips from Tochi.

Super Easy Eats

Restaurant cutbacks, inflation, and the post-pandemic return to work and school have accelerated demand for ultra-convenient products and a more sophisticated level of at-home food preparation. As of November 2022, 78% of meals are being prepared at home, according to IRI. Households with teens, followed by those with young families, spend the most money on center-store foods, per IRI.

Products like Williams Sonoma’s Piccata Pan Sauce and eight-serving Progresso soup mixes deliver easy mealtime solutions. Ajinomoto clearly flags preparation time on packaging for its line of Tai Pai frozen foods.

Center-store product categories that posted sales growth of more than 10% for the year ended Oct. 30, include soup, rice, pasta, spaghetti sauce, bottled/canned fruit, canned beans, and shelf-stable dinners/sides, IRI reports.

Six in 10 meal preparers research recipes for Crock-Pots, 45% do so for air fryers, and 37% look for Instant Pot recipes, according to IRI’s 2022 The Power of Meat report. Hanover Foods’ new line of frozen Seasoned Air Fryer Ready to Cook Vegetables includes Flavors of India Spiced Cauliflower.

Consumers are most interested in grilled, roasted, and stir-fried protein preparations. Tomatillo, adobo, Thai chili, paneer, and chaat marsala are the dinner flavors they would most like to try, per a T. Hasegawa 2023 report.

With dollar sales flat and unit sales down 4.6% in the $5 billion spices/seasonings category, according to IRI, there may be a strong market opportunity for boldly flavored products, sauces, and flavor enhancers such as Korean Raspberry Gochujang BBQ Sauce from Wozz! Kitchen Creations and Hot and Spicy Japanese Barbecue Sauce from Bachan’s.

Bread is an important center-store category, and Gen Z/millennial consumers have put bread/rolls back on the table. In particular, they’re sending sales of sourdough, ”everything,” cinnamon, and pretzel breads soaring, according to IRI. Dollar sales of center-store bread/rolls reached $16.0 billion, +9.0% for the year ended Oct. 30, per IRI, with sales of bagels/bialys up 13.7% to $1.4 billion. FMI – The Food Industry Association points to gluten-free, non-GMO, and organic as the most sought-after healthful attributes for bread and rolls.

Global favorites such as paratha, roti, and pastry buns, all of which are among the National Restaurant Association’s top culinary trends to watch for 2023, offer an opportunity to upgrade traditional sandwich carriers. Mama Lupe’s new line of flavored tortillas in varieties such as chocolate, pumpkin spice, and buffalo spice brings a taste of something different to the supermarket bakery products aisle.

Sales of products for home baking needs reached $2.8 billion for the year ended Oct. 30, IRI reports. Dollar sales of flour/meal rose 12.1%, frosting sales were up 8.0%, and sales of baking mixes grew by 6.6% for the year ended Oct. 30, per IRI. Sales of oils and shortenings increased even more in that period—up 15.8% to $4.8 billion.

Affordable bakery is playing an increasingly important role at breakfast time, especially for items that can be consumed away from home. A 2022 consumer survey by Rich Products found that two-thirds (67%) of respondents said they planned to purchase more bread and rolls in order to save money.

Expect unique spreads for breakfast breads to gain traction. Jelly/jam dollar sales reached $2.1 billion, up 14.2% for the year end Oct. 30, per IRI, and sales of nut butters reached $2.6 billion, up 6%.

Although unit sales are down by 7.7%, frozen single-serve and multi-serve meals remain the largest frozen food category, with sales of $12.6 billion, up 8.2%, for the year ended Oct. 30, per IRI. Frozen cookies, processed poultry, breakfast food, appetizers/snacks, poultry pieces, and bread dough posted double-digit dollar sales gains. Thanks to inflation and increased restaurant visits versus the past few years, sales of frozen and fresh seafood have declined, but frozen seafood outperformed the fresh seafood category in a 13-week period ending Aug. 7, 2022.

For the 12 weeks ending Oct. 30, unit sales of frozen breakfast entrées grew by 4.1% while frozen handheld breakfasts unit sales fell by 1.9%, per IRI. Sales of hot cereal were up 14.9% to $1.6 billion for the year ended Oct. 30, toaster pastry sales were up 9.4% to $976 million, and pancake mix sales climbed by 7.3% to $651 million.

Frozen thaw-and-go portable foods are gaining in popularity. J.M. Smucker reported that its Uncrustables frozen sandwiches have passed the $500 million mark in sales, a year ahead of the company’s anticipated timetable. In 2022, Nestlé debuted thaw-and-eat Hot Pocket Deliwiches, which don’t need to be heated up in a microwave, and Kellogg’s introduced Eggo Grab & Go Liege-Style Waffles, the first Eggo waffle that doesn’t require a toaster and which the company says it developed to meet the needs of busy parents.

Market Movers

- Packaged in resealable jars, cookie, muffin, and brownie mixes from PB2 Pantry are made with peanut flour, deliver 14 grams of protein per serving, and are vegan and gluten-free.

- LALA U.S. introduced traditional Mexican breakfast smoothies made with milk, fruit, and oats under the Licuado brand name.

- Extra White Gold gluten-free mixes for cake, bread, pancakes, and more are certified free of major allergens.

- Sempio Foods’ Yondu vegetable umami savory seasoning made with organic soybeans fermented for three months in a vegetable broth naturally boosts the flavor of dishes from soups to stir-fries.

- The Good Bean now offers a line of heat-and-eat bean-based meals, including a Mexican Smoky Chipotle variety made with pinto beans.

High-Performance Health

Consumers continue to turn to food for its health benefits. Half of global consumers surveyed by HealthFocus said their belief in the “food as medicine” concept is much stronger now than it was two years ago. And Mintel reports that four in 10 U.S. consumers say they’ll consume even more healthy foods and drinks this year than they did last year.

Parents are an important target audience for healthful products. HealhFocus reports that parents are more proactive than those without children in learning about health, trying new foods with health benefits, and paying more for healthy foods. Comparing parents aged 40 and under with other consumers in that age group, HealthFocus found that 75% of the parents were willing to pay more for healthful foods versus 63% of the non-parents who were willing to do so.

In addition, IFIC research shows that 70% of parents with children under age 18 at home have followed a specific diet or eating pattern in the past year. The top health benefits parents seek from foods and beverages are more energy/less fatigue and improved sleep.

Food/drinks with functional benefits are diving sales. IRI reports that sales of foods/drinks with essential vitamins increased by a whopping 271% for the year ended May 15, 2022; sales of products touting energy benefits were up 21%; those with brain health benefits increased by 18%; and those with immune support benefits grew by 14%.

IFIC data confirms the priority consumers are placing on pumping up their energy levels. Energy tops the list of benefits consumers most want to get from foods and beverages, IFIC reports, followed by weight loss, digestive health, heart heath, improved sleep, immune function, muscle strength/endurance, and bone health.

Half of consumers are now looking to energy foods and drinks for mental energy and/or an energy boost, according to HealthFocus; 45% seek sustained energy and 42% want energy for exercise. More than six in 10 energy drink users say they are interested in pomegranate, passion fruit, elderberry, and blood orange as energy drink flavors; 65% choose energy drinks for flavor, per a T. Hasegawa 2023 report

In descending order, consumers are very or extremely interested in foods/drinks that contain vitamin C, vitamin D, protein, fiber, whole grains, omega-3s, B vitamins, antioxidants, probiotics, and zinc, according to HealthFocus. One-third are willing to pay a 10% premium for foods with vitamin C, collagen, B vitamins, or vitamin D.

The weight management sector grew 9.2% in 2021, according to Nutrition Business Journal, with growth driven by weight management meal supplements, up 12%, bringing the category to nearly $5.1 billion.

Among those following a specific dietary regimen, a heart-healthy diet is now the most popular, adopted by 17%. Other popular dietary approaches, include, in descending order, low-carb (excluding Atkins), gluten-free, lactose-free, plant-based, Mediterranean, keto, Whole 30, glycemic diet, and paleo, according to FMI. HealthFocus reports that one in five adults say they always or usually try to avoid gluten.

Six in 10 consumers aged 18–39 choose foods/beverages to improve their mood; 45% of those aged 50–49 and 38% of those aged 50-plus do so, per HealthFocus.

Fermented foods, blueberries, seeds, exotic fruit, avocados, green tea, nuts, ancient grains, leafy greens, and kale were the top 10 superfruits for 2022, a survey from Pollock Communications showed. Elderberry, followed by psyllium, apple cider vinegar, horehound, turmeric, cranberry, ashwagandha, ivy leaf, ginger, and fenugreek were the best-selling botanical supplements in mainstream channels last year, per SPINS.

With some plant-based meat companies struggling and the category getting negative media attention, consumers’ confidence in the healthfulness of plant-based foods has waned. Only half of “plant loyalists” who never consume animal products or eat only dairy/eggs, now say plant-based products are healthier, and even fewer believe they are more sustainable, according to HealthFocus.

That said, however, products that offer authentic benefits related to sustainability, regenerative agriculture, and upcycling will be favorably received because consumers increasingly are equating planetary health with personal health.

Market Movers

- King Arthur Baking Co. offers a Keto Wheat Baking Flour, catering to low-carb enthusiasts or keto diet adherents.

- The Lemon Lavender Ice Cream Sandwich from premium frozen novelty maker Ruby Jewel was among the first botanically inspired frozen treats.

- Mycobrew drink mixes from Host Defense Mushrooms come in convenient grab-n-go packets.

- Foods Alive flax oil dressings are cold pressed and unrefined and tout their omega fatty acid content.

- Upcycled ingredient company Renewal Mill partnered with specialty sweetener brand Just Date for a new gluten-free, vegan muffin mix.

- Hrbvor introduced herbal teas in Revive, Calm, and Focus varieties flavored with ingredients including hibiscus flowers, moringa leaves, lemongrass, and peppermint leaves.

- Phyll is a shelf-stable fruit and veggie drink that provides 15 grams of plant protein.

- Brad’s Salad Snacks contain an array of crispy and crunchy vegetables, fruits, seeds, and seasonings, and are made with a proprietary aid-dried process.

* U.S. – Multi-Outlet includes grocery, drug, mass market, military, and select club and dollar retailers.

REFERENCES

Datassential. 2022. “Year-end Trends.” Webcast, Dec. 8. Datassential.com, Chicago.

FMI. 2022. The Power of Meat. FMI—The Food Industry Association, Alexandria, Va. fmi.org.

FMI. 2022. The Power of In-Store Bakery.

Grubhub. 2022. "2022 Delivered." Dec 14. https://about.grubhub.com/news/grubhub-reveals-countrys-top-food-ordering-trends-in-2022-delivered-report-a-year-of-takeout-wrapped-in-layers-of-comfort/.

HealthFocus. 2022. Top 10 Consumer Trends 2023. HealthFocus Intl., St. Petersburg, Fla. healthfocus.com.

IFIC. 2022. Food & Health Survey. International Food Information Council, Washington, D.C. foodinsight.org.

IRI. 2022. “Brand Growth: A Playbook for 2023.” Webcast, Nov. 22. IRI Worldwide, Chicago. iriworldwide.com.

IRI. 2022. “How Consumers Found Value in Fresh in 2022.” Webcast, Nov. 9.

IRI. 2022.”Fresh Bread Trends/Winning with Younger Consumers.” Webcast.

IRI. 2022. “Tracking Retail Food and Beverage Inflation.” Webcast, Dec. 8.

Mintel. 2022. Global Food and Drink Trends 2023. Mintel Intl., Chicago. mintel.com.

Nutrition Business Journal. 2021. Nutrition Business Journal Database. newhope360.com.

NPD/CREST. 2022. “Lower-Income Households Hardest Hit by Inflation, Stretch Their Food Dollars and Significantly Cut Back on Restaurant Visits.” Press release, Aug. 17. NPD Group, Port Washington, N.Y. npd.com.

NRA. 2022. “What’s Hot 2023 Culinary Forecast.” National Restaurant Association, Washington, D.C. restaurant.org.

Rich Products. 2022. “Bakery Survey Shows Consumer Behavior Has Changed.” Press release, Dec. 5. Rich Products Corp., Buffalo, N.Y. richs.com.

SFA. 2022. Today’s Specialty Food Consumer. Specialty Foods Assoc., New York, N.Y. specialtyfoods.com.

SPINS. 2022. “2023 Health & Wellness Trends Predictions,” Webcast, Dec. 4. SPINS, Chicago. spins.com.

T. Hasegawa. 2022. Flavor Flash: Regional and International. T. Hasegawa USA, Cerritos, Calif. thasegawa.com.

T. Hasegawa. 2022. Food and Beverage Flavor Trends Report.

Key Takeaways

- While center-store dollar sales grew by 8.7% for the year ended Oct. 30, 2022, price inflation, not volume growth, was the reason.

- Products that deliver experiential value will be winners.

- Making meal preparation easy is a smart strategy for center-store products.

- Consumers remain highly focused on products that deliver functional health benefits.