A Global Innovation Expedition

Emerging economies populated by members of a rising middle class mean new market opportunities for products including fresh food kits, cheese entrees, and yogurt look-alikes.

More multinational food/beverage companies, an enormous and fast-emerging middle class in many of the world’s largest countries (whose up and comers are anxious to enjoy the convenience and indulgence of Western foodie ways), and rising economic confidence in many markets have combined to create an unprecedented environment for new product innovation and for sharing concepts and ingredients around the globe.

It is the intent of this worldwide expedition to further characterize this new global environment and to highlight some unique product concepts and noteworthy market directions. This global review of new products was made possible by Innova Market Insights and its Food and Beverage Database (www.innova-food.com).

The New Global Reality

By 2020, three emerging markets—China, India, and Russia—will join the United States and Japan as the world’s largest economies; Germany will fall out. The U.S. will remain the largest consumer products marketplace, followed by China, Japan, Germany, and Brazil (Euromonitor, 2013a).

As the economy picks up, so do food product development activities, research and development innovation, and consumer purchases. Economic confidence grew in Asia, North America, the Middle East, and Africa for the year-long period that concluded at the end of the second quarter of 2013. Spending was flat in Europe; confidence declined in Latin America (Nielsen, 2013a).

Of the 58 countries surveyed by Nielsen, Indonesia enjoys the highest level of consumer economic confidence, Portugal the lowest. Although 55% of global consumers still thought they were in a recession in the second quarter of 2013, it was the lowest level reported since early 2011 (Nielsen, 2013a).

New consumer product testing activity was up 100% in 2012 vs three years earlier, driven by Africa, which reported an increase of 131%, and the BRIC countries (Brazil, Russia, India, and China), where activity was up 173% (Nielsen, 2012). BRIC countries are among those with a large and growing middle class poised to purchase premium, trendy, and convenient food/beverages, such as Starbucks drinks or ready meals (Kharas, 2012). The Chinese, for example, have enjoyed a four-fold increase in average household income in just over a decade (Nielsen, 2013b). In Russia, the middle 60% have as much income as the top 20% (Euromonitor, 2013b).

Lastly, as more women enter the workforce, they fuel new markets for convenience foods, more indulgent treats, and child-specific foods. Moreover, working women have catapulted both work/life balance and health into the top five global consumer issues, just behind the economy and job security (Nielsen, 2012). Secondary education is also increasing among women globally and will help drive the demand for healthier food, especially for children (Nielsen, 2011).

Couples with children are the largest global household unit with 916 million households, making family meals important around the globe (Euromonitor, 2013c). The global market for kid-specific foods and beverages is projected to reach $89.3 billion by 2015. North America, Europe, and Asia-Pacific, especially Japan, are the strongest markets for kid-specific foods/beverages (GIA, 2010).

More than half of meal preparers globally said they prepare and eat food at home nearly as much as they did a year ago; one-quarter do so more frequently. Breakfast and dinner are the meals most often cooked at home. More than half of meal preparers make breakfast at home more than five days a week; lunch is made at home between two and five days a week. Fresh foods are still used more often than processed (Euromonitor, 2012).

--- PAGE BREAK ---

Meal Makers

More than half (54%) of women in developed countries feel pressed for time, and 38% feel stressed/overworked; in emerging markets, the comparable statistics are 62% and 49% (Nielsen, 2011). Thus it’s not surprising that products that make food preparation easier and faster remain in high demand. One in five new food products introduced globally in 2012 carried a microwaveable claim, according to Innova Market Insights.

In the United Kingdom, Tesco’s Bag and Bake Mediterranean Tomato and Herb Seasoning for Chicken includes a dry seasoning mix with a baking bag. Salomon FoodWorld GmbH in Germany offers ServEasy Mediterranean Vitello & Tagliatelle pasta meals that are oven-ready and packaged in parchment for baking.

Uncle Ben’s Rice and Sauce Mexican Chili in Canada is packaged in a cup with chili sauce under the lid to be added later. In Australia, Lean Cuisine’s Steam Indian Style Butter Chicken with Rice is “steamed perfectly in two trays for a better taste,” according to the marketer.

Uncle Ben’s Rice and Sauce Mexican Chili in Canada is packaged in a cup with chili sauce under the lid to be added later. In Australia, Lean Cuisine’s Steam Indian Style Butter Chicken with Rice is “steamed perfectly in two trays for a better taste,” according to the marketer.

Fresh meal kits and packaging major components separately in frozen meals to allow consumers to enjoy the cooking/assembling experience and maximize quality are trends that are on the rise. In the Netherlands, components in Unox Zuurkool Stampport meals-for-one are packaged individually and sold in a paper sleeve. In the United Kingdom, Tesco offers a line of mix-and-match dinner components—entrées, sides, and desserts—as well as its Finest Restaurant Collection of upscale take-away meals such as Slow Cooked Chianti Beef. In Canada, Campbell’s offers Nourish complete balanced meals in a can, which are reportedly targeted to lower-income consumers.

Iglo Austria’s Vegetable Rice Ideas are a mix of 50% crunchy vegetables and 50% perfectly cooked rice. Riso Gallo France has introduced risotto in a microwaveable takeout box with a fork.

Stone-baked and fruited flatbreads are new trends in pizza; Sodebo’s chilled pizza in France comes in thin oval shapes. In Germany, Fish & More offers the first tuna pizza that is Marine Stewardship Certified.

Grain and legume side dish blends are creating more flavor and texture contrasts. In Belgium, microwaveable Danival’s Les Graines Express side dish combines two legumes and two cereals: kidney beans, lentils, quinoa, and spelt.

Edamame, pulses, adzuki beans, kidney beans, and broad beans are adding protein to side dishes. Polenta and tabouli salads are becoming popular sides. Bulgar, millet, quinoa, buckwheat, amaranth, sorghum, flaxseed, chia, and freekeh are among the grains/seeds moving into the spotlight.

Naanster’s Chicken Tikka Filled Naan Bread wraps in the United Kingdom are set to rival burritos. Salad sandwiches are on the rise. In the Philippines, Starbucks offers Ratatouille and Mozzarella Cheese sandwiches. Upscale descriptors are being used to “premiumize” sandwiches in Spain (e.g., Serrano Ham and Artisan Young Manchego Cheese). A new baguette vending machine in Paris contains bread that is partially baked, with final baking occurring upon ordering, according to Innova Market Insights.

--- PAGE BREAK ---

Seasonings have gone upscale with exotic and remote origins touted (e.g., Virginia Dare’s Madagascar vanilla). Wild pepper, artisan garlic, and piquillo peppers are among the new spice trends. Dorot’s Garlic & Herbs line of frozen sauces in the United Kingdom are packaged five to a box and are ready to use in three minutes.

Heinz Culinair ketchup in European markets comes in Thyme & Honey, Balsamic Vinegar, and Basil & Oregano flavors. In Finland, Santa Maria offers Thai Wok Sauce with Oyster & Garlic Flavor.

Heinz Culinair ketchup in European markets comes in Thyme & Honey, Balsamic Vinegar, and Basil & Oregano flavors. In Finland, Santa Maria offers Thai Wok Sauce with Oyster & Garlic Flavor.

Sriracha, a hot sauce from Thailand, is the fastest-growing ethnic flavor on menus at nonethnic restaurants in the U.S., followed by chimichurri, wasabi aioli, and yuzu (Datassential, 2013).

When it comes to the early morning meal, Innova Market Insights’ new product tracking signals a global boom in liquid breakfasts that mimic the milk-and-cereal experience. Kellogg’s Coco Pops and Nutri-Grain breakfast drinks in Australia deliver 10 g protein, 5 g fiber, and 22 vitamins/minerals.

With Kraft’s highly successful global launch of BelVita, the breakfast biscuits category is heating up. In Europe, McVite’s introduced a Breakfast Porridge Oats biscuit, and Kraft added Yogurt Crunch to its biscuit line.

In the United Kingdom, the Weetabix Food Co.’s Weetabix Breakfast Biscuits on the Go are fortified with vitamins/iron. Moreover, they provide what the company describes as “slow release energy throughout the day,” which promotes a feeling of satiety.

In the United Kingdom, the Weetabix Food Co.’s Weetabix Breakfast Biscuits on the Go are fortified with vitamins/iron. Moreover, they provide what the company describes as “slow release energy throughout the day,” which promotes a feeling of satiety.

Cereal marketers remain innovative. Func* Supermüsli from Sweden is one of the world’s first truly naturally functional cereals. Prebiotics, novel fibers, and resistant starch are increasingly being used in cereals around the globe.

In Australia, Uncle Tom’s markets Plus Essentials for Women ready-to-eat cereal. Fresh Marketing’s Fuel is an energy-packed breakfast granola cereal targeted to men in the United Kingdom; it contains B vitamins and guarana. Products formulated with omega-3s and high fiber are among the top trends in children’s cereals. Inclusion of pork, meat, and chicken in porridge-style breakfast products is popular in East Asian countries, especially Thailand, China, and Korea.

--- PAGE BREAK ---

Snacks and Treats Come on Strong

Snacks are one of the highest-potential global food categories as they gain traction only after a significant number of consumers reach middle-class status and have a comfortable level of disposable income.

Mondelez, the global snack joint venture between Kraft and PepsiCo’s Frito-Lay group, projects 110 million households in India, Russia, and Brazil will move into the middle class and become regular snack purchasers. They also project that these markets will triple their chocolate consumption. Mondelez relies on emerging markets for 40% of its revenue (Schultz, 2013).

Latin America and Asia remain the largest global snack opportunities; China is the fastest-growing snack market with a compound annual growth rate forecast of 7% for 2012–17. In 2012, snack food sales in Eastern Europe rose 8.5%, in Asia Pacific 9.9%, the Middle East/Africa 10.5%, and Latin America 10.9% (Schultz, 2013).

Novel textures, intense flavors, and new shapes are driving the savory snack market. Deeper ridges (e.g., Walkers Deep Ridged Salt & Malt Vinegar crisps with 8 mm ridges and United Biscuits’ Hula Hoops Big Hoops) are positioned to capitalize on the trend toward maximum crispness and texture. Chips now come in shapes ranging from ghosts to cones to stars.

Very intense flavors or flavors that suggest a main dish or entrée continue to be among the hot trends for savory snacks. Pringles crisps come in Thai Sweet Chili, Prawn Cocktail, and Roasted Chicken and Herb flavors in Europe; Pringles Xtreme products are available in Extra Spicy and other intense flavors.

Pringles offers Light Aromas crisps in select markets; the crisps are enhanced by pleasing aromas (e.g., Red Paprika or Szechuan Beef). Pastas Alimenticias Romero S.A. in Spain has introduced Nack-Snack, a unique macaroni snack fried in olive oil. In Germany, Chio Tortilla Rolls & Dip are co-packaged in triangular packs to be microwaved hot for dipping.

From morsels to classic French hors d’oeuvres, finger foods remain a very strong global snack trend. In the United Kingdom, Iceland Foods offers Mini Beef Wellingtons. In the Netherlands, Paturain Borrelkaasjes sells Mini Cheeses, an eye-appealing assortment of mini cream cheese rounds topped with herbs and packaged egg-like in a 20-piece clear plastic container.

From morsels to classic French hors d’oeuvres, finger foods remain a very strong global snack trend. In the United Kingdom, Iceland Foods offers Mini Beef Wellingtons. In the Netherlands, Paturain Borrelkaasjes sells Mini Cheeses, an eye-appealing assortment of mini cream cheese rounds topped with herbs and packaged egg-like in a 20-piece clear plastic container.

The cheese category remains front and center when it comes to snacks. Group Soparind Bongrain in France has created classic cheeses such as Brie with an indulgent filling. In Belgium, Boursin cheese is mixed with nuts and figs. Norway’s Grok Con Cereali is a crispy cheese snack made from padano cheese with 25% crushed cereal.

Marinated, chocolate, and handmade cheeses in unique flavors (e.g., curry) are other exciting cheese trends. In Eastern Europe, curd and cottage cheese bars covered with a milk chocolate coating are a popular everyday snack.

Puleva’s Burgos Calcio Desnatado skimmed milk cheese in Spain is fortified with calcium and vitamin D and positioned for bone strength. In Greece, Minerva’s Benecol White Cheese contains plant sterols for cholesterol-lowering.

--- PAGE BREAK ---

Breaded cheeses are moving to the center of the plate. In Italy, Giravolte Gusto Prosciutto Cotto is a breaded cheese containing sliced ham to bake or fry for an entree. Germany’s Sott Zottarella Mozzarella Taler are small round cheeses covered with dough to be baked and served as a main dish with dipping sauce.

Breaded cheeses are moving to the center of the plate. In Italy, Giravolte Gusto Prosciutto Cotto is a breaded cheese containing sliced ham to bake or fry for an entree. Germany’s Sott Zottarella Mozzarella Taler are small round cheeses covered with dough to be baked and served as a main dish with dipping sauce.

For crackers and cookies, super thin is in. In Canada, Peek Freans’ LifeStyle Selections Blueberry Brown Sugar Biscuits with Flax bring fruit into the cracker world. In the Netherlands, Sultana Jummies Banaan & Melk are fruit crackers with banana milk filling for kids.

New cookie flavors range from Grapefruit & Butterscotch to Green Apple & Almond in Banketbakkerij Van Strien’s John Altman Cookies in the Netherlands. In India, Britannia Industries offers a tea-time biscuit with a double layer of oat and wheat fibers for women; it makes a heart health claim. Soft, triple-layer indulgent cookies resembling chocolate truffles are a delicious new concept.

At the same time, yogurt maintains a strong presence across snack and early morning dayparts. Yogurt has been whipped, moussed, sold in tubes, twisted, combined with sorbet, and sold in “squishy” pocket packs around the world for kids. Perhaps most exciting is the large number of global dairy products that have the opportunity to be the next Greek yogurt phenomenon. These include skyr from Iceland, fromage frais in France and Belgium, quark from Germany and the Netherlands, Bulgarian yogurt, Russian yogurt, pot cheese, and French/natural set yogurt. Goat milk yogurt is also growing in popularity.

At the same time, yogurt maintains a strong presence across snack and early morning dayparts. Yogurt has been whipped, moussed, sold in tubes, twisted, combined with sorbet, and sold in “squishy” pocket packs around the world for kids. Perhaps most exciting is the large number of global dairy products that have the opportunity to be the next Greek yogurt phenomenon. These include skyr from Iceland, fromage frais in France and Belgium, quark from Germany and the Netherlands, Bulgarian yogurt, Russian yogurt, pot cheese, and French/natural set yogurt. Goat milk yogurt is also growing in popularity.

Drink Up

Healthy and natural are now perceived as more important than convenience in terms of global consumer high need/high interest criteria for new beverages, according to a 2013 survey of global beverage industry executives. Collectively, low sugar, low calorie, high protein, and energy are a close second (Beverage Industry, 2013).

Innova Market Insights reports rising interest in superfruits around the globe. Pomegranate was the most used superfruit flavor in global beverage launches over the past five years. Guanabana, marula, gooseberry, goji, and soursop were the top five gainers in 2012.

Innova Market Insights reports rising interest in superfruits around the globe. Pomegranate was the most used superfruit flavor in global beverage launches over the past five years. Guanabana, marula, gooseberry, goji, and soursop were the top five gainers in 2012.

Herbs, spices, honey, and hot n’ spicy beverage profiles are also increasing around the world. Globally, flower flavors are well established in green and iced tea and cordial products; the trend is now infiltrating the carbonated products market, according to Innova Market Insights. The use of local fruit flavor, cocktail/beer flavors for soft drinks, vegetable flavors, and real fruit and natural sugar are other global beverage trends.

Flavored milk is forecast to increase globally with a compound annual growth rate of 4.1% from 2012–2015. Increased demand for flavored milk between 2009 and 2012 was mainly driven by Brazil, China, India, and Indonesia (Tetra-Pak, 2013).

Medicinal teas continue to hold appeal; green tea is now touted for preventing bad breath; beauty teas remain prominent in Asia. Traditional lassi from India and ayran or laban from Turkey are easily transferred global dairy beverage concepts. Lassi products are already appearing in Europe. Fortified yogurt drinks targeted to men represent a new product direction in Eastern Europe; some are positioned for increasing energy.

--- PAGE BREAK ---

A Functional Future

The global functional foods market is projected to reach $130 billion by 2015; weight control foods will be $200 billion (GIA, 2012).

Baby formula, probiotic yogurt, flavored milk drinks, breakfast cereals, and meal replacements/slimming were the fastest-growing packaged functional foods globally in 2012; energy, fruit/vegetable juices, and sports drinks were the top functional beverages (Hudson, 2013).

When it comes to global claim categories, “suitable for” (e.g., for kids, diabetics, or the gluten-sensitive) has taken the lead and continues to grow in 2013, followed by natural and ethical/environmental claims, which are also increasing (Dornblaser, 2013a).

The strict enforcement and lack of approval of new and often existing health claims in the European Union has slowed the pace of functional food innovation, according to Innova Market Insights. Functional health claims (e.g., heart health), accounted for 14% of new product launch activity in the U.S. and only 7% in Europe in 2012. Passive health claims (e.g., low-fat, low-calorie, or high-fiber) were much higher: 50% in the U.S. and 36% in Europe.

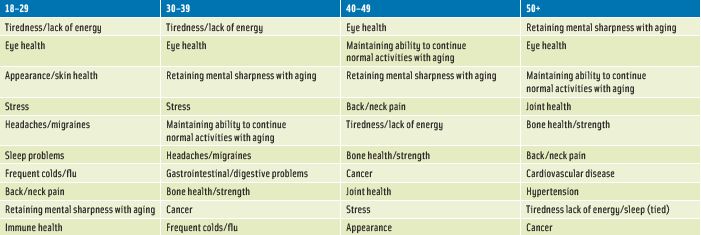

The most active new product categories for functional health were dairy, soft drinks, baby food, cereals, and confectionery. The top five global functional health positionings in 2012 were digestive/gut, vitamin/mineral fortified, energy/alertness, omega-3, and heart health, according to Innova Market Insights data. Consumer health issues remain very different with age and region. Tiredness tops the list for younger adults, retaining mental sharpness for those 50+; eye health is a very strong concern for all ages (HealthFocus, 2012; Figure 1).

Cholesterol-lowering milks, yogurts, and other dairy products continue to gain in importance; in the Far East, drinks to lower high blood pressure are popular, and magnesium milks are offered in France and Australia.

Omega-3s/fish oil, gingko biloba, American/Asian ginseng, antioxidant vitamins A, C, and E, and iron are the ingredients trending upward around the world to substantiate cognition claims (Dornblaser, 2013b).

With health claims restricted in the European Union, it’s not suprising that the number of products that tout vitamin A, D, or E content increased by 70% between 2007 and 2012, according to Innova Market Insights. Sales of probiotic supplements and yogurt products have fallen in Europe (Hudson, 2013). Danone’s Actimel Powerfruit Yogurt now relies on vitamin C sourced from acerola to support its immunity claim rather than probiotics, as such claims are prohibited in Europe. GalaxoSmithKline is focused on the high vitamin C content of black currents for its Ribena brand.

--- PAGE BREAK ---

High protein is a worldwide trend that has yet to peak, according to Innova Market Insights; new high protein product launches were up more than 250% in 2012 vs 2011. The U.S., Germany, Brazil, India, and Finland are the most active high protein markets. In Australia, Nu-Vit Health Foods’ Phyto Soy LSA Mix is simply soy protein that can easily be added to or sprinkled on any dish.

Globally, yogurt, milk/other dairy drinks, cereal bars/energy bars, ice cream, and prepared pasta/noodles were the top added protein categories; cereals, cereal bars/energy bars, sweet biscuits/cookies, bread products, and savory biscuits/crackers were the top categories for high fiber.

High protein and fiber have taken the weight management focus back to a more natural approach. Satiereal Saffron Extract, PromOat, a beta-glucan ingredient, and Slendesta Potato Extract are among the new satiating ingredients tracked by Innova Market Insights.

Globally, B vitamins, milk proteins, inulin and konjac, calcium/vitamin D, and green tea are the ingredients trending upward to substantiate weight control claims (Dornblaser, 2013b). Fermented foods, soy isoflavones, plant sterols, and white tea are trending upward for support of longevity claims; chocolate, berries, wine, tryptophan, L-theanine, omega-3s, and coffee are cited for mood improvement (Dornblaser, 2013b).

One of the most untapped categories globally is sports nutrition, which is projected to grow 40% from 2012 to 2017 (Euromonitor, 2013d). Health issues that tend to receive more emphasis globally than they do in the U.S. include allergies (e.g., gluten, lactose, and dairy), satiety/weight, and the glycemic index.

Ready meals with unique health propositions are on the rise in the United Kingdom. Marks & Spencer has created a new Simpler Fuller Longer line of ready meals specifically for satiety/weight management. On the Menu is a new line of high protein, nutrient-dense frozen meals and desserts for older adults.

Products positioned for diabetics launched around the world jumped 275% in 2012 vs 2011. The U.S., the United Kingdom, Australia, and South Africa had the highest tracked new products launched on a low glycemic platform.

Phytoestrogens, botanicals, cultures, polysaccharides, and protein are set to be the five food and beverage ingredients with the highest forecast growth rates globally. Nearly 30% of all global food and beverage ingredients were consumed in Asia Pacific in 2012, up from 27% in 2007 (Euromonitor, 2013e).

Euromonitor predicts that there are good opportunities for specialty fibers and protein ingredients in meal replacements and medical products, despite this being something of a niche category. Consumption of maltodextrin, milk protein, and soy protein concentrates in meal replacement products is forecast to grow steadily, especially in South Korea, India, and Brazil (Euromonitor, 2013e).

--- PAGE BREAK ---

Lastly, while recent media coverage and activist activity would lead us to believe that food products claiming to be free of genetically modified organisms (GMOs) are on the rise around the globe, Innova Market Insights reports that just 1.1% of all new products launched in the year ended March 2013 were making GMO-free label claims. In contrast, 13% of all new products introduced during this time frame were marketed on an additive/preservative-free platform. GMO-free numbers were slightly higher in the European Union and Australia, but less than 1% in North America.

A. Elizabeth Sloan, Ph.D.,

A. Elizabeth Sloan, Ph.D.,

a Professional Member of IFT and Contributing Editor of Food Technology,

is President, Sloan Trends Inc., 2958 Sunset Hills, Suite 202, Escondido, CA 92025

([email protected]).

The author thanks Innova Market Insights (www.innovadatabase.com) for access to its Innova Food & Beverage Database, monthly newsletters, and photos.

References

Beverage Industry. 2013. 2012 New product development survey. Beverage Industry 194(1): 52, 54, 56, 58, 69.

Datassential. 2013. Datasential MenuTrends to watch. QSR OneSource special edition. Jan. 3-20.

Dornblaser, L. 2013a. Colors & flavors: the move to natural. Presented at Annual Meeting, Institute of Food Technologists, Chicago, Ill., July 13-16.

Dornblaser, L. 2013b. Formulating for health and wellness. Presented at Annual Meeting, Institute of Food Technologists, Chicago, Ill., July 13-16.

Euromonitor. 2012. Quick pulse: is home cooking a lost art? Aug. 24. http://blog.euromonitor.com.

Euromonitor. 2013a. Forecast: world’s largest economies in 2012. May 16. http://blog.euromonitor.com.

Euromonitor. 2013b. Luxury goods in Russia. Jan.

Euromonitor. 2013c. Special report: the family structure of the future. July 5.

Euromonitor. 2013d. Retailers look to capitalize on protein supplement and sports nutrition. March 12.

Euromonitor. 2013e. Latest insights from the new edition of ingredients 2013; food and beverage ingredients. Aug. 8.

GIA. 2010. Kids market: kids’ food and beverages—a global market report. Global Industry Analysts, San Jose, Calif. Nov. www.strategyr.com.

GIA. 2012. Functional foods and drinks—a global strategic business report. Nov.

HealthFocus. 2013. 2012 International consumer study. HealthFocus International, St. Petersburg, Fla. www.healthfocus.com.

Hudson, E. 2013. Global probiotic strategic business planning. Presented at Nutracon, Anaheim, Calif., March.

Kharas, H. 2012. The emerging middle class in developing countries. Office of Economic Development Center, Paris.

Nielsen. 2011. Women of tomorrow: a study of women around the world. June. ACNielsen, Schaumburg, Ill.

Nielsen. 2012. Consumer confidence, concerns & spending intentions around the world, Qtr.1.

Nielsen. 2013a. Consumer confidence survey, 29,000 global consumers. Qtr. 2. July.

Nielsen. 2013b. In china premium sells. Press release, May 22.

Schultz, E.J. 2013. World’s snacking habits stoke hunger for Mondelez-PepsiCo merger. Advertising Age. May 6.

Tetra-Pak. 2013. Tetra-Pak liquid dairy product research study. Press release, June 7. Tetra-Pak, Vernon Hills, Ill.